2017 Investment Banking Report: 8 Key Trends to Know

Wall Street Oasis (WSO) released a detailed 2017 Investment Banking Report that includes data on compensation, the interview process, employee satisfaction, and more. All statistics featured in the reports are based solely on paid user submissions to the WSO Company Database during 2015, 2016 and YTD 2017, with approximately 70% of the submissions coming from the United States. In addition, the investment banking industry made its voice heard by supplying almost half of the 50,000+ submissions, followed by an approximately 20% representation by Asset Management. This data is high quality and statistically robust. Main categories are analyzed below with an emphasis on most relevant employers and key points of interest.

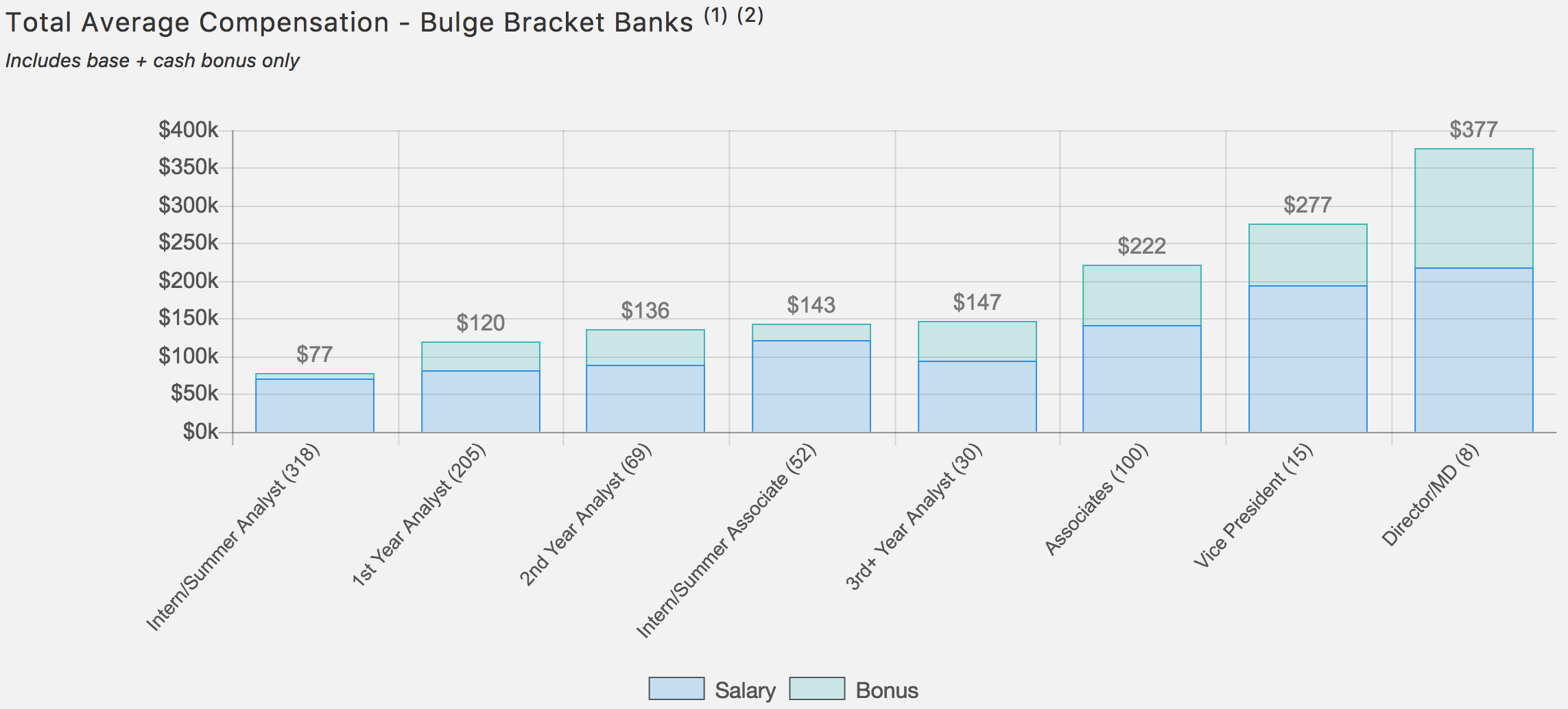

Total Average Compensation

Key Observation 1: First-year analyst total (base & bonus) compensation averages $121,000 with associate level rising to $218,000.The total average compensation, including base salary and bonus, for bulge bracket banks ranges from $121,000 annually for a first-year analyst to $377,000 for a director-level position (small sample size). The first-year analyst compensation has increased slightly from $114,000 in 2015 to $121,000 in 2017 as has the associate compensation from $211,000 in 2015 to $218,000 in 2017. The salaries along the continuum of career advancement remained consistent between bulge bracket banks and boutique banks since 2016, with the exception of a significant increase in pay for the vice president level at $457,000 annually among boutique banks, albeit with a smaller sample size. Unlike bulge bracket banks, the top compensated positions at boutiques have remained steady over the past several years. An interesting finding in this investment banking report involves the correlation between career advancement and percentage of bonus in overall compensation figures.

In the bulge bracket bank category, the top three companies for first-year analyst compensation are:

- UBS AG at $134,800

- Bank of America/Merrill Lynch at $134,600

- Barclays Capital at $133,100

In addition, the top three companies for associate compensation are:

- UBS AG at $252,300

- Barclays Capital at $236,500

- Wells Fargo and Company at $226,600

The top three boutique banks for first-year analyst compensation are:

- PJT Partners at $167,100

- Moelis & Company at $154,100

- Rothschild at $139,700

Based on both salary and compensation data provided for 18 out of 25 boutique banks, the top three for associate compensation are:

- Houlihan Lokey at $310,500

- Moelis & Company at $270,000

- Piper Jaffray at $268,500

Overall, employees at Houlihan Lokey, Bank of America/Merrill Lynch and Citigroup were most satisfied with their pay compared to similar jobs elsewhere.

This is in comparison to other industries like consulting where starting salary is around $80,000 base and rises to $320,000 at the director level. At an average technology company, software engineers' base starts at around $75,000 but is capped at $271,000 as directors.

