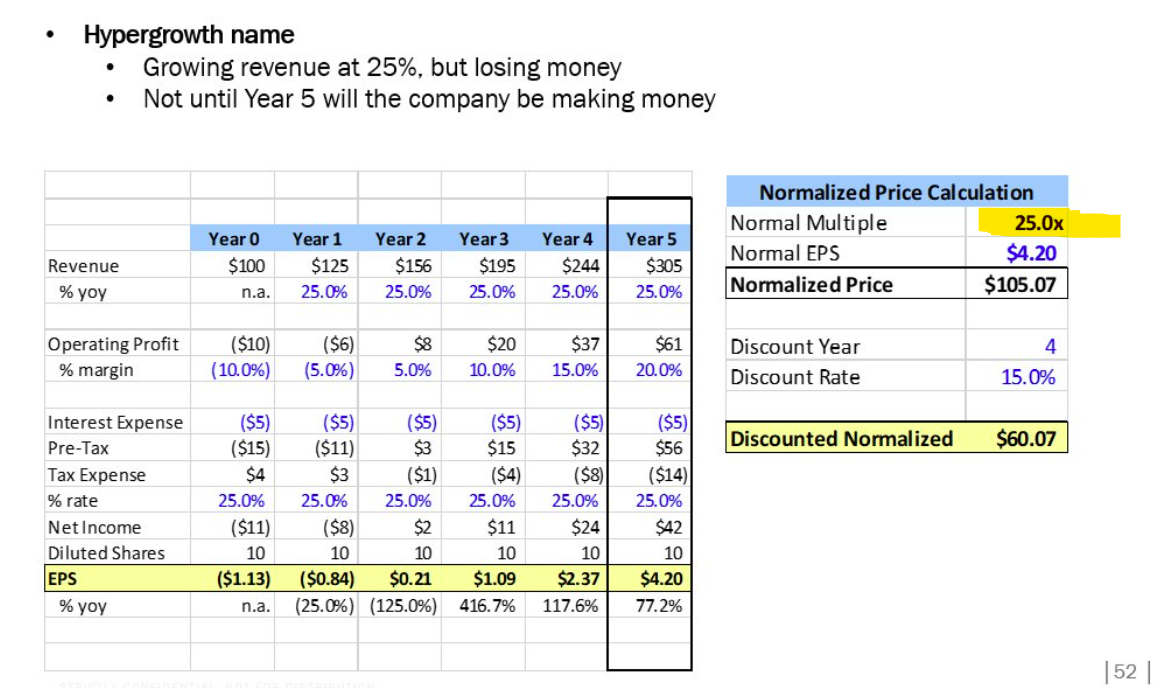

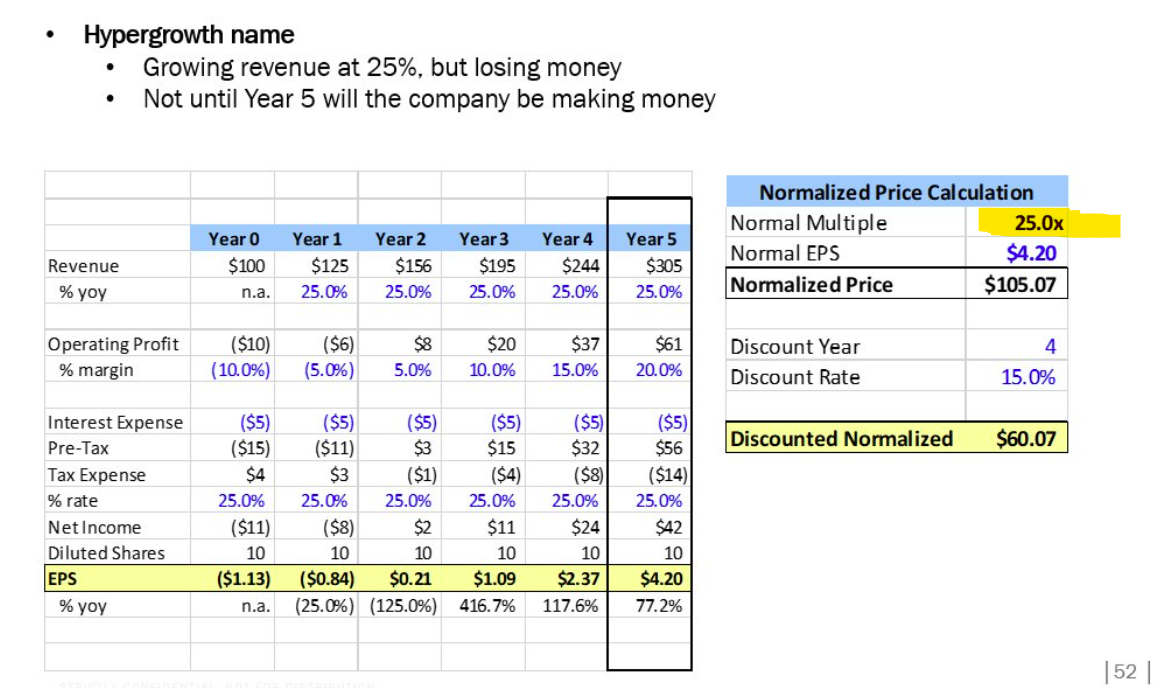

Normalized earnings, why use 25x EPS?

