Commodity Valuation

The process of deriving the worth or the “intrinsic value” of a commodity under market conditions described as perfect and/or optimal

What is Commodity Valuation?

The process of deriving the worth or the “intrinsic value” of a commodity under market conditions described as perfect and/or optimal is known as commodity valuation. In a perfectly competitive market, the price of the goods reflects the intrinsic value of those corresponding goods.

Because commodity markets are mostly based on demand and supply patterns, the only method for an investor to profit off of speculation is to predict future price changes of those commodities.

Futures contracts represent a significant portion of commodity market investments. They are derivative instruments wherein the parties agree to buy or sell a specific commodity at a predetermined price and date in the future.

Commodity prices are negotiated ex-ante, i.e., before the goods are delivered. Therefore, a significant risk is associated when negotiating a price for a particular product because spot prices or real market prices may differ significantly from contract prices.

Due to the seller’s commitment to satisfy the contract’s conditions, the buyer may be protected from price fluctuations. However, the seller may lose money if there is a positive price movement in the future.

While predetermined prices help investors hedge against adverse price changes, they also restrict their potential gains from positive price movements in the future due to contractual obligations. Therefore, various pricing models have evolved to facilitate agreement among parties.

Key Takeaways

- Commodity Valuation s the process of determining the intrinsic value of commodities under ideal market conditions, critical for investors navigating commodity markets.

- Commodity valuation relies heavily on understanding supply and demand dynamics, with investors seeking to predict future price movements for profitable speculation.

- A significant aspect of commodity market investment, futures contracts enable parties to agree on buying or selling commodities at predetermined prices and dates.

- While fixed prices in contracts offer stability, they also limit potential gains, prompting the development of pricing models like floor and ceiling prices to balance risk and reward.

- Speculators play a vital role in commodity markets, capitalizing on price fluctuations for profit, but success demands astute market analysis and risk management to mitigate losses.

Fixed Price Under Commodity Valuation

A fixed price is the most basic form of settling a price for a commodity or a futures contract and is determined at the very start of the contract. It is often based on the futures’ price with comparable sizes and delivery dates.

Under the “fixed price” model, the two parties are obligated to trade at predetermined prices, regardless of the real market value of the traded goods at the delivery date. This acts as “insurance” for both parties against unwarranted changes.

Advantages

The advantages of the model are:

- Finalized Pricing: Neither party can overcharge or undercharge the other, as the agreement has been laid out since the beginning.

- Predictability: The parties do not have to excessively worry about external factors affecting the terms of their contracts because, as mentioned earlier, under this model, pricing is predetermined. The status of the trade becomes easy to monitor.

Disadvantages

The disadvantages of the model are:

- Rigid terms: Once the contract has been agreed upon, it cannot be modified to accommodate external factors. Any changes require separate negotiations.

- Long-term planning: These contracts require long-term or in-depth planning. The parties have to discuss every action and every detail, along with the pitfalls associated with the said contract.

Note

It’s common for the two parties to agree to periodic price revisions in the contract. This ensures that their contracts remain aligned with prevailing market prices.

Floor and Ceiling Price

In the floor and the ceiling price model, we are introduced to two new concepts, price ceiling and price flooring, widely recognized in economics.

Price floor

This is the minimum price or the value at which the product or the good is allowed to be sold. It keeps the price from falling below a certain point.

Normally, price floors are associated with agricultural goods. For example, the secretary of agriculture in the United States is responsible for setting a quota and a price floor on necessities sold there.

