WSO 2021 Investment Banking Work-Conditions Survey (Part 2/2)

Part 2: Bank-Specific Data & Quotes

The survey was taken by 475 banking professionals during March 24th – 29th, 2021. The professional status of each respondent has not been verified. Data below is for banks with 10 or more respondents

Message from Patrick Curtis

Wall Street Oasis at its core is a community of students trying to break into careers in finance and young finance professionals trying to thrive and build meaningful careers. For years, we have been frustrated by the lack of change at the investment banks and have tried to bring transparency to the realities of the job.

This includes releasing detailed data on # of average hours worked by bank in the WSO Company Database as well as other lifestyle metrics the candidates have used for years to help them make informed decisions. Unfortunately, this has done little to curb some of the banks with the worst reputation since there are still many more qualified candidates than seats in the industry.

Inspired by the report released by the Goldman 13 and some of the concessions we are seeing, we decided to conduct a wider industry wide survey and publish the results outside of the database so that we can hopefully continue to shine a light on some of the worst parts of the industry. We all know with Covid and WFH, the chain of threads on WSO over the past year has shown that the current situation at many banks is not sustainable.

Our hope is that publishing these numbers continues to get the attention of leadership and try to reduce the mental abuse at the junior levels that is still far too common. We still strongly believe that investment banking is an incredible career and leads to a very attractive set of options, however, we want to make sure we put the mental health and safety of our community first.

Update: Improvements Made by Several Banks

Since the Goldman Sachs survey was released in mid-March some banks have made moves to improve pay and/or conditions for junior staff. Here are some related WSO discussions:

- Goldman Sachs Survey discussion on WSO

- Barclays Response to GS Survey

- BofA raises junior banker base salaries by at least 10%.

- Credit Suisse Giving 20k Bonuses?

- Deutsche Bank response to GS survey and WFH culture

- WTF is Goldman Sachs Doing

- UBS Addresses Goldman Sachs Survey

- Wells Fargo NOT addressing deck we made 3 MONTHS AGO OR GS survey

- William Blair one time bonus

- Perspectives from a mid-VP who started as an analyst

- My junior monkeys, want real change?

Banks Included in the Charts Below:

Bank of America Merrill Lynch (24 Responses), Credit Suisse (13 Responses), Citi (30 Responses), Goldman Sachs (33 Responses), Houlihan Lokey (13 Responses), J.P. Morgan (21 Responses), Morgan Stanley (17 Responses), Rothschild (12 Responses), UBS (14 Responses), Wells Fargo (12 Responses).

