GS Analyst Survey Results

Liquidity dropped what all of us feel... the real question is does anything come of this? Do senior bankers change anything at all? Are analysts lucky to even be paid?

Mod Note (April 14, 2021) - Here are some related discussions showing how things have changed since the GS survey was released:

- Barclays Response to GS Survey https://www.wallstreetoasis.com/forums/thoughts-o…

- BofA raises junior banker base salaries by at least 10%.

- Credit Suisse Giving 20k Bonuses?

- Deutsche Bank response to GS survey and WFH culture

- WTF is Goldman Sachs Doing

- UBS Addresses Goldman Sachs Survey

- Wells Fargo NOT addressing deck we made 3 MONTHS AGO OR GS survey

- Blair one time bonus https://www.wallstreetoasis.com/forums/william-bl…

- Perspectives from a mid-VP who started as an analyst

- My junior monkeys, want real change?

Jesus Christ this is concerning, is this due to WFH or is it usually like this?

GS worked their analysts like crazy in general, but I believe it was upped even more by WFH

i would say that WFH increased the hours like 20-30%

So, prospects, are 98% of you still willing to give handjobs to old fat men to land GS IBD?

I'm willing to give old thin men handjobs for free but I would never give a fatty a handjob. Have standards!!

Yes sir!

Obvisouly — you get in then get out. What else?

You think I'm lying: I'm so fucking serious. GS or bust

Good intern. Thank you

haha, you are welcome. Hope my team this summer reflects similarly on my work during the summer to give me an FT offer.

This generation is so weak.

You are at the best bank and you are crying help and people are giving you a break while you make 5x the median income straight out of college.

Earn your paycheck and stop being a p*ssy

Imagine being so fucked up in the head, that you think a little bit of money justifies treating another person as sub-human.

Goldman Sachs doesn't offer the best financial package for their analysts, some other banks are more competitive in salaries.

World record moronic comment lololol

I would bet my year end bonus that you're a dumb fuck over 35

"You are at the best bank"

I, too, want to work at the goldman sachs

I am curious for those in IB, what do you think about the quality of your work when you're hitting the 80-100 hour mark? My previous career was in public safety, I went back to school, and am breaking into the VC space. I get the cultural thing where... "it was this way for me...so it has to be this way for you rookie" mentality. Being sleep deprived as a firefighter, there would be times I was driving a fire engine at night and literally didn't know where I was or where I was going for a few moments.

From my reading and research, at a certain level of sleep deprivation, you are literally impaired mentally. This has been the same case with resident physicians, etc, who also work crazy long hours and can make mistake that can literally be life threatening. Why? Because culturally that what has been ingrained...only the toughest should get the privilege to practice, etc.

Surely there is a diminishing return on type/quality of work versus hours a week.... thoughts?

There's no question that long periods of sleep deprivation have a diminishing affect on work output. Especially with all the toxic levels of anxiety that are produced by that kind of mental exhaustion. At a certain point, it has to be taking more and more time just to put out the same level of work, and I think that's where the diminishing returns come into play. You end up taking 2 hours to do something that would have taken you 45 minutes with a sharp mind and 7 hours of sleep.

One thing I will say, from my own experience as a firefighter, is the type of sleep deprivation in firefighting is far more sudden and unpredictable. Sure, in IB you could have an MD ping you at the last second when you're about to hit the pillow at 2am for an emergency 2 hour fire drill, and that may be relatively unexpected. But it's not a total shock to the system, its a long term compounding affect on your mental capacity. In firefighting, you're getting suddenly and violently awoken from a deep sleep cycle at 3 am by a 100 decible klaxon alarm to get up and immediately get behind the wheel of a 40 ton vehicle. That is a much different beast than long term consistent sleep deprivation. I remember being woken up for those late night calls at 3-4am and being so out of it I'd practically take a header down the stairs to the engine bay. The slow burn of IB can drive you insane, but it always felt like the acute shocks to the system in firefighting had much higher stakes.

