WSO 2023 Investment Banking Work-Conditions Survey RESULTS (3rd Annual)

Summary

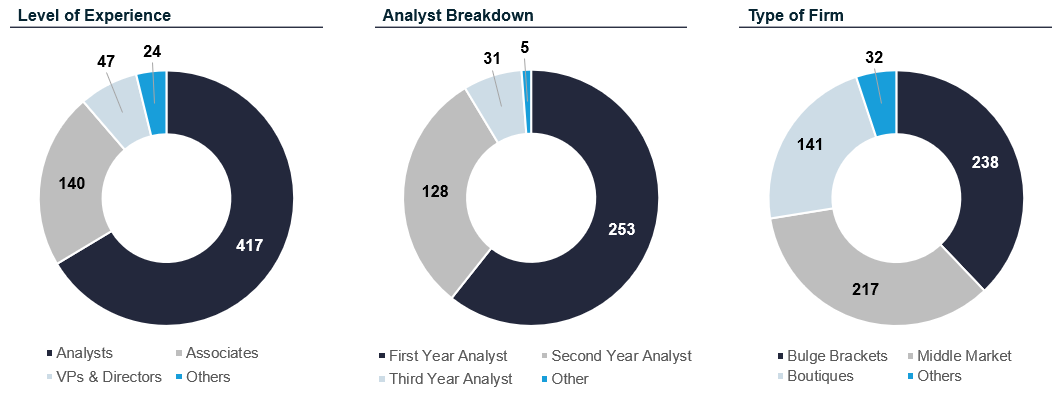

- The survey was taken by 628 banking professionals during March 29th – April 28rd, 2023 (the professional status of each respondent has not been verified)

- 40% of respondents are first year analysts

- 38% of respondents work at a bulge bracket bank

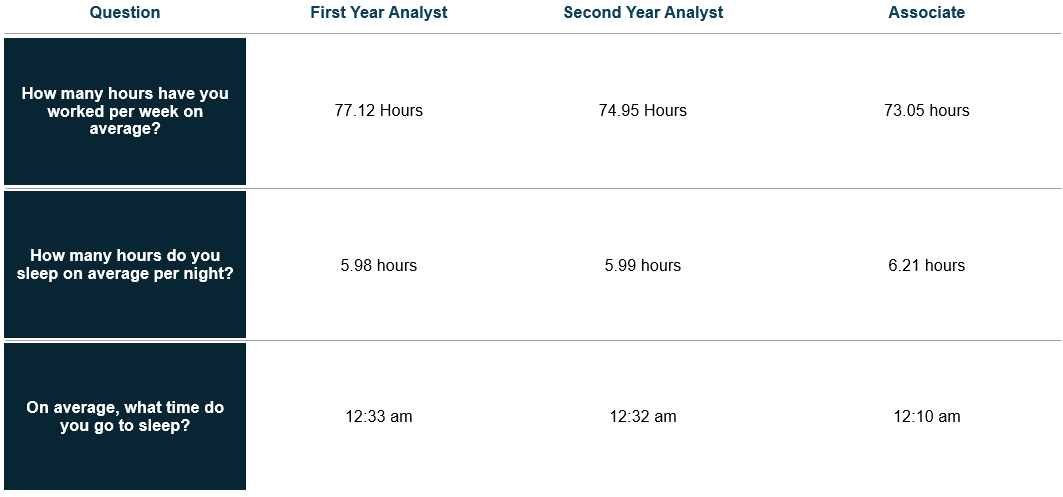

- 15% of respondents have averaged 91 work hours or more during 2023 (5% at 101 hours+)