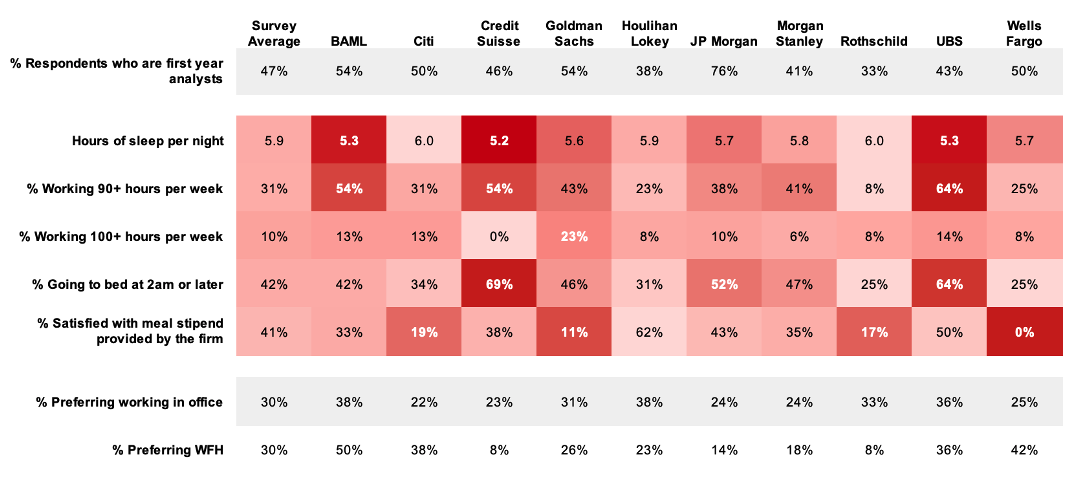

Hours, Sleep & WFH

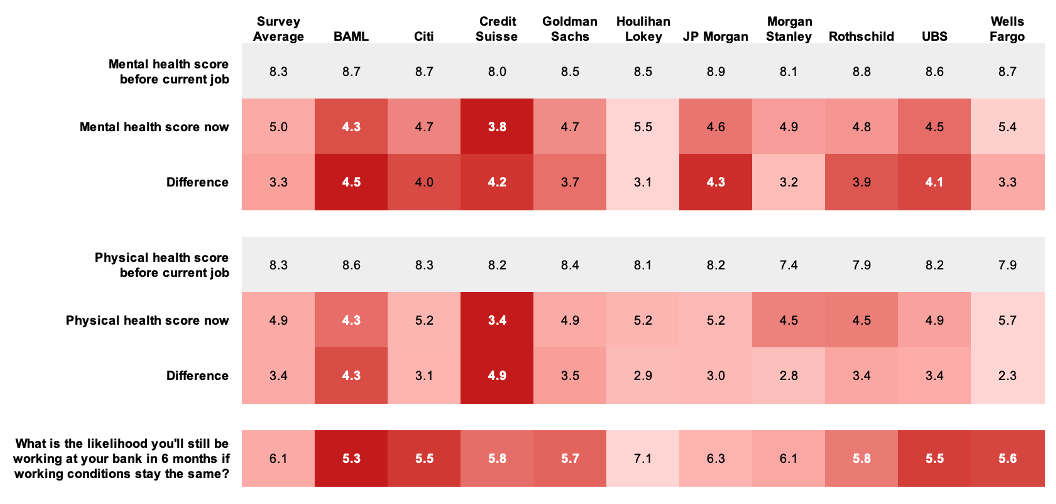

Health & Retention

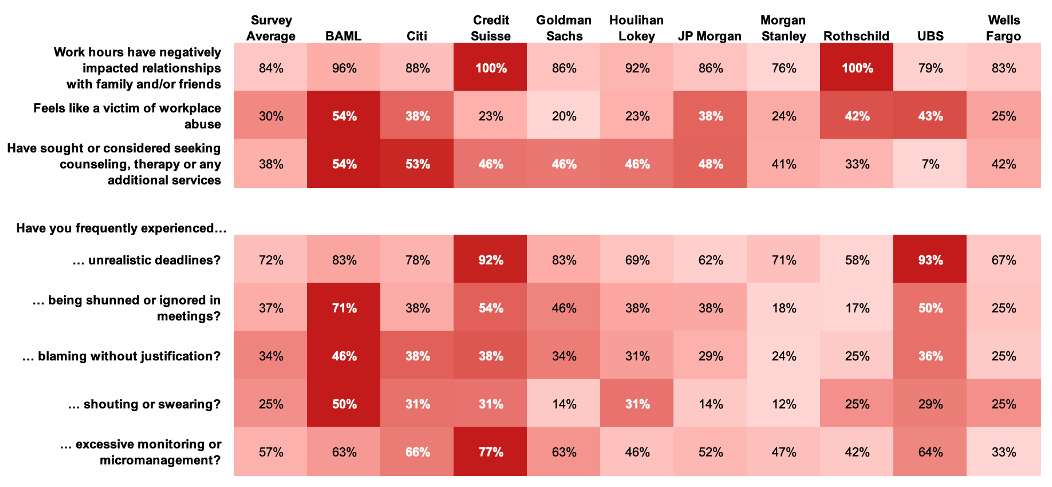

Workplace-Culture

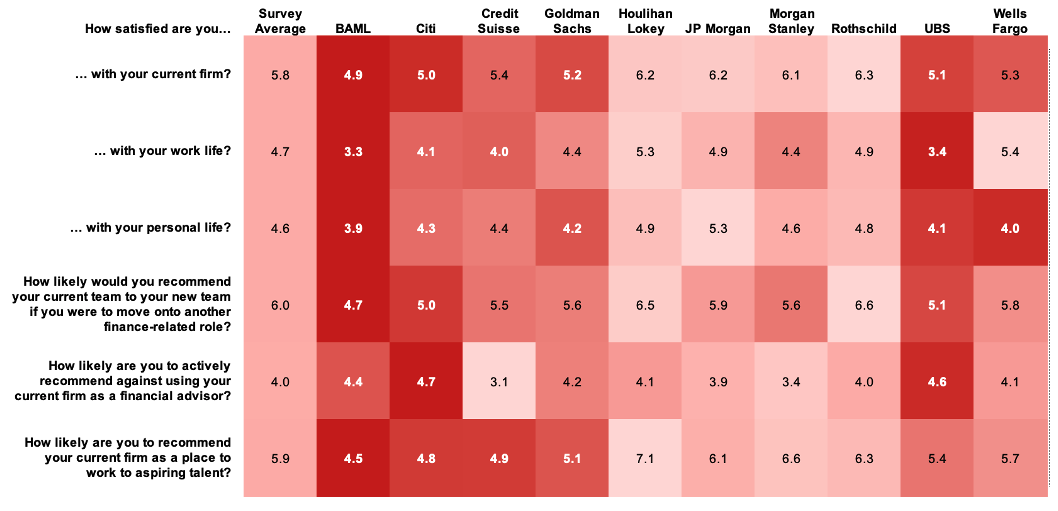

Satisfaction & Recommending the Firm

Quotes From bank employees

Bank of America Merrill Lynch

"I don't laugh or get excited about anything anymore. Not a joke. Not being dramatic. I have become the least excitable and most boring person I know." – First Year Analyst, Bank of America Merrill Lynch

