Investment Banker Salary

Investment Banking Salary Guide: Provides salary information for different positions in the industry, helping individuals understand earning potential and benchmark salaries.

Investment banking (IB) is a type of banking that offers services related to raising capital to other companies and sometimes even governments.

Investment banks (referred to as “banks” here) employ investment bankers (referred to as “bankers” here) who routinely guide their clients through vast and complicated transactions. In addition, they identify associated risks for their clients, thereby saving clients’ resources (time and money) before they proceed forward.

They help plan and manage the financial aspects of sizable projects, and their services include:

- Facilitating and underwriting the sale of securities

- Advising on restructuring

- Connecting buyers and sellers

- Advising on deal structuring and valuations in merger and acquisition (M&A) transactions

The fees paid by clients are a significant determinant of their earnings.

IB is a borderless career where bankers work with clients worldwide, meaning they manage their schedules around the clients’ time zones. They typically work for extended hours into the night.

However, the stressful work and the high-pressure environment reward them generously with high earnings and outstanding opportunities to advance their career.

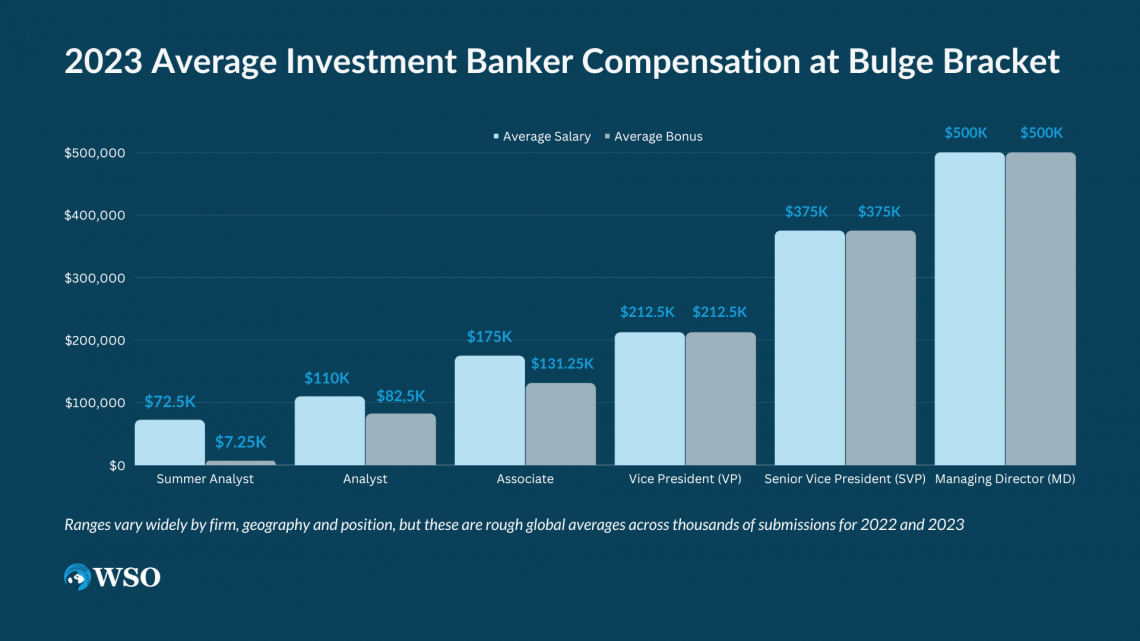

Before we dive into the article, here is a summary of who makes how much at an investment bank.

| Role | Base Salary ($) | Average Year-End Bonus (% of base) |

|---|---|---|

| Summer Analyst | $65,000 - $80,000 | 10% |

| Analyst | $100,000 - $120,000 | 50% - 100% |

| Associate | $150,000 - $200,000 | 50% - 100% |

| Vice President (VP) | $200,000 - $225,000 | 50% - 150% |

| Senior Vice President (SVP) | $250,000 - $500,000 | > 100% |

| Managing Director (MD) | $400,000 - $600,000 | > 100% |

Components of an investment banker’s salary

Unlike most industries, salary in IB is not a fixed end-of-the-month sum; instead, it has many components, which we have listed below.

- Base salary: This is “salary” in the conventional sense. It is earned biweekly, is stable, and increases each year. Performance does not affect this component much.

- Stub bonus: It is only a fraction of the usual bonus because banks recruit from target schools in the middle of the calendar year. It is generally 20%-30% of the first-year base salary.

