Appraisal-based Indices

It acts as a reliable guide for real estate investors, aiding them in evaluating and monitoring their investment portfolio

What are Appraisal-based Indices?

Appraisal-based Indices provide standardized and objective assessments of real estate asset values by aggregating individual property appraisals. These indices help investors track market trends, aiding decision-making for Real Estate Investment Trusts (REITs) and diverse portfolios.

Understanding Appraisal-Based Indices is crucial for informed property valuation and investment strategies in the dynamic real estate sector. Let’s start with a short story: Ron, a 35-year-old Data Scientist at a top IT Company, desires to buy a villa with a budget of $120,000.

As a layman, he computed the P/E (PRICE TO EARNINGS) RATIO of the chosen villa, whose expected earning was $241 monthly or $2892 yearly. Therefore, the price-to-earnings ratio would be $120,000/ $2892= $41.493.

Now, Ron thinks that what if he invested the same amount as fixed deposits in Banks @ 6% p.a?

The P/E Ratio, in this case, would be $ 120,000/ $120,000 * 6% = $ 16.67.

But still, Ron invested in real estate despite knowing the fact that he is giving away $ 24.823 (($41.493 - 16.67) extra to earn $1 from real estate.

Do you know why? It is because investment in Real estate is very revered and significant for any person. Being a productive asset, real estate ownership creates a sense of security and pride in the investor.

Key Takeaways

- Appraisal-Based Indices are standardized tools used to assess real estate asset values by aggregating individual property appraisals, aiding investors in tracking market trends and making informed decisions.

- Appraisal-Based Indices play a crucial role in real estate investment, offering insights into property valuation and portfolio management, especially for Real Estate Investment Trusts (REITs) and diversified portfolios.

- The construction of Appraisal-Based Indices involves periodic property appraisals, data aggregation, and the calculation of index values, providing a reliable benchmark for comparing property values over time.

- These indices come in various types, including Residential Real Estate Index (RREI), Commercial Real Estate Index (CREI), Income Capitalization Index (ICI), and more, each tailored to specific property valuation methods and purposes.

Features of Appraisal-Based Indices

The Appraisal Based Indices act as a reliable guide for real estate investors, aiding them in evaluating and monitoring their investment portfolio.

The following features make these indices distinctive from other performance evaluation metrics.

1. Periodicity

Periodic appraisals by licensed appraisers form the basis of the appraisal-based indices.

They gather data about the property's value, market comparisons, replacement cost, and earning capacity; monthly, quarterly, or annually to construct the indices.

2. Wide Scope

Applicable for residential and commercial property.

3. Specificity

They are usually constructed to derive the appraised value of the properties belonging to a geographic area, such as a city, county, or state.

4. Facilitates Decision-Making

Investors, lenders, appraisers, and many industry professionals rely on these indices for informed decision-making since they facilitate the tracking and monitoring of trends in specific real estate markets, such as office, retail, or multifamily.

5. Comparability

These indices provide a clear picture of the value of residential and commercial properties across different regions or periods.

Construction of Apprasial-Based Indices

Generally, these indices follow a multi-step process, which is briefly explained below:

1. Selection of Sample

Firstly, a relevant and representative property sample is selected, and an appropriate and consistent methodology is chosen for appraising properties in the sample.

2. Inspection of Sample

This is followed by site visits for physical inspection of the data accumulated on various attributes of the properties in the sample:

- Physical characteristics

- Location

- Income potential

3. Value Appraisal

In the third step, such data is analyzed to determine the appraised value of each property in the sample. Consistency and Accuracy Tests are run on the obtained appraised values and are then aggregated together.

4. Average Appraised Value Of The Sample

The aggregated value is divided by the number of properties in the sample to obtain the Average Appraised Value Of The Sample.

5. Choosing Base Period

After this, a base period for the index is chosen, and the base period appraised value is set to 100.

6. Computation of Index Value

This is followed by calculating the index value for each subsequent period considering the change in the average appraised value from the base period.

7. Adjustment of Computed Value

The index value is then adjusted concerning various components of the property sample based on parameters like property types (apartment or building) and regional and locational differences.

8. Dissemination of the Indices

Once an accurate and consistent index value is devised, it is published quarterly or annually through proper channels to disseminate it to the various stakeholders (Investors and Policymakers).