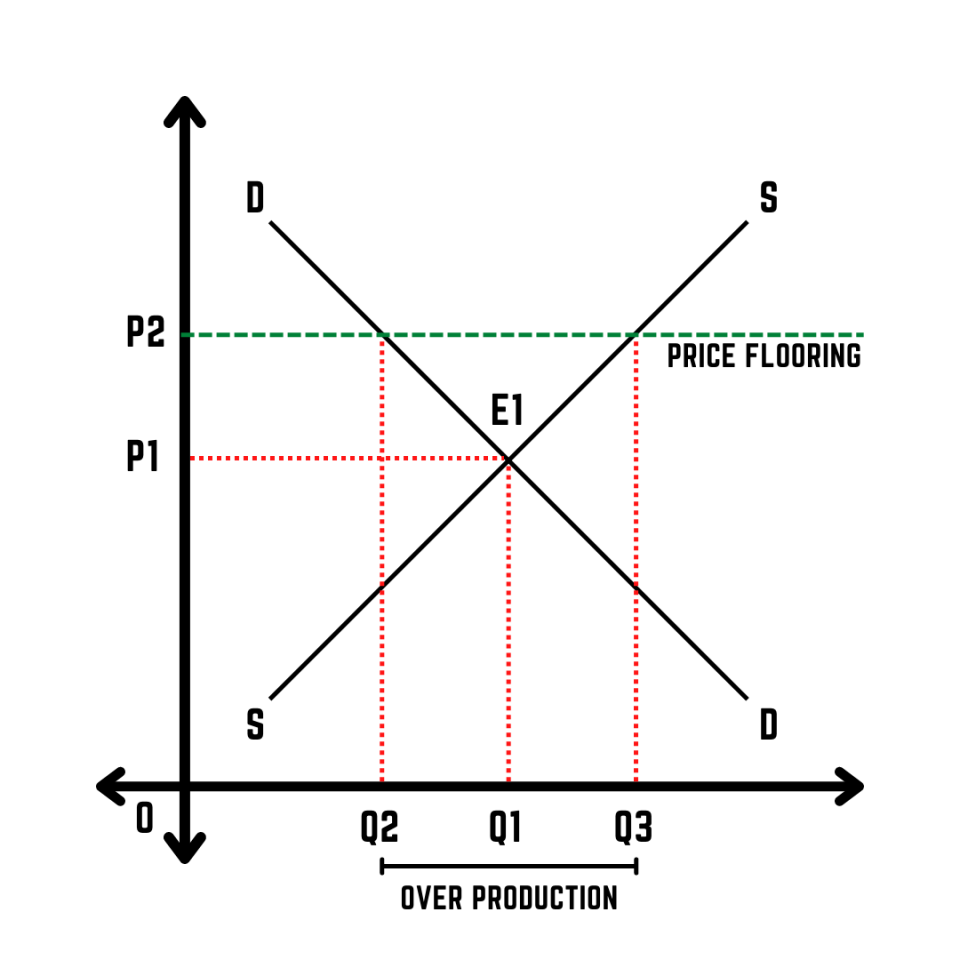

As an example, let us consider the following illustration.

Let us say that the demand and supply curves for the wheat market are D and S, respectively. At price P1, the demand and supply curves intersect at point E1, representing the equilibrium point, where a total of Q1 units of wheat are produced and traded.

“Now, to assist farmers, the government imposes a price floor, setting the minimum price that can be charged at P2, which is above the market equilibrium.

At price level P2, the quantity demanded for wheat would decrease from Q1 to Q2, while the quantity supplied would increase from Q1 to Q3. Therefore, due to the price floor, there will be a wheat surplus in the market, equal to Q3-Q2.

Note

Many unions impose price floors, too. For example, in the United States, the Screen Actors Guild (SAG) imposes a minimum price that needs to be paid, which results in prices being pushed above the level of unconstrained markets.

Price Ceiling

This is the maximum price or the value at which the product or the good is allowed to be sold. It keeps the price from rising above a certain point.

Normally, price ceilings are associated with the production of demerit goods, i.e., goods that do more harm to consumers than goods, E.g., alcohol. Governments would impose a price ceiling to deter the production of alcoholic products.

