Debt Capital Markets (DCM)

The DCM group will work with a client to organize borrowing and to help provide access to a global pool of investors who are looking for opportunities.

This includes providing advice on the following:

- Raising debt for acquisitions,

- Refinancing of existing debt, or

- Restructuring of existing debt.

In some cases, companies prefer to raise debt since it's typically a cheaper way to access capital when compared to raising equity. This is primarily due to debt sitting higher up in the capital structure and the fact that the interest on debt is tax-deductible.

People working in this group will typically be working with bonds, treasuries, and money market instruments.

Understanding DCM

The capital market ("CM") is how new capital is issued or existing capital is traded. It consists of the primary (new stock and bond) and secondary (existing securities) markets.

Some insight from a WSO member, [mrb87].

There's no book on how to work in this group. Understand the following:

- Bonds -- how they are priced (spread over Treasuries)

- Duration

- Price/yield relationship

- The macro-environment

No book is going to tell you what a pricing call is like or what type of things to put in a pitchbook.

Having a general understanding of CM is the first step toward securing a job in this group, but a more nuanced understanding to related topics (think yield curves) will give you a much better chance.

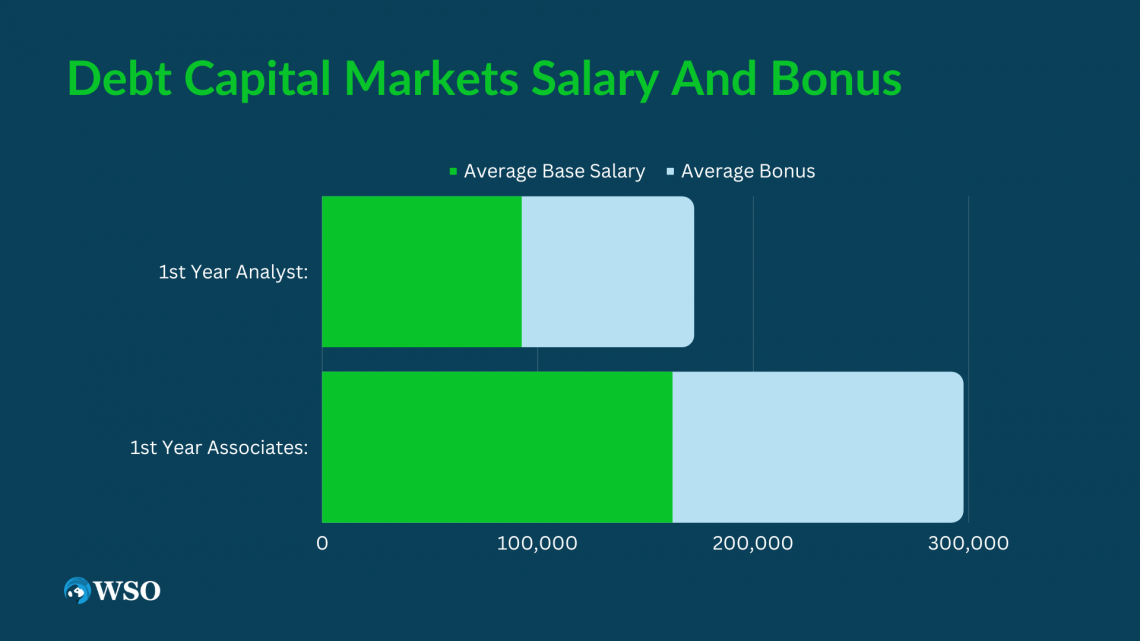

Debt Capital Markets Salary and Bonus

Base salary in this division is roughly the same as coverage/M&A bankers, which is around $85,000 - 120,000 a year for first year analysts. With the major recent increases to base salary across most major banks and elite boutiques, we are seeing the following pay ranges for these employees in our company database.

- Base Salary - 1st Year Analyst: $65,000 - $120,000

- Bonus Range - 1st Year Analyst: $10,000 - $150,000

- Base Salary - 1st Year Associates: $100,000 - $225,000

- Bonus Range - 1st Year Associates : $20,000 - $250,000

Bonuses for coverage/M&A bankers may be slightly greater, but that really varies by firm, so it's better to leverage the database we linked above to get an idea of firm specific trends.