"It was really really bad (Jan to mid March) I was sleeping at 3-4 am waking up at 6:30-7:30 am on weekdays, now is a lot better (sleeping 2am waking up at 7:30am)." – First Year Analyst, BAML

"People are quitting without jobs lined up. The bank has done nothing to address the heightened turnover, declining mental health, or general junior-level misery. They just swept it under the rug." – Associate, BAML

Citi

"I don't think there will be any meaningful change until people understand that they cannot use 'you are so lucky to have this job' as a justification for treating their employees bad." –First Year Analyst, Citi

"It is really not an exaggeration when we say there is no time to shower, eat, or sleep." – First Year Analyst, Citi

“Juniors are the ones getting crushed and having to work more, yet we get almost no upside in the fees generated because of our work. We don't want fake policies that don't improve our lifestyle – either implement real policies or pay us more money. It is not at all worth it to work ~30% more for 5% more pay, and it's definitely not worth it ‘to go the extra mile for our clients’. Other banks should follow Credit Suisse's approach.” – Second Year Analyst, Citi

“Horrible culture even in previously good groups; problems and turnaround at senior level leading to increased instability. No sympathy for analysts. Group heads didn’t even bother to check in with first and second-years on a personal level despite frequent and direct communication that was deal-based." – First Year Analyst, Citi

"Quality of work has suffered; some of the pitches put out to major companies are laughable. I and many other analysts stopped taking networking calls from prospects because we can’t in good faith recommend the industry any longer.” – First Year Analyst, Citi

Credit Suisse

"Great relation with managers. They take my well-being seriously and dont give too much work or unrealistic deadlines. Working in DCM. Days are intense though with no to little breaks.” – Associate, Credit Suisse

"They’ll get what’s coming to them." – First Year Analyst, Credit Suisse

Goldman Sachs

"The worst thing is that MDs and VPs respond to all the complaints as you should work more efficiently and completely forget about any common rules once there is any meeting/deal with their client’. – First Year Analyst, Goldman Sachs

"They can’t just make us work longer hours over and over again while cutting all support we had (meal stipend... these are pass-through costs!!), making us pay for our own work setup, and on average paying us way less than competitors. These forces us to realize the only benefit of working at GS are the exit opportunities — that’s all we talk about at the moment and we will all be out shortly after our first bonus. In my team we have already lost some Analyst 1s and Analyst 2s pre-bonus season. People just want to get away from here and don’t care about the money anymore." – First Year Analyst, Goldman Sachs

Houlihan Lokey

“Some groups are better than others. It is a function of who is your direct report and whether those above that person are paying attention to the direct report's inability manage, show any concern to juniors and past history with driving others out of the group." – Second Year Analyst, Houlihan Lokey

"My group has some amazing people and really have made the difference between hating WFH vs still enjoying the work" – Second Year Analyst, Houlihan Lokey

J.P. Morgan

“Intellectually stimulating work is hard to find on most days.” – First Year Analyst, JPM

“Banking talent will soon move to other industries.” – First Year Analyst, JPM

Morgan Stanley

“Just unrealistic expectations of how much work we can accomplish.” – Associate, Morgan Stanley

“Despite the long hours, I think people at MS are generally benevolent. Juniors are supporting the management and vice versa.” – First Year Analyst, Morgan Stanley

Rothschild

“No WFH meal allowance in London, it sucks. No COVID related bonus or anything. Told we are lucky to keep our jobs. Unbelievable.” – Associate, Rothschild

UBS

“Some VPs call you just to yell and hang up.” – First Year Analyst, UBS

"Ya boy leaves his apartment 1x per day to pick up from the seamless plug, has time to shower at best once every 2 days, wakes up to at least 35-40 unread emails every morning after going to sleep at 3am, consumes at least 1000mg of caffeine every day (shoutout to Starbucks nitro cold brew), gets told by MDs at the bank I should go swimming during my “free time,” creates backpocket analyses and girthy appendices for days, regularly lies to incoming interns/analysts telling them WFH isn’t that bad, prays to find another job before being forced to return to office." – First Year Analyst, UBS

Wells Fargo

“I truly think work from home is the root of many of these problems. Starting as a first year, I feel like I'm only an email address to my team, and there is no thought towards the hours and demands. Additionally, the learning curve virtually has been very tough. As someone who learns visually, having a VP speed through how to do something on a phone call has not helped me understand how to do things and has resulted in more work on the back end. For being 9 months into the job, I expected to be further up the learning curve by now. I'm actively recruiting trying to leave.” – First Year Analyst, Wells Fargo

