deciding between 2 offers

Hi all- any insights would be greatly appreciated!

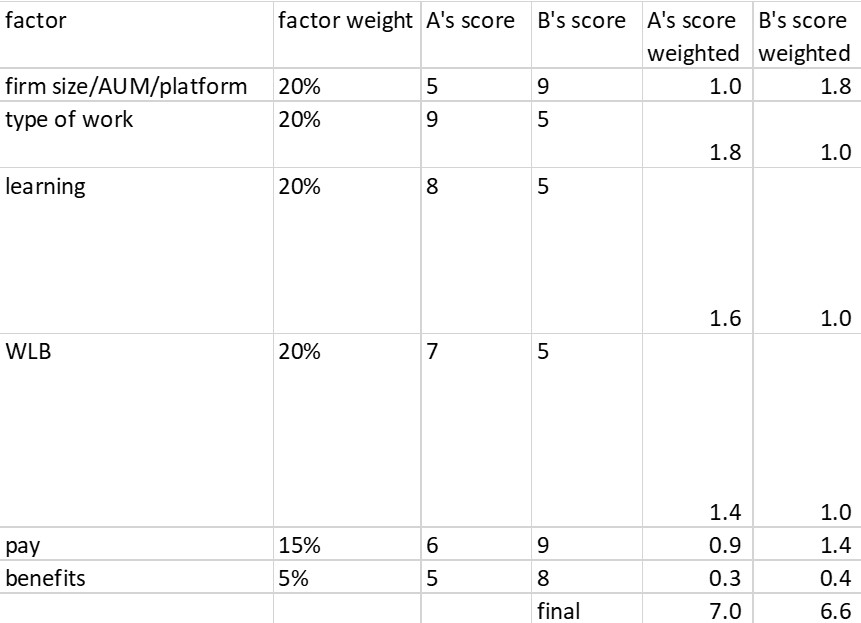

Currently doing asset allocation at an AM. Tbh both offers are not exactly what I want to pursue long term but it’s been super toxic at work and there’re not that many local openings (prefer to not relocate) out there so I’m thinking maybe I could move to one of them and then figure out what’s next from there. Table above shows the comparison but below is a bit more context:

A: an independent PWM with VHNW/UHNW clients. Position is investment-related. They use the same toolkit like bberg/capIQ as I do now so I’d assume it’s close to the markets. Pay is 30k LESS than B. Concern: PWM is frowned upon by AM so not sure how easy it is to move to AM again if I don’t love what I’ll be doing in PWM.

B: AM. Good platform/pay/benefit. But the position offered is data analyst so it’s back office. I worked in back office at a fairly good platform in the past and didn’t love it at all so I moved to asset allocation early in my career. Also the HM seems pretty hands on (daily standups and on-site team while the rest of the firm is hybrid) and was told that the HM works crazy hours so I’m not sure about their WLB.

I’d go with A here. PWM is not that frowned about by AM, and the role is closer to the investment side too.

Thank you! I'm thinking the same.

Allocation -> WM -> AM sounds like a decent path, if one can pull it off.

Thank you for the reply. I'm basically trying to escape an unhappy job and go from there. We'll see.

Agreed with the above - Option A is your best bet. Confirm the details of the role and just how much 'investing' it will be - it probably doesn't matter as you are unhappy where you are, but some can be very client service heavy and less 'investing' so to speak.

Same goes for moving between AM and PWM - it is heavily role depending IMO on what will or won't transfer.

Temporibus qui impedit eos et. Aperiam minima veniam tempora. Voluptatum cupiditate architecto nulla omnis ut.

Qui eum velit et eos animi eos ad ut. Voluptate quis et laborum rerum. A ipsam est sunt nisi. Et voluptatibus officia necessitatibus quisquam dignissimos tempora. Autem molestiae voluptatibus dolor necessitatibus non. Aut cupiditate inventore veritatis.

Eligendi ut et enim dolore. Nemo officia sint dolores quo nostrum pariatur. Aliquam hic aliquam quia modi ipsam. Id ut sed id saepe. Vel dolores maxime molestias temporibus. Consectetur totam laudantium quo ab quas.

Sit consectetur repudiandae natus est incidunt blanditiis fugiat error. Et neque sit et commodi laudantium incidunt et. Ipsum aut commodi similique.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...