DCM Hours - Day in the Life

Hours will be slightly less for in this division than in most other investment banking groups, more in the realm of 70 hours than the 80+ hours other groups see.

What you'll end up doing is different from what the typical investment banking analyst does. Here's some insight from [TheAxe]

As far as responsibilities go, outside of basic financial functions (PV of cash flows, etc.), there is much less emphasis on modeling in Excel and more of your time will be spent using:

- Different debt sizing

- Refunding

- Assumptive applications (more of some than others based on if you are in Derivatives Banking, Public Finance/Munis, High Yield/Corporate, etc.)

Most of my time is consumed by doing the majority of the analytics for my deal team (everyone will contribute to the pitchbooks).

As for a day to day responsibilities, here’s what another user had to say:

- It is market hours based (in before 7am), so roughly 65-70 hrs/wk with weekends off

- Typically, I start my day by looking at my emails, fielding any requests from corp/IB/other teams and catching up on any overnight news

- Daily calls before markets open with the traders and syndicate

- Mornings are usually busier, but no 'typical' day really follows

- Updating pitch books, sending out market updates, listening in on calls with clients about a pitch/upcoming transaction or internal calls to discuss pitch materials, working on deal prep and any misc. requests/projects

Read the full breakdown in this comment.

Typically, you get more responsibility at the junior levels in these groups. There’s more client interaction, but less financial modeling.

Debt Capital Market Skill Set

What skillset is desired for these analysts and what skills can you expect to develop after a stint in this investment bank’s division?

Going in, they're looking for the same skills as the typical investment banking analyst.

I'm an analyst in the CM group and feel like the skill set desired of new hires (and there haven't been very many in the year or so I've been here) is similar to that of any prospective IB employee: sharp, analytically, attentive to detail, good work ethic, etc.

In addition to these skills, you will also be expected to have some technical skills related to the field. This includes being up to date on things like bonds, treasuries, and the fixed income market.

Here’s another perspective on the skills necessary to succeed in this division:

- The understanding of interest rates

- Monetary policies and the broad macro environment is key and much more relevant than pure corporate finance skills

- Being good at developing relationships and interacting with people will make the difference

- Regarding modeling - It (corporate investment grade) is basically non-existent

This group looks at the models developed by coverage/M&A and then they decide which pricing the bond portion of the M&A package would have. This division can be the one who develops these models in smaller banks. Otherwise, the only models developed by them are triggered by the banker's curiosity and eagerness to learn. You can develop models for your use to see if a client has enough money to service its debt/meet redemptions or if an acquisition will trigger a downgrade or how much they need to borrow if they buy something. In any case, the ratios/metrics which matter in credit are different from the equity world - this should be well clear if going to an interview.

Read the full breakdown at this discussion.

That said, because of the nature of the work, you will develop an atypical set of skills.

DCM Exit Opportunities

How do the exit opportunities compare to the typical IBD gig? Here’s @bankonbanking" with a nice summary of exit opportunities out of this group.

If you are hoping to move on from IB into P/E or a boutique, you will have a much harder time since your skill set will be limited to high-grade companies, and you will have very limited financial modeling exposure - VERY limited. If you are interested in banking in general and more of the sales side, not as much the analytical modeling side of the business, then High-Grade Capital Markets (CM) would be great for you. I personally prefer the modeling side of the equation, so for me, high-grade CM wasn't a great fit. I know other bankers that absolutely enjoy it.

Here’s another user’s opinion of the subject:

“It seems like buyside exits are atypical/opportunistic for CM analysts (I'm excluding lev fin when I say CM). They can happen but these analysts aren't targeted because coverage/M&A/LF get more relevant modeling experience. Most of the exits from this group I've heard of (to buy-side) are one-offs to hedge funds that traded the product you had experience with or maybe even MM private equity. Basically: nobody goes to this division to buy side exits, but they're possible.

I don’t think it's "common" to lateral to M&A/LF/coverage after your second year, but it's possible and it's the most likely juncture for an internal move. You just need to have good reviews, have seniors in your group who will vouch for you, and have spots open in those groups.