- 30% of respondents have averaged 5 hours of sleep or less per night in 2023

- 22% of respondents have averaged a 2AM bedtime or later in 2023

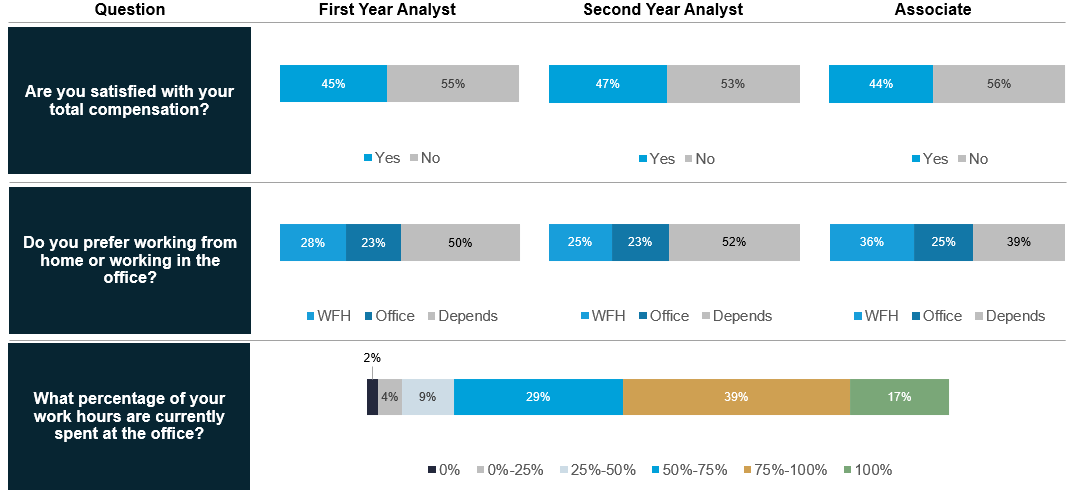

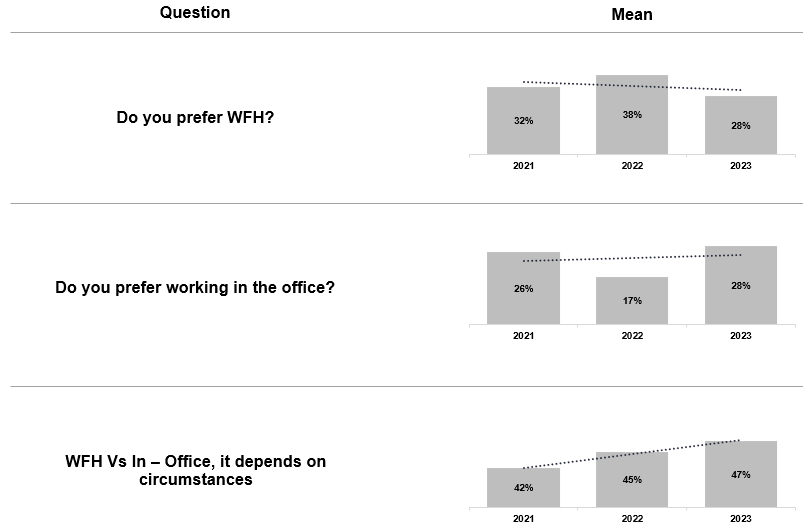

- First year analysts, second year analysts, and associates prefer WFH over working at office

- 48% of respondents aren't happy with the meal stipend their bank provides

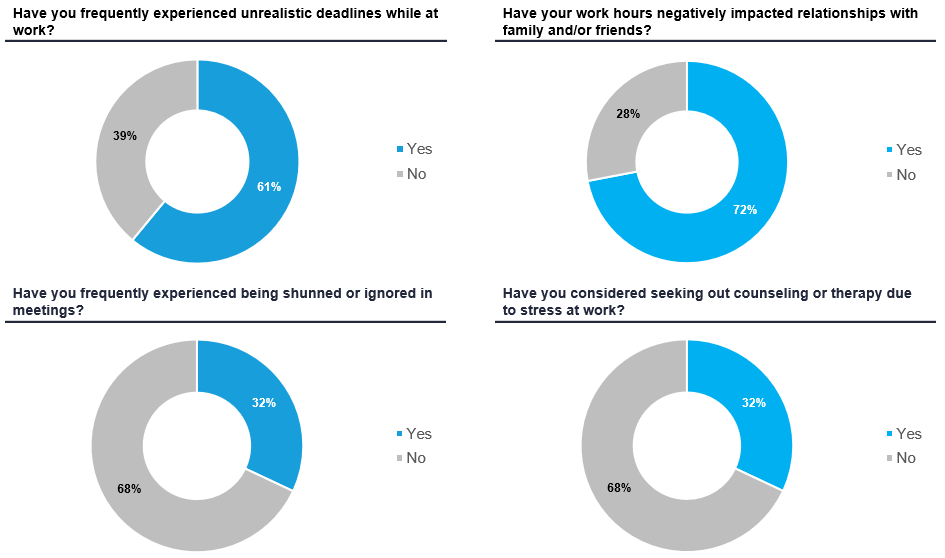

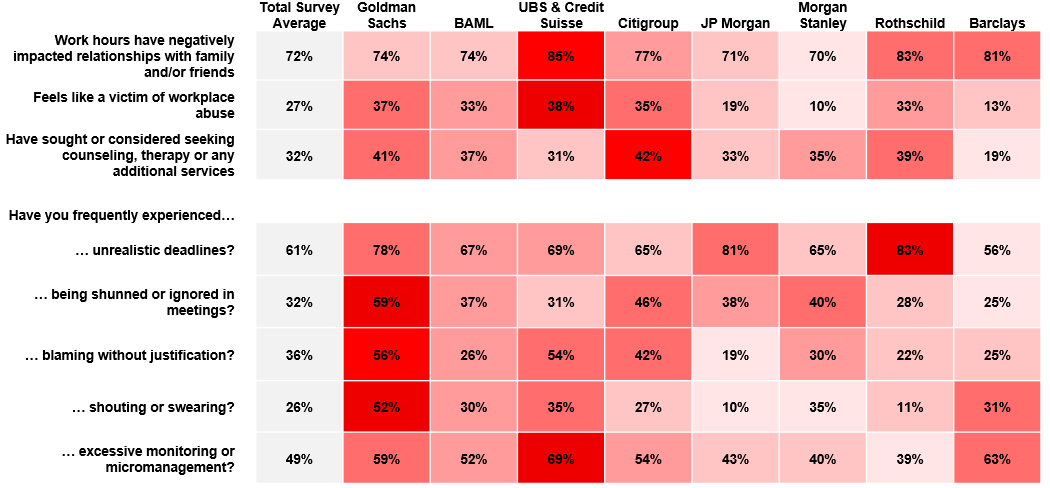

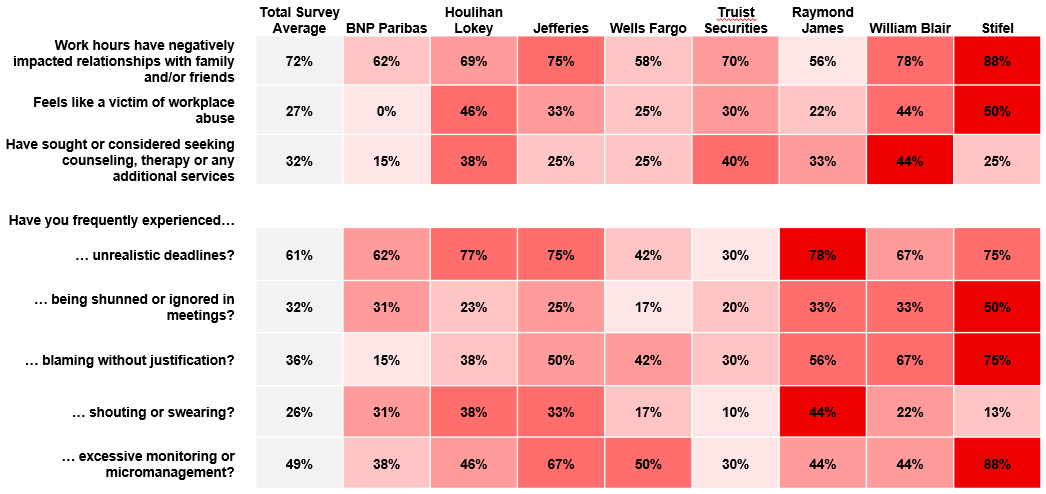

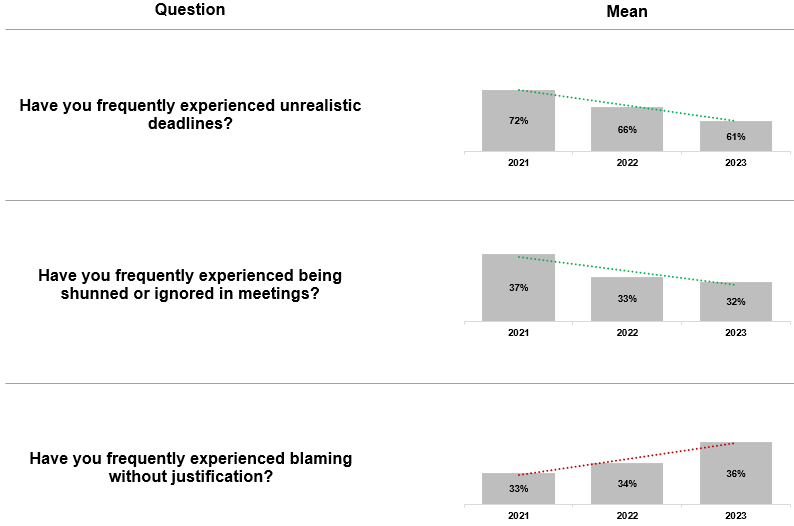

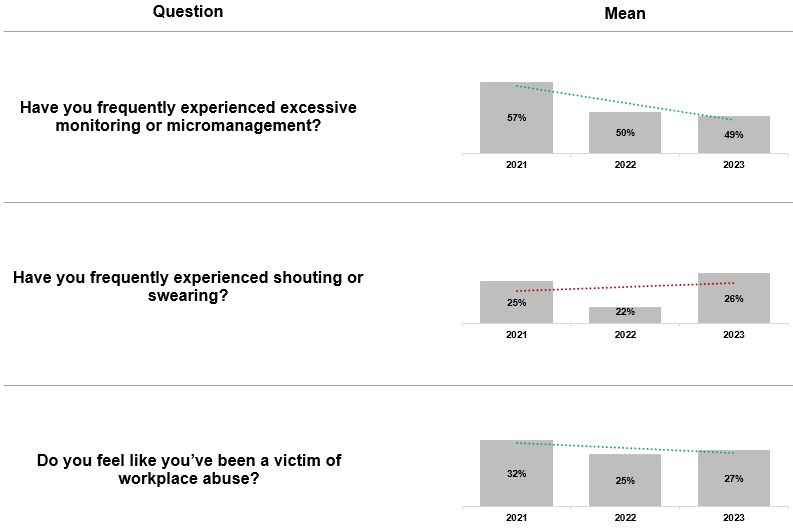

- 27% of respondents say they feel like they've been a victim of workplace abuse

- 61% of respondents say they frequently experienced unrealistic deadlines

- 72% of respondents say their work hours have negatively affected relationships with family and/or friends

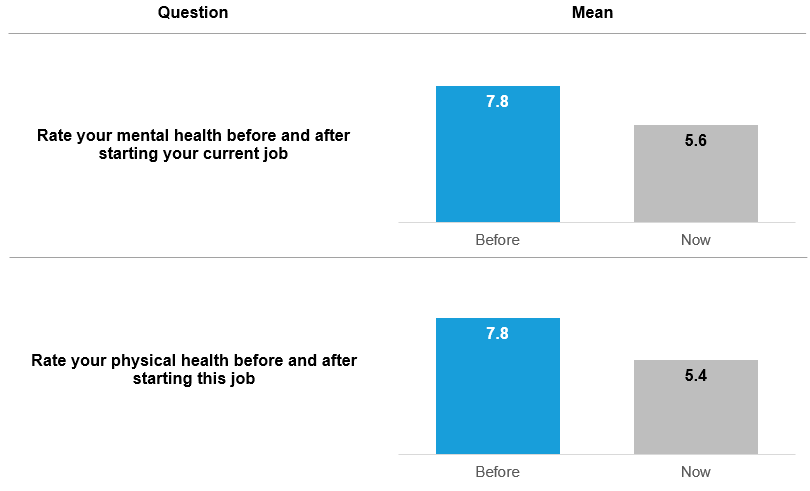

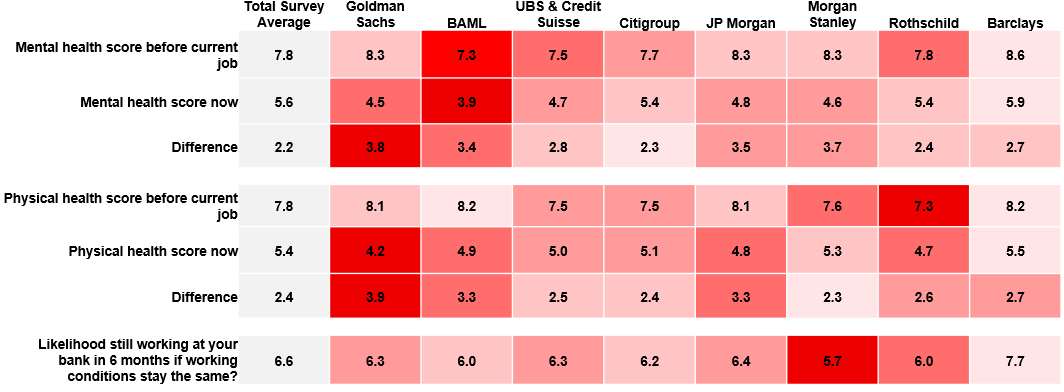

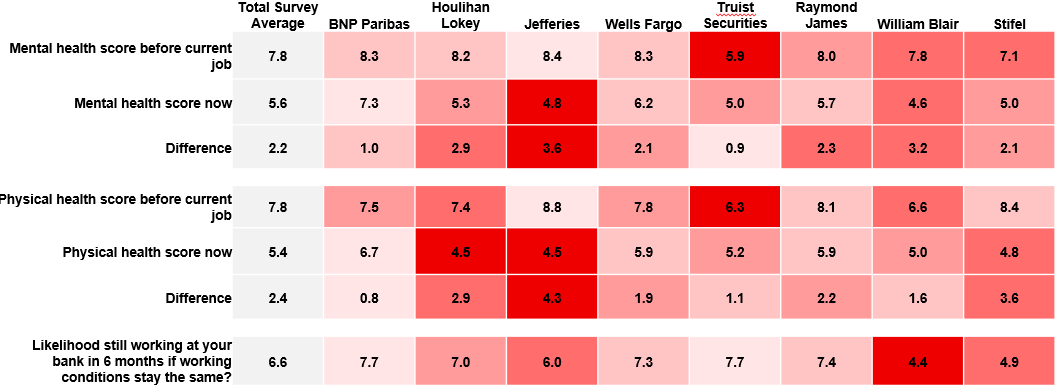

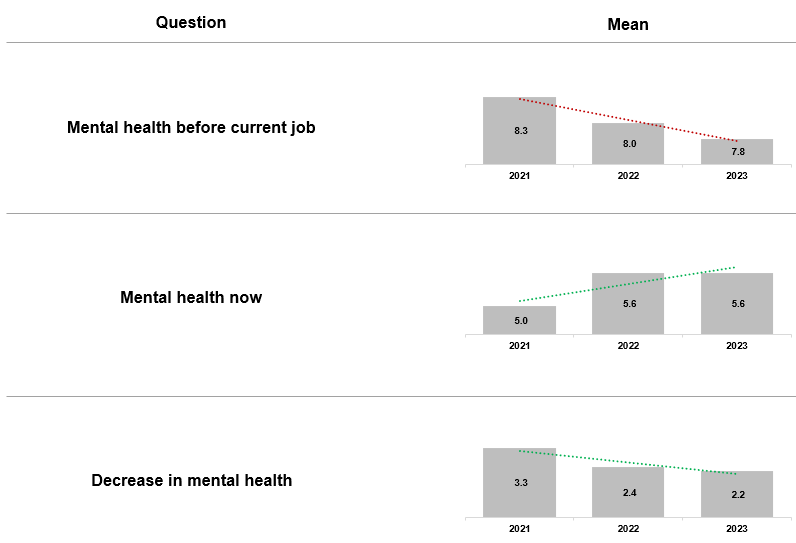

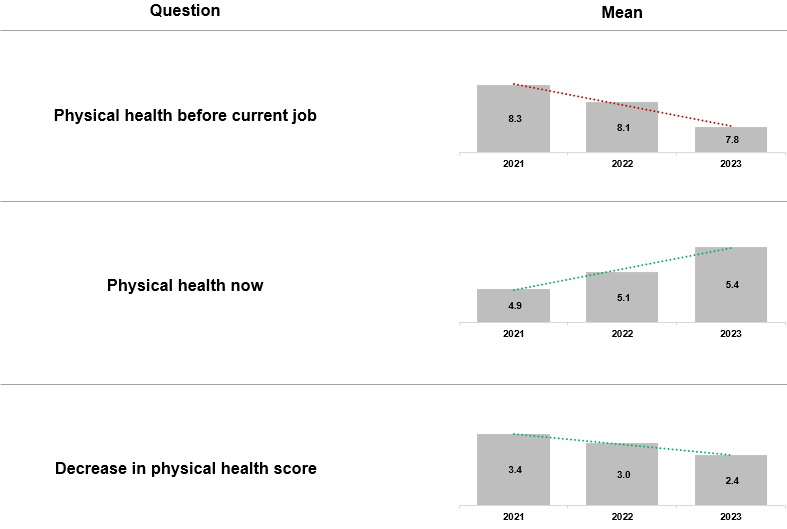

- Respondents report a 30% decline in mental and physical health (comparing health before starting their current job with now)

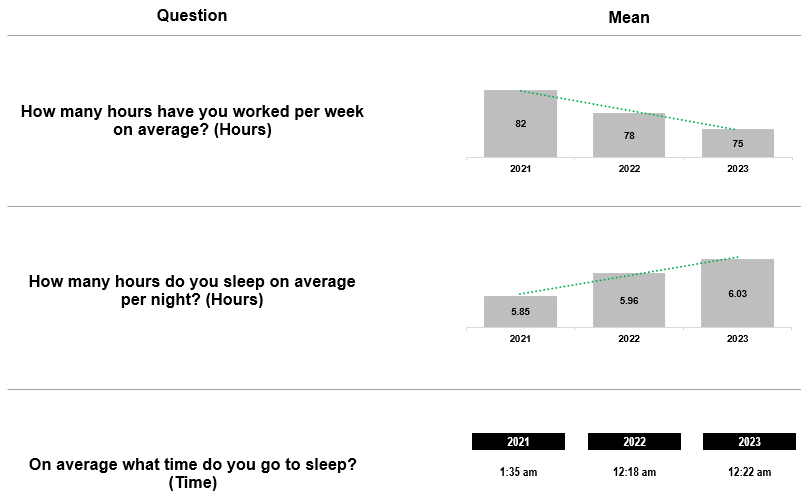

- Average hours worked per week by respondents reduced from 82 in 2021 to 75 in 2023

- Average sleep per night by respondents increased from 5.85 in 2021 to 6.03 in 2023

- Average time that respondents went to bed has improved from 1:35 AM in 2021 to 12:22 AM in 2023.

- A downloadable PDF is attached to this post

Message from Patrick Curtis

Wall Street Oasis at its core is a community of students trying to break into careers in finance and young finance professionals trying to thrive and build meaningful careers. For years, we have been frustrated by the lack of change at the investment banks and have tried to bring transparency to the realities of the job.

This includes releasing detailed data on # of average hours worked by bank in the WSO Company Database as well as other lifestyle metrics the candidates have used for years to help them make informed decisions. Unfortunately, this has done little to curb some of the banks with the worst reputation since there are still many more qualified candidates than seats in the industry.

Inspired by the report released by Goldman 13 in 2020 and some of the concessions we saw then, we decided to continue to conduct this wider industry-wide survey and continue to track this data each year.

Our hope is that publishing these numbers continues to get the attention of leadership and make the junior banker role more sustainable. We still strongly believe that investment banking is an incredible career and leads to a very attractive set of options, however, we want to make sure we put the mental health and safety of our community first.

Demographic Breakdown

Hours Worked

“Analysts and Associates in the team work extremely hard (without exaggeration, 100+ hour weeks are very common and somewhat normalized)” – Industrials Analyst @ Barclays

WFH, Pay, and Treatment

“Ridiculous culture, firing too many people, lying about pay” – Generalist VP @ Citi

“Culture in investment banking should become more human and be focused on retention more. These are not 2000s anymore, people have a life besides work” – TMT Associate @ Goldman Sachs

Mental And Physical Health

“Individual experience is so, so dependent on your team. I don’t understand why everyone is so desperate to join the rate race of ‘TMT this, M&A that’ when they only plan on staying there long enough to jump ship” Financing Origination Analyst @ Bulge Bracket

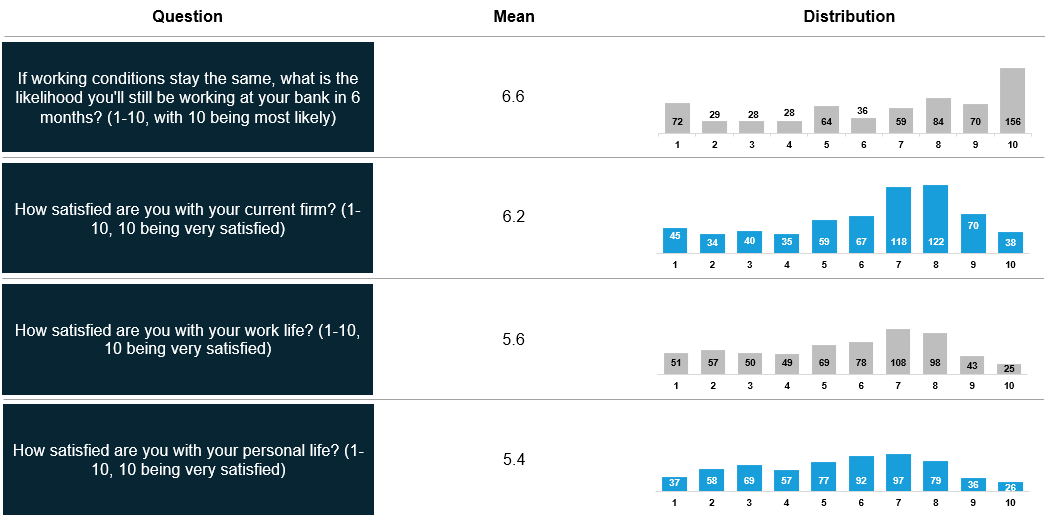

Retention And Satisfaction

“It is truly baffling how often I end up in the office from 1 am – 2 am just because my Director, VP, or Associate is here. They each leave when they’re done with their work, but it’s highly frowned upon for Analysts to leave before all of them have left.” Industrials Analyst @ Stifel

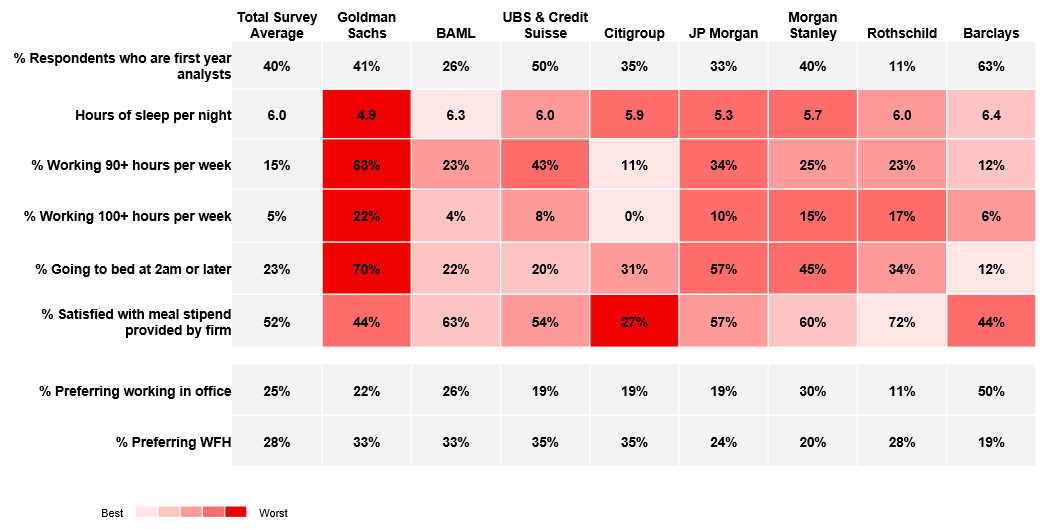

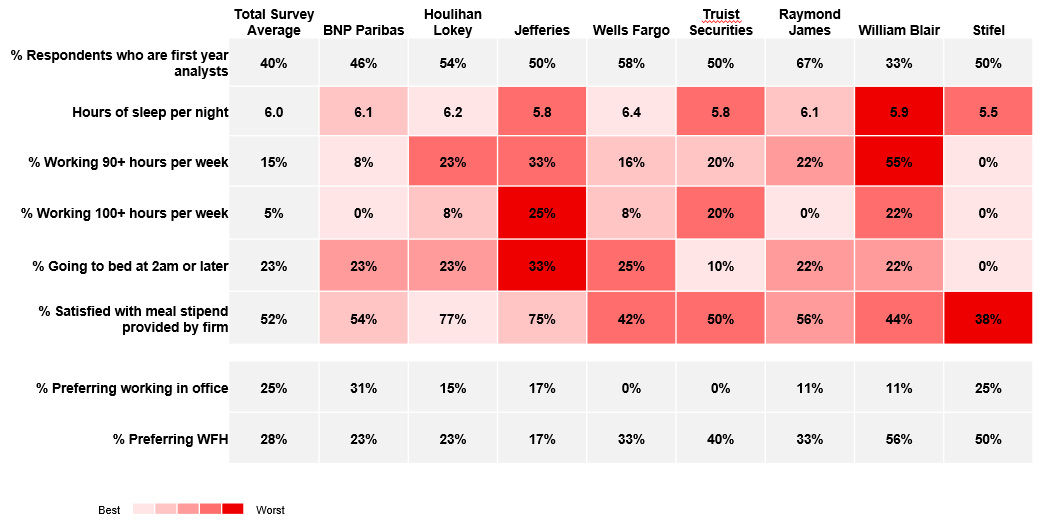

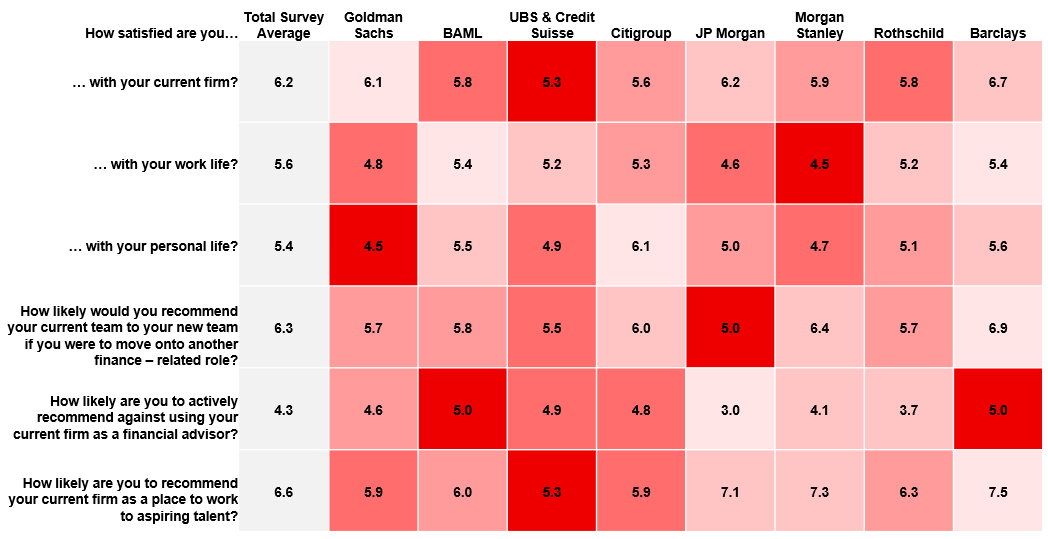

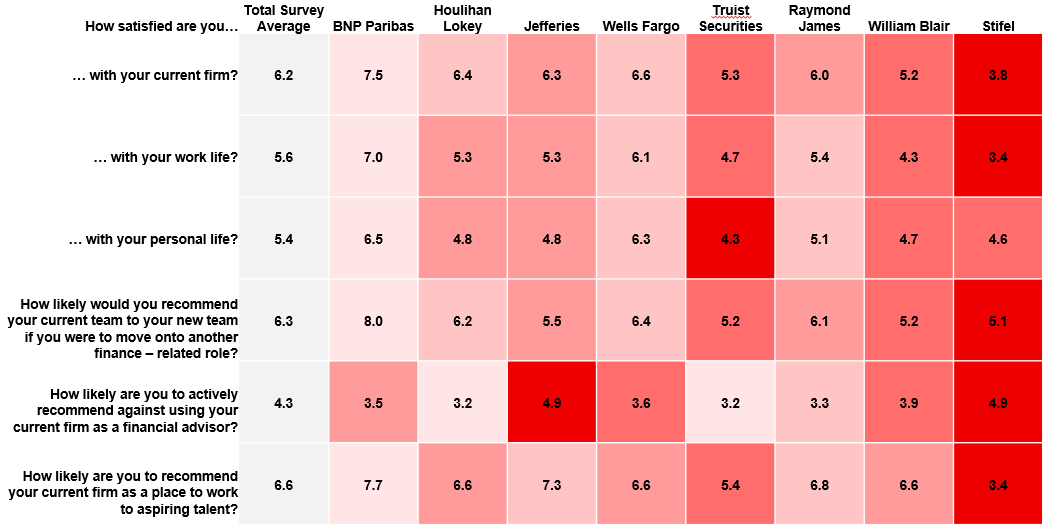

Bank-Specific Data & Quotes

Banks Included in the Charts Below:

Goldman Sachs (27 Responses), Bank Of America Merill Lynch (27 Responses), UBS & Credit Suisse (26 Responses), Citigroup (26 Responses), JP Morgan (21 Responses), Morgan Stanley (20 Responses), Rothschild (18 Responses), Barclays (16 Responses), BNP Paribas (13 Responses), Houlihan Lokey (13 Responses), Jefferies & Company (12 Responses), Wells Fargo (12 Responses), Truist Securities (10 Responses), Raymond James (9 Responses), William Blair (9 Responses), and Stifel (8 Responses).

Hours, Sleep & WFH

Health & Retention

Workplace-Culture

Satisfaction & Recommending the Firm

Quotes From Bank Employees

J.P. Morgan

“One of the most toxic work environments on Wall Street. Tons of departures (literally dozens) with toxic workplace environment where we're forced to come in, was told that we shouldn't expect vacation / discouraged, and people actively undercut others. Not a team environment and have frequently heard peoples’ surprise at just how horrible a place can be”

Wells Fargo

“Work place culture is excellent, juniors are good for the most part, managing directors are total idiots, that’s why WF Houston doesn’t do M&A”

“Don’t mind the hours on something live, it’s the hours spent pitching that suck”

“Within my group it doesn’t seem like internal mobility is encouraged. Some MDs are territorial when working across the bank”

Rothschild

“Lighter hours than most of my other peers in IB, but I still don't love the job”

“No protected weekends, no mentorship, more MDs and VPs in the group than junior bankers, unsupportive of PE recruiting, we work more than anyone else but generate no fees, overall it’s a sorry excuse for a group at a bank”

Trends from 2021 to 2023

Hours and WFH

Treatment

Mental Health

Physical Health

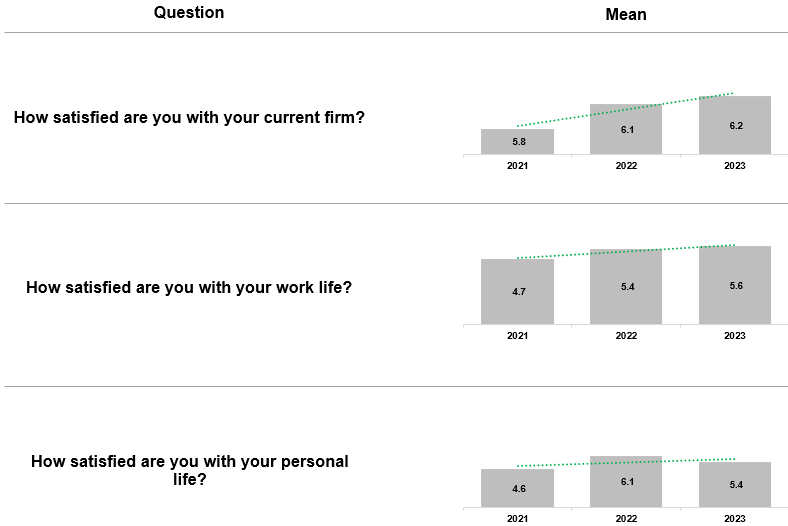

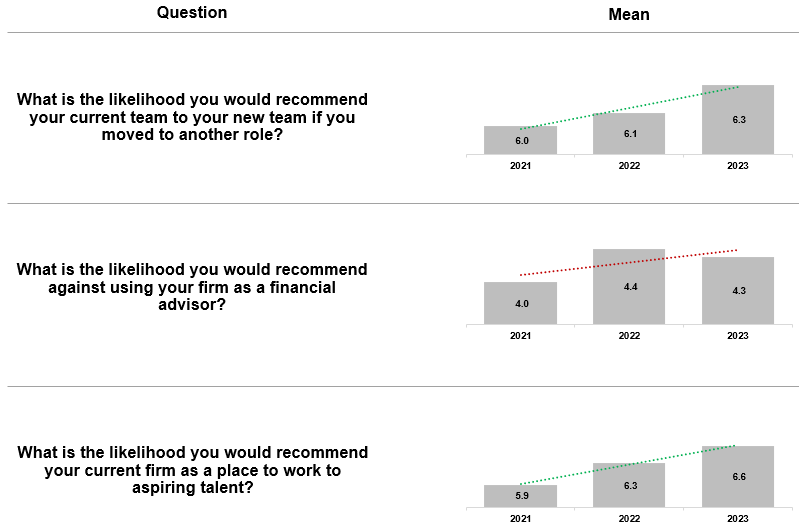

Satisfaction and Recommending Your Firm

For more bank-specific data, please check out the PDF report attached to this post.

| Attachment | Size |

|---|---|

| 2023 Investment Banking Working Conditions Survey 811.55 KB | 811.55 KB |

Awesome, Patrick! I'll take ~75 hour average work weeks! Wonder how much of this is strictly do to slowing deal flow versus a concerted effort to improve WLB.

Thanks - good data in here. What are some solutions though? What can banks do to make these jobs more fulfilling, build loyalty in the analyst class and add value to their firms?

Stifel & UBS look like a shit show

Stifel with the 88% "excessive monitoring or micromanagement"

You get GoPros strapped to your forehead or what?

Its crazy that there's such a decline in physical health. I'm guessing when people say physical health they don't necessarily mean actual health conditions

I was surprised it wasn’t higher tbh, but read it as gaining weight, feeling out of shape etc

.

JPM has been a joke for awhile now. They’ve forgotten they’re an American company. They’ve gone completely globalist and manage their company as if employees are a bunch of cyborgs. Problem is, they’re simply so intertwined with the government they literally cannot fail.

Voluptates saepe natus debitis. Incidunt laborum ratione consequatur in consequatur et ut. Eveniet ratione illum ad.

Et sunt voluptatibus dolore quam et nostrum. Aliquam nesciunt fuga sunt dolores sapiente. Sed perspiciatis ipsum impedit cum rerum ut. Adipisci natus voluptas blanditiis et sed.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...