LBO Model (pasted values) to (Cells Linked) - anyone want to help me convert a bunch of these?

Model (pasted values) to Model (Cells Linked) - anyone want to help me convert a bunch of these? Help me, Help You.

Have a bunch of models in excel in different formats I've identified as "Good" that I want to convert, and see what I like. Establish a few "Go To" versions depending on the situation. No rush, just thought I'd inquire. Preferably someone w/ lev fin/IB modeling experience, but truly idc

Happy to add value to whoever helps me - by offering my expertise in whatever area is of priority to you (Lev Fin/Direct Lending, Side Businesses, online businesses, online marketing, etc.)

and hopefully as this evolves get a relationship going where I can maybe send a funny WSO post I saw, or ask a question (and vice versa).

May regret posting this, as it'll probably be a huge distraction.

lemme know

A few formats I like pasted below - not all encompassing, but illustrative of some things I like

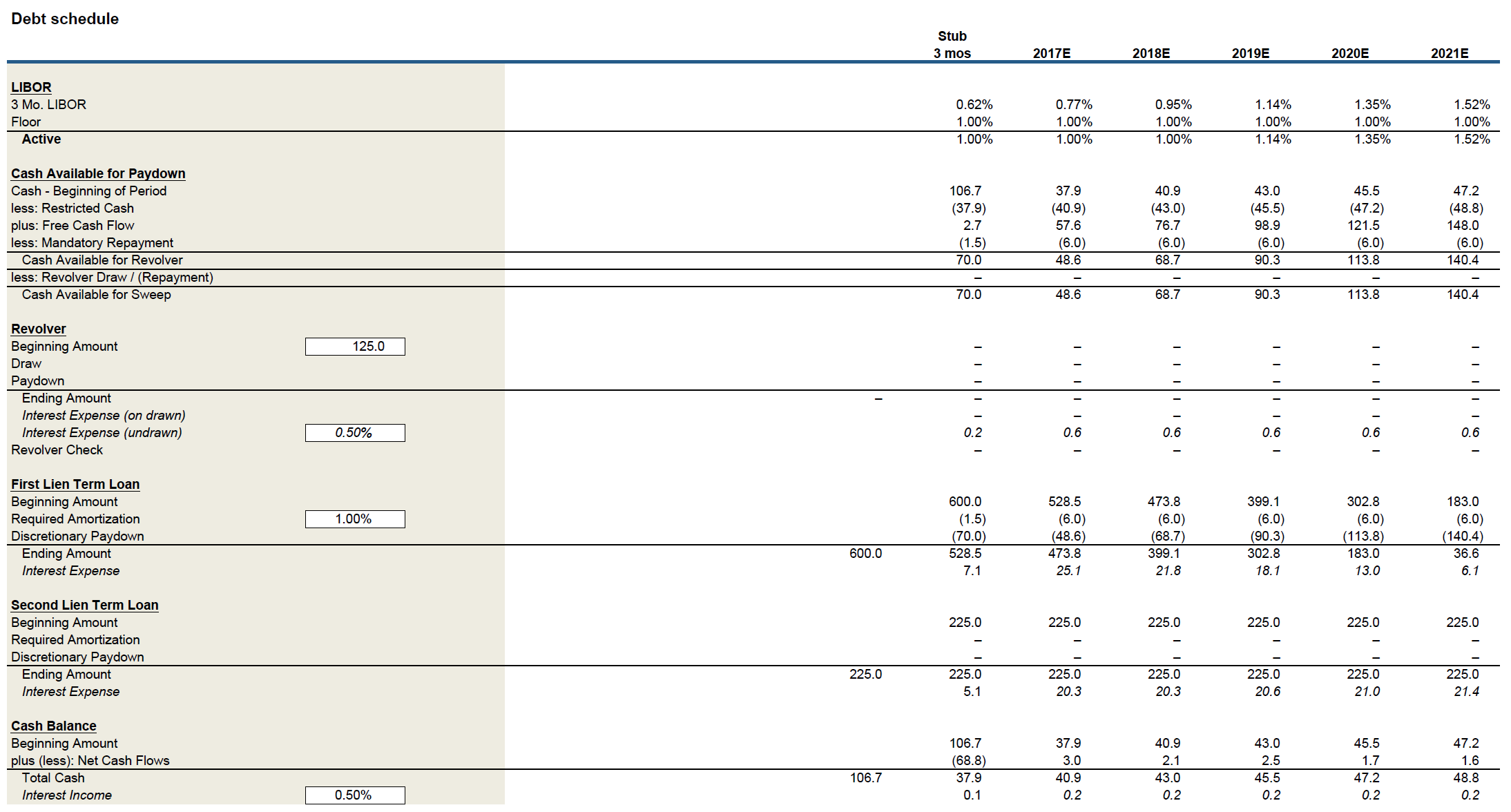

- RC beg amount

- RC % interest - undrawn

- 1L TL - amort

- Interest Income - %

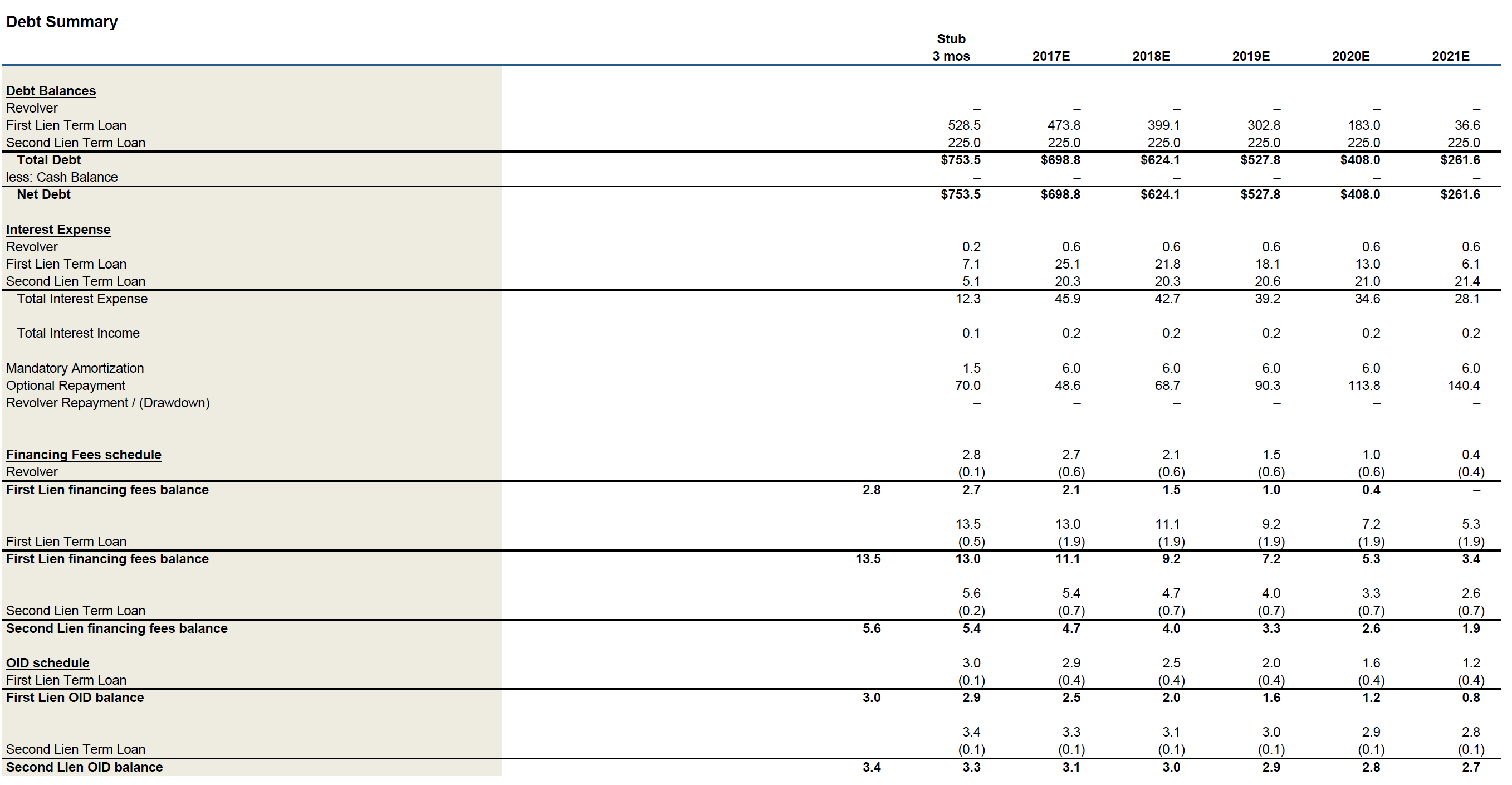

2) Debt Summary

2) Debt Summary

- Mandatory amort

- optional repayment