- End-of-year bonus: They earn this after their first full year working. Analysts and Associates, and even high-ranking bankers at smaller firms, receive this sum entirely in cash. Bulge bracket and publicly traded banks often pay most of this bonus as deferred or stock-based compensation instead. Deal flow and individual performance determine the year-end bonus, which is usually represented as a percentage of base salary.

- Deferred and stock-based bonus: Associates with some experience at publicly traded banks receive a part of their total bonus in stock that vests over the years. This portion forms a more significant part of the bonus as they move up the ranks and serves two purposes—compliance with regulations and incentivizing employees to stay at the firm.

- Signing bonus: Analysts typically receive about $10,000 to $15,000 in signing bonus when they accept full-time offers, while Associates receive about $50,000 to $60,000.

- Other benefits: IB positions also come with additional perks like health insurance, 401(k) retirement plans, vacation days, etc.

Roles and salaries in IB

The career path in IB is relatively standard and does not vary much from bank to bank. However, the titles may differ. The usual front office hierarchy at an investment bank is presented below in ascending order.

- Summer Intern

- Analyst

- Associate

- Vice President (VP)

- Senior Vice President (SVP) or Director

- Managing Director (MD)

This article gives an overview of the responsibilities and compensation at each level. Please note that the compensation figures are mainly based on banks in the US. The pay can be slightly lower at smaller banks and in other regions.

Summer Intern

An internship allows banks to filter the cream of the crop, as few students can put in 80+ hours every week, deliver timely and accurately, and last the entire internship period.

Astoundingly, banks recruit interns up to a couple of years before the internships. Aspirants usually win internships by networking, submitting applications, and acing a series of interviews and assessments.

Their primary duty is assisting Analysts and Associates with everything from trivial tasks like ordering food to core tasks like financial modeling and analysis. However, entry-level bankers perform these functions in their full-time jobs as well.

The WSO salary database indicates that summer interns usually earn between $65,000 and $80,000 (extrapolated for a year based on hourly rates assuming 2,000 work hours) with humble bonuses of less than 10% of the base on average.

IB Analyst pay guide

They handle all things Excel and PowerPoint and administrative functions like:

- Coordinating between buyers and sellers

- Managing data and documents

- Responding to requests from clients

However, exceptions exist, and some elite boutique banks pay their Analysts $10,000 to $20,000 higher than the average base salary and bonuses closer to 100%.

Salary of an IB Associate

They have more experience and a higher salary than Analysts. They assign the grunt work to Analysts, review it, and lend a hand with Excel and PowerPoint on complicated assignments.

They usually do not get called in for last-minute emergencies, so they work slightly fewer hours (60-80 hours/week) than Analysts. In addition, they are also a part of more meetings and have more client interactions. However, they do not have a notable role in those meetings.

Their average base salary starts at about $150,000 and increases to about $200,000 in equal increments over the years.

They bag bonuses of about 50% of the base on average, but some elite boutique banks award bonuses well over 100%. Please note that these numbers do not represent all banks, and actuals can vary.

Investment banking Vice President (VP) salaries

They are often project managers and do not engage in granular tasks. Instead, they receive requests from Directors and Managing Directors and ensure that Associates and Analysts get the job done. Additionally, they also review the work done by their juniors to ensure that it meets the quality standards.

They enjoy an even more client-facing role than Associates. As a result, VPs learn to develop relationships and bring in clients over time.

The WSO database indicates that the average bonus is underwhelmingly less than 100% of the base, but some elite boutiques pay well over 100%. It is noteworthy that bonuses are discretionary and may vary depending on the bank, its performance, and the banker’s performance each year.

Senior Vice President (SVP) or Director

There are other variations of this title in the industry, like Principal and Executive Director (ED). The role differs bank by bank, but it is safe to say that it is a mix of the Vice President and Managing Director positions.

They equally devote their time towards bringing in clients, developing relationships, and managing projects. Nonetheless, since the next level is all about winning clients, SVP must start doing more of that to progress ahead.

As SVP, there is a sizable bump in the salary over the previous level. The normal range for their total compensation is from $500,000 to $1M, with the bonus forming more than half of it. Bonuses start to matter much more here onwards.

How much do Managing Directors (MDs) at investment banks make?

They are responsible for winning clients and, thus, generating revenue. They spend most of their time developing relationships with current and prospective clients and traveling. Although the workweeks are about the same as at the Director level, this role demands even more traveling.

Although it is one of the most, if not the most, senior titles in the hierarchy, they generally don’t make eight-figures. Of course, their total compensation can considerably differ from bank to bank, but it may range from $1M to a few million if they and their bank perform decently.

