Cost Recovery Calculation

Can someone please help explain where the 100% is coming from? Why is it 100 divided by class life, what is the logic behind this calculation?

Can someone please help explain where the 100% is coming from? Why is it 100 divided by class life, what is the logic behind this calculation?

Career Resources

Troll ? Amount * 1/27.5 = X/27.5 and 1= 100%..not sure what to explain there ?

Thank you for the explanation but still a little confused -->

You're saying Amount * 1 / 27.5 --> But that would mean 100% or 1 / 27.5 = 1 / Amount --> Why is 1 divided by amount the cost recovery percentage and here when you say amount what are you referring to?

Really grateful for any clarifications!

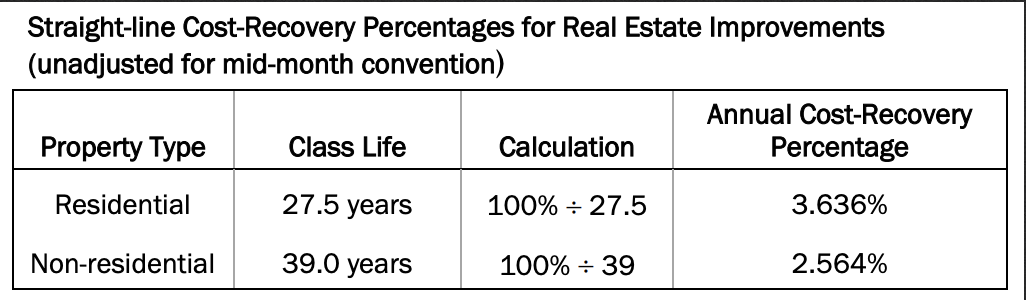

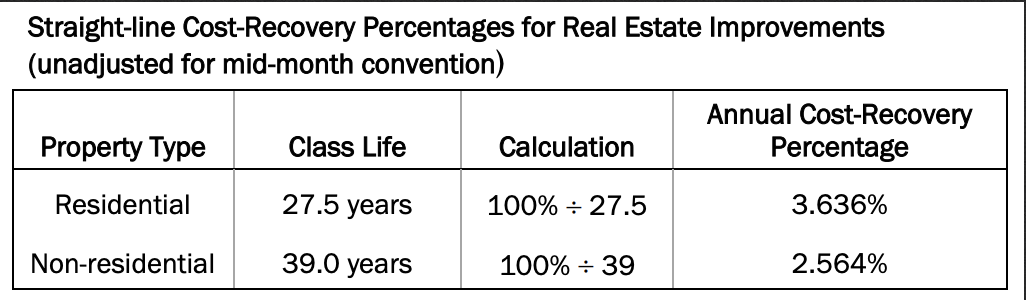

To say it another way, for residential properties you get to depreciate the cost basis of your asset in equal annual installments over 27.5 years.

So to calculate how much you can depreciate/write off on an annual basis you simply divide 1/27.5. 1/27.5 = 0.036363636363636 or 3.636%

So, you take 3.636% and multiply it by your cost basis to calculate your depreciation (aka cost recovery) for that year.

Wow this is a very clear and great response, it completely makes sense now, thank you for taking the time to explain, really appreciate it!

In understanding "cost recovery", it's defined as "return of investment in business and income-producing property, pro-rated over its class life"

How is cost of recovery a return of investment? I understand cost of recovery to be a depreciation over time. It can become an expense to reduce taxes, but I don't understand how it can be a return of investment as it doesn't produce actual cash flow or return. Would really appreciate if you would be able to explain this or give an example!

Cost recovery is simply an accounting method which allows you to not recognize gross profits for tax purposes until the full cost of the item sold is recovered. It’s not specific to real estate and applies to many other businesses. In real estate it takes the form of depreciation as calculated and discussed above. In retail goods it’s little different and takes the form of COGS (cost of goods sold)

For example if you produce a widget at a cost of $100,000 and then sell it to joe blow for 3 annual installments of $50,000, you wouldn’t need to recognize any profits until year 3 because in the first 2 years you get to directly offset the cost to produce the widget (COGS) against the 2 $50,000 installments.

In summary, cost recovery is an accounting method. In CRE it takes the form of depreciation where you can write off your basis over a defined amount of years, in manufacturing it takes the form of COGS which gets directly written off against sales revenue as it is received.

The definition you mentioned which includes the term “return of investment” is just a poor choice of words on the part of the author (if it’s real estate book) because that term has a very specific meaning in real estate.

Maiores distinctio tempore voluptatem maxime maxime quisquam amet ut. Ex aperiam explicabo perferendis sapiente nobis magni. Eos a modi soluta. Sint consectetur accusamus atque quae soluta eius quibusdam.

Consequatur qui at et. Sint itaque quam itaque autem aut. Sed dolorum officiis voluptatem corrupti.

Aperiam qui occaecati omnis qui et quaerat. Atque architecto sapiente accusantium non autem vitae enim asperiores. Ipsam voluptate velit dolorem repellat expedita.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...