- RC repayment/drawdown

- Financing fees schedule

- OID Fee Schedule

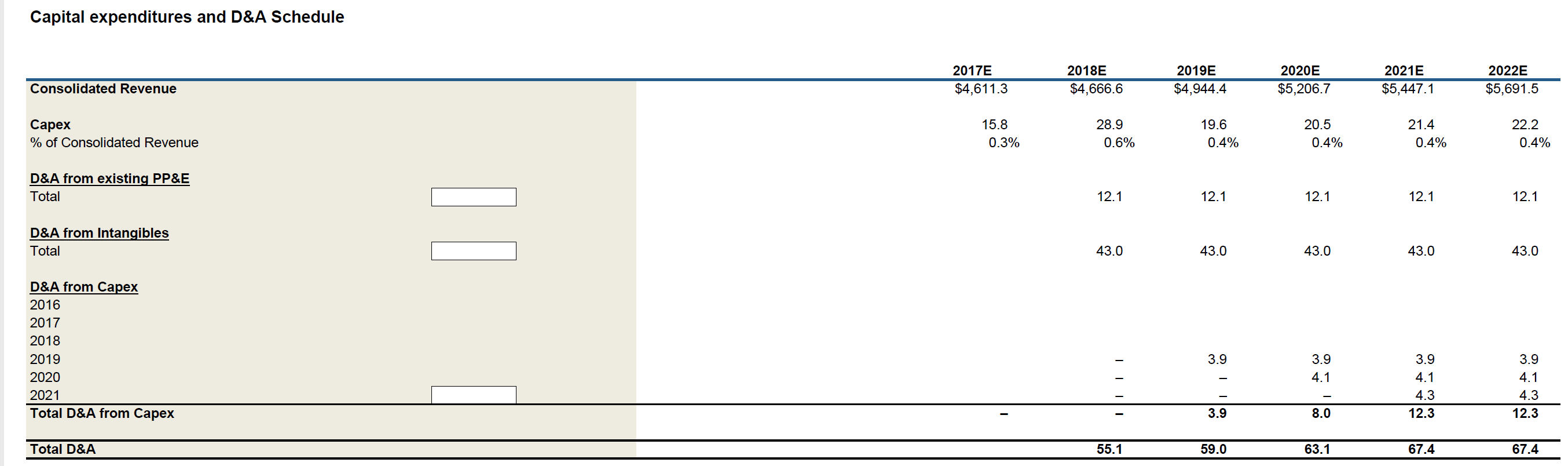

3) Capital Expenditures and D&A Schedule

3) Capital Expenditures and D&A Schedule

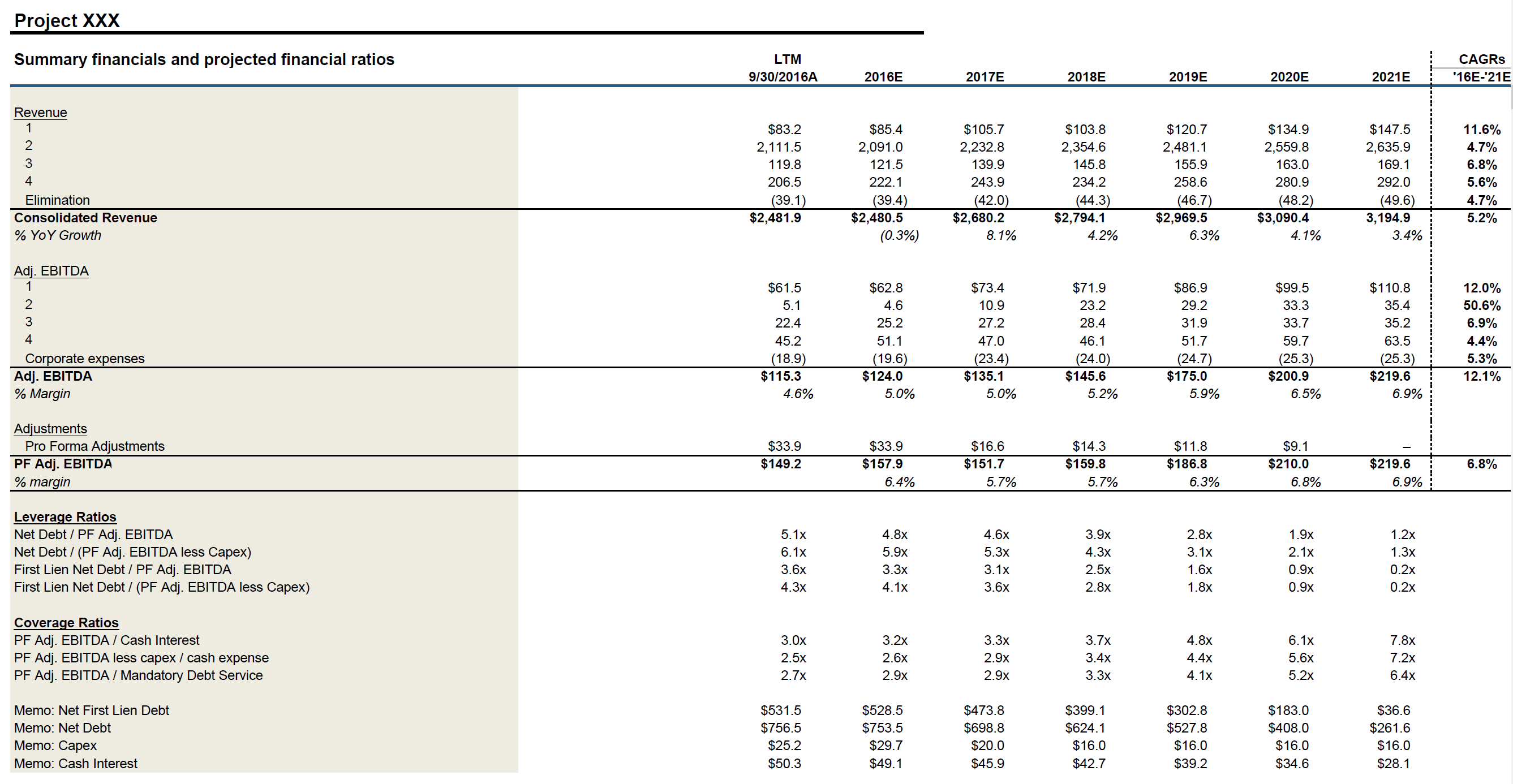

4) Project XXX - Summary Financials and Projected Financial Ratios (w/ credit stats at bottom)

4) Project XXX - Summary Financials and Projected Financial Ratios (w/ credit stats at bottom)