The bonus, which is highly variable and directly linked with their contribution to the bank’s deal flow and revenue, forms a significant part of the millions they earn. It can range from zero to a million or more. In addition, elite boutique banks offer bonuses in cash rather than restricted stock.

Below, we have summarized the salary data presented in this article for you.

| Role | Base Salary ($) | Average Year-End Bonus (% of base) |

|---|---|---|

| Summer Analyst | $65,000 - $80,000 | 10% |

| Analyst | $100,000 - $120,000 | 50% - 100% |

| Associate | $150,000 - $200,000 | 50% - 100% |

| Vice President (VP) | $200,000 - $225,000 | 50% - 150% |

| Senior Vice President (SVP) | $250,000 - $500,000 | > 100% |

| Managing Director (MD) | $400,000 - $600,000 | > 100% |

IB Compensation by region

While banks pay similar sums across various locations in the US, the same is not valid for locations outside the US. The starting base salary for a first-year Analyst in the US has been bumped up to $100,000, for instance, while it is only two-thirds of that in London.

The gaps in compensations of US and European banks have slightly widened in the past year or two, reversing the trend of the previous years.

Here is a summary of pay in New York, London, and Singapore to give you an overview of how much they can differ across the world.

Bonuses are discretionary and largely depend on the bank, deal flow and performance, and individual performance, so we will compare base salaries here. All figures represent averages in USD.

| Role | New York | London | Singapore |

|---|---|---|---|

| Summer Analyst | $65,000 - $80,000 | N/A | N/A |

| Analyst | $100,000 - $120,000 | $68,000 - $82,000 | $90,000 - $110,000 |

| Associate | $150,000 - $200,000 | $122,000 - $166,000 | $110,000 - $165,000 |

| Vice President (VP) | $200,000 - $225,000 | $197,000 - $230,000 | $200,000 - $235,000 |

| Senior Vice President (SVP) | $250,000 - $500,000 | $250,000 - $400,000 | $275,000 - $340,000 |

| Managing Director (MD) | $400,000 - $600,000 | $550,000 - $750,000 | $385,000 - $450,000 |

IB salary in New York

Being where the grand Wall Street and its institutions are located, the overwhelming deal flow at New York investment banks warrants higher salaries than other regions in the world.

IB analysts in NY can expect to earn as much as 50% more than those in London. The pay gap between them narrows as they progress in their careers. However, MDs in London earn a significantly higher base salary.

Bonuses are a different discussion altogether as they greatly vary depending on the year, firm, individual performance, etc.

The pay gap between NY and Singapore is narrow at the bottom levels but significantly widens going up the ladder.

London IB pay guide

Statistically speaking, the front office roles in investment banking (M&A, Sales, Trading, ECM, etc.) earn drastically more if one can stick around beyond the age of 25. Besides, promotions are the key points in IB careers, as base salaries and bonuses get bigger and bigger with each promotion.

Between 21 years of age to 25 years, Bankers get promoted from Analyst to Associate, and their base salary increases to about $120,000 from $80,000. Sticking till 30 will earn you the Vice President (VP) title and grow your base salary to at least $195,000.

VPs are typically promoted to Director or Senior Vice President (SVP) around the age of 35 and can start earning over $250,000 up to $400,000. Bankers who show guts by staying till the age of 40 become MDs and receive well over $500,000.

Singapore IB pay guide

Getting into the Singapore market is no easy feat especially coming from another country without experience in Singapore. But it’s not impossible. Salaries in Singapore are decently good, especially for those starting their careers with bulge bracket banks.

So the result is quite satisfying even though the market is tough to enter. Along with a great basic salary, you also get a hefty bonus.

Although high, Singaporean figures are not quite at par with what European and American banks pay their bankers.

However, IB salaries in Singapore are comparable to those at mid-tier banks in the US (next section). Besides, the IB market is much smaller in Singapore, and the work culture is also quite different.

They rarely work on major deals; thus, the external pressure is far lesser. While work hours are not shorter as teams are smaller, the teams are closely-knit.

Furthermore, MDs are accessible to even entry-level analysts. Surprisingly, the focus is more on sales than on technicalities, so people rarely build models and do valuations. Hence, there tends to be more concentration on sales and pitch-books-making skills.

Bulge Bracket vs. Boutique investment banker salaries

As WSO user @2226416 pointed out, the revenue per banker at elite boutique banks is usually much higher than bulge bracket banks.

Boutique banks have lean operational models, as evident from their fewer employees and low admin overheads. As a result, a higher portion of revenue flows through to bankers in the form of higher base salaries and bonuses.

Hence, despite being smaller, boutique banks can pay competitive salaries compared to bulge bracket banks. Moreover, they also follow the principle that deal teams should receive a larger part of the payout, so they get a larger portion of deal commissions.

