Corporate Bond Valuation

Is the process of determining the fair value of a bond

What is Corporate Bond Valuation?

Corporate bond valuation is the process of determining the fair value of a bond.

The process takes three inputs into consideration:

- Present value of the bonds coupon payments

- Repayment of the principal value

- The probability of the bond defaulting

The valuation of corporate bonds is dependent on the present value of future cash flows. The probability of the bond defaulting and the payout ratio from defaulting will also be used in the calculation.

Corporate bonds carry the risk of the company defaulting. Therefore, from an investor's point of view, they are riskier when compared to government bonds. However, for that reason, corporate bonds offer higher yields than government bonds.

For example, a government bond, such as a US Treasury Bill a very conservative investment. The yield would be calculated using the Federal Funds rate, interest and inflation risk rate, and premiums.

Corporate bonds would be at the same rates; however, due to the risk of the corporation defaulting, they require further payment.

Key Takeaways

-

Corporate bond valuation involves determining the fair value of a bond by considering the present value of coupon payments, repayment of the principal, and the probability of default.

-

Corporate bonds carry higher risk compared to government bonds, but they offer higher yields as compensation for the additional risk.

-

Corporate bonds are debt obligations where investors lend money to corporations in exchange for periodic interest payments and repayment of the principal.

-

Bond ratings provided by credit agencies indicate the level of risk associated with corporate bonds. Investment-grade bonds have lower risk, while speculative-grade bonds carry higher risk but offer higher interest payments.

-

Corporate bond valuation can be done using techniques like probability trees and discounted cash flow analysis. Calculating expected values for cash flows and discounting them to their present value helps determine the bond's fair value and yield.

What is a Corporate Bond?

Similar to any other bond, a corporate bond is a debt obligation. In this case, investors' money is borrowed by a corporation for the return of timely interest payments on the principal. When the bond matures (comes to an end), the corporation is obligated, in most cases, to return the principal.

This is very different from a stock, where the investor has a share in the company's ownership, receives dividend payments, and experiences capital appreciation/depreciation along with the company's value.

Bonds are different as there is no ownership in the company; however, similar to dividends, the investor may receive small, periodic payments.

Corporate bonds are widely used and considered one of the largest components of the U.S. bond market.

Corporations need bonds to raise funds to purchase new equipment, research and development (R&D), stock buy-backs, dividend payments, and mergers and acquisitions (M&A).

Like all other bonds, corporate bonds are given a credit rating from an agency based on an evaluation of the risk of the company defaulting. From the rating, the bond is then given either investment-grade status or speculative-grade status.

You can view a list of the top corporate bonds of 2022 by U.S. News here.

A corporate bond is deemed investment grade, indicating a low risk of default. Bonds deemed “AAA” (triple A) prove to be of the lowest risk. However, with low risk also comes lower returns.

On the other hand, speculative-grade bonds are the opposite, signifying a greater risk of the company defaulting. Bonds given ratings below “BBB” show the bond may be risky; however, they will offer greater interest payments.

Any rating below “BB” (one down from “BBB”) is deemed to be a junk bond.

