Top Banks in Mexico

The banking sector is crucial in building Mexico's economy by offering diverse financial services and contributing to its growth and progressive development.

Mexico has a well-established banking sector that includes domestic and international banks such as BBVA Bancomer, Citibanamex, Santander Mexico, Banorte, and HSBC.

These banking institutions provide various services to individuals, businesses, and corporate entities, catering to their specific needs, such as facilitating financial transactions, capital allocation, and wealth management.

The Mexican banking sector is regulated by the National Banking and Securities Commission (CNBV), which oversees adherence to regulatory requirements, fosters transparency, and maintains the financial system's stability.

The central bank of Mexico, Banco de México, plays an important role in making monetary policies for the country and ensures a stable and smooth movement of the financial

System.

To promote financial inclusion and reduce cash reliance, Mexico has introduced initiatives like the CoDi system, which encourages electronic payments and improves access to banking services, especially for underserved populations.

Deposit insurance is provided through the Mexican Deposit Insurance Institute (IPAB), which guarantees deposits up to a certain amount per account, protecting depositors in case of bank insolvency.

The banking sector significantly contributes to Mexico's economy by supporting capital formation, providing credit to businesses and individuals, and facilitating efficient financial transactions.

Banks also attract foreign investment, support trade activities, and stimulate economic growth.

However, challenges like money laundering and financial fraud still haunt the Mexican banking sector.

Banks are required to conduct due diligence, report suspicious transactions, and collaborate with authorities to combat financial crimes.

The banking sector in Mexico operates under regulatory oversight, ensuring stability and transparency.

By promoting financial inclusion and providing essential services, Mexican banks play a vital role in driving economic development and facilitating domestic and international transactions.

Let’s now look into some of the most recognized banks in Mexico and take a brief look at the banking structure of the country.

According to Open Finance 2020, here are some of the top banks that operate in Mexico:

- BBVA

- Citibanamex

- Banorte

- Santander

- HSBC

Let's look at each bank in detail and deeply understand the banking sector in Mexico.

Key Takeaways

- Mexico has a well-developed and competitive banking system comprising various financial institutions, including commercial banks, development banks, and credit unions.

- Mexico's banking sector is supervised and regulated by the National Banking and Securities Commission (CNBV) and the Bank of Mexico (Banxico).

- The Mexican government has tried to promote financial inclusion and improve access to banking services for all citizens.

- The adoption of digital banking services has increased in Mexico, reflecting the growing trend of utilizing technology for financial transactions.

Top Banks In mexico: Banco Bilbao Vizcaya Argentaria

BBVA México, previously known as Bancomer (Banco de Comercio), was established in 1932 in Mexico City. Salvador Ugarte initially owned Bancomer on behalf of other investors - Raul Bailleres, Liberto Senderos, Mario Dominguez, and Ernesto Amescua.

In 1982, Bancomer was nationalized under President José López Portillo's administration. However, in 1991, during the presidency of Carlos Salinas de Gortari, Bancomer underwent privatization when a group of investors led by Eugenio Garza Lagüera acquired the majority of the bank's stock.

In July 2000, Spanish Banco Bilbao Vizcaya Argentaria (BBVA) purchased a significant portion of Bancomer S.A.'s public stock from Canada's BMO Financial Group. This acquisition led to a partial merger with BBV Probursa, resulting in the incorporation of BBVA into its name.

In February 2004, BBVA acquired the remaining shares of Bancomer S.A.'s public stock, thus gaining full bank ownership. BBVA México currently operates as a wholly-owned subsidiary of the Spanish BBVA Group.

In June 2019, BBVA globally unified its brand, and as part of this initiative, BBVA Bancomer was renamed BBVA. The bank offers various services, including checking and savings accounts, credit cards, personal and mortgage loans, business loans, and investment products.

Additionally, it offers digital banking solutions that empower customers to carry out transactions conveniently using online and mobile platforms. BBVA Bancomer, a prominent bank in Mexico, plays a vital role in driving the country's economy.

By delivering financial services to individuals and businesses, facilitating transactions, and actively contributing to the advancement and expansion of Mexico's financial sector, BBVA Bancomer actively promotes economic activities.

