Market Value Added (MVA)

It is a measurement of the wealth a company has been able to generate for its stakeholders since its founding

What Is Market Value Added (MVA)?

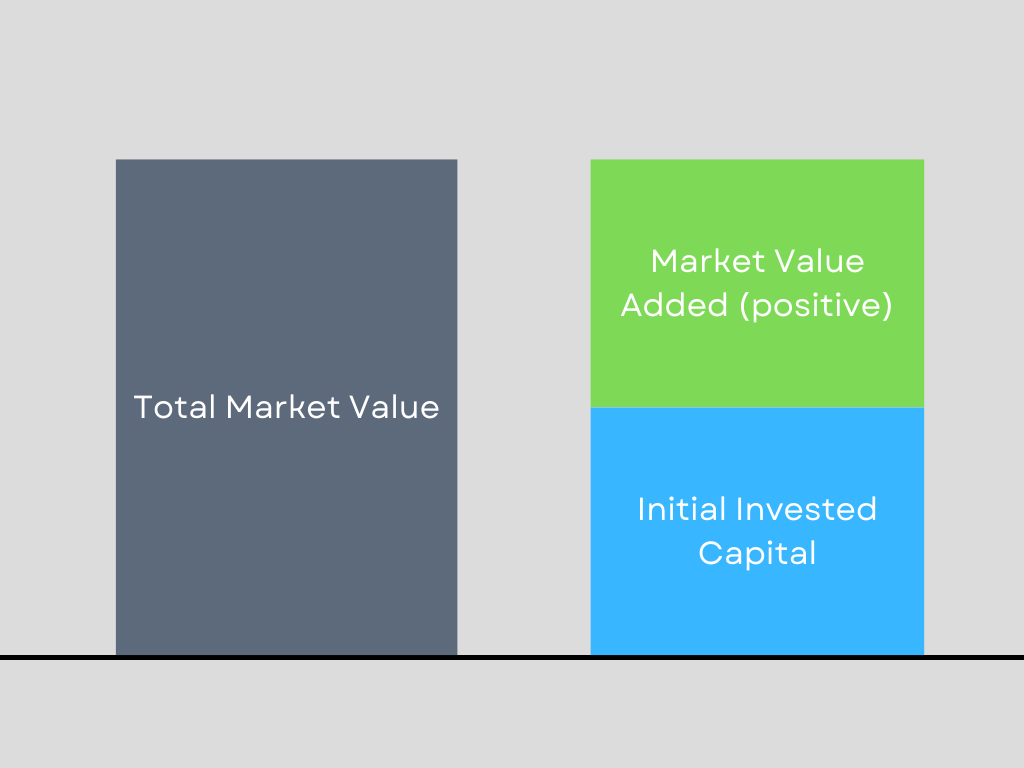

Market Value Added (MVA) is a measurement of the wealth a company has been able to generate for its stakeholders since its founding.

Simply put, it's the difference between the stock's current market value and the initial value that both bondholders and stockholders contributed to the company, i.e., the initial invested capital.

Market and economic value added (EVA) are similar concepts. This article clarifies the distinctions between the two.

Investors first look at the measurement when they want to know how a firm performs for its shareholders. The MVA of a firm reveals its ability to raise shareholder value steadily. A high measurement demonstrates excellent operational capability and efficient management.

A low measurement may indicate that the efforts and investments of management are not worth as much as the capital provided by shareholders.

A negative market value indicates that the management's decisions and investments have reduced the value of the capital shareholders have provided.

Investors are drawn to companies with high measurements, not just because there is a higher possibility that they will generate positive returns but also because it is a sign that they have solid governance and competent leadership.

The MVA can be understood as the sum of money management provided to its initial early-stage investors in addition to what they invested in the business.

Businesses that can maintain or grow the measurement over time often draw more investment, further boosting the firm's market value.

Because it does not consider cash payments made to shareholders, such as dividends and stock repurchases, the measurement may overstate a company's performance.

When stock prices are generally rising, and there is a solid bullish market, market value added may not be a good indication of managerial performance.

Key Takeaways

- MVA measures a company's wealth creation by comparing current market value to the initial capital contributed by stakeholders.

- High MVA indicates efficient management, showcasing a company's ability to steadily increase shareholder value.

- MVA may be less reliable in bull markets, as it doesn't account for cash payments, potentially overstating a company's performance.

- Calculated as Market Value of Shares minus Book Value of Shareholders' Equity, MVA considers both equity and debt.

- High MVA enhances investor appeal, suggesting a healthy business with potential for high returns and increased survival chances.

How To Calculate Market Value Added (MVA)?

Investors utilize the measurement as a critical concept to assess how effectively the company has used its capital. It can be either positive or negative and can support or sabotage the company's present direction.

In the case of negative measurement, the company might choose to change course in favor of a more value-oriented strategy. However, a negative measurement also implies that management isn't employing the business's resources well or efficiently. As a result, it's a bad investment.

The formula is as follows:

MVA = Market Value of Shares - Book Value of Shareholders' Equity

The Market Value of shares incorporates the value of the company's equity and debt., it is also known as the enterprise value. To determine the market value of shares, we need to multiply the outstanding shares by the current market price per share.