I agree wholeheartedly with you. However, the reason nothing is done about this is lean deal teams, less physicians improve margins. People going into IB wouldn't sacrifice their compensation for slightly fewer hours. If they would, they sure as hell would want to do something more fulfilling than investment banking

At ubs...it's the same here. Want to die

I thought you guys had protected saturdays? What group are you in?

Not saying

Protected Saturdays aren't enforced well and if they are they just an exception to policy and you work anyways.

Sunday is considered a normal working day too (calls at 9am, need to be responsive and ready grind till 2am etc)

Everyone in my group is depressed

Same, everyone I know in levfin, fig and industrials getting crushed, staffed late fridays and saturdays, etc. the “wellness hour” that we get is a downright joke and I haven’t seen anyone use it. Wonder if we could make a similar deck because right now I fucking hate my life as a first year analyst.

agreed. im just upset this isnt UBS getting the attention..might actually cause something to change

its become employee abuse

nothing like submitting a time sheet for 100 hrs and getting staffed right after (this has happened to me)

Damn, what about the yoga mats and leaving the office at 7pm?

More seriously, I didn't know UBS was this hard, goodluck man.

people need to call out these banks by name. UBS is a sweatshop right now (wasn't before WFH).

I am looking to leave ASAP. my entire group wants to leave. the staffers have no power to change it

if the bank doesnt do something immediately to stop the 100hr weeks they will see insane turnover (and good luck with the new laterals you hope to hire...)

Culture in this group was actually pretty solid where analysts and associates were staffed on 1 live deal at a time with no other work (like books for meetings) but hours were 80-ish when on a deal. However, once the deal closed, you were only staffed on non-urgent / non-deal things for at least 3-4 months during which hours were 60-70 max, with many weeks being less. Seniors and juniors were all pretty nice and respectful as well (save for 1-2 seniors who were still way better than at many places with terrible cultures).

However, since COVID, the group specifically the TMT team has been extremely crushed. All semblance of a culture has disappeared to the point where if you don't send a farewell email, no one will have even known or cared if you left. Any semblance of group infrastructure or templates that the group has tried to maintain has retreated several steps as both analysts and associates are so jammed that they don't have time to worry about it, leading to the recreation of several materials and analyses whose PPT and Excel back-ups could never be found on the drive. Even after the NY and SF groups decided to merge to help with the deal flow, things have been very bad. The NY team had much fewer hours than the SF team but now are working just as hard at 100+ hours. And yes, all juniors are getting staffed on workstreams even though they all put 100+ hours on their timesheets. While I know all the people in our group are nice people, the strong deal flow has forced all seniors and juniors to work non-stop. Even Saturday policies (which used to be heavily monitored) are now often ignored or the work has been so much that though we are not supposed to work on Saturdays, many analysts and associates are forced to work so they don't fall behind on Sundays. Since bonuses hit recently, people have been leaving so much that every week, someone is sending out at least one farewell email.

BTW, associates are getting as crushed as analysts as we often have to split up the work with the analyst or completely do it for them given how busy they already are themselves. While I don't think associates should not be opening Excel and PPT files, it is very clear that analysts are so crushed that associates have no choice but to turn comments and help out in a significant way.

As someone who considers themselves a veteran of the group based on tenure, it's insane to see what COVID has done to the group's dynamics. I've also heard that there is no way there will be a full return to the office until 2022 and MDs will not be returning to the office given they believe they do not need to be in the office as their business is revenue generation. So expect another year of back-to-back Zoom meetings and getting staffed on three live deals at least regardless if you are an analyst or associate.

Damn, appreciate the write up and insight. Best of luck to you and the team...

Has the team posted openings for TMT?

Yup can confirm UBS is total sweatshop right now. Usually run pretty lean groups anyway, but insane volume coupled with like 50%+ departures of the AN2's makes it much worse. 95-100 has been around average since starting.

Seeing those recruiting posts just adds salt to the wound.

It's 13 Analysts griping about the job to each other and publishing the results on GS PPT headers. This wasn't some sort of broad HR survey, and if it was, they certainly wouldn't have "selected" those quotes. Not diminishing the truth of it, but absolutely nothing will come of this other than probable disciplinary action against whoever created and leaked that document.

