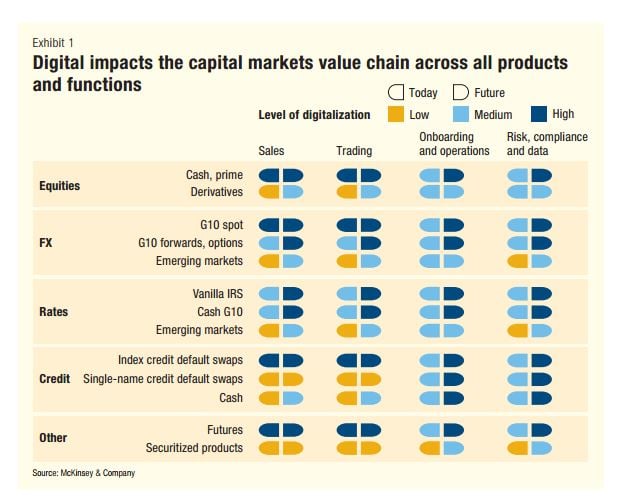

Automation Across Asset Classes — McKinsey Report

Junior undergrad, incoming S&T SA. I've been researching different desk opportunities and found an old (2014-2015) McKinsey report describing current and future automation across asset classes. Recap of report is here https://www.efinancialcareers.com/news/2015/10/ho…

I'd be interested to hear how these takes have held up over the past 6 years, and if anyone can confirm/deny some of these claims. Some, like cash equities (in Dallas), make a lot of sense.

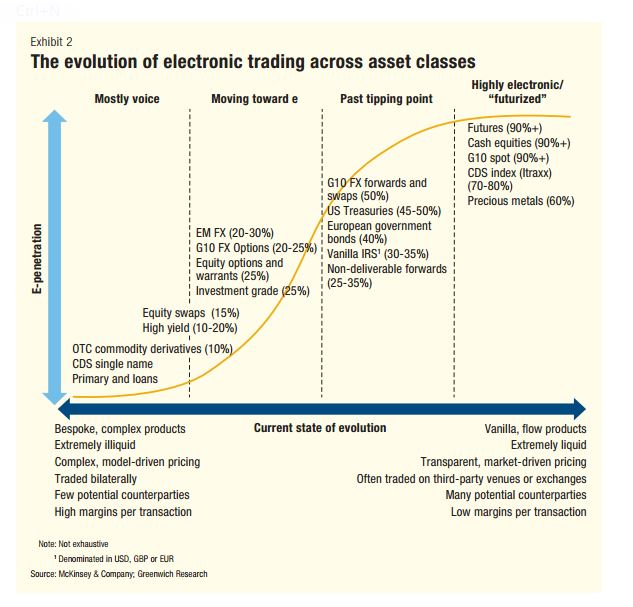

I am really interested in rates and FX derivatives, though these graphics make them seem risky. Is this true? Where would exotic rates/FX derivatives and structured products fall on this curve? All insight/comments are appreciated.

The futures space is highly digitalized, no doubt, and volume has been through the roof. What is your concern? Digitalization just means it's moved off the floor/pits and there's less voice messaging. Traders are still thriving as they have more DMA and less need to interact with FCM and brokers in general. There's still a huge marketplace for that sellside level all the same. Many CTAs and hedge funds push their orders to bank order desks to remove their execution risk.

From what I've seen, the general attitude on this site is that automation = bad, in the sense that automation causes reduced head counts, pay cuts, and lower job security for sales/traders on those desks. The example I see most often is cash equities — people are always commenting on how much the head count there has decreased since the early 2000s. I'm just repeating what I've read here, I cannot speak to any of this from personal experience.

My concern is being phased out by tech, landing a role that becomes less involved/interesting/secure as technology improves over the years. That's why I said that the above report makes rates and FX derivatives seem "risky."

What are the percentages nowadays?

Mollitia vel dolores maiores ut. Commodi excepturi ad esse harum voluptas officia. Adipisci veritatis rerum eos. Iure consectetur modi aut impedit.

Nihil alias et eligendi assumenda laborum qui. Officia non molestiae praesentium totam recusandae excepturi. Repellendus ea suscipit ducimus quas neque illum recusandae. Quibusdam eaque sed reprehenderit unde quo.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...