Synthetic Cash

Financial instruments or strategies that replicate the characteristics of cash without holding actual currency

What is Synthetic Cash?

Synthetic cash refers to financial instruments or strategies that replicate the characteristics of cash without holding actual currency. It is typically created through derivative instruments.

In finance, synthetic usually describes an artificial financial instrument used to mimic certain assumptions while changing some common characteristics in the traditional tool. As a result, synthetic financial instruments reduce risk while offering a higher return.

Hence, its functions are similar to the financial instruments commonly used when evaluating investments; it is a derivative, meaning that most of its cash flow relies upon other assets.

The structure of synthetic cash or its flow depends on the investors since it can be tailored based on investors' requirements and purposes. This increases diversification. One example is synthetic collateralized debt, which is invested in non-cash assets to obtain a fixed-income asset portfolio.

Key Takeaways

- Synthetic cash, achieved through derivatives, mimics cash's characteristics without holding actual currency, offering flexibility and risk management in financial strategies.

- Investors utilize synthetic cash for various purposes, including risk mitigation and accessing investment scenarios without deploying actual capital, leveraging derivative contracts for both short and long positions.

- Synthetic cash products range from income-paying to price appreciation-based instruments, such as synthetic dividends and synthetic convertible bonds, offering tailored investment options.

- The rising demand for synthetic cash, particularly among institutional investors, reflects its adaptability and role in decentralized finance (DeFi), indicating a transition towards technology-driven financial ecosystems.

Uses of Synthetic Cash

There are three main reasons that synthetic cash is useful.

- It can be customized to meet various requirements and assumptions, catering to investors of all sizes

- It allows investors to access scenarios without deploying actual capital, minimizing risks

- Investors can utilize synthetic cash for both short and long positions, although it's important to note that these positions are derivatives and distinct from traditional stock short-selling

Under this, there are two types of products:

- Ones that pay with income

- Ones that pay with price appreciation

The latter is more common. They are different from synthetic positions as products require contracts for their structuring.

An example of an income-generating synthetic cash product is a synthetic dividend, wherein investors use financial instruments to create an income stream resembling dividend payments.

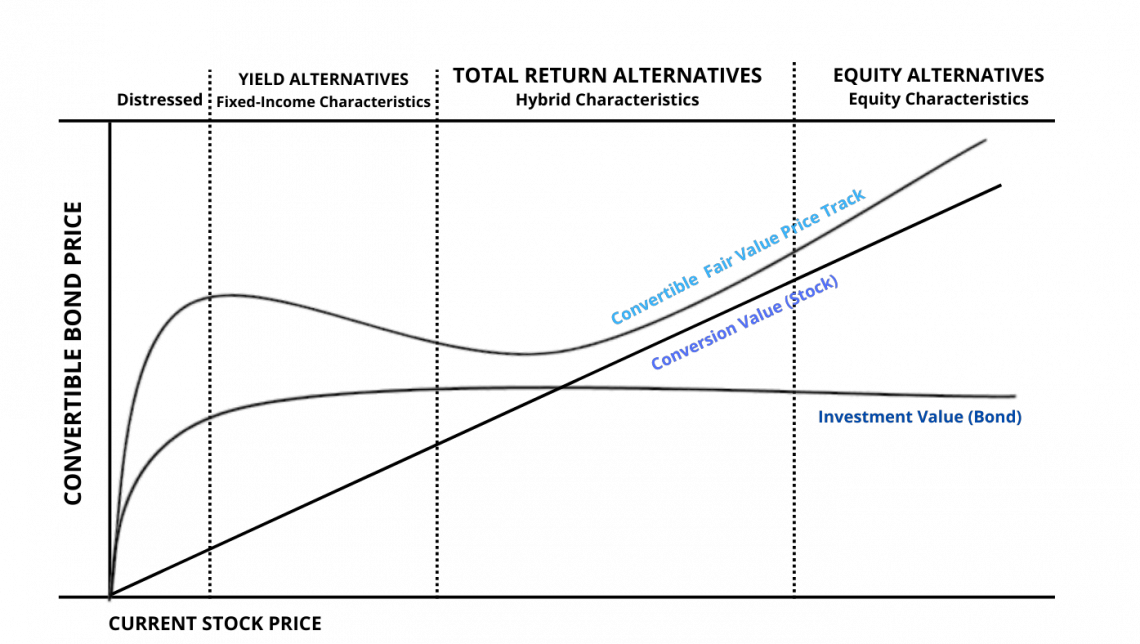

Synthetic convertible bonds

An example of the second product type is convertible bonds, synthetic products. A synthetic convertible bond has two main types of securities:

- Bank-issued structure notes

- Synthetic convertible units (SCUs)

Bank-Issued Structure Notes

These notes, arranged by investment bankers and the credit risk of a third party, are sold in complete packages.

