Functions of M&A

Is M&A usually involved in venture financing (such as series C or D funding)?

To rephrase the question more clearly. If an investment banking firm is involved in Series C or D financing, what subdivisions of the bank would be involved? Would it be an industry-coverage team, some specific product team or another division within the bank that's not part of IB?

Not really sure what this question is asking, but I guess one way the M&A world and the venture world connect is that large strategic companies will buy equity stakes in startup funding rounds if they think it has a promising complementary product or would become a competitor. This allows the strategic to have connections with those companies from the get-go and also provide market intelligence in the event they want to acquire the startup once it’s more mature.

Think things like Walgreens investing into Theranos, Visa into Stripe, etc.

Okay, let me rephrase the question more clearly. If an investment banking firm is involved in Series C or D financing, what subdivisions of the bank would be involved? Would it be an industry-coverage team, some specific product team or another division within the bank that's not part of IB?

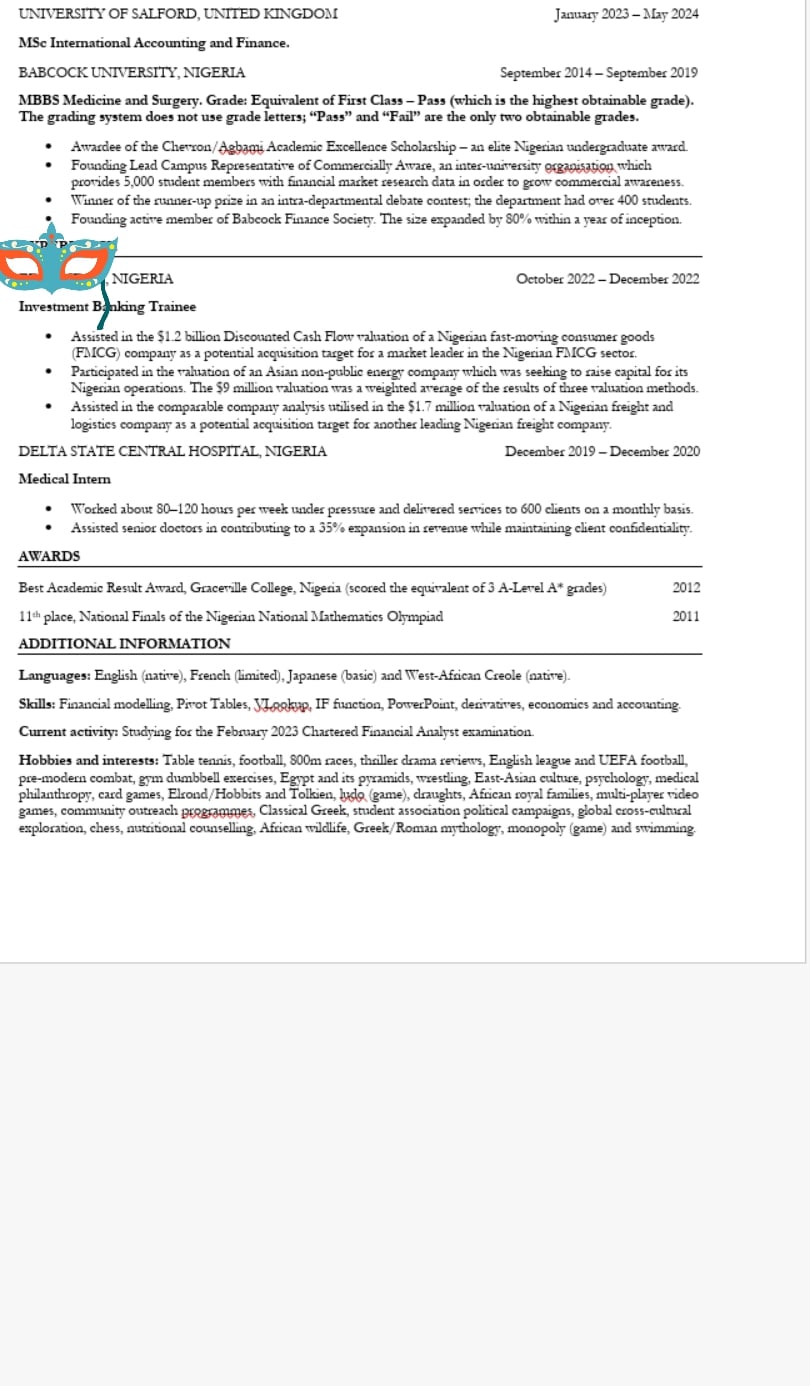

I want your suggestion. As my uni is not a UK target school, because of which HR might filter it out even before it gets reviewed by a banker (correct me if I'm mistaken), do you think it is a good idea to move the work experience to the top and move education to a lower part of the CV in order to make my banking experience the first thing that is seen on the CV? Or is it safer to stick to the conventional format of listing the education first. This is the full CV

Iure optio molestiae sit dolorem minus. Temporibus quia reprehenderit ipsum provident. Saepe aut maxime et distinctio animi cum. Quia esse beatae earum labore accusamus sint sed. Corrupti occaecati voluptate dolores tempore non.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...