Corporate Bond Valuation Example

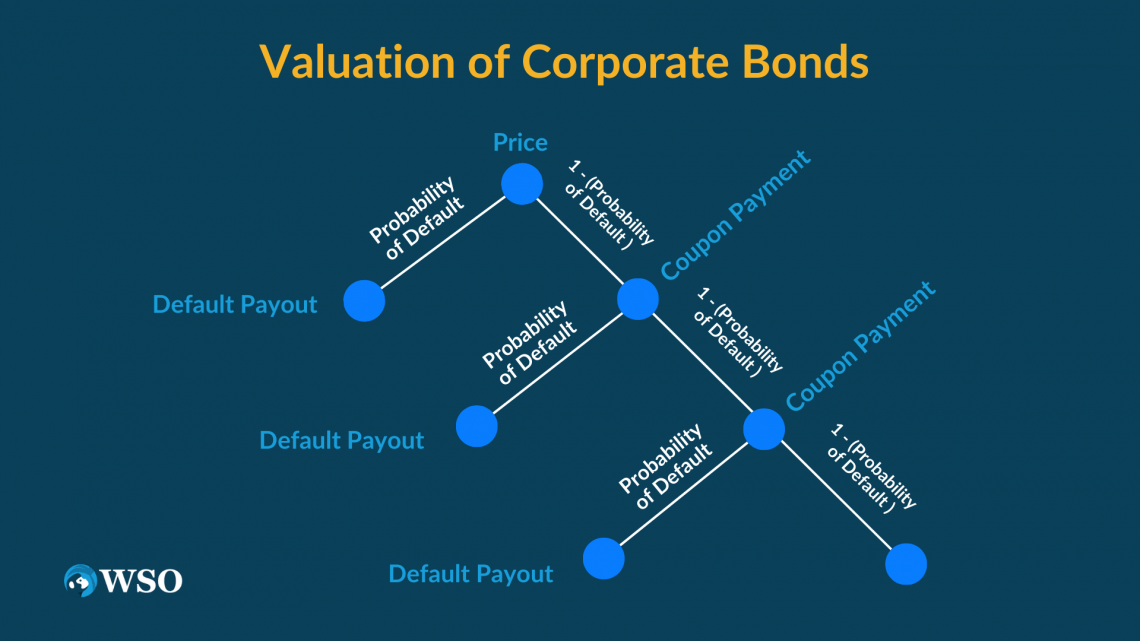

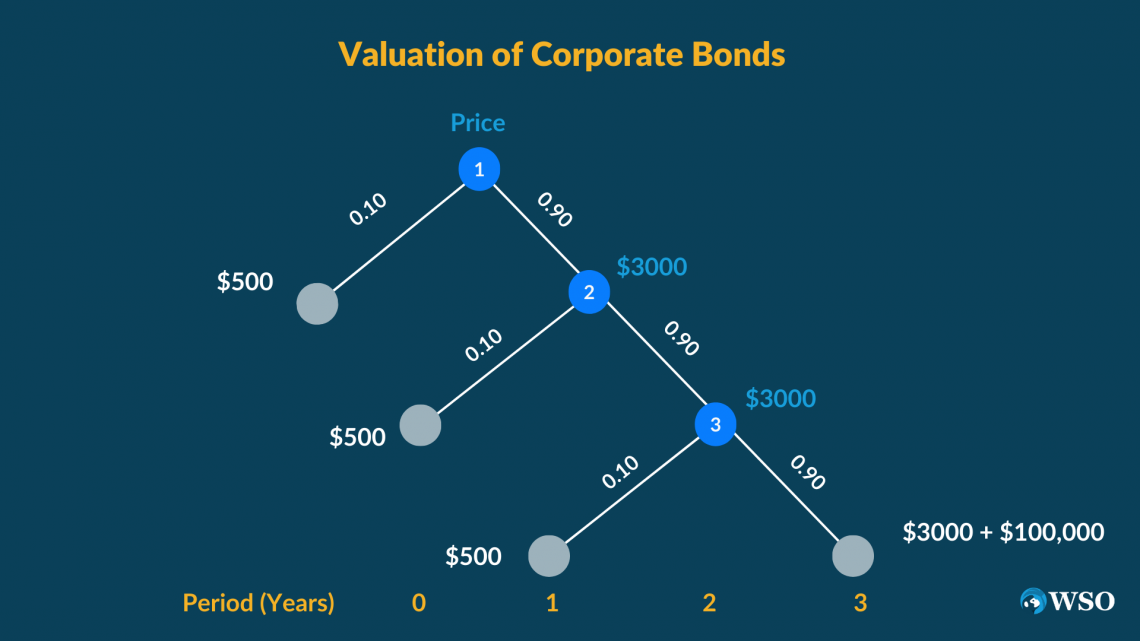

The valuation of corporate bonds is easiest to understand through a visual example. A common way to structure a corporate bond is using a probability tree.

To better understand how the probability tree works, let's continue with the following example:

Corporate Bond

- 3 Year maturity

- $100,000 Face Value

- 3% Coupon Rate ($3,000 paid annually)

- 50% Payout Ratio ($50,000 default payout)

- 10% Probability of Default

- 5% Risk-Adjusted Discount Rate

1. Calculate the expected value (EV):

We will begin by calculating an expected value (EV) for each period of the corporate bond. The formula for each expected value will be the product of the default probability and default payout, plus the product of the coupon payment and the probability of not defaulting. The probability of default will be represented with the letter (P).

Period 1

EV1= P(Default Payout) + (1-P)(Coupon Payment)

EV1 = 0.10($50,000) + 0.90($3,000)

EV1= $7,700

Period 2

Calculating the expected value for period two will use the same formula. However, there is now the added uncertainty of (1-P) or (0.9), the chance bond of not defaulting.

Therefore, we will multiply everything from the original formula by that probability.