9. Accuracy Appraisal and Review

Last but not least, the indices constructed are monitored continuously to maintain their accuracy and to ensure that they are relevant and useful to the stakeholders in the real estate industry.

Types of Appraisals

Different appraisal reports can be used to construct a reliable and accurate index. Generically, they are categorized into three (3) types:

1. Full Appraisals

A professional appraiser generates comprehensive reports based on a physical property inspection concerning its location, condition, size, and features.

Here, the property's interior and exterior are appraised; hence, reports and indices are more detailed and accurate. Valuation based on this method is preferred by many when the property is mortgaged.

2. Drive-By Appraisals

Here, a licensed appraiser determines the property's appraised value by inspecting it from the streets. Despite being a cost-effective alternative to the Full Appraisal Method, the reports only highlight the property's exterior (like size, curb appeal, and condition).

Valuation by this method, though based on limited information, is suitable for properties situated in low-risk areas and is also required for mortgage refinancing.

3. Desktop Appraisals

Online appraisal of property value using online tools without a physical inspection of the property is known as desktop appraisal.

The characteristics are similar to Drive-by appraisal, except that they consider some interior attributes of the property too.

Appraisal Methods

Broadly, Economics and Finance Experts across the globe have devised the following three (3) methods to construct robust Appraisal Based Indices:

1. Cost Approach

Property valuation is done based on the cost of replacing the said property with a similar one, excluding any depreciation accumulated thereon. This methodology suits newly constructed properties and is considered in insurance-related cases.

Formula:

Property Value = (Cost Of Reproduction Or Replacement) - (Depreciation) + (Land Value)

For instance, let’s assume a property with the following features:

- Cost of reproduction = $100,000

- Depreciation = $10,000

- Value of Land = $25,000

Therefore,

Valuation Of Property = $100,000 - $10,000 + $25,000 = $115,000

2. Sales Comparison Method

Under this method, residential property valuation is done by comparison of the value at which other similar properties in that area have been sold. Such value is determined by considering several factors like size, location, and features of a similar property sold, etc.

Formula:

Property Value = (Adjusted Sale Price Of Comparable Properties)/ (Number Of Comparable Properties)

For instance, let $110,000, $225,000, and $115,000 be the value at which 3 similar comparable properties have been sold. Therefore,

Valuation Of Property=$110,000 + $225,000 + $115,000 / 3 = $150,000

3. Income Capitalization Method

This method targets income-generating properties such as rental properties and commercial real estate wherein the value of the said property are determined based on its income-generating capacity.

Formula:

Property Value = (Net Operating Income)/ (Capitalization Rate)

For instance, a property yields $100,000 as net operating income with a 10% capitalization rate. Therefore,

Valuation Of Property = $100,000/ 0.1 = $1000,000

However, the accuracy of these indices primarily relies on the nature and reliability of appraisals. Hence, the appraisals must be performed by unbiased licensed appraisers who adhere to professional standards.

Potential Biases Against Appraisal-Based Indices

As per the Collins English Dictionary, the word “Biasness” refers to the state of being biased; that is, being partial and inclined to a particular side.

While interpreting these indices, an investor should consider the following potential biases that may arise while constructing them:

1. Sample Selection bias

Choosing an accurate sample representative of the broader population of properties forms the building blocks of an appraisal-based index. Factors such as location, size, and quality of the properties in the sample can introduce bias into the index.

- Location & Quality of the property: The index will OVERSTATE the real estate market's performance for a sample that consists of properties situated in high-demand areas and of superior build quality.

- Size of the property: A sample with a higher concentration of small-sized properties will UNDERSTATE the real estate market’s performance.

2. Appraiser bias

The appraiser's personal experiences, beliefs, judgments, and perspectives influence the appraisal process. So, the appraised value of the properties will be inaccurate and inconsistent, thus, hampering the accuracy of the index.

3. Market bias

The real estate market is Seasonal and Cyclical in nature and is characterized by various economic changes concerning its peaks and troughs. In such cases, concluding the data becomes difficult, and the index becomes inaccurate.

4. Lack of transparency

The opaque appraisal process undermines the index's credibility and makes it difficult for the shareholders to understand how the index is constructed. Hence, no conclusions can be drawn from such indices, thus, rendering them useless.