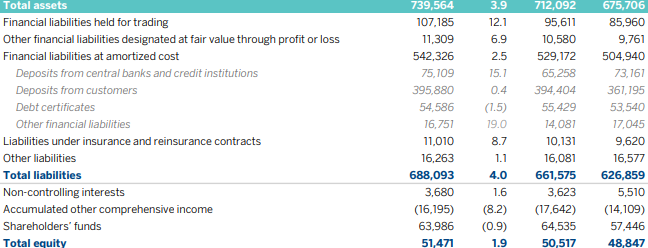

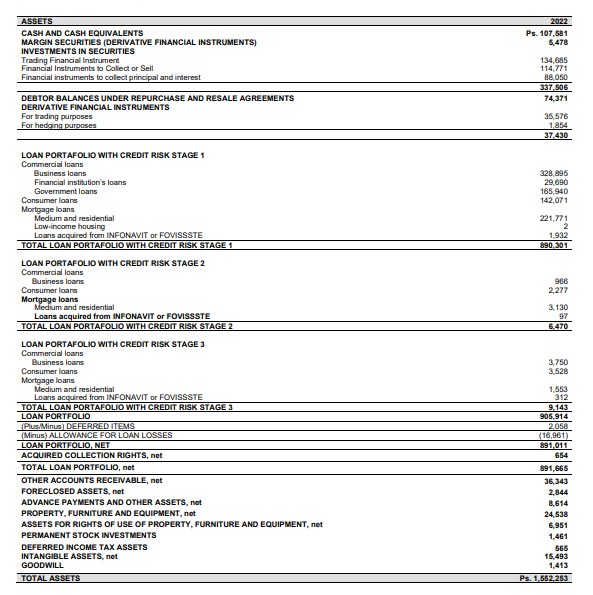

Source: Annual Report from BBVA 2023

The consolidated balance sheet from their annual report shows a very strong and significant gain in assets of BBVA, showing that the bank is much more stable, and stability is an important factor to consider in the banking system.

Top Banks In Mexico: Citibanamex

Citibanamex has a rich history in Mexico, tracing its origins to the merger of Banco Nacional Mexicano and Banco Mercantil Mexicano in 1884.

Over time, it further grew by incorporating Guadalajara into its network. During World War I, the French managers of the bank left Mexico, but it was eventually revitalized under the leadership of Agustín Legorreta Ramírez, who served as acting president.

Through collaboration with Banco de Mexico and US government officials, Banamex regained stability and, by 1937, owned 36 out of 50 bank branches in Mexico.

Banamex introduced various financial innovations to the Mexican market, including the first credit cards in 1968 and an ATM banking system in 1972.

In 1977, Grupo Banamex was formed, combining the bank with its investment and mortgage assets. Four years later, Banamex acquired the California Commerce Bank.

Following a severe economic crisis in 1982, President José López Portillo announced a significant peso devaluation and nationalized all private banks in Mexico. Banamex operated as a government-owned national credit association for nine years.

In 1991, Grupo Financiero Banamex–Accival was reprivatized and established through a partnership with the investment bank Acciones y Valores de México (Accival).

At the time, Banamex had 720 branch offices, 31,797 employees, assets totaling $26.2 billion, and a customer base of four million people, making it the largest financial group in Latin America.

Citigroup Inc. completed the acquisition of Grupo Financiero Banamex-Accival on August 6, 2001, for a total of US$12.5 billion. This merger between Citigroup and Grupo Financiero Banamex-Accival represented the largest-ever corporate merger between the United States and Mexico.

Following the acquisition, the operations of Grupo Financiero Banamex were combined with Citibank's existing Mexico business, operating under the Banamex brand name.

Citibanamex provides various financial services to individuals, businesses, and corporations. These services encompass checking and savings accounts, credit cards, personal and mortgage loans, investment products, insurance, and online banking solutions.

The bank strives to meet the diverse requirements of its customers by aiding them in effectively managing their finances, obtaining credit, and helping with their financial goals.

Operating an extensive network of branches and ATMs throughout Mexico, Citibanamex ensures convenient access to its services. Additionally, the bank offers digital banking platforms, enabling customers to conduct transactions and access banking services online and via mobile devices.

As a prominent institution in Mexico's financial sector, Citibanamex is significant in supporting economic activities. Providing financial services to individuals and businesses and facilitating transactions contributed to the overall growth and development of Mexico's financial landscape.

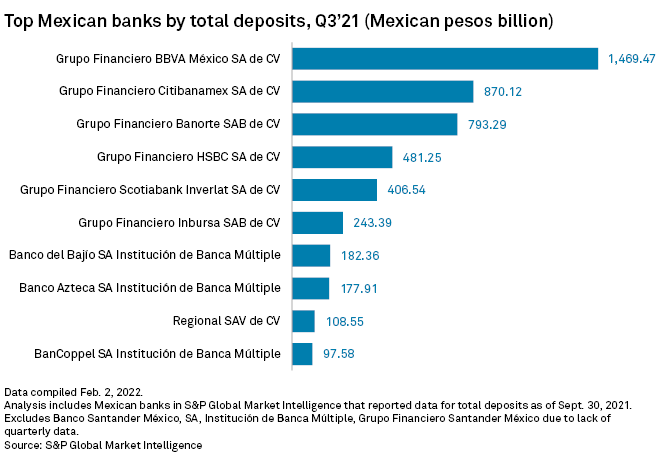

Source: S&P global market intelligence report published in 2022.