I've also heard that many people join this group eventually wanting to do IB, but end up so satisfied with the lifestyle and comp that they decide they want to stay on as an associate (and beyond). It might be hard now to stomach being in a less-sexy group but when you're walking out at 8pm every night before the IB guys even get their comments back (and you're taking home same range of comp) it must be a good feeling (yes, clearly some bias here, but it's the truth).

Two common criticisms of CM are:

- Poor exits opportunities relative to coverage/M&A

- "Simpler" work and not modeling intensive, etc.

Elaborating on the 2nd point: Many people say the work can be boring vs IB, and the reason for that is that most of the work is very process-oriented. You own a particular product, and most of the time it looks very similar.

You're never reinventing the wheel, just tweaking terms and details based on who the client is. Where it makes up for this "monotony" is in exposure to the markets and faster deal flow (deals are faster and there is a higher volume).

The reasons someone would leave another group in investment banking to join DCM are for:

- A far better lifestyle

- Less hours

- Little weekend work

- More predictable schedule

- More access to senior bankers

- Leaner teams

- Faster promotions

Read the full discussion.

Here’s another user’s opinion on exits from this group at a large bank:

- Treasury at a F500 company

- If you have some elements of modeling you could go to a debt fund

- Corporate banking

- Relationship manager

- ECM probably has less exit opportunities, but it is all how you sell it.

Read the full discussion.

In summary: exit opps out of this group aren't as good as the typical investment banking gig for private equity. Yes, you can absolutely compensate for this with drive, networking, financial modeling competence, and more - but you are at a disadvantage compared to the typical investment banking group.

For hedge funds, CM has better exit opportunities.

Coverage/M&A generally place better to PE. Go to the PE websites and you can see this yourself. Read the bios and see how many of the associates come from coverage/M&A versus capital markets. You will find this group is infrequent relative to coverage/M&A. Not improbable, but less frequent. HF placements tend to be better, especially the debt funds. For exit opps not PE/HF/high finance, I think being a coverage/M&A banker is more marketable.

DCM Interview Experience

Here are some perspectives from WSO members that have relevant experience.

As far as the interview goes, having an even basic knowledge of how the debt markets work and an understanding of important related aspects (yield curves in particular) will go a long way as a lot of applicants are more familiar with the sexy equity counterpart of CM.

Understand your bond valuation down pat. Know exactly what Duration, Convexity, Rates, etc., is and how it affects bonds from an issuer and investor standpoint. Understand a bit of M&A valuation methodologies, DCF, etc. Also, understand the DCM Investment-Grade Market. It's hot but not as hot as it was a couple months back. Understand Yield and where rates are (10 year treasuries) . What have they been doing the last couple months? Know what the fed said last week? Well, what happened to rates and the yield curve?

Here’s another perspective on a CM interview process:

The interviews were all very similar to IB, but some had market-oriented components (closer to what you would expect in S&T). Interviews were definitely more IB than S&T, close to 80-20 split, and were a lot more relaxed than what I saw when interviewing for other groups/areas.

Initial interviews focused on fit questions and screening on basic technical knowledge, so I would encourage you to go through typical IB questions:

- What are ways to value a company?

- General accounting

Further along I saw more market-related questions thrown into the mix, but a great part of the interviews were about my experience and knowledge of what CM is and what they do. Interview format was either largely behavioral with 1 or 2 technical questions at the end (nothing too complex) or we would start off talking about the market, recent deals, etc. and then do some behavioral questions.

They were more interested in determining if I had a passion for banking and financial markets, and wanted to figure out if I was a good fit for the team. Remember cap markets is not about hardcore modeling so have the technical knowledge but don't overdo it. Treat the process like an IB interview and have some knowledge of what's going on with the market/company (that I assume you follow regardless), and you'll be just fine. At the end of the day they need to figure out if they're cool with seeing your face 16 hours per day, every day.

The thing that helped me the most was talking with people in the industry and particularly those in the sectors I was going for. Ideally talk with people in the banks you are applying to to get a sense of "what matters" at those places. Have an understanding of what the group is and what they do, and have answers to why you want to be at the ECM/DCM groups at that bank rather than other banks/divisions.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?