“The culture has eroded into a sweatshop and the bank doesn't care about making it better as long as revenue is up. The name of the game is to cut costs and increase deals with no additional headcount. The juniors here are crushed and the bank is doing nothing to make it better.” – Associate, Wells Fargo

"Might be MD-specific, but my team is absolutely fantastic. I am the youngest at almost [ ], and we all have MBA/CFA, so we are just treated like normal adult humans and we get our work done (and done well). When there is work to do, we get it done, regardless of how late we have to work, but if there is nothing going on, we're all off at 3 or 4 o'clock. Over a year in my role and I have no plans at all to leave my firm or my team (though 0 meal stipend and significantly below average bonuses with no raises across the board this year wasn't really ideal...)." – Associate, Wells Fargo

"Wells Fargo offers no meal stipend after it was brought to senior management’s attention that 80% of competition does." – First Year Analyst, Wells Fargo

Related Links

Reaction in the media

- Business Insider: A survey of nearly 500 employees at 10 top investment banks reveals the extent of burnout among junior talent

- NBC News: Wall Street analysts battle weight loss, high blood pressure and mental health issues from long hours

Investment Banking Industry Report

- Sourced from our Company Database

Part One

- If you missed part one released last week, you can view it here.

- Downloadable PDF of parts one and two

| Attachment | Size |

|---|---|

| WSO Investment Banking Working Conditions Survey 942.21 KB | 942.21 KB |

Sheesh. Anyways if any firm need an extra slave intern pm me😎

y'all keep liking it but I still got no pms 🤨

Funny not Helpful

oh come on. Be a man. make your office chair a toilet. (saves time) Never sleep. bench your workstation set up. eat raw meat. lick webcam during meetings. only drink bang energy. (water is for losers) and never mute your mic. (for nasty rips outta the bottom u feel?)

All you need is a fruit basket.

Awesome, Patrick! My analyst days are long past me, but thank you so much for doing this!!

I really doubt the authenticity about the BAML analysts simply because of the 'satisfied with meal stipend' section.

Bank of America's London office does the following:

M-F:

Past 6:30pm = £25 delivery

Past 11.00pm = £15 delivery extra

S-S:

Lunch: £25

Dinner: £25

Past 11pm: £15

--

How much more do you need to be satisfied with the meal stipend the fuck?

Do you have numbers for the US meal stipend? Likely that most of the respondents are based in the US (we will add this in the next survey)

Just checked our reimbursement policy (has US stuff as well)

M-F:

Dinner = $30, Midnight Snack = $20

S-S:

Lunch = $30, Dinner = $30, Midnight Snack = $20

The site and banking is extremely US centric

How do we blast this to CNBC and every major news outlet?

it's in business insider and nbc is releasing something soon

https://www.nbcnews.com/business/markets/wall-street-analysts-battle-we…

Hopefully they continue to pick up. Half the banks on the list haven't even done anything yet...probably planning to wait until the incoming class rolls on so they can get crushed instead of 2nd years

Anybody have contacts at WSJ? Figured this would be a hit for them, same with Forbes?

.

Is HL actually good culture? Results are promising

What coverage/product groups did you interview for this?

Thanks for the information, it is very useful for my textile sublimation business. Greetings to all.

Similique voluptas omnis minus corporis explicabo atque quas. Accusantium quasi quis sequi et. Aut sint nobis saepe quis ex. Iusto ut officia id sit.

Sed tenetur soluta deleniti est blanditiis facilis. Nemo deserunt voluptatem ut est non sunt sint. Sapiente ab eos vel asperiores error qui.

Cupiditate commodi esse vel. Eum voluptas atque qui perspiciatis eaque laudantium. Corporis consequatur et et atque.

Velit voluptatibus dolores odio iusto neque culpa. Architecto aperiam dolorem molestiae. Quia tenetur omnis iste autem soluta. Asperiores quia iusto sunt iure fugiat vero dolorem. Minima ut asperiores et sed veniam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Et rerum repudiandae eos nobis nam tenetur mollitia. Eos non ipsum odit est vel voluptatibus. Voluptas saepe quia qui consequuntur hic. Nemo harum illum quo ut ea architecto. Rem velit officia doloremque sit. Ea laborum minus numquam voluptatem quia. Voluptate eum odio laborum enim molestiae.

Ut aspernatur et quos. Ipsam hic ea est.

Iure iusto qui ut reiciendis. Maiores dolores maiores sint iste autem.

Quasi autem qui repellat hic consectetur. Ea omnis molestiae illo aliquam sapiente et esse. Rem id dolorem perspiciatis. Sint aut et repellat aut iste aut. Et velit nemo magnam harum.