According to the S&P global market intelligence report published in 2022, the bank ranked 2nd in total deposits in quarter 3 of the financial year 2021. This also shows the trust levels of customers in the bank.

Top Banks in Mexico: Banorte

Banorte traces its roots back to 1889, when it was established as Banco Mercantil de Monterrey.

In 1992, Banorte was acquired from the Mexican Government by a group of investors led by Roberto González Barrera, a prominent Mexican businessman.

Under new ownership, Banorte underwent a significant transformation, expanding its operations from a regional bank focused on northern Mexico to a bank with nationwide coverage.

During the 1990s, Banorte diversified its business lines to include leasing services through Arrendadora Banorte in 1990 and warehousing and factoring services through Almacenadora Banorte and Factor Banorte in 1991.

To establish a comprehensive financial group, Banorte also acquired Casa de Bolsa Afin, a securities company, in July 1993.

In 1997, Banorte formed an alliance with the Italian insurance company Generali to provide insurance, pension funds, and services through their respective subsidiaries: Afore Banorte-Generalli, Seguros Banorte-Generalli, and Pensiones Banorte-Generalli.

Banorte further expanded its operations through strategic acquisitions. In late 2001, the bank acquired Bancrecer for US$125 million. Bancrecer had previously been taken over by IPAB in 1999 and had acquired another bank, Banco del Noroeste (Banoro), in 1997.

To broaden its international presence, Banorte established operations in New York, known as Banorte Securities, and in Grand Cayman, with the Banorte Grand Cayman Branch.

Banorte has a rich history of growth and expansion, evolving from a regional bank to a national financial institution with a diverse range of services, subsidiaries, and international operations.

Banorte has a wide network of branches and ATMs throughout Mexico, ensuring convenient access to its services for customers across the country.

Additionally, the bank offers digital banking platforms to help customers carry out transactions, manage their accounts, and easily access banking services online and through mobile devices.

In Mexico's economy, Banorte plays a significant role by actively supporting economic activities and contributing to the growth and development of the financial sector.

The bank facilitates financial transactions, provides credit facilities to individuals and businesses, and supports various investment and wealth management initiatives.

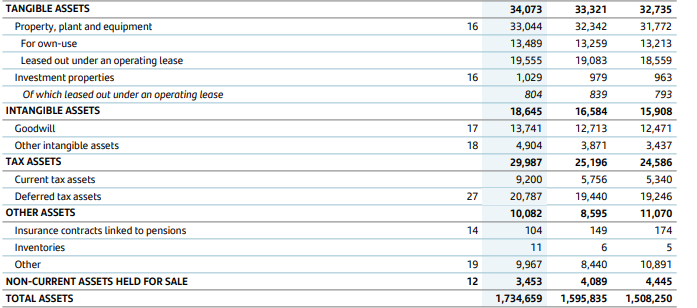

Source: Grupo Financiero Bank Annual Report of 2022

Top Banks In Mexico: Santander

The banking group Grupo Financiero InverMexico was established in 1991. It underwent several name changes over the years. In 1997, it was renamed Grupo Financiero Santander Mexicano after being acquired by Banco Santander. In 1998, the group merged with Grupo Financiero Santander Mexico.

In 2000, it merged with sister group Grupo Financiero Serfin, leading to another name change to Grupo Financiero Santander Serfin in 2001.

Subsequently, in 2006, the group was renamed Grupo Financiero Santander, S.A. de C.V., and later that year, it adopted the name Grupo Financiero Santander, S.A.B. de C.V. as a publicly traded variable capital corporation.

Santander Mexico, operating under the name Banco Santander is a respected bank in Mexico and a subsidiary of Santander Group. It is an international financial institution headquartered in Spain. Santander Mexico has emerged as a key participant in Mexico's banking sector.

The services include checking and savings accounts, credit cards, personal loans, mortgage loans, business loans, investment opportunities, insurance coverage, and online banking solutions.

Santander Mexico aims to meet the diverse financial requirements of its customers while delivering convenient and dependable banking services. Through its extensive network of branches and ATMs spread across Mexico, Santander ensures accessible customer services throughout the country.

In addition to traditional banking practices, the bank also offers digital banking platforms. Santander Mexico plays a crucial role in Mexico's economy by actively supporting economic activities, providing financing options to individuals and businesses, facilitating transactions, and contributing to the growth and development of the financial sector.

Source: Santander annual report of 2023

Like all Mexican banks listed in the article Santander also shows strong positive growth in its assets in its financial reports.

top banks in Mexico: HSBC Mexico

HSBC Mexico, formerly known as Bital and officially known as HSBC México S.A., is a prominent banking institution in Mexico and a subsidiary of HSBC Bank. The rebranding of Bital to HSBC took place on January 29, 2004, accompanied by an extensive marketing campaign across various platforms.