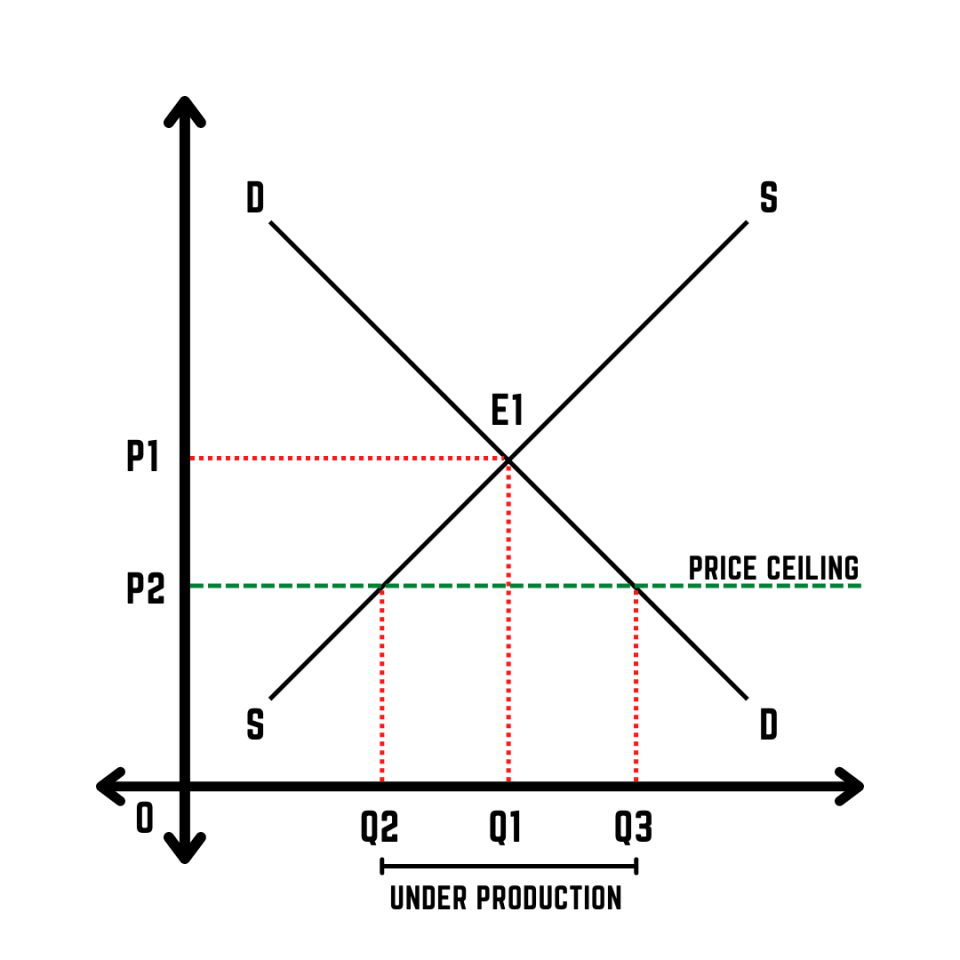

Let us consider the following illustration.

For the alcohol market, the demand and supply curves are D and S, respectively. Under the price P1, the two curves intersect at point E1, which is the equilibrium point, and therefore, a total of Q1 is produced and traded.

Now, to deter production, the government imposes a price ceiling, under which the maximum price that can be charged is P2, which is below the equilibrium level.

At price level P2, the demand for alcoholic products would increase from Q1 to Q3, and the supply would fall from Q1 to Q2. Therefore, we say that due to the price ceiling, there will be an underproduction of alcohol in the market, equal to Q2-Q3.