Anyone knows why Brett uses 25x as a normal multiple? Does this only apply to hypergrowth stocks? What's the normalized multiple to use for like a CPG company or an auto maker?

Anyone knows why Brett uses 25x as a normal multiple? Does this only apply to hypergrowth stocks? What's the normalized multiple to use for like a CPG company or an auto maker?

| +53 | Looking for a Fund Manager to partner with to start a new fund. | 26 | 11h | |

| +34 | Law to Quant Pivot? | 10 | 4d | |

| +30 | How to destress at Pod HF? | 8 | 3d | |

| +24 | People who work at hedge funds, what made you interested initially? | 13 | 3d | |

| +23 | Starting Personal Account | 12 | 2d | |

| +19 | Hedge Fund WLB | 6 | 3d | |

| +18 | Any R course recommendations? | 14 | 23h | |

| +16 | Which Funds focus on timing the broad market rather than L/S individual equities? | 10 | 3d | |

| +15 | CRE Team at Credit Oriented Hedge Fund | 3 | 5d | |

| +15 | CRE Team At Credit Oriented Hedge Fund | 0 | 5d |

Career Resources

All other numbers look arbitrary to me. He might've just chosen a random number? I don't think there's one right multiple for an industry as different players within industry all have different growth/margin profiles

Can compare it to similar companies, ‘high quality growth’ tended to trade around that level once it reached maturity when interest rates were like zero… can think about it in terms of earnings yield (inverse of PE), you can invest risk free in treasuries, what is the yield spread you would need to invest in some high quality company. Some people will do yield plus growth type calculations to get to implied TSR so 4-5% yield plus 5-10% growth gets to reasonable return vs the market - however question what yield makes sense with treasuries where they are now and ‘quality’ of earnings given more adjustments vs GAAP, SBC etc.

In this very illustrative example you have a company growing revenue 25% and earnings 77% by year 5 - if this was real 25x PE doesn’t seem unreasonable… but can regress similar high growth companies (sales / earnings growth vs multiple) to get to implied multiple

Some will do bull / base / bear case too so could assume 25x for base, 30x for bull, 20x for bear, assume some arbitrary probabilities and get to an expect value - ultimately is all guess work so wouldn’t read too much into it but general idea is spread vs risk free rate and multiple for growth vs peers

Thanks. Helpful.

Thanks. When you say "a company growing revenue 25% and earnings 77% by year 5 - if this was real 25x PE doesn't seem unreasonable", how do you know it's not unreasonable? it's more i want hear how you just know 25x PE is reasonable?

When you say regress, is that what a comp sheet is for?

I don't understand the "not until year 5 will the company be making money".

The whole bet is on their earning power 5 years out and beyond

Still not entirely clear. Would u mind expanding on that a bit more?

But if we take this example, the company is seemingly making money on year 2.

First off, this is just a made up example slide for his course. 25x is not always going to be "normalized" - there are volumes of text to understand what a multiple is and how to determine what multiple to use / comp / analyze a company with. I suggest reading a lot of mauboussin's work for more stuff on that.

I don't remember the thread on this, but I think the point was if you are looking at a company in year 1,2,3, the stock is in hypergrowth mode and the multiple can look super expensive (for example it may be trading at 50x 3yr fwd. P/E at that point and look too expensive to you) so to understand the valuation and assess if there is an opportunity, you want to look at a more "normalized" state for the business - what is the earnings power as it reaches some level of initial scale? Clearly it is generating some positive earnings before year 5, but we are just taking a further out approach to get a better sense of what earnings power can look like at scale / through short cycles / at a "normalized" level of profitability.

In this hypothetical scenario, a 25x multiple may be an appropriate initial benchmark for that later stage, where revenue is still clipping +25%, margins are expanding 500bps, and earnings are growing like crazy. Realistically businesses like this can easily trade at an even higher multiple on forward 1-2 yr EPS, but remember to get that framework for valuation, you want to understand a more "normalized" state of earnings + multiple. Then you discount it back (essentially short hand DCF anyways), and suddenly a stock that you thought was trading at +50x NTM P/E and was way too expensive, is relatively cheap on a more normalized earnings power base.

This is often why a highly cyclical business can be at a "cheap" multiple of 5x, but still be very expensive as earnings are collapsing in the cycle, and then when they are 20x, it can still be a good buy as earnings are expanding and the more normalized level in out years shows it is actually cheap - god how many times have I seen a thesis on MU that was basically this.

Odio doloribus ut ratione facilis id. Libero dolore et necessitatibus blanditiis error voluptatem. Cupiditate minus laborum voluptatem ducimus magni quam.

Repudiandae temporibus alias atque enim voluptas voluptas labore optio. Quas in nobis quod rerum eaque rem ut. Porro dolores dolores velit in.

Id dolore est et aperiam velit blanditiis. Sint facere reprehenderit officia. Enim id et commodi voluptas voluptatem nam molestias. Sunt voluptatem debitis laboriosam. Earum blanditiis natus labore non ut cupiditate. Corrupti corrupti quia nihil. Sed qui et possimus odio.

Expedita non excepturi ut qui. Molestias id dicta ipsa praesentium iure. Molestiae nihil omnis sunt accusamus id qui est.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...