Family Offices List

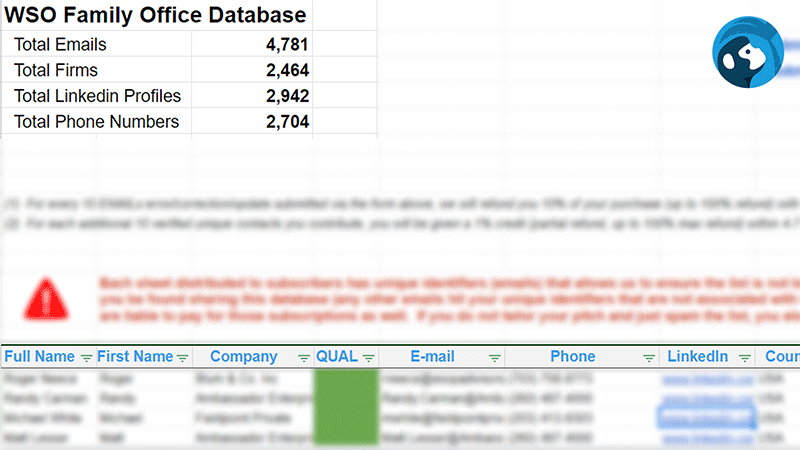

2,411 Firms / 4,635 Emails / 2,851 LinkedIn Profile URLs / 2,634 Phone Numbers and Growing Fast

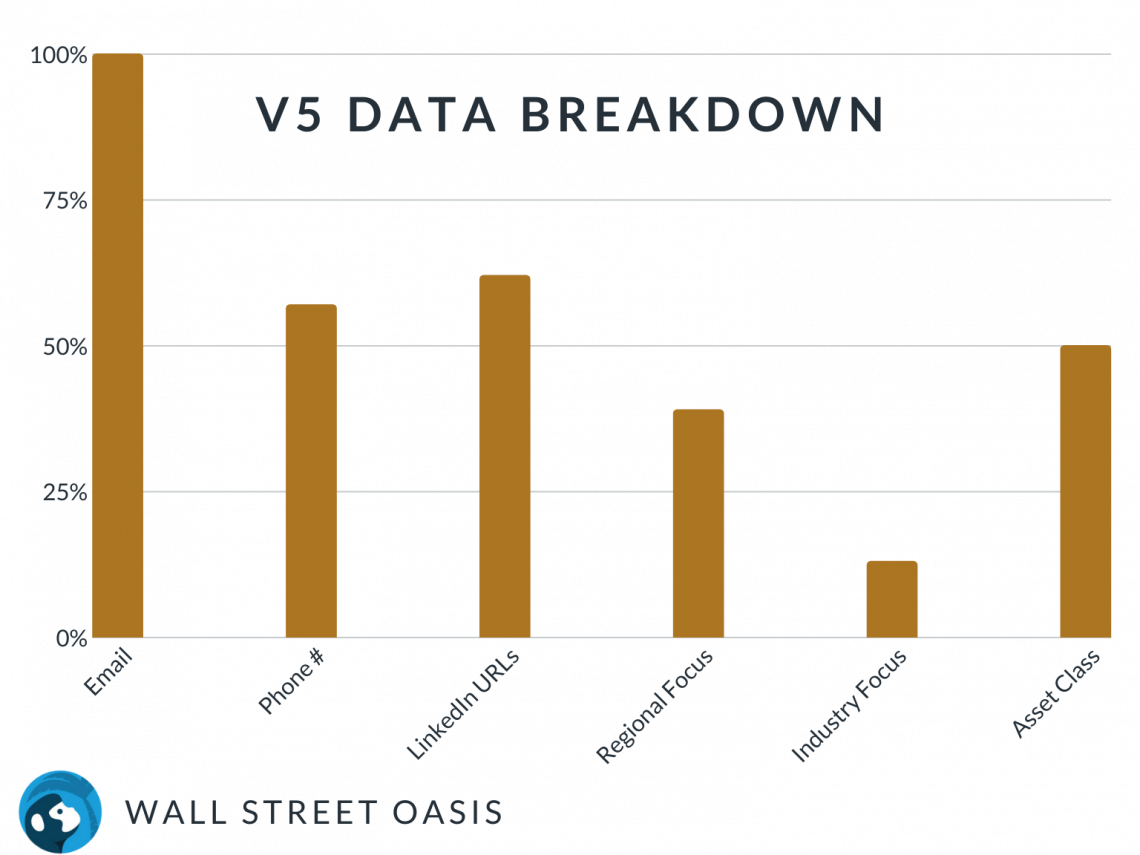

V5 Update Released - March 2020: This update adds new data to the existing contacts. This includes Regional Investing Focus, Industry Investing Focus, Asset Class Investing Focus, and any Notes we feel may be important.

With the help of the WSO community (700,000+ members and counting), we are building a massive, self-adapting crowdsourced list of family offices that won’t break the bank.

With