Fixed Income Forward Contract

An agreement between a buyer and a seller to purchase or sell a fixed-income asset at a predetermined price at a future date.

What Is A Fixed Income Forward Contract?

A fixed-income forward contract is an agreement between a buyer and a seller to purchase or sell a fixed-income asset at a predetermined price at a future date.

These contracts are an example of a derivative instrument used in the financial industry to speculate on future interest rate fluctuations or to protect against interest rate risks.

A fixed-income investment is one in which periodic income is received at predictable, regular intervals. By using forward contracts on fixed-income assets, investors can fix the price of a bond today while acquiring or disposing of the actual security in the future.

Investors utilize fixed-income forward contracts to speculate or protect against volatility.

Fixed income forward rates show what the market believes the interest rate level will be at that time in the future.

Fixed-income securities can be considered debt instruments that can be issued by a firm, government, or other organization to fund and grow their operations. They offer returns to investors in the form of regular, set payments and eventual principal repayment upon maturity.

Key Takeaways

- A fixed-income forward contract is an agreement to buy or sell a fixed-income security at a predetermined price at a future date (the forward date).

- One type of over-the-counter (OTC) derivative instrument is a fixed income forward contract. It enables an agreement between two parties to specify the bond or fixed income security to be delivered and purchased in the future.

- These agreements are very flexible. The parties can specify the bond or fixed income instrument, the delivery date, and the price at which the transaction will take place.

- Fixed-income forward contracts don't need an initial exchange of funds (initial margin), unlike futures contracts. Payment usually happens when the contract matures.

- The interest rate environment at the time of entering into the contract and the creditworthiness of the underlying bond issuer can significantly impact the forward price.

What Does Fixed Income Mean?

Fixed income, also known as fixed-income securities or fixed-income investments, is a type of investment that resembles a loan given by an investor to a borrower (usually a firm or the government) in exchange for the payment of the bond value at maturity and periodic interest payments.

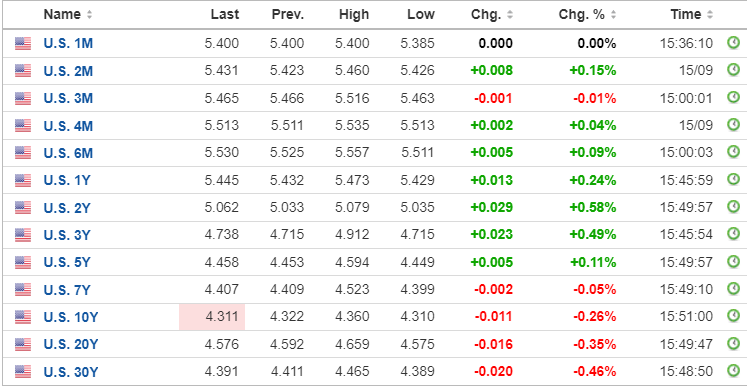

The image shows US government bonds with their maturity duration, yields, and price change.

Fixed income instruments are a key component of the financial markets and a major component of investment portfolios.

Bonds, Treasury Bills, Mortgages, or Preferred Shares are a few examples of fixed-income securities. All of these securities reflect a debt from the investor to the issuer.

There are 3 types of fixed income securities:

1. Bonds

The most popular type of fixed income securities is bonds. They can be found in various forms, including corporate, municipal, government, and mortgage-backed securities. Bonds have a set maturity date and a fixed interest rate (coupon rate).

2. Certificate of Deposits

Banks and credit unions may provide certificates of deposit, also known as CDs, as a sort of savings account. In general, you consent to keep your funds in the CD for a predetermined period without making any withdrawals. Early withdrawals result in penalties that must be paid to the bank.

3. Preferred Stocks

Preferred stocks combine aspects of fixed income and equity. Similar to bonds, they offer a fixed dividend payout while also representing ownership of the issuing business.

These debt instruments provide strategies for building diversified portfolios. Fixed-income investments are considered less risky than equities and create a consistent income stream for many investors, especially seniors.

These financial instruments often offer a guaranteed return on your investment if maintained until maturity because fixed-income securities' payments are predictable in advance.

What Are Forward Contracts?

A forward contract is a two-way agreement that binds the parties to buy and sell a certain amount of an asset at a predetermined price on a specific date in the future. Usually, neither party pays anything to enter into the agreement.

The right to purchase at the contract price will have a positive value if the asset's estimated future price rises during the agreement term, whereas the obligation to sell will be equal parts negative.

The outcome is reversed, and the right to sell (at a price above the market) will have a positive value if the asset's future price falls below the contract price.

The parties may enter into the contract as speculation on the future price. More often, a party seeks to enter into a forward contract to hedge a risk it already has. The forward contract eliminates uncertainty about the future price of an asset it plans to buy or sell at a later date.

Understanding Fixed Income Forward Contracts

A fixed income forward contract or forward rate agreement (FRA) is a financial derivative contract comparable to a forward agreement to borrow or lend money at a specific rate later. In practice, these contracts settle in cash, but no actual loan is made at the settlement date.

These contracts are primarily used to hedge interest rate risk or speculate on future interest rate movements. The parties involved are:

- Buyer (Long Position): This party agrees to borrow money at a predetermined interest rate in the future

- Seller (Short Position): This party agrees to lend money at the same predetermined interest in the future

If the floating rate at the contract expires, the long position in the contract can be considered as the right to borrow at a rate that is higher than that stated in the forward agreement below market rates, and the long will receive a payment. If the reference rate at the expiration date is below the contract rate, the short will receive a cash payment from the long.