EDIT: People MS'ing me have never spent any time actually working for a bank. This sort of feedback has existed since the dawn of time. Yes, it's worse right now, and I'm not arguing against that. But GS HR is not going to call this kid into and office and pat him on the back for creating a document like this on company letterhead and sending it to a public meme account.

How are they gonna catch it? Think it’s probably fairly hard to identify who made it

Someone left a name in the properties of the original...

13 analysts is a significant number. I think it’s fair to say they are representative of a broader theme...

13 Analysts is like half of one group. 90% of you people were Econ majors. You took statistics classes. If you actually polled however many Analysts GS actually has (hundreds), it would settle somewhere in the comfortable middle, with comments that HR could cherry pick to make it seem no worse than normal. And that's not because things aren't worse than normal, it's because most people, if surveyed, will not skewer their employer because they know their employer can see their individual response.

Take this for what it is. A couple like-minded Analysts who have been getting railed that wanted to air their grievances on Instagram for fun. This is not some scandal that is going to change anything in this industry for the better.

lol it's not even like 10% of Goldman's entire new grad US IB class.. talk of the second years.

nope, it was a real survey by a staffer in one of their larger offices. and yes, getting worked to shit is what people sign up for in banking, but its been unusually awful at a lot of shops during covid. right after the pandemic started everyone was running around like the sky was falling. then, they realized the world wasn't going to end, they were in the back half of the year having done zero deals, and panicked and started fucking the junior staff to make things happen and it hasn't really stopped.

You sound like a major fucking tool. You’re part of the problem and I guarantee your analysts hate working for you.

lol the only people who upvoted this are nontargets who are salty about not breaking into IBD. This guy has no idea what he's talking about

you're living proof that most people working at IBs are not really that smart. Yeah, these have been around forever. Guess what hasnt??? SOCIAL MEDIA

Underrated comment. I was in a group with horrible hours and got absolutely destroyed year one. None of us had any time at all to recruit and it was miserable. I still can't imagine spending the time to put this information together and make actual bar charts. What's really going on is that the awful working conditions are just a lot less bearable when you're doing it alone from your apartment. Has nothing to do with the bank, it's WFH (no communal meals with other analysts, limited human interaction, etc.).

Mgmt right now:

Its just TMT analysts in SF that were surveyed. The doc was circulated internally last week for a bit until GS blocked sharing it. Funny it was posted almost a full week later. I told someone who got it to take pics on their phone and send to NY Post under NDA for $$.

were any of the analysts reprimanded?

https://imgur.com/a/v0ckTUm

I have sent this to every semi sketchy right wing news source I follow (they hate Goldman Sachs for.....reasons).

Expect this to blow up. they love the occasional goldman hit piece

karma for shitty bonuses. very fitting imo

Work at a different bank, but can echo that the hours and the stress are the same. Since January it's been completely crashing and it's a month than i'm north of 100hrs per week. The saddest thing is that you / your team start hoping deals do not go through as we're all well above our max capacity.

They say learning curve is steep, which is true. Anyway once you're so tired you don't learn any longer. That's at least what I'm experiencing

Careful there. David Solomon may now have another story about how his lazy analysts where wasting time filling a survey instead of working themselves to death

This is like the "Piper Jaffray: Sweatier Than Ever in 2018" thread but way worse because 1) it's Goldman not Piper, and 2) it hit the finmeme accounts and not just WSO.

From what I hear, Piper has gotten even worse these days. Associates and Analyst working until 3/4am every night for past few months. Mainly healthcare and industrials from what I understand.

Based on their open positions on LinkedIn lately/compared to usual, you are 100% correct. Mad postings everywhere

Late response I know, but yeah I've heard this from people I know still there.

That post actually led to a whole skew of changes at Piper (at least in the short-term / until COVID hit), I wonder if this will have a real impact or if Goldman has too much prestige inertia.

