Small Cap Stock

A public company with a market capitalization of about 300 million USD to 2 billion USD.

What is a small-cap stock?

A small-cap stock is a public company with a market capitalization of about 300 million USD to 2 billion USD. The figures may vary. Classifications such as large-cap or small-cap are approximations that change over time. Furthermore, the precise definition of small-cap stocks vs. large-cap stocks may differ among brokers.

There is a conception that prevails that they are some startups or brand-new companies. But that's a vague concept. Even a large-cap stock of this month can be a small cap in the next month.

Many small-cap companies may be well-established companies with great financials. As the company is smaller, the chances of its growth are very high. That's why investment in such stocks lures investors.

Whether a stock will be a small cap or large cap completely depends on the shares outstanding,i.e., the number of shares traded in the secondary market and the market price of the particular share.

Although the number of outstanding shares may not be volatile, the prices can be the decisive factor in capitalization size.

Some examples are stocks of Rocket Companies, Boston beers, etc. Some of them in NYSE are The Joint Chiropractic, Container Store Group, etc.

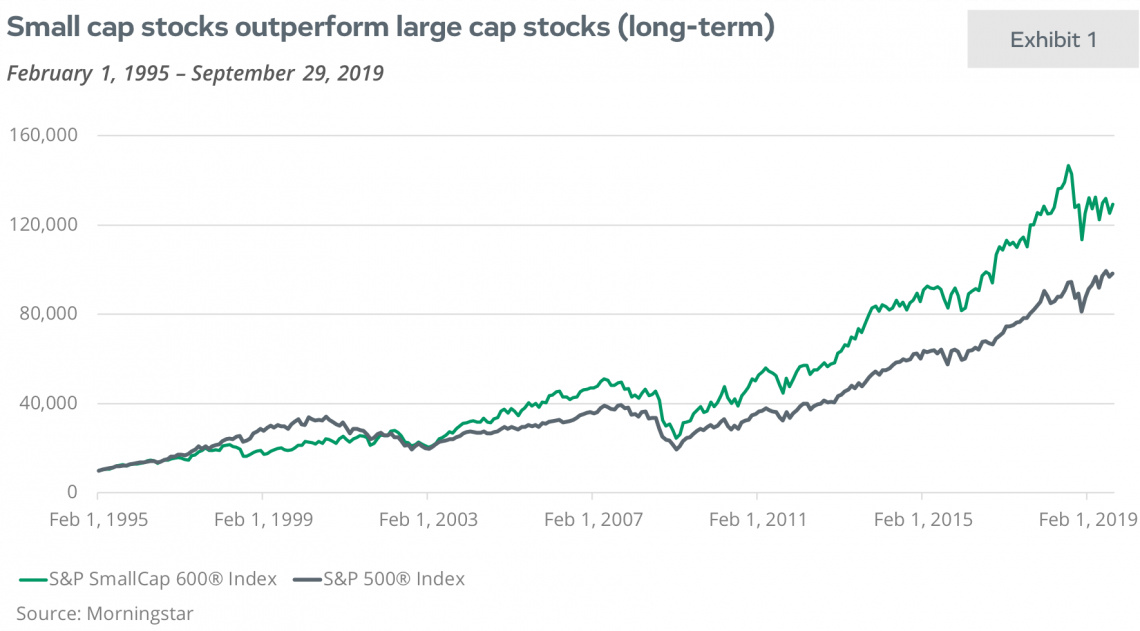

Historically, these are often seen outperforming large-cap stocks. However, whether smaller or larger companies do better depends on time-based on the broader economic situation.

For example, large-cap companies reigned in the era of the tech bubble of the 1990s, as investors were attracted to stocks such as Microsoft (MSFT), Cisco (CSCO), etc.

But, the tech bubble burst in March 2000, and small-cap companies became the better performers, as many of the large caps blunted value in the crash.

How to Calculate Market Cap

‘Cap’ in finance is an abbreviation of capitalization, which refers to the market capitalization of a company. Market capitalization means the value of a company traded on the stock market, calculated by multiplying the total number of shares by the current share price.

Market Cap = Price Per Share × Shares Outstanding

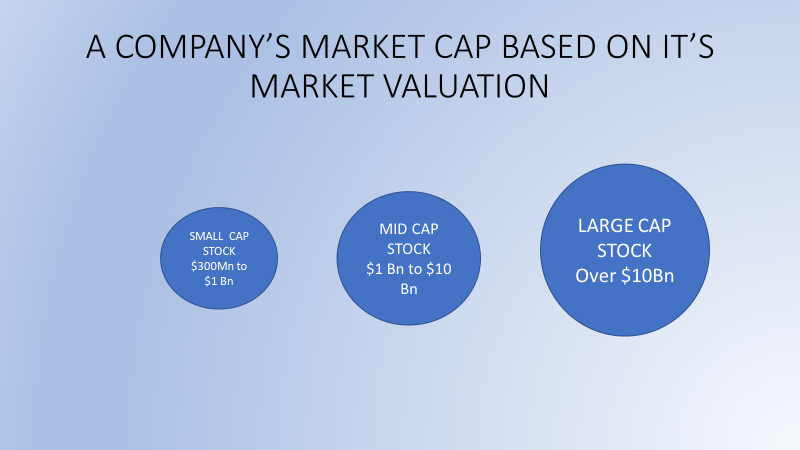

Based on market capitalization, stocks can be divided into categories, i.e., Large Cap, Mid Cap, and Small Cap Stock.