5. Incomplete data

Moreover, incomplete, inadequate, and outdated data used to construct the index affects the index as a whole. Hence, a database consisting of the historical values of the indices becomes handy as a tool for research and analysis.

Commonly Used Appraisal-Based Indices

Well, the list is long due to the vast and dynamic nature of the real estate market. Yet, let me list out the most common ones.

1. Residential Real Estate Index (RREI)

This shows the relationship between the average price of a property basket and the average to a base period or benchmark.

This index is a useful tool for understanding, measuring, and evaluating the performance and trends in the residential real estate market.

Property Sales Data, Home Price Trends, Mortgage Trends, and Buyer sentiment are some factors considered for constructing this index.

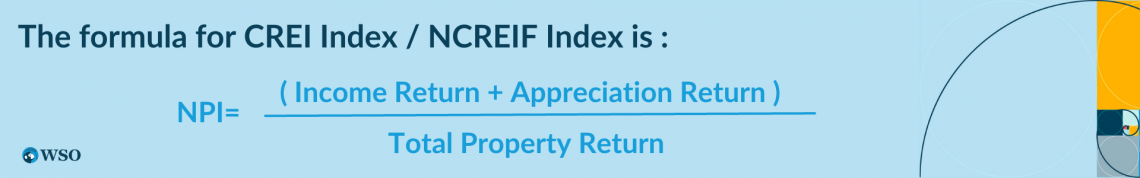

2. Commercial Real Estate Index (CREI)

This index is prevalent for measuring the performance of commercial, income-generating real estate properties.

The sum of the return generated by such properties ( INCOME RETURN ) and the return generated by the increment in the value of properties (APPRECIATION RETURN ) is divided by the TOTAL REVENUE generated by the properties in the index.

The National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index is the most commonly used by various stakeholders for decision-making and analysis.

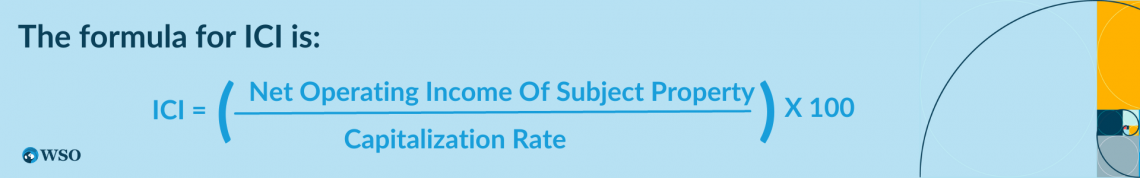

3. Income Capitalization Index (ICI)

This index follows the Income Capitalization Method.

4. Sales Comparison Index (SCI)

This index is constructed following the Sales Comparison Method.

5. Cost Approach Index (CAI)

This index is constructed following the Cost Approach.

6. Time-Adjusted Index (TAI)

This metric is suitable for tracking property valuation over a long period. Through this index, the current value of a property can be evaluated, keeping the historical valuations as the base.

The historical valuations are, however, adjusted with the effect of economic factors like inflation that has occurred over time.

7. Geographical Index (GI)

Location is a major factor affecting property value. This index thus considers the regional differences in the real estate market. Real Estate Agents and Policymakers widely use this index to obtain insights into the relative value of properties in different areas.

The construction of this index may vary, but generally, it uses the sales data of similar properties in the vicinity and demographics therein.

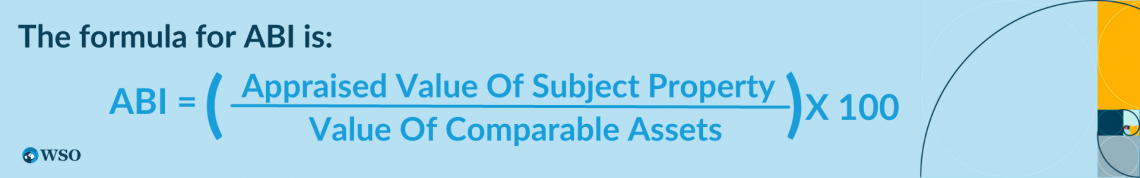

8. Asset-Based Index (ABI)

Here, the replacement cost of the building and other physical assets such as land, equipment, and fixtures are taken as a base rather than the revenue generated by the property.

ABI is used to accurately evaluate specialized property like schools and hospitals, especially where income generated is not a reliable indicator.