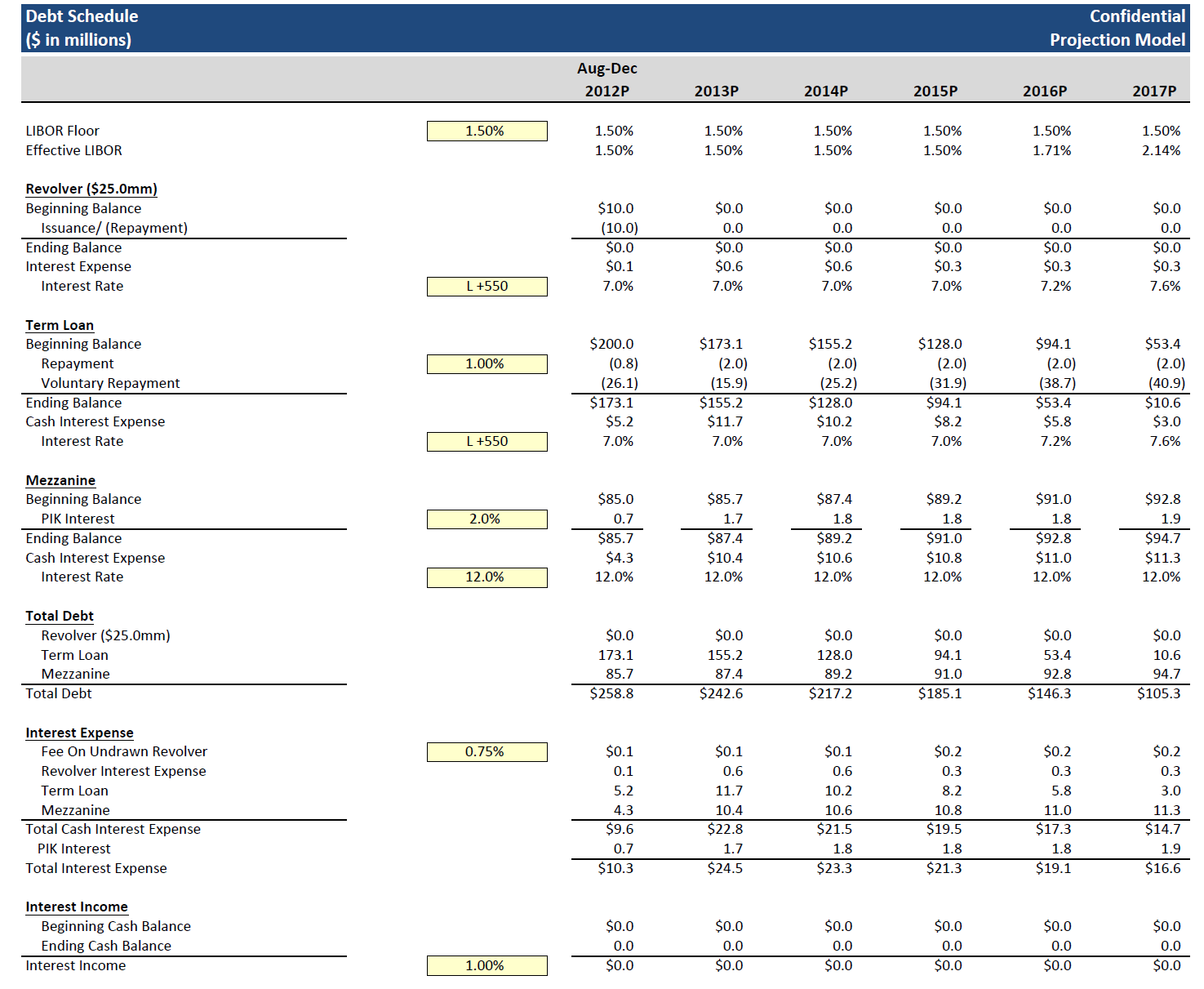

5) Debt Schedule - Projection Model

5) Debt Schedule - Projection Model

- Floor %

- RC Drawn margin

- TL amort

- TL Drawn margin

- Mezz PIK interest

- Mezz interest rate

- RC - undrawn fee

- Interest income %

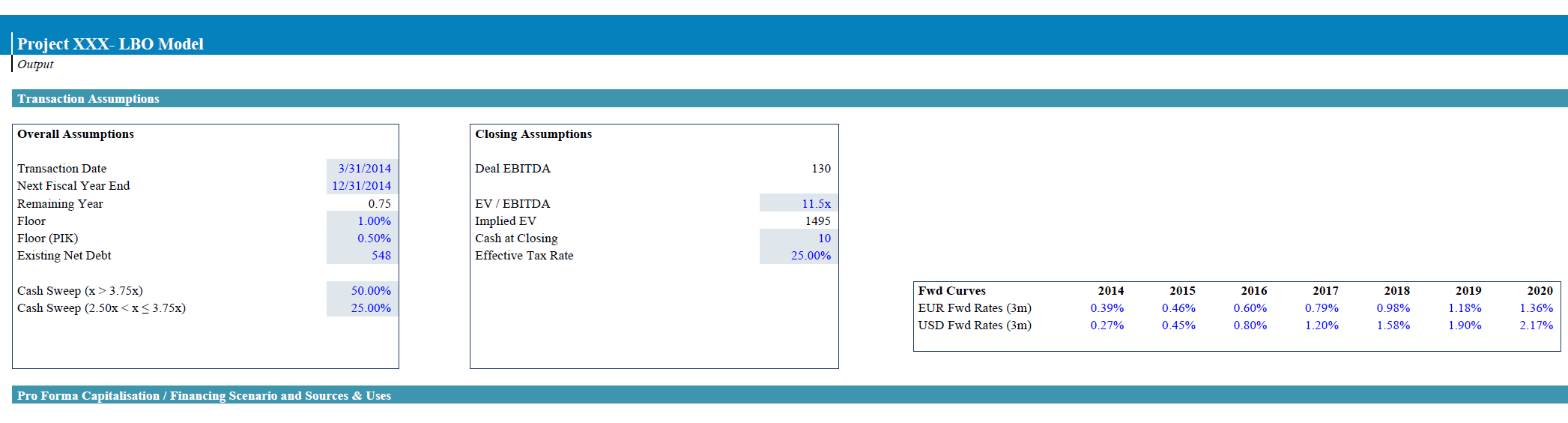

6) Project XXX: LBO Model - Output (Transaction Assumptions, Closing Assumptions, FWD Curves)

6) Project XXX: LBO Model - Output (Transaction Assumptions, Closing Assumptions, FWD Curves)

These look suspiciously like the Macabacus templates.....

LOL ... they do ... hmmmm 👀

Deleted

LMAO 😂 I've maybe been to that site by accident 1-2x in the past decade.

DEBUNKING MISINFORMATION

@leveragedbailout is in panic mode seeking a PE modeling interview prep bailout, he's incorrect here (Appendix A - see below). These are deal models of Companies beginning with the letter "A" in a folder of deal models filtered A-Z obviously.

LOAN BOY, NOT COPY AVERAGE CONTENT BOY

Also - friends call me "loan boy" and if you read some of my comment history you'll quickly see my policy of OC (original content) only. Differentiated content often. To answer your question: no, I'm not copying an open-source already existing model from that site.

POSSIBLE EXPLANATION

Maybe he was mistaken bc all models from a high level have the same inputs and structure and text in cells (can't just create a new name for Revenue, EBITDA, Amortization, Sources & Uses).

CHECK YOUR WORK

@leveragedbailout please check your work and double-check any claims to future posts: you risk spreading misinformation, and creating a non-value add thread to de-bunk your faulty claim. Jk, I chuckled - it added a little humor to the thread so all is good 👍. But still - dont sabotage any of my future threads! Thx

APPENDIX A

@leveragedbailout PE Modeling Interview Panic Mode Post

Subject: “Holy sht Need Help ASAP PE Associate Interview Coming Up”

Date: 2/28/2023

OP username: @leveragedbailout

URL: https://www.wallstreetoasis.com/forum/private-equity/holy-sht-need-help…

Et velit dolor omnis dolorem inventore occaecati et. Sequi quam saepe iure quas rem ratione.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...