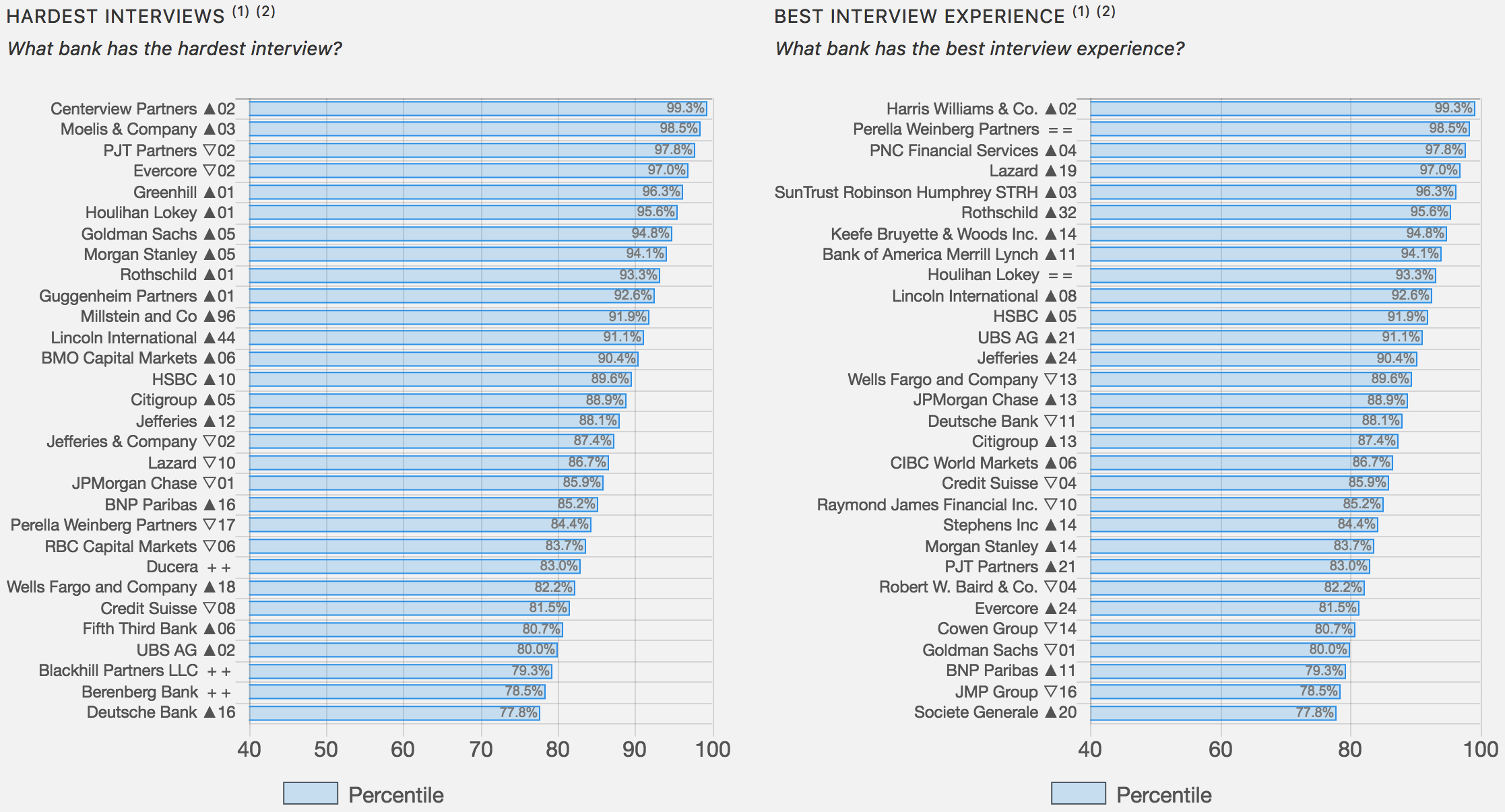

Interview Statistics – Hardest & Best

Key Observation 2: Centerview Partners, PJT Partners, Moelis & Company and Evercore are viewed as having the hardest interview process.Member submissions also provided information on the interview process, including the hardest and best experiences. To compile the statistics, each company is given an adjusted score using Bayesian estimates, which takes into account the number of reviews for a particular company with a minimum of two required. The results are representative of 135 firms. Earning the reputation as having the hardest interview process are Centerview Partners, PJT Partners, Moelis & Company, and Evercore. This is not too surprising since these firms are all considered elite boutique investment banks with incredibly competitive recruiting processes. PJT, while a newcomer, spun out of Blackstone in 2015 and is following in Blackstone’s tradition of being in the top five for hardest interview process. The other three also had consistently difficult interviews from 2014-2017. The best interview process reviews go to Harris Williams & Co., Perella Weinberg Partners and PNC Financial Services. Each of these investment banking firms also increased or maintained its ranking compared to the 2016 WSO Investment Banking Industry Report.

Hardest Interviews and Best Interview Experience, listed by banks’ percentile. Data up until October 2017.

Professional Development Opportunities

Key Observation 3: Industry leaders in the professional development category correlate with the total compensation category but not with the interview process rankings.The professional development section of the 2017 Investment Banking Reports focuses on the four sub-categories. We’ve highlighted the top 3 out of 79 firms in each sub-category.