100 hr. average is rough as hell lol

in PE its like the half haha

I love liquidity account lol

that was just not great to hear

I thought this was fake because formatting is so ugly lmao

that's the real GS format

Believe it or not, that’s their actual format. Have seen books from all the banks and honestly GS wouldn’t rank that highly for me in terms of style. They’ve barely changed anything in a decade, but I guess if it ain’t broken...

Which banks would you say have the best formatting? I've heard Lazard's got some nice slides in Garamond font...

https://www.cnbc.com/2021/03/18/goldman-sachs-junior-bankers-complain-o…

I’m sure GS is in panic mode this morning with this hitting the front page of CNBC haha. Fuck Goldman though, they deserve every ounce of shit they get.

I can't tell you how frustrating it is to see my firms name not up there with them, we've been at 110 hours a week with no protected weekends or vacations as MDs make money hand over fist on our suffering

lol rt

Pretty sure this already went around internally for a few weeks but was suppressed by senior leadership.

For those that have seen the full deck, who knows what "CS work" is?

Client service - so basically any non live deal work for clients

Thanks, guessing this excludes pitches?

Bad take by Andrew Ross Sorkin here

Sorkin is a complete suck up to the big banks. His book too big to fail was basically a homoerotic love letter to Jamie dimon(srs). He wouldnever denigrate these firms because hed lose access.

I mean it's not a bad take - but just adds zero value. Everybody knows 13 analysts don't represent "the entirety of employees" and that was never the point! The slides were supposed to show how shitty everything is for first years... Sorkin just completely whiffed on the whole point

journos are stupid

in other news, water is wet and cliff asness is a better writer than investor

It is a bad take because his point is only technical.....is this representative of the compliance guy and the back office operations guy at GS? No. Technically, that's correct. Is it reflective of the average IB analyst experience, probably pretty close.

I don't ususally write on here but this is exactly how it's been at our EB. The treatment of junior bankers if flat our inhumane and there is no other way to say it. I can no longer recommend this career path to anyone.

Investment banking + work from home does not mix well until VP/Director level. Get these guys back in (to the office)!

The issue is that the seniors still dictate the experience regardless of whether you are in the office. Now that they see how easy it is to communicate remotely, they’ll continue to expect a high level of responsiveness 24/7 (even when they’re not in the office late at night or on weekends)

I hear that but banking has always been like that. The difference is that in office you are not melding your personal/home life into the work experience. That is meaningful because environment plays a huge role in productivity. So jr bankers today are probably working long and harder but with marginal gains in productivity.

Not sure it does even then. I've had multiple VP-level friends who thought they were staying in banking forever change their minds during COVID and look for an exit. One of them specifically said he didn't want to try for MD "because I have a soul" and cited the treatment of juniors during COVID.

I have the PDF slide deck if anyone wants it to make sure this doesn't continue to get suppressed.

why its being supressed?

https://cdn.fbsbx.com/v/t59.2708-21/158429739_264708011993089_747276957…

Has this been the case across all banks? Like are there any that have the resemblance of normal banking hours. Haven't even heard from guys at FT Partners or like Jefferies, Houlihan, which are certified sweatshops.

Anyone on here, pulling pre-covid hours?

I've started to staff myself strategically on projects with low intensity MDs. Been helping my hours significantly

My roommate works at FT Partners and has been working until 3-4 AM 6-7 days a week. At the rate he's going, the place will kill him

"I've been through foster care and this is arguably worse"

Sheesh...interesting timing too with the Bloomberg article earlier this week on the big name exits over the past year: https://www.bloomberg.com/news/articles/2021-03-14/goldman-ceo-s-year-o…

YOU ALREADY AHEAD OF THE GAME

For context to others —

This is what was said by a Citi Houston IB MD when asked about WFH Dinner Stipends. As it turned out tho, a week after that email exchange went viral, Citi instituted its Dinner stipends even for WFH again.

lololol

Hah, this shit went on Bloomberg!

The entire street has to know about this now.

https://www.bloomberg.com/news/articles/2021-03-18/goldman-bankers-beg-…

I wonder, how fast the shit hits the fan.

Btw, the full 11 slide presentation is linked on Bloomberg, hilariously enough.

(Not directly related to topic)

I just wanted to say their slides look trash.