There can be three more categories, such as Mega Cap, Micro Cap, and Nano Cap, but they are not used much. As the name suggests, the small-cap consists of stocks with the smallest capitalization size.

Some of the most important criteria are outlined here. We'll examine both the positive and negative aspects of the small-cap universe. These considerations will aid you in determining whether a small-cap investment is worthwhile and suitable for you.

Features of Small-Cap Stocks

Small-cap stocks are very easy to find. On any finance-based website, it is very easy to search. However, to confirm if a particular stock is a small cap, we need to know its features listed below.

- Volatility: The value of such stocks is heavily influenced by the market, which makes them volatile. As a result, they perform well during high markets and may underperform when markets are down.

- Risk factor: There can be plenty of risk factors for the investor to be invested in these kinds of stocks. As the price is volatile and the number of shares outstanding is often low, resulting in inferior liquidity, there can be times when the investor wants to exit the market but can’t. Also, the stocks are more prone to market recessions; thus, a bad economic situation may completely drain all the equity invested in the stock.

- Returns: These are counted among the top-yielding investment options. We often hear the term ‘Multibaggers,’ the stocks that surge 1.5x or 2.0x or even more, yielding very high returns. Most of the multi-baggers were previously small-cap stocks.

- Investment horizon: There is no specific time horizon or hard and fast rule on how much time to invest in the market. Instead, it’s all about your risk appetite and targets to earn through that investment.

Investing in Small-Cap Stocks

Small caps are risky, volatile, and often less liquid but still attractive. So if someone has a good risk appetite, they can bear having them in their portfolio.

The more risk, the better the chances of high returns. There are many compelling reasons why an investor would be investing in this stock:

- There is great growth potential in these kinds of stocks

- Opportunity to avail stocks at fair prices, which large institutions do not influence

- Availing quality stocks at very low prices owing to the inefficiencies in the market

Over the long term, small cap stocks tend to outperform large cap stocks by 2.3% annually. Over ten years, with $10,000 invested, this could result in an additional $5,000. But taking these risks should not be rushed.

Not researching properly before investing in this stock is either gambling or foolishness. So if one wants to invest, proper research should be a no-brainer.

advantages of investing in small-cap stocks

There are many advantages an investor can avail of from small cap stocks. Therefore, including some of them in your investment portfolio could be beneficial, particularly if you want to develop long-term wealth.

Here are three reasons to diversify your portfolio with small-cap stocks if you typically invest in large-cap stocks:

- Fairly Priced: It is fairly priced as the large institutions can’t illustrate their power of money and pump the stock prices easily. They have to adhere to some limitations, which helps the small investor have it in their portfolio at fair prices.

- Greater growth opportunity: There is a great growth opportunity for investors' wealth invested in the small cap stocks as they are low-priced stocks with good fundamentals, and the price may increase with time.

- Low Priced quality stocks: Usually, it is low-priced quality stock that possesses the potential to rise as the company’s fundamentals improve.

Risks of investing in small-cap stocks

The risk associated with the investment into the small cap stocks can be listed below:

-

There is too much volatility in the market, and it can be risky for investors.

-

Offers comparatively less liquidity than mid cap and large cap stocks.

-

There is a lack of operational history and the chances for its unproven business model to prove dishonest. These two factors can make it very hard for small companies to compete with larger companies efficiently.

-

Because smaller companies don’t have a loyal customer base that they can rely upon and are more vulnerable to consumer preference changes.

-

Requires ample time to research and determine which stock the investor can bet on.

-

The fourth aspect of risk with small cap companies is data. All the required data about small companies are usually available to the public, making an informed evaluation of small cap stocks more difficult for keen investors.

Conclusion

In conclusion, small cap stocks are surely investible, but a lot of risk burden has to be borne.

There should be adequate studies and research on whether to invest or not. Financials alone are not enough to determine that; even the quality and activity of the management and board of the particular company demands a lot of attention.

There may also be some manipulations from the company's side in the annual results. So finding a great small cap company is not that easy.

A lot of prospects are to be checked upon. Finally, even if an investor is satisfied with all his research and ready to bet on the stock, he needs to identify his risk appetite and his target price on the particular stock.

The investor also needs to be firm on his decision because a lot of moments can come where the investment tumbles, but if the company's financials are solid, it will surely reach where it deserves.

As we know how important research is, the investor should learn that, and we have our course where the investor can easily put up that skill.

or Want to Sign up with your social account?