Overall Employee Satisfaction

- Wells Fargo & Company

- Goldman Sachs

- Bank of America/Merrill Lynch

Professional Growth Opportunities

- Wells Fargo & Company

- Goldman Sachs

- Bank of America/Merrill Lynch

Career Advancement Opportunities

- Wells Fargo & Company

- Goldman Sachs

- Houlihan Lokey

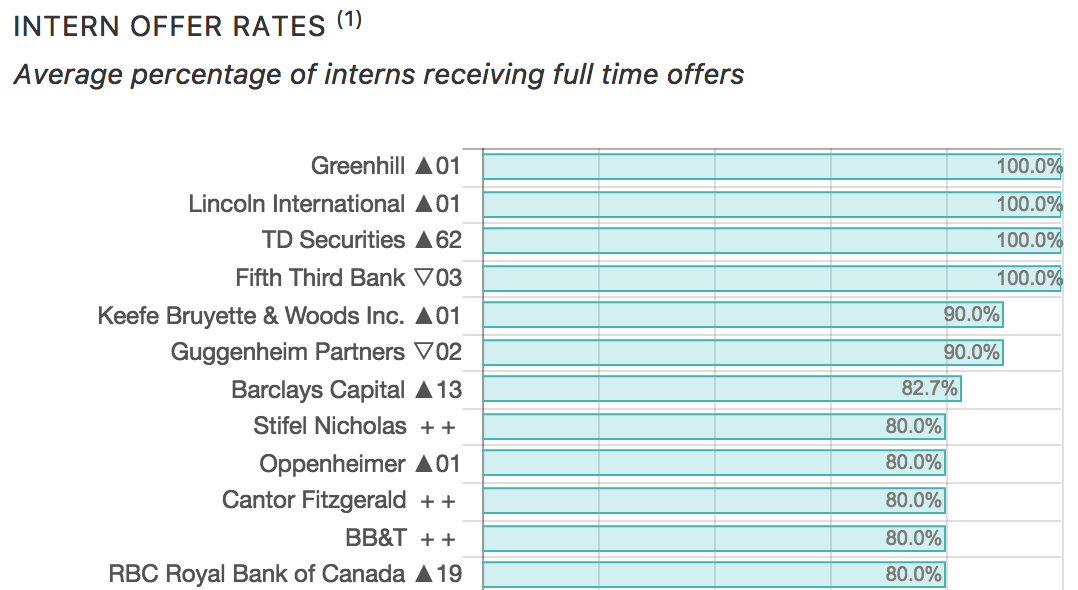

Intern Offer Rates, listed by offer rate. Data up until October 2017.

Intern Offer Rates, listed by offer rate. Data up until October 2017.Four investment banks have been in the top 10 for intern offer rates three of the last four years:

- Fifth Third Bank

- Greenhill

- Guggenheim Partners

- Lincoln International

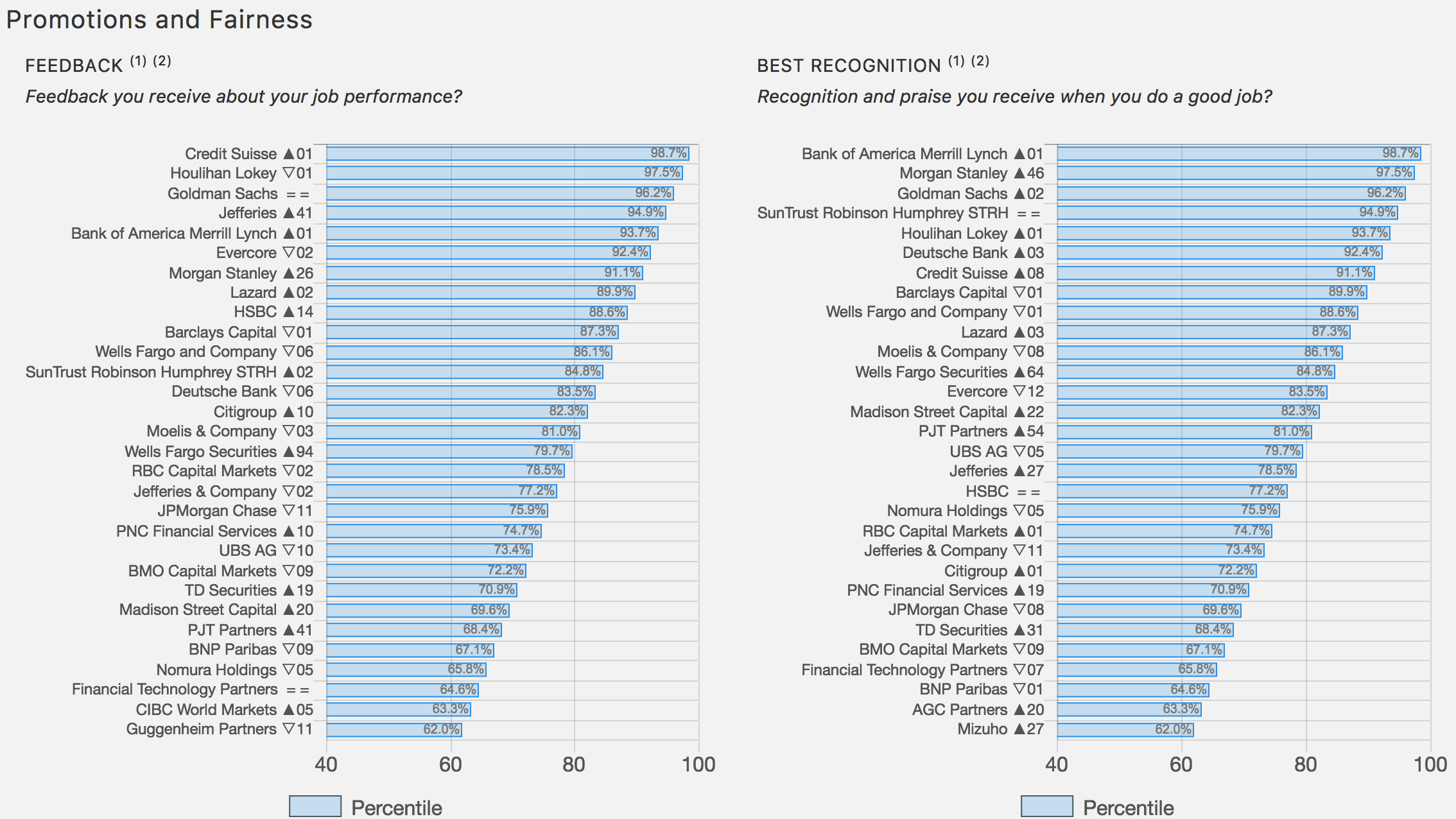

Promotions & Fairness

Key Observation 4: Goldman Sachs was the sole investment banking firm in the top three in each sub-category.Member submissions also shed light on promotions and fairness in Investment Banking. Again, we’ve highlighted the top firms in each sub-category.

Feedback

- Credit Suisse

- Houlihan Lokey

- Goldman Sachs

Best Recognition

- Bank of America/Merrill Lynch

- Morgan Stanley

- Goldman Sachs

Most Fair

- Goldman Sachs

- Wells Fargo Securities

- Houlihan Lokey

Promotions and Recognition listing, by investment bank. Data up until October 2017.

Promotions and Recognition listing, by investment bank. Data up until October 2017.

Reputation

Key Observation 5: Goldman Sachs and Bank of America/Merrill Lynch have the proudest employees and would be recommended to others by their employees.Perhaps the most important evaluation of a company is what its employees say outside of work. In this report, reputation is defined by two factors, employee pride and whether employees would recommend the company to others. Not surprisingly, top performers noted throughout the 2017 Investment Banking Reports were also top performers in this category. Goldman Sachs, Bank of America/Merrill Lynch and Lazard earn the top honors for “proudest employees” while Goldman Sachs, Bank of America/Merrill Lynch and Houlihan Lokey round out the top three for their firms being “recommended” to others by their employees. Notably, Evercore wasn’t in the top three in either sub-category this year but was in the top two of both sub-categories in 2016. This is likely because Evercore hasn’t been getting much press over the past year, but should revert soon since it still has strong deal flow.