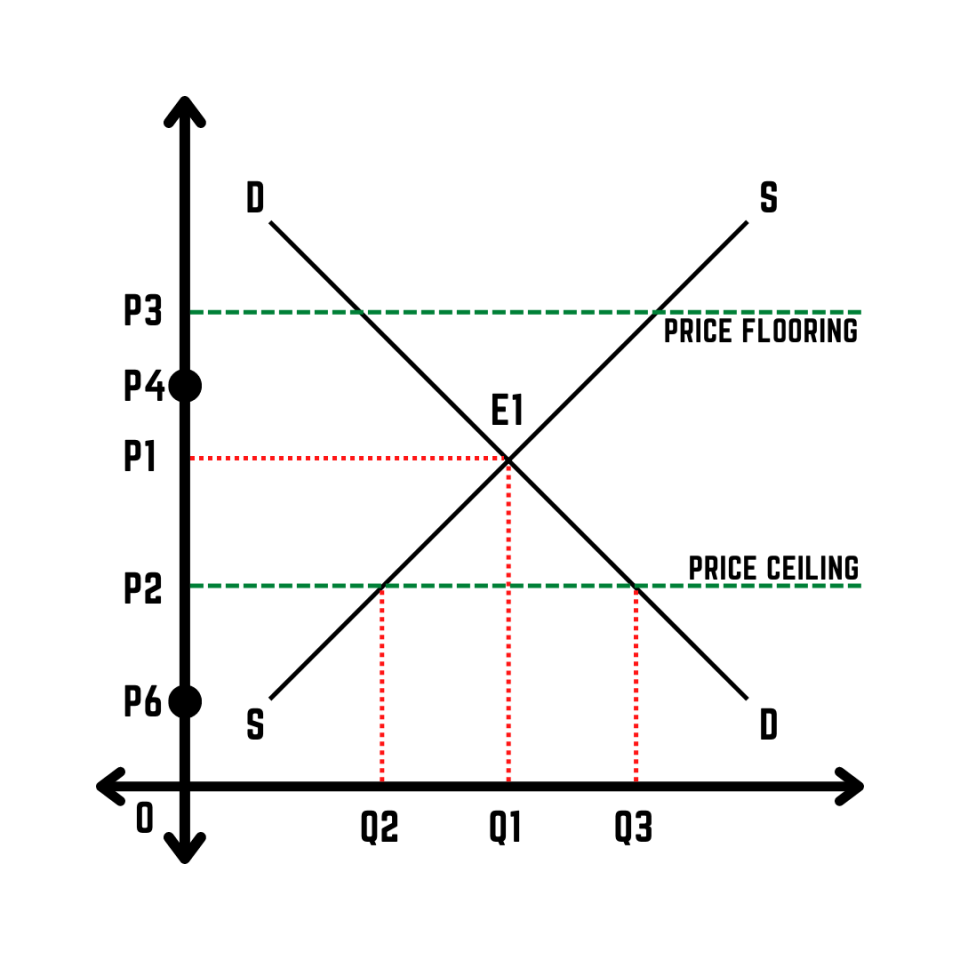

We have understood the concepts of price flooring and price ceiling. Therefore, let us briefly understand the floor and ceiling price model of commodity valuation using a similar illustration.

In this illustration, the model allows commodity values to fluctuate within the range of prices P2 and P3, providing flexibility to both parties. Moderate price fluctuations within this range can lead to mutual benefits.

If the commodity’s market price falls within the range of prices P2 and P3, that spot price determines the price of the good on the delivery date.

Suppose the spot price is above the equilibrium level. In that case, the seller of the commodity will gain at the buyer’s expense, and if the spot price is below the equilibrium level, then the buyer of the goodwill benefits.

In the above illustration, as P4 is within this window, it will become the commodity’s price on the delivery date. If the market price on the delivery date is P6, both parties will share profits.

Floating Price Under Commodity Valuation

A floating price is another pricing mechanism for determining a price for a commodity contract. It is the average of a reference price over a specified time. This strategy reduces the impact of temporary price spikes at the time of delivery.

A quick price spike will typically have a limited effect on the total commodity price when using averaging. Because the chance of a price fluctuation grows with the contract’s length, this pricing is especially beneficial for long-term contracts.

The reference price for such a contract is set at the beginning of the contract and is frequently the spot price of a commodity on a major exchange.

Another method of floating price is to agree to pay the spot price at the time of delivery or a date close to the delivery date. But, again, the parties must agree on the exchange rate as the reference price.

Due to the future price uncertainty, this pricing strategy carries inherent risk as prices can fluctuate unpredictably. Typically, both the participants will use an exchange to hedge their pricing risks to protect themselves against price volatility.

Note

The floating price in a swap contract is the leg determined by the level of a variable, such as an interest rate, currency exchange rate, or asset price. Most swaps typically involve one floating and one fixed leg, although both legs can float.

The party paying the floating rate anticipates a decrease in the rate over the life of the swap. In a swap, one party agrees to pay the second party a predetermined, fixed interest rate on a notional principal on specific dates over a specified period.

Concurrently, the second party agrees to make payments to the first party on the same notional principal on the same specified dates for the same specified period based on a floating interest rate.

Speculative Trading Under Commodity Valuation

The various traders that operate the market can have a significant impact on the commodity market’s volatility.

Speculative trading, often known as speculation, involves buying or selling financial assets based on anticipated price movements rather than intrinsic value. You profit or lose based on whether your prediction is true or false.

Speculators (also known as traders) profit by buying and selling stocks. They look for price differences, market fluctuations, and news to identify profit opportunities, like betting on whether a company will succeed or fail.

Speculation necessitates paying close attention to short-term factors that can shift quickly, where even experts are frequently mistaken. The outcomes of speculative trading vary widely; while some speculators may achieve significant profits, others may incur substantial losses.

Note

Various strategies are employed in speculative trading across different markets. Stock market speculation involves assuming substantial risks in pursuit of potentially high returns.

These speculative traders do not adhere to normal market cycles. Instead, they develop systems to forecast when stocks will rise or fall in value. New variations on day trading or swing trading (trading over a single day) can earn you large payouts if executed correctly.

Speculative trading is simply betting on price fluctuations in securities. Traders do not typically own stock but buy and sell contracts based on their value. Futures, options, and spread trading are a few types of speculative trading.

Advantages

The advantages are:

- It may yield great returns if done correctly

- Over the long term, index funds frequently outperform other funds, lowering risk more significantly than diversification

- Speculators often contribute to market liquidity and assume risk

Disadvantages

The disadvantages are:

- Successful speculative trading requires comprehensive research on investments, sectors, and companies

- Researching risky investments can be time-consuming for individual speculators

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?