Left margin way too wide, right margin too narrow

First chart not center aligned / dragged across the entire slide

Why does source start from where it is currently starting from? Should it be aligned to the left of the GS logo???????????????????

pls fix thx

Relax man. These dudes probably put this together at 3:00 AM for lols

ok

people like you are why IB is complete JOKE

focuses more on format vs actual message

meanwhile some tech quant doesnt give a phuck about formatting and hes making millions a year working on actual problems that require thought vs prettying up a powerpoint page like a complete corporate cuck

Tell me how you really feel... but first pls fix. Thx

the "tech quant" stuff that ur dickriding basically just means momentum/trend follow, HFT options market making, or scalping lol...

doesnt rly involve much "thought" or "working on actual problems" and doesnt rly add much to society either

not defending banking culture or anything but ur just spitting out buzzwords tbh

Well nobody's going to read your slides if they have trash formatting so I'm not sure what you're going on about.

Same goes for modelling.

Tech quant's life is going to be very difficult if his code's a mess and he can't audit it.

https://cdn.fbsbx.com/v/t59.2708-21/159982695_1227428334338664_88935348…

link to full presentation

says url signature expired

Damn, he looks fairly young for a Goldman Analyst 🥴 What group he in??

Can confirm its true for JPM..

Serious question: does anyone think anything actually comes of this? The fact that it was on CNBC seems like good news, but we’ve seen many stories like this ultimately just fizzle out because no actual pressure was put on management. I mean I hope DJ David gets shit on his fat bald head and that the monkeys at GS and everywhere else see an improvement, but if we’re being realistic what can actually happen as a result of this?

Not really - the Piper thread blew up internally and there was a lot of talk about things actually changing and certainly some things did improve, but from what I've heard over time things slowly reverted back to how things were before and only a few of the changes were permanent. Also think about a few years ago when there was a string of semi-high profile deaths / suicides (BAML, Moelis, GS) in a short period of time and nothing really happened out of that I don't think either.

I'm not on the IB side, but if the bankers killing themselves over the past few years don't exact lasting policy change then this measly slide deck will have even less effect. Sure they'll say something, may even change things for a year, but once everyone forgets or a new analyst class comes in it'll be right back to the same thing.

Perfect time to rise up and form a union like everyone previously joked about lol

some hot takes in the comments https://www.linkedin.com/feed/update/urn:li:activity:6778381410437787648

That Haggarty-Weir guy sounds like the biggest fucking prick

Strong correlation between # of letters after your name and level of ahole-ness

"face time", really fatty, read and think before typing with those sausage fingers the context is wfh so no real face time. maybe go get another meaningless credential.

.