Senior Management

Key Observation 6: Top senior management rankings have had strong volatility since 2014.The senior management statistics were generated from the following four sub-categories. We’ve highlighted the top three out of 79 firms in each sub-category.

Best Communication

- Goldman Sachs

- Wells Fargo and Company

- Bank of America-Merrill Lynch

Best Teamwork

- Wells Fargo Securities

- SunTrust Robinson Humphrey

- Bank of America/Merrill Lynch

Best Leadership

- Goldman Sachs

- Lazard

- SunTrust Robinson Humphrey

Competence

- Goldman Sachs

- Evercore

- Houlihan Lokey

Lifestyle

Key Observation 7: None of the top-ranked lifestyle firms are in the top 10 for most average hours worked per week.The 2017 Investment Banking Reports also include respondents’ opinions on which firms provide the most satisfying lifestyle as defined by three sub-categories. The top firms in each sub-category are listed below.

Time off

- Wells Fargo Securities

- Goldman Sachs

- Bank of America/Merrill Lynch

Best Work/Life Balance

- SunTrust Robinson Humphrey

- Credit Suisse

- Wells Fargo Securities

Most Average Hours Worked

- LionTree Advisors (90 hours/week)

- Greentech Capital Advisors (86.3 hours/week)

- Petsky Prunier (85 hours/week)

Additional Points of Interest

Key Observation 8: New York and NYU generated the highest response rate by farIn addition to the main categories discussed throughout this article, there are several other points of interest. The greatest number of submissions came from employees at top-ranked firms throughout the 2017 Investment Banking Reports.