Below is a brief comparison of salaries in the bulge bracket and elite boutique and mid-tier banks in the US.

|

Role |

Bulge Bracket (BB) | Elite Boutique (EB) | Mid-Tier Banks |

|---|---|---|---|

|

Analyst |

$100,000 - $130,000 | $110,000 - $140,000 | $90,000 - $120,000 |

|

Associate |

$180,000 - $250,000 | $195,000 - $265,000 | $130,000 - $220,000 |

|

Vice President (VP) |

$230,000 - $270,000 | $245,000 - $292,000 | $180,000 - $235,000 |

|

Senior Vice President (SVP) |

$260,000 - $450,000 | $280,000 - $475,000 | $250,000 - $375,000 |

|

Managing Director (MD) |

$475,000 - $1,000,000 | $500,000 - $1,060,000 | $400,000 - $550,000 |

The below video walks you through using the WSO Company and Salary Database.

Impact of COVID on IB salaries

Initially, the M&A activity stumbled significantly but raising capital via equity and debt kept investment bankers busy while the US Fed went on printing money.

Soon after, the M&A activity bounced back when medical experts confirmed that the pandemic would not wipe out human civilization and gave hope in the form of vaccines.

Regardless, the pandemic has brought in some noteworthy changes.

- Banks have stopped adhering to a pay range. Previously, bankers’ salaries did not vary much and fell within a relatively narrow range, regardless of the bank.

- Covid has affected compensations dissimilarly in different roles and at various banks. For instance, the base salary at bulge bracket banks was slightly underwhelming the past year, while elite boutique banks paid their employees relatively generously. In addition, the base salaries for the Associate and higher ranks have hiked over the past few years, while the bonus range for Analysts has grown broader.

- The lack of real-life interactions made working long hours exceedingly intolerable, which resulted in various banks finding it difficult to retain new hires. As a result, they fast-tracked promotions for Analysts and Associates to incentivize them to stay longer.

The WFH culture may be here to stay, and it might even provide some comfort against the long workdays. However, new employees may find it challenging to work comfortably in a team of unknown people without interacting with them in person.

Investment Banker Salary FAQs

Aspirants may wonder whether salaries in investment banking vary depending on the region. To summarize, the earnings potential does not differ considerably at larger banks. However, the same cannot be said for smaller middle-market or boutique banks.

Nonetheless, it is vital to consider the exit opportunities available in different cities. To elaborate, although the same IB role may offer similar salaries in New York and a low cost-of-living area, the position in New York will also come with first-rate exit opportunities. Meanwhile, it is easy to find yourself stagnant with a high salary and close to no exit opportunities in other cities.

Considering the average spans for promotions at each level, an Analyst can become MD in 10-15 years. Working 60-80 hours every week for over a decade before making MD is no cakewalk.

Most bankers who join entry-level roles switch industries or simply find themselves stuck in the middle ranks. Promotion paths to the Associate and VP roles are relatively more straightforward than paths beyond those. So, if you hate the extended hours or find the work exhausting, it is unlikely that you will make it past the mid-level roles.

Besides, the covid-induced “work from home” (WFH) culture has taken away real-life interactions from the work environment and made the path to MD insufferable to many.

The short answers are the long workweeks that include weekends and the sacrifice of life outside IB.

For example, when a client asks on a weekend how many supermarkets or gas stations are there in a developing country, an analyst stays up at night to deliver the correct numbers in a neat presentation by the next day.

To intensify the urgency, an Associate and a VP also spend most of their weekend staying updated on the progress and making countless revisions to the deliverables that must satisfy the client and, thus, the MD. Furthermore, after delivering the files to the MD, more modifications ensue.

So, working 12-16 hours a day, for 6, sometimes 7, days a week is a constant in IB. Low- and mid-level bankers do as their seniors ask them.

The idea behind chasing a career in IB is to earn bucket loads of money in exchange for time and possibly health. Of course, the longer bankers last in the industry, the more their compensation grows. However, most do not stick around until they get promoted to rainmaking roles.

The Bureau of Labor Statistics (BLS) reports that as the economy continues to grow, investment banking services, like assisting with raising capital and facilitating M&A transactions, will be in demand. Furthermore, economic growth in other countries will contribute to the employment growth in the US financial sector as Wall Street remains the international financial hub.

Additionally, as individuals in an aging populace increasingly seek agents to facilitate securities purchases, IB professionals will observe an increase in demand for their skills, even more so due to the declining popularity of traditional pensions.

Free Resources

Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?