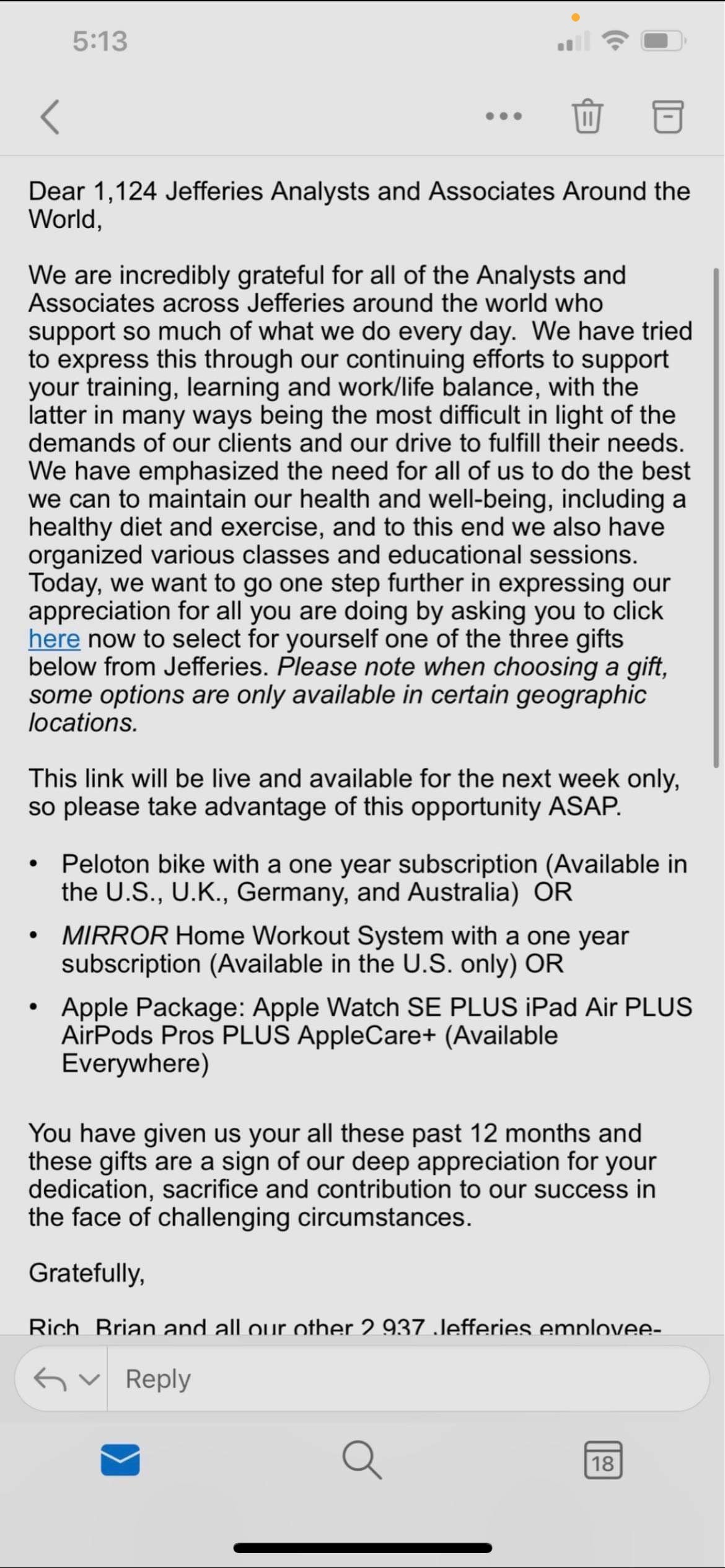

Meanwhile Jefferies...

WTF that is insane

That's nuts... but why the hell would Jefferies offer a Mirror instead of a Tonal? If you're paying 2K plus for the Peloton, you can at least spring for the better "Mirror Type" system

Is there any issue with just giving it as a cash bonus? pretty sure it would be easier for all parties involved.

wouldn't the junior bankers then have to pay taxes on this? Unlikely that Jefferies will send a grossed up cash-bonus to make bankers whole

Meanwhile DB not even paying for their analyst's dinner for all of COVID lmao

Is this real? They're not expensing dinners?

Didn’t a child just get killed by a peloton? Maybe that’s the angle they are going for to drive more efficiency from WFH

as much as i hate AOC and Elizabeth Warren, I hope they get wind of this and start twitter blasting Goldman (something they like to do already) about this. AOC you are my only hope

would make Goldman Board of Directors pucker up REAL fast

I remember being a naive 12 year old. You think the BoD at GS has a fuck to give about aoc has literally ever said? Fucking funniest shit in the world

He's actually not wrong. The more flak this catches from influential folks (and by influential I just mean large reach not folks who I or others respect), the more a Board will be obligated to enforce at least public-facing action. A lot of their duty lies in obviously generating returns for shareholders but secondly making sure that the firm is seen in a good light (relatively speaking) so that large institutional shareholders don't make a fuss when bad press comes to light amongst other things.

You think some MD at GS who spends his entire day begging clients to let him work for them has more pull than two of the most prominent member of congress? It’s important to have some perspective.