Unlike traditional convertible security, bank-issued structure notes' credit risk does not come from the company issuing common stock and providing convertibility features. Instead, a third party regulates the credit risk.

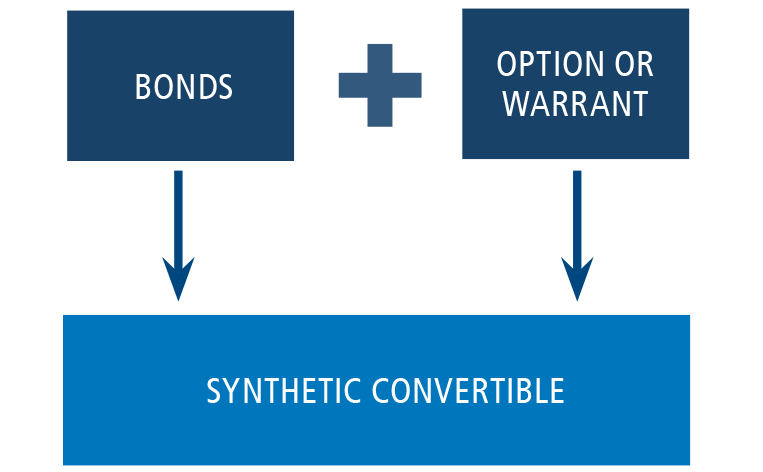

Unlike bank-issued structure notes, synthetic convertible units (SCUs) combine bonds and options/warrants. To simplify the concept, SCUs are straight bonds with a long-term call option, which is the right to convert the bond back to stock.

Synthetic Convertible Units (SCUs)

SCUs are constructed by purchasing small quantities to provide the risk or reward an investment manager is looking for.

Synthetic convertible bonds may be suitable for companies seeking to offer credits at a lower rate under certain market conditions and investor preferences. Thus, issuing the bond can increase the market demand without increasing the interest payments or the coupon rate.

This way, bond issuers benefit from converting bonds to stocks and attract investors who would like to sacrifice certain benefits in exchange for stock appreciation.

Bond issuers can also attract other stockholders by adding specific features to convertible bonds. For instance, attaching principal protection to the bonds prevents the losses of principal payments.

Synthetic Cash Market Demand

The market demand for synthetic cash is rising due to its popularity, spreading mainly through investor referrals.

Demand has shifted gradually from individual users to institutional investors, acknowledging the practicality of synthetic cash in helping investors make informed decisions.

In many cases, investors may collaborate with institutions that offer convertible bonds. These institutions provide convertibles tailored to the adaptable characteristics sought by investors.

Synthetic cash, including certain fixed-income bonds, may, depending on the specific structure and terms of the instrument, protect principal payments from losses or mitigate the effects of bond market volatility.

The rising popularity of cryptocurrencies and the emergence of decentralized finance (DeFi) contribute to the increasing market demand for synthetic cash.

Defi

Decentralized finance (Defi) is a financial ecosystem based on blockchain technology. As briefly mentioned in the last section, blockchain technology is a ledger system consisting of blocks that digitally store information in public databases.

Although popular Defi companies are experiencing a drop in monthly revenue, the cumulative Defi revenue has grown to over $4.2 billion since June 2022, demonstrating many users and the tremendous number of transactions in the market.

Note

As of March 2022, Defi has a market cap of $120 billion after making it to its new low this year. The number of wallets grew to 4.4 million unique addresses.

The growth in the Defi market suggests that millions of people use blockchain to build and participate in the new form of an economic system developed by code.

Additionally, the growth demonstrates users' adaptation to include technology in finance. Although it is not a form of technology, it represents a novel approach to investing.

The positive correlation between the two markets shows the slow dominance of the new economic system over the traditional one, as the new generation feels more comfortable with trading in the tokenized economy.

Synthetic cash vs. Synthetic Asset

One may confuse synthetic cash with synthetic assets since cash is a more traditional form of asset.

