Tips When Using the Short Straddle Option Strategy

Short Straddle Option Strategy is a tactical wager on the steadiness of the market. It encompasses selling both a call and a put option concurrently, each with an identical strike price and expiration date, focused on one particular asset.

"Ever wonder what gives seasoned options traders their edge?" Picture options trading as a chessboard, where every move and countermove counts. In this strategic landscape, the short straddle option strategy carves its niche as an invaluable tactic for those who master its application.

Imagine positioning yourself on both sides of the playing field by concurrently selling a put and a call option, both set at the same strike price and expiration date for a particular stock. This approach is a departure from strategies dependent on large swings in stock prices, favoring instead a more stable market environment. Grasping the nuances of the short straddle is crucial; it’s a strategy that can be as rewarding in a tranquil market as it can be risky in a volatile one.

Understanding the Basics of Short Straddle

The short straddle strategy, fundamentally, is a tactical wager on the steadiness of the market. It encompasses selling both a call and a put option concurrently, each with an identical strike price and expiration date, focused on one particular asset. This two-pronged approach is rooted in the anticipation that the asset’s price will experience minimal or no substantial fluctuations.

The essence of a short straddle is playing both sides of the market game. When you sell a call, you’re expecting the stock won’t rise above the strike price; similarly, selling a put suggests the stock won’t fall below it. This strategy often finds its place in traders’ playbooks during periods of expected market tranquility – think times when a company’s financial reports are due or when no major economic shifts are anticipated.

But before leaping in, a trader must assess a few critical factors. Analyzing the historical volatility of the asset and the current market landscape is crucial. Are there upcoming events that could sway the asset's price? This foresight is vital. Also, setting up robust risk management measures is non-negotiable. The potential loss, especially with the call option, can be substantial if the market moves unexpectedly. A well-thought-out exit strategy and tools like stop-loss orders are indispensable to mitigate these risks.

In short, the short straddle is a sophisticated yet risky play, suitable for calm markets and requiring careful preparation and risk assessment.

Risk Management Strategies For Short Straddle

In the world of trading, managing risk is paramount. This strategy inherently involves substantial risks, particularly due to the limitless potential losses it can incur, especially with the call option. The stakes are even higher if the market takes an abrupt and unexpected turn, which could drastically affect the trader’s position.

For risk mitigation, traders need to be thoroughly vigilant. The first step is to pinpoint the primary risk elements: significant market movements and their associated volatility. It's critical for traders to monitor market patterns and news closely, as these can set off volatility. Special attention should be paid to specific events like company earnings releases, key economic reports, or geopolitical shifts, any of which could lead to abrupt market changes.

Utilizing tools that limit risk is also essential. Stop-loss orders serve as a key line of defense, enabling traders to set a specific price level where their position will automatically close, thus curbing potential losses. Additionally, traders might consider using other options strategies like spreads, which help create a buffer zone, defining limits for the outcomes of their trades.

Effectively handling risks in short straddle trading is a blend of sharp market scrutiny and the strategic application of tools that limit risks. Such a proactive stance aids traders in steering through the options market’s unpredictability with more assurance and control.

Another key aspect of risk management involves financial planning for potential tax consequences. For instance, traders should be aware of capital gains tax, which may apply to profits made from short straddle positions. Understanding the specific tax implications and planning accordingly can help in making more informed trading decisions and managing the net profitability of trades.

Short Straddle - Market Analysis and Timing

In short straddle trading, a keen analysis of the market and the right timing are more than just advantageous—they're essential. The effectiveness of a short straddle is closely tied to the state of the market. It's a strategy that works best in a market that's not showing much price movement. But if the market gets choppy, the risks can escalate quickly. This makes a trader’s skill in interpreting and forecasting market trends incredibly important.

The timing of a short straddle is just as critical as the analysis. Accurately predicting periods of market stability is key to executing this strategy. This usually means delving deep into market research, understanding past market behaviors, and keeping an eye on forthcoming events that might impact the market's steadiness. Traders often align their short straddle positions with times they expect the market to be calm, such as when there are no significant economic reports or company earnings on the horizon.

For better insights, traders turn to various analytical tools and indicators. For instance, Bollinger Bands and the Average True Range (ATR) are common picks for assessing market volatility. Economic calendars are also a staple, offering a glimpse into events that could stir the market. By leveraging these resources, traders can make more strategic decisions on when to initiate or exit a short straddle, boosting their prospects for success.

Ultimately, the successful deployment of a short straddle strategy hinges on thorough market analysis and impeccable timing, equipping traders to traverse the complex terrain of the options market with enhanced accuracy and assurance.

Short Straddle - Practical Tips and Common Mistakes

Following a set of key best practices can significantly improve your success.