- Geographically, New York generated highest response rate by far, followed by Chicago and London.

- Level of education also played a role with 58% of the report’s 33,400 unique contributors citing a GPA between 3.5-4.0.

- Even more, graduates of schools in major markets are most represented in the study, with New York University (NYU), University of Pennsylvania and Cornell rounding out the top three.

- Finally, the report does not account for gender as a distinguishing factor in the data.

Graphics Disclosure: Background vector created by Brgfx - Freepik.com // Designs by Freepik // Icons made by Freepik from www.flaticon.com is licensed by CC 3.0 BY // Edited by Ajay Patel

:)

ha, facebook or uber software engineers make 75k. BS.

It was very informative. Thanks a lot for sharing such an important information.

Any chance you have the breakdown by city for each firm? NY, Chi, SF typically are the same but some noticeable differences occur with regional offices (Houston-Non E&P, Charlotte, Salt Lake City, Minneapolis, etc)

yes, you need to visit the bank-specific pages in the WSO Company Database - specifically the salary tab and then you can filter those entries by city, division, etc...

Very insightful, thank you. For an aspiring college student that want to work in IB, I don't exactly have the best GPA in the world given the indicated 3.5-4.0 (I avg. low 3), but my resume is pretty damn good in comparison to most. I've been on the crew team since freshman year and I was invited to be captain by senior year among other diversity experiences with several banks and summer job internships every summer since freshman year. Any comments/advice in respect to this? Thanks

there's a ***ton of posts on this. google dude.

Thanks for sharing this information.

Very useful information.

I find it interesting that Yale and Princeton are not on the top 10 most targeted universities.

Perhaps because unless you have a scholarship it is often the very wealthy that go to those schools. Somebody who grew up affluent may not have the desire to work 100 hour weeks in an investment bank, or the drive to not want to be poor any longer.

This is very informative. Thanks for sharing.

Thanks for sharing this information, it is very useful information.

Nicely summarized. Much welcomed.

Very informative, thank you

Good information. Thanks!

hello, thank you very much for sharing - very informative post / article... although I'm from Russia and currently living in Vienna, Austria, and the article focuses more on America etc. I found it really interesting.. some new details for me, food for thought I would say... I love to read about things I didn't know and that surprise me :) cheers, Alex, and have a nice weekend. more posts like this please! =)

Hi, I'm pretty new to the industry and could use some insight on compensation. I'm being paid $80k base and a $20k stub bonus; is it fair to view my all-in first year compensation as $120k by annualizing the bonus? Does the bulge bracket average of $121k mean the stub bonuses those analysts are getting pre-tax are literally double mine (~$41k), or annualized (~20.5k) like mine? Thanks :)

All of the figures are annualized

Labore id rem et temporibus. Ut quis sapiente quia esse. Minus cupiditate temporibus dolorum nobis.

Ad et sit ut et. Commodi aliquid quae sint omnis optio. Voluptas repellendus et sunt aut maxime. Cumque excepturi quam dolor ab. Dolore molestias alias in optio culpa dolore. Delectus ut quae quia repellendus tempore porro aut. Sunt similique omnis magnam maiores quae et et.

Omnis maxime ut sunt unde hic consequatur excepturi amet. Modi nisi quisquam inventore voluptatem molestias odio. Porro omnis ut quae animi ut.

Placeat ut dicta nisi neque ut alias fugit. Consequatur porro adipisci modi similique laborum ut et atque. Molestias laborum nulla consequatur amet enim. Quia ab suscipit necessitatibus.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Molestiae vel sunt placeat excepturi deserunt occaecati. Labore ab animi rerum laboriosam repellat beatae provident facilis. Qui voluptas aliquam impedit magnam cupiditate officiis. Placeat adipisci totam eos quos aliquid qui facilis amet. Occaecati repudiandae voluptatem et quibusdam magni dolor similique ex. Velit id voluptate quia accusamus. Dolores eius dolores aut neque temporibus laudantium totam.

Distinctio id aliquid autem provident. Necessitatibus qui excepturi beatae adipisci qui at.