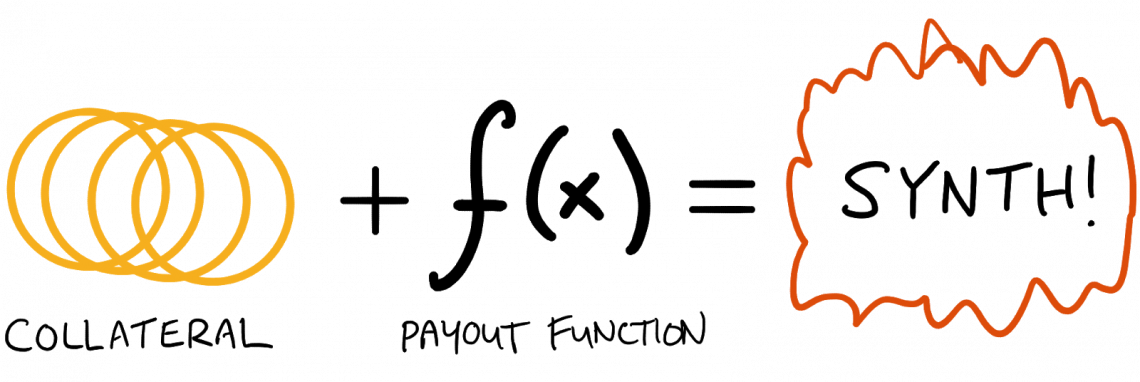

However, according to Coin Market Cap, synthetic assets, also known as synths, are a new form of asset that caters to a wider range of audiences. They combine cryptocurrencies and traditional derivative assets.

Traditional derivative assets are bonds or stocks investors do not own but want to buy or sell. Adding to this concept, synthetic assets are tokenized derivatives that create a blockchain pathway between the asset and the purchaser.

| Features | Synthetic cash | Synthetic Asset |

|---|---|---|

| Definition | A digital representation of fiat currency, usually pegged 1:1 to a specific currency (e.g., USD, EUR) on a blockchain platform. | A digital representation of real-world assets (e.g., stocks, commodities, real estate) created through smart contracts and blockchain technology. |

| Purpose | Used for transactions, settlements, and as a stable medium of exchange in decentralized finance (DeFi) platforms. | Provides exposure to traditional assets without direct ownership, enabling diversification, trading, and investment opportunities in DeFi and decentralized exchanges (DEXs). |

| Stability | Typically aims to maintain a stable value relative to the pegged fiat currency, minimizing volatility. | Value fluctuates based on the underlying assets' performance, potentially subject to greater volatility than synthetic cash. |

| Pegging Mechanism | Often backed by reserves of the corresponding fiat currency held in custody or through algorithmic stabilization mechanisms. | Pegged to the value of the underlying assets through collateralization, algorithmic rebalancing, or other mechanisms designed to maintain parity. |

| Liquidity | Liquidity may vary depending on adoption, integration with DeFi platforms, and the stability of the pegging mechanism. | Liquidity influenced by the underlying asset's market liquidity, demand, and the efficiency of the synthetic asset protocol. |

| Use Cases |

|

|

| Examples |

|

|

| Regulatory Concerns | Less likely to face regulatory scrutiny as it mirrors traditional fiat currency. | Depending on jurisdiction and asset type, may encounter regulatory challenges related to securities, commodities, or other financial regulations. |

| Risks |

|

|

Synthetic cash Vs. Synthetic Money

Since cash and money are often used interchangeably, many confuse synthetic cash with synthetic money. Nevertheless, they are very different conceptually and in their usage.

Let's look at the table below to understand the main difference:

| Feature | Synthetic Cash | Synthetic Money |

|---|---|---|

| Definition | A digital representation of physical currency. | Digital assets or cryptocurrencies designed to mimic the value and function of traditional fiat currencies. |

| Backing | Typically backed by reserves held by a central bank. | May not have physical backing; value is derived from the market demand and algorithmic mechanisms. |

| Stability | Tends to be stable in value, reflecting the currency it represents. | Can be volatile, subject to market speculation and fluctuations in demand. |

| Use | Used for transactions within a specific digital ecosystem. | Often used for trading, investment, and as a hedge against traditional currency fluctuations. |

| Regulation | Generally subject to financial regulations governing fiat currencies. | Regulation can vary significantly, from minimal oversight to comprehensive regulatory frameworks. |

| Examples | Central bank digital currencies (CBDCs), stablecoins. | Bitcoin, Ethereum, Tether, USD Coin (USDC), Dai. |

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?