First and foremost, keeping a balanced investment portfolio is essential. Avoid putting all your eggs in one basket; the key is to diversify your strategies. Also, it’s critical to keep a close watch on your trades. The options market is known for its quick shifts, and being alert enables you to make smart, timely decisions.

One common mistake traders make is failing to consider big events that could shake the market. It’s important to regularly check the economic calendar and be ready to tweak your strategy in light of major events, like updates from the Federal Reserve or significant corporate earnings. Additionally, not having a clear exit strategy is another oversight. Whether you're in a profitable position or facing a loss, knowing exactly when to pull out is a crucial aspect of managing risk effectively.

Take, for example, a trader who opts for a short straddle in a phase of predicted low market volatility. Despite thorough preparation, an unexpected geopolitical development occurs, causing market chaos and resulting in major losses. This highlights the need to stay well-informed and have backup plans in place.

To sum up, mastering short straddle trading involves strategic planning, continuous attention to market movements, and an understanding of common errors. Adhering to these principles can help traders maneuver through this complex strategy more skillfully and cautiously.

Conclusion

To sum up, the short straddle strategy in options trading hinges on accurate market analysis, timely execution, and stringent risk management. Its effectiveness largely rests on the predictability of market conditions. Key practices like diversifying your portfolio, closely monitoring your trades, and adapting to market shifts are fundamental for success.

However, be mindful of the risks; the short straddle can yield rewards in stable markets but also pose significant losses in volatile conditions. An alert approach and a clear exit strategy are imperative. This strategy, though intricate, offers experienced traders a unique way to leverage specific market situations, equipping them with knowledge of both its potential and its pitfalls.

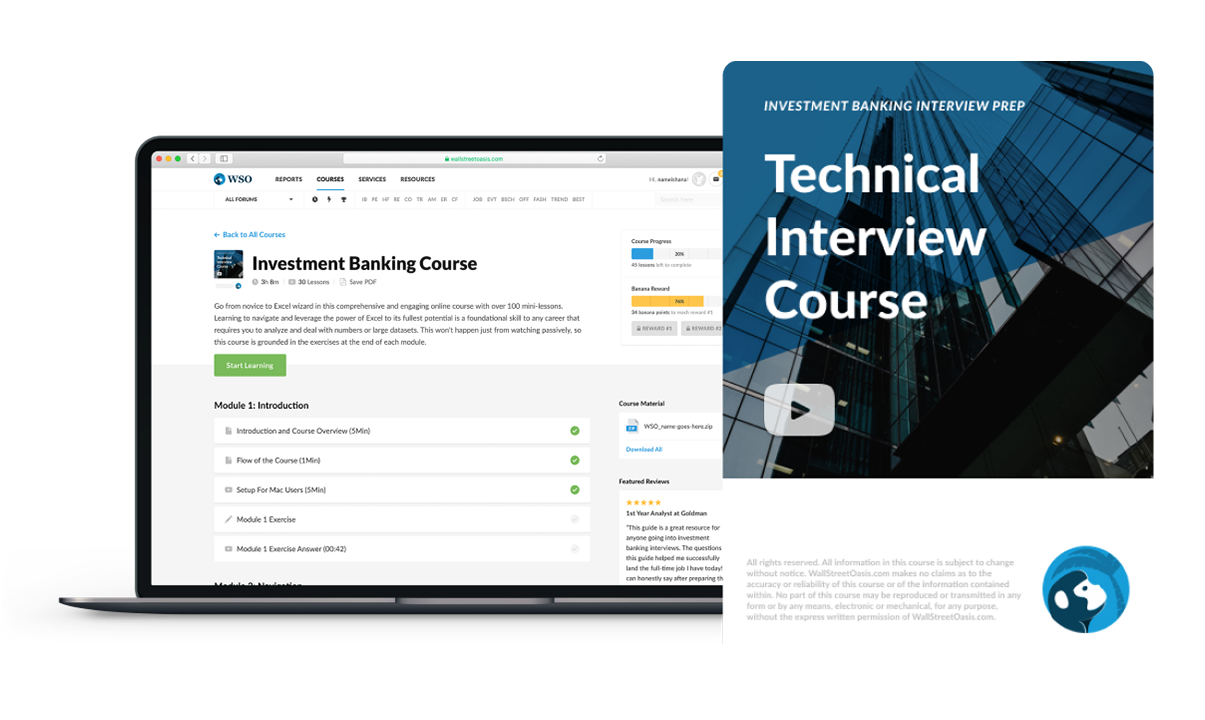

Everything You Need To Break into Investment Banking

Sign Up to The Insider's Guide on How to Land the Most Prestigious Jobs on Wall Street.

Authored By Shane Neagle

or Want to Sign up with your social account?