If the average time you’re going to sleep is 3 am, odds are you’re either wildly inefficient at your job, or just suck, or some combination thereof. And yes, even if you’re at a BB like GS. I’ve done IB at both a BB and boutique, these reports are either extreme outliers or exaggerations

If the average time you’re going to sleep is 3 am, odds are you’re either wildly inefficient at your job, or just suck, or some combination thereof. And yes, even if you’re at a BB like GS.

or your vp/sr associate/director above you sucks

my VP emails me all night asking for updates NOW. it never ends

same with my MDs. we do calls at midnight

fuck off

You should be more proactive in your communication. Will help with late night emails + the annoying “where are we with This!!!!?”

Just my opinion mate. Talked to all my buddies in IB and they agree the report is extreme.

or it could be that things have just gotten worse over Covid because everybody's cooped up at home and the already flimsy line between life and work just up and disappeared

Nihil qui dolorem ea voluptas. Odit vero nesciunt eligendi ipsum rerum sint. Ut et nostrum minima aperiam aut recusandae. Facere rerum omnis eos sint eum accusamus. Veritatis ratione velit repellendus earum soluta molestias dolorem error.

At eos voluptatem placeat est qui. Aliquid quia nemo non quia. Consequatur commodi porro possimus voluptas fuga aspernatur nisi.

Odit quibusdam error similique harum. Qui neque neque itaque sunt et est. Commodi eaque corporis rerum accusamus ea hic sunt. Illum consequuntur ut dolorem et. Qui enim repellendus aut qui iure. Animi fuga officiis aut voluptatem harum voluptatibus culpa.

Id eligendi laborum quaerat voluptatem. Odio quis modi aliquid quisquam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Quod sint sed repellat consectetur velit ut. Quam ut voluptas quaerat nihil ex voluptatibus. Sit aliquam ex aliquid libero sit sed.

Magnam voluptatem molestiae aut neque vel molestias quos. Non voluptas qui debitis exercitationem aliquid. Molestiae sint autem ex facere soluta itaque. Ex neque unde neque aut. Sit perferendis quia voluptatem ut illo aliquam.

Neque vitae odio quidem ipsa quae. Sint optio illo labore laborum nobis. Natus deserunt expedita voluptatibus voluptas ut dolor dolor. Deserunt animi omnis animi autem molestiae facilis. Quo praesentium quam soluta necessitatibus rerum.

Sit in facilis et qui pariatur. Reprehenderit neque molestiae veritatis suscipit dolor aut. Sed nihil aut repudiandae qui et molestias.

Ea sed id voluptatum ut suscipit est. Fugiat debitis labore esse voluptas placeat quas voluptatem. Quia reprehenderit necessitatibus quia repudiandae fuga. Quas velit quis provident distinctio veritatis quia aut. Pariatur quia ratione voluptate corrupti sint. Culpa officia sint esse eveniet autem deleniti quia totam.

Quod et repellat corrupti aut est suscipit mollitia quisquam. Similique quia unde molestiae. Quis et eius provident sequi et ut. Vitae dicta omnis repellendus perspiciatis dicta facere. Quod ipsum repudiandae ab delectus fuga quia.

Quod laborum ducimus accusamus ratione non praesentium illum. Iusto sint molestiae et omnis adipisci voluptatem explicabo. Non est quisquam qui fugit. Fugit blanditiis possimus iusto distinctio. Qui sapiente quas et et rerum voluptate dolore.

Est animi reiciendis asperiores est excepturi. A labore qui omnis mollitia error aut in odit. Adipisci quisquam enim voluptatem. Sed reiciendis rerum qui nostrum et. Quia ipsum a occaecati itaque odit. Tempore voluptas quo aspernatur quis fuga.

Ipsa temporibus et mollitia dolorem. Ut autem consequatur perferendis aut. Veritatis neque quod consequatur quaerat aut ut minus.

Dicta consectetur iure dolores velit et. Et asperiores labore repellat mollitia voluptatum. Nobis nihil omnis at doloribus enim qui velit.

Voluptatum reiciendis culpa molestias nesciunt autem autem. Autem alias facilis ducimus cupiditate. Maiores in qui optio sequi. In nobis voluptatem autem nesciunt. Exercitationem deleniti animi dicta sed et. Ut suscipit deserunt quam deserunt neque a accusamus.