EV / EBITDA Multiple: Investment needs

Hi @all,

in one of my university courses, there is the following statement:

"Main criticism to EV/EBITDA: does not properly reflect investment needs: "

Now, my question amounts to: why?

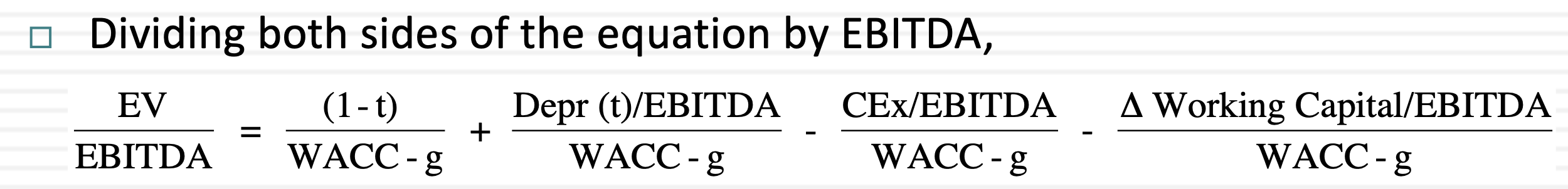

When looking at the formula uploaded by Damodaran, ceteris paribus, a company that needs to reinvest more to achieve a similar sales / EBITDA has a lower multiple.

EV accounts for the different reinvestment needs. SO: why does it not reflect the reinvestment needs?

Because of EBITDA. I’m unfamiliar with that formula, but without accounting for depreciation, you don’t really have an idea of the asset base with which to generate earnings in the future

An example of some random manufacturing company

Company A trades at an EV/EBITDA of 4x

Company B trades at an EV/EBITDA of 10x

On its face, you would say Company A is more attractive from an investment perspective.

Now what if Company A has manufacturing processes from the 80s with outdated machinery. They haven’t invested much in the business, so their future prospects are hindered.

Company B however has been pouring capital into new machines. They have a huge new asset base of manufacturing sites with state of the art of equipment. They have sensors online to take advantage of the new IoT environment to truly optimize production and maintenance. They are going to produce better and more t widgets and a lot more of them.

Obviously, Company B would be the one you would want, but you wouldn’t see the investment story from them if you only looked at EBITDA because it wouldn’t account for that. In the case of Company A, you would see as all their old equipment would have been depreciated down. For a Company B, you would see the massive non cash charges as they begin to account for their investments.

Does that help?

Hi, first of all thank you for your response.

Now following up on your remarks: Don't I implicitly account for the investment needs by adapting the EV? If firm B has higher investment needs, my FCFF, hence going forward my EV, will be lower, since I need to invest. Company A has a new asset base, thus it is less dependent on current investments?!

From my understanding, I would implicitly account for my investment needs in my EV calculations as my annual FCF is lower due to the increased capex spending over time. The same is stated in the upper Damodaran formula:

Correct me if I’m wrong, but in this type of comparable valuation analysis, you would use market EV data rather than trying to calculate it yourself.

Think about it, in your case, your EV/EBITDA multiple wouldn’t be apples to apples. If you are using the perpetual growth model, you would account for the CapEx, but your EBITDA would be BEFORE depreciation, so it wouldn’t reflect that capex.

Ex fugiat inventore qui suscipit aut minus hic. Iure voluptates aliquam illo pariatur. Reiciendis cupiditate corporis at.

Facere nam magnam maxime nulla beatae tempore soluta. Laborum doloremque possimus officia ab totam quo sit. Voluptas et aut earum et repellendus. Alias in dolores laudantium nisi minima vero autem.

Vitae minus doloremque accusantium voluptas architecto labore. Voluptas et repellendus expedita itaque ratione. Reprehenderit explicabo voluptatum et modi accusantium ut. Omnis aut nisi reprehenderit vitae ut non totam rerum. Maxime nihil optio laudantium enim optio. Vel facilis est laborum perspiciatis quo et. Ratione ducimus rerum ut et quia.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Et neque hic quia recusandae. Nostrum ducimus excepturi voluptatum omnis. Rerum qui provident aut odio velit est odit. Quidem neque odio dolores laboriosam quas esse aperiam.

Pariatur unde provident at sed est. Voluptatibus dolores debitis tenetur voluptas recusandae quia.