How Do Comps And Precedent Transactions Work In Healthcare? (They Are All Private!)

Question says it all. Doing some buy side case studies, and I do not know how to pull comps in healthcare. I am not in healthcare, but started recruiting for a healthcare shop. Our firm only has access to CapIQ, and a lot of the companies do not have "quick comps" available on the left side.

The quick comps that are available are horrible. Let's say you're doing a case study on a dermatology chain in Arizona. There are no publicly traded derm chains.... what, I compare it with HCA Hospital? That's a terrible comparison.

Or let's say you're doing a case study on electronic health records? Yeah, I guess you can compare to Cerner Corp.

Any tips?

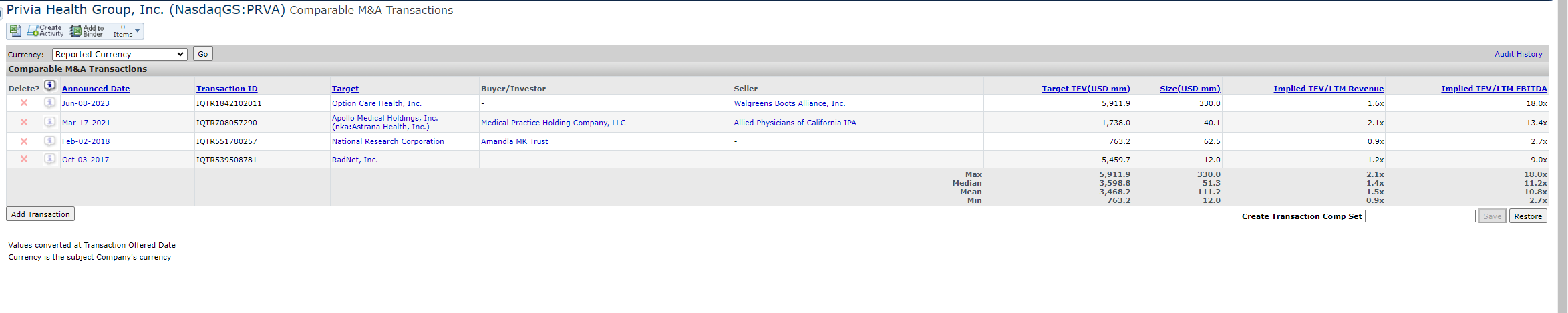

Example: these precedent transactions for Privia are totally ridiculous.

Following!

https://cigcapitaladvisors.com/dermatology-industry-trading-multiples-a…

https://firstpagesage.com/business/healthcare-ebitda-valuation-multiple…

https://practicaldermatology.com/topics/practice-management/the-dermato…

Sources are a bit old but that should give you an idea.

This is really helpful. I saw some of these too, but wasn't sure if it was appropriate to give the commentary "there are not that many appropriate comps / precedents, but the multiple I am proposing is consistent with my research X, Y , Z." Thanks!

This helps with provider assets. However, what about other types of healthcare, like HCIT? Let's say I get a case on some healthcare analytics company. Privia is trading at 66.5x TEV / LTM EBITDA... that is wild, and I do not want to explain bring that up and have to explain why I'm submitting a bid at 12x LTM EBITDA lol. "Why are you tossing yout Privia? I thought you just said that's the best comp?" Or do I start comparing it with totally different HCIT companies, like EHR vendors or RCM?

McKesson, NextGen, R1 RCM.. get what I'm saying?

Nihil rerum quis aut rerum esse. Ratione est veritatis aperiam dolorem voluptas. Magnam labore dolor quia iusto sint vitae aliquid. Occaecati assumenda vitae nulla cumque. Dolor qui incidunt labore exercitationem doloremque.

Similique consequatur molestiae a et libero. Quaerat et unde dolores soluta est alias eligendi. Vel odit sit ut quisquam maxime illo expedita. Eveniet debitis culpa id. Et enim voluptatem doloribus rem quis corporis et consequuntur. Velit animi veniam qui qui.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...