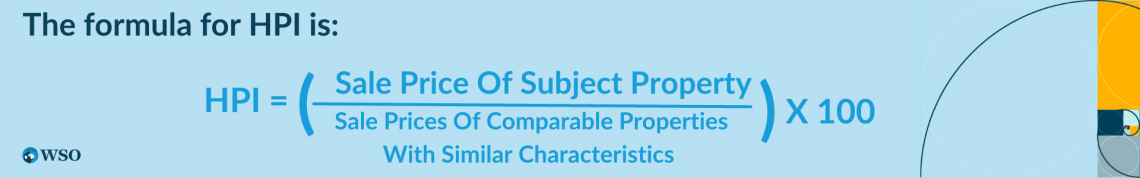

9. Hedonic Price Index (HPI)

Property Valuation at aggregate levels is very challenging. Moreover, property valuation is affected by various attributes and characteristics such as size, location, and quality.

This index compares the value of a property based on its characteristics, such as size, location, and amenities.

Time Dummy Method and Price Characteristics Method is used to construct this index. While the former considers the characteristics as independent variables and the natural log of the collected price as the dependent variable, the latter is the geometric mean of property valuation in the ‘t’ and ‘t+1’ periods.

10. Market Share Index (MSI)

A company's market share and competitive position within a particular industry are chalked out through this index.

Factors such as market size and competitiveness in the industry are its major constituents.

11. Confidence Index (CI)

This index measures the confidence level investors can gauge in the economy by conducting a survey.

Various Parameters like inflation, economic growth, interest rates, market volatility, etc., are surveyed, thus, throwing light upon investor sentiments and enabling policymakers to adjust their policies accordingly.

12. Development Index (DI)

This index evaluates a property's financial viability, feasibility, and profitability before and after development.

Land costs, construction costs, and potential revenue from the developmental project are the major constituents of this index.

Appraisal-Based Indices Pros and Cons

Appraisal-based indices enable investors to optimally measure portfolio performance without being influenced by market fluctuations. However, like any other analytical tool, deploying this metric has pros and cons.

Some of the distinct advantages of appraisal-based indices are:

- Unlike sales-based indices, these indices offer a more accurate and comprehensive picture of the real estate sector performance

- Property valuation is made possible even when sales data is unavailable (like properties in rural areas)

- Tracking fluctuations in the value of real estate properties over time aids investors and professionals in their decision-making process.

- Daily fluctuations do not influence these indices in the real estate market, thus, leading to reduced short-term volatility.

- They are not generalized but customized based on various properties (like apartments or buildings), leading to a more detailed analysis.

Some potential disadvantages of these indices are:

- A property appraisal is a time-consuming and costly process, especially when many properties need to be appraised for an area.

- Geographical variations act as a roadblock for the comparability of these indices.

- Calculation and analysis using these indices are comparatively tedious and time-consuming compared to other investment tools.

- Failure to depict the real-time market fluctuations as they are constructed on a periodic done periodically (monthly/quarterly/yearly).

- Appraisals are subject to the appraiser’s personal bias; hence, in some cases, the indices fail to show the true and fair position of the real estate market.

Appraisal-Based Indices in Real Estate Investment

Many of you must have heard about Dow Jones, Nikkei, and FT-30 Stock Market Indices. But did you know that there are also a set of indices for property valuation?

The real estate sector is volatile and dynamic in nature, affected by price fluctuations quite often. Various factors such as market trends, interest rates, overall economic conditions, location, political stability, raw materials, and the labor market impact real estate prices.

The key features of Appraisal-based indices are as follows:

- Appraisal-based indices (ABI) are a valuable tool for investors to evaluate the performance of their portfolios with others in a standardized and objective manner. Thus, investors can track market trends by measuring the value of real estate assets based on period appraisal data.

- The construction of these indices involves data aggregation from individual property appraisals to arrive at a composite value for a particular market or region.

- The application of these Appraisal-Based Indices is quite vast- from Real Estate Investment Trusts (REITs) to investment portfolios holding art and collectibles, especially those with a premature market.

- Acting as a reliable benchmark, appraisal-based indices aid investors in decision-making and portfolio management.

Thus, an all-around knowledge and a clear understanding of the valuation of properties are quintessential for any investor. To serve that purpose, one must be aware of the utility and application of the indices.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?