EV2 = (1-P) ( P(Default Payout) + (1-P)(Coupon Payment) )

EV2 = (0.9) (0.10($50,000) + 0.90($3,000))

EV2 = $6,930

Period 3

For period three, there is now another uncertainty of (1-P), or (0.9), that will be applied, causing the original formula to be multiplied by (1-P)2.

EV3 = (1-P)2( P(Default Payout) + (1-P)(Coupon Payment + Principal) )

EV3 = (0.9)2 (0.10($50,000) + 0.90($3,000 + 100,000))

EV3 = $79,137

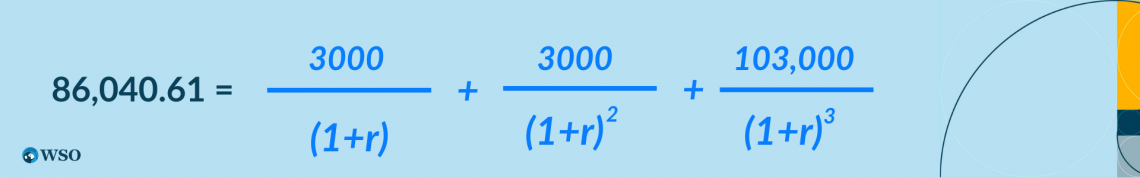

2. Discount back to present value

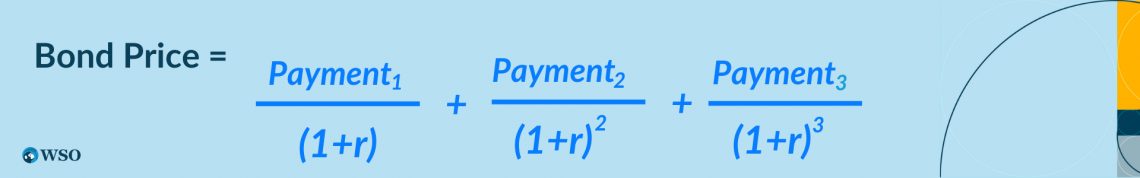

Now that the expected value for each period is calculated, they must be brought back to their present value (period 0) using a risk-adjusted rate (r) to derive the bond's price. In the following equation, n represents the number of periods.

Bond Price = (EV1)/ (1+r) + (EV2)/ (1+r)^2 + …….. + (EVn)/ (1+r)^n

Bond Price = (7,700)/ (1.05) + (6,930)/ (1.05)^2 + (79,137)/ (1.03)^3

Bond Price = $86,040.61

The calculated value of the corporate bond is $86,040.61. Bonds can trade at a discount or a premium depending on the current market interest rate.

The bond is sold at a premium when the interest rate is lower than the bond's coupon rate.

The bond is sold at a discount if the interest rate is higher than the bond's coupon rate.

Therefore, the value of the bond may change throughout the term.

3. Calculate the bond's yield

Once the bond price has been calculated, it is possible to find the yield. The calculation will start with setting the bond price equal to the payments divided by the interest rate plus one.

Now, solving for ‘r’, the yield of the corporate bond amounts to a yield of 4.02%.

Corporate Bond Valuation FAQs

A process called a probability tree is commonly used to calculate the value of a corporate bond. The process depends on the present value of future cash flows, discounted at a risk-adjusted rate, with the probability of defaulting factored in.

When calculating the yield of a corporate bond, set the bond price equal to the value of the payments, divided by one plus the rate (r). The formula can then be solved for r, which is the yield.

Corporate bonds can be rated investment-grade or speculative-grade. Investment-grade bonds are offered by well-established companies. They have low yield due to the lower level of risk.

Speculative-grade bonds are known as high-yield bonds as they are issued by newer or lesser-known companies that are riskier to deal with. A company offering speculative-grade bonds is riskier because there is a higher likelihood of default.

To value a corporate bond, we used the probability tree to calculate future cash flows, which are then discounted back to their present value. Stocks, on the other hand, are far more difficult to value, as their future cash flows can be hard to predict.

Common models to value common stock include a dividend discount model (DDM), a discounted cash flow (DCF) analysis, and a comparables model.

Bonds tend to be easier to evaluate because the investor’s payments are fixed, and the most a bondholder will receive is their coupon payments.

For stocks, however, there is no limit to how high dividend payments can be. This is why valuing a stock is more complex, as the analyst must also evaluate the company's profits, as the more they make, the larger their dividend payments will be.

There is also a large risk variance between the two. When choosing bonds, the investor must know if the company has sufficient cash to make the payments.

Future cash flows are harder to estimate and do not guarantee dividend payments, as they could be cut down or fail to be paid out if the company is low on money.

or Want to Sign up with your social account?