Here’s an example:

Consider a contract wherein party A agrees to pay $990 to party B in 30 days in exchange for a $1,000 face value, 90-day Treasury note. Party B is the short, while Party A is the long.

The price that each party will pay or receive for the T-bill at a later time has been made certain for both parties.

The short must deliver the T-bill to the long in exchange for a $990 payment if 30-day T-bills are trading at $992. The long must buy the T-bill from the short for $990, the contract price, if T-bills are trading at $988 at the future date.

Each party to a forward contract is exposed to default risk, the probability that the other party (counterparty) will not perform as promised.

Unlike futures contracts, where each participant posts a down payment as a performance guarantee, it is unusual for any cash to be exchanged at the inception of a forward.

At any point in time, including the settlement date, only one forward contract party will be in debt, making that side of the contract worthless. The positive value on the other side of the contract will be equal to that amount.

The short has defaulted on the transaction if, using the example, the T-bill price is $992 on the settlement day and the short does not deliver the T-bill for $990 as needed.

The long receives a payout on the contract's expiration date if the asset's price is higher than the agreed-upon (forward) price, and the short receives a payment if the asset's price is lower than the contract price.

Fixed Income Forward Contract Termination

A party to a forward contract can terminate the position before expiration by entering into an opposite forward contract with an expiration date equal to the time remaining on the original contract.

A fixed income forward contract can be terminated easily if the buyer (long position) and seller (short position) agree to do so. Before the contract's maturity date, both parties may decide to terminate it.

One party might engage in an offset deal that essentially turns the original forward contract on its head. For instance, the buyer of the forward contract may enter into a new forward contract with the opposing position if they choose to terminate the first one early.

The contract will automatically end on the predetermined maturity date if the forward contract calls for the actual delivery of the underlying fixed income instrument or cash settlement at maturity. The actual delivery or financial settlement will subsequently occur under the contract's conditions.

The fixed income forward contract may be terminated if one of the parties violates its terms. The other party may be entitled to break the contract and seek damages if one party violates the conditions.

Forward Contracts On Zero-Coupon And Coupon Bonds

The forward contracts on short-term, zero-coupon bonds (known as T-bills in the United States) and coupon-paying bonds are quite similar to the forward contracts on stocks.

Bonds have a maturity date, whereas stocks do not; hence, the forward contract must settle before the bond matures.

Zero-coupon bonds and regular bonds differ in that regular bonds are less susceptible to interest rate and inflation risk while having regular interest payments, whereas zero-coupon bonds are more sensitive to both interest rate and inflation risk.

Zero-Coupon Bonds

Consider an investor who wishes to sign into a forward contract on a zero-coupon bond to guarantee a known future yield.

The $1,000 face value zero-coupon bond with a January 1, 2025 maturity date is the subject of a forward contract between investors A and B on January 1, 2023. They agreed on a forward price for the bond of $900.

Investor A gives Investor B $900 on the maturity date, while Investor B gives Investor A the $1,000 face value zero-coupon bond. In this case, Investor A secured a known yield at maturity by locking the zero-coupon bond's purchase price in advance at $900.

Regular Coupon Bonds

A forward contract on a $1,000 face value coupon bond with a July 1, 2025 maturity date and a 5% yearly coupon rate is agreed to on July 1st, 2023, by Investor X and Investor Y.

They settled on $950 forward pricing. Investor X pays Investor Y $950 at the start of the contract, which is the forward price.

Investor X receives coupon payments as per the bond's terms between July 1st, 2023, and July 1st, 2025 (for example, $50 yearly, assuming semi-annual payments). The contract is fulfilled when Investor Y gives Investor X the $1,000 face value coupon bond on the maturity date.

In this case, Investor X has essentially pre-locked the $950 purchase price of the coupon bond. Throughout the contract term, they continue to get their coupon payments on time.

Both of these instances show how forward contracts can be used to control the price of bonds with various payment structures (zero-coupon vs. coupon) and how they support investors' hedging or speculation on potential changes in interest rates.

When market interest rates increase, discounts increase, and T-bills prices fall. A buyer who is obligated to purchase the bonds will have losses on the forward contract when interest rates rise and gains on the contract when interest rates fall. The outcome for the short will be the opposite.

The price specified in forward contracts on coupon-bearing bonds is typically stated as a yield to maturity as of the settlement date, exclusive of accrued interest.

If the contract is on bonds with the possibility of default, there must be provisions in the contract to define default and specify the obligations of the parties in the event of default.

Special provisions must also be included if the bonds have embedded options such as call features or conversion features. Forward contracts can be constructed covering individual bonds or portfolios of bonds.

Conclusion

A fixed income forward contract is a financial arrangement for the exchange of a set quantity of fixed income securities at a later time for a predetermined price. Investors and institutions frequently utilize these contracts to protect themselves from interest rate volatility or to lock in a specified yield.

The notional amount, the fixed interest rate, the settlement date, and the underlying fixed income security are the essential elements of a fixed income forward contract.

These agreements are flexible in how interest rate risk and investment strategies are managed since they can be tailored to the particular requirements of the parties concerned. Fixed income derivatives can be traded on exchanges with standardized underlying bonds and contract terms.

Depending on whose side of the contract an investor is on, a fixed income forward can be profitable. Since the profit made from the difference between the agreed price and the market price justifies the buyer's entry into the contract, they do so in the hopes that the market price of the bond will rise in the future. The bond's seller anticipates a decline in price.

or Want to Sign up with your social account?