If the company has both preferred and common stocks, then you must calculate the sum to obtain the total market value.

Example:

Consider Company ABC, whose stockholders' equity is $900,000. The corporation has 50,000 outstanding common stocks and 2,000 preferred stocks.

The current market value of common stocks is $30, while the value of preferred shares is $100 per share.

Market Value of Common Shares = 50,000 X $30 = $1,500,000

Market Value of Preferred Shares = 2,000 X $100 = $200,000

Total Market Value of Shares = $1,500,000 + $200,000 = $1,700,000

Using the results above, we obtain:

Market Value Added = $1,700,000 – 900,000 = $800,000

Examples of companies with high MVA

Google's parent company, Alphabet Inc. (GOOGL), is one of the most valuable businesses in the world, with strong future growth prospects. In its first ten years of existence, its stock returned 1,293%.

Although market vibrancy over its shares can be credited with a significant portion of its MVA in the early years, the business has been able to more than double it from 2015 to 2019.

From $354.25 billion in 2015 to $606.20 billion in December 2017, $809.01 billion in December 2019, and $1.19 trillion in 2020, Alphabet's MVA has increased significantly.

Economic Value Added Vs. Market Value Added

It is essential to remember that lenders and investors apply several methods to determine a company's value. Therefore, it is crucial for individuals wishing to invest in a specific company. Additionally, valuations are used to assess a company's credit risk.

To assess a company's value, investors mostly employ the methods of:

- Economic Value Added (EVA)

- Market Value Added (MVA)

Sal Fazzolari, senior vice president, chief financial officer, and treasurer of Camp Hill, Pennsylvania-based industrial services company Harsco Corp., which started using market value added and economic value added as financial-measurement tools in 2001,

Stated that it "simplifies everything." However, everyone in the firm should focus on this one metric. It considers every aspect of a company's finances.

The fundamental tenets of market value added and economic value added is maximizing shareholder return which should be management's top priority, and a corporation should generate more revenue than its cost of capital.

Economic Value Added (EVA)

Economic value added (EVA) is a performance metric designed by Stern Stewart & Co. EVA to estimate the real economic profit a business generates.

It appraises a company's economic success (or failure) over time and is often referred to as "economic profit."

Economic value Added is helpful for investors who want to know how successfully a company has generated value for its investors. In addition, this parameter helps to rapidly examine a firm's performance in its industry relative to its peers.

Economic Value Added Formula

Economic profit can be determined by taking a business's NOPAT (net operating profit after tax) and deducting the sum of the invested capital of the business multiplied by the weighted average cost of capital (WACC) from it.

EVA = NOPAT - (Invested Capital * WACC)

Where:

- NOPAT = Net operating profit after taxes

- Invested capital = long-term debt at the beginning of the period + shareholders' equity

- WACC = Weighted average cost of capital

Economic Value Added Example

In 2020, Company XYZ achieved net earnings of $500,000 after taxes. The company invested $4 million as capital at an average cost of capital of 10 percent. To figure out XYZ's EVA:

EVA = $500,000 – ($4,000,000 * 10%) = $100,000

The $100,000 figure suggests that Company ABC made sufficient income to offset its initial cost of conducting business.

Market Value Added

On the other hand, market value added is the difference between the company's present market value and the initial investments made by its investors.

Contrary to popular belief, Market Value Added is not a performance measure. It is a wealth measurement metric instead. In essence, it is utilized to calculate the precise value the company has gathered over time.

A well-performing firm that has been retaining its earnings will raise the company's stock's book value. As a result, investors will appreciate the shares' prices in anticipation of rising profits in the future.

The entire procedure dramatically raises the company's market value and increases its appeal to potential investors.

In contrast to economic value added, market value added is a straightforward indicator of a company's operating competence. As a result, it does not consider the opportunity cost of other investments.

Advantages Of Market Value Added (MVA)

A high market value demonstrates that the business has value in addition to the capital invested by shareholders.

A company has many advantages to having a healthy added market value.

These advantages include:

- Increasing appeal to potential investors.

- The likelihood of high returns for investors.

- Higher survival chances for the company.

1. It Increases attractiveness to investors:

A company is more likely to attract investors seeking appealing opportunities to place their money if it has a higher added market value since it is evident that the company is healthy and prosperous.

Investing in a company with a high measurement is safer and more secure for investors who aren't seeking a long-shot, big-payoff bet.

2. It promotes high returns for investors:

There are benefits for individuals who have already invested their money. For example, a business with a high added market value has shown to be successful for present investors and has produced considerable returns.

A corporation can anticipate positive news and significant investor interest in the future with such a reputation among investors in the business sector, ensuring a certain level of success and profitability.

3. It boosts the survival chances of the firm:

Nothing should be taken for granted in the business world. A business generating millions of dollars in profit could at any given time go bankrupt. However, a company's likelihood of success is unquestionably strong if it has a high market value added.

A high measurement indicates competent management and a robust business model that has allowed the business to grow in the past and has a high probability of it growing in the future.

or Want to Sign up with your social account?