HSBC made an extensive marketing push by saturating newspapers, television, and radio, along with purchasing advertising space on various platforms such as luggage trolleys at Mexico City International Airport, taxis, buses, plastic bags used for newspaper delivery, and even flower stalls and tall buildings in Mexico City.

On the same day of the rebranding, Bital customers received new credit cards bearing the HSBC logo and were notified about changes to their account numbers.

HSBC Mexico has established a strong presence within the Mexican banking industry. The bank offers a variety of financial products and services to meet the requirements of individuals and business firms.

The services include checking and savings accounts, business loans, investment opportunities, insurance coverage, and online banking solutions.

With an extensive network of branches and ATMs spread across Mexico, HSBC ensures that its services are easily accessible to customers throughout the country.

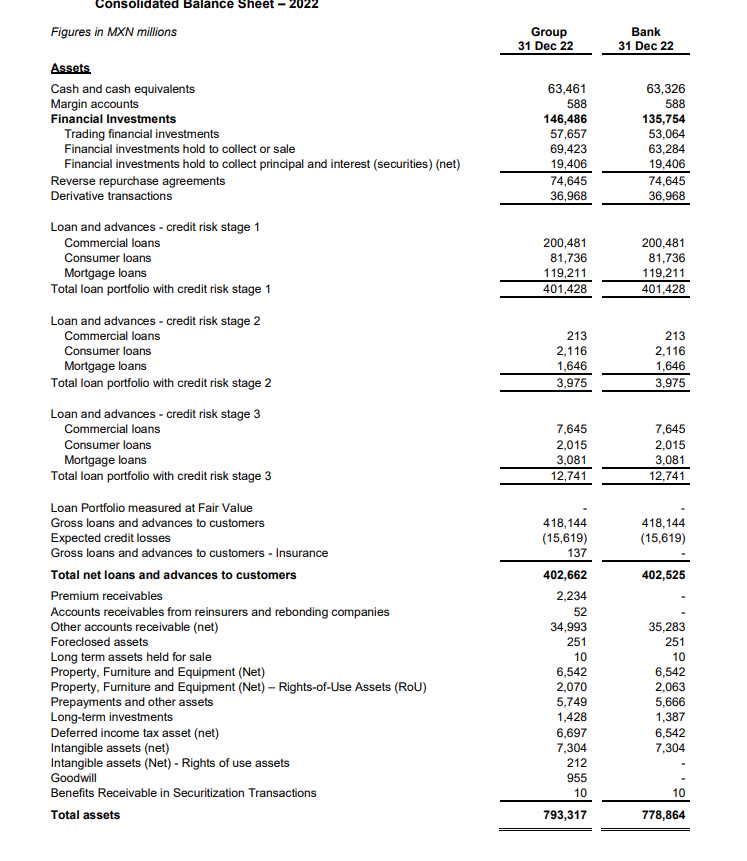

Source: HSBC annual report of 2022

The consolidated balance sheet of HSBC Mexico shows important figures, including a slight increase in the asset value of the banking firm, which is a positive sign.

HSBC Mexico plays a significant role in the Mexican economy by actively supporting economic activities, extending financing to individuals and businesses, facilitating transactions, and contributing to the growth and advancement of the financial sector.

Summary

The Mexican banking sector is significant in the country's economy, providing financial services and contributing to its overall progress.

BBVA, Citibanamex, Banorte, Santander Mexico, and HSBC Mexico are key players in the Mexican banking sector, significantly contributing to Mexico's financial landscape and economic growth and providing essential financial services to individuals, businesses, and corporations.

BBVA, formerly Bancomer, is one of Mexico's leading banks, established in 1932, and is currently a wholly-owned subsidiary of the Spanish BBVA Group.

BBVA significantly contributes to the overall revenues of the BBVA Group Citibanamex, another prominent Mexican bank, originated from the merger of two banks in 1884. It has experienced periods of nationalization and privatization and was ultimately acquired by Citigroup in 2001.

Banorte, tracing its roots back to 1889, has transformed from a regional bank to a national financial institution. Offering services like accounts and online banking solutions, Banorte boasts an extensive network of branches and ATMs across the country.

Santander Mexico, a subsidiary of the international financial institution Santander Group, caters to individuals, businesses, and corporations with diverse financial products and services.

HSBC Mexico, previously known as Bital, underwent a rebranding and became part of the HSBC Group.

With an extensive branch network, the banks offer various financial services, actively promoting them through marketing initiatives.

Note

The current value of Mexican pesos is 1 peso = $0.056 which is a good exchange rate (As of 2023 May) in Mexico in terms of global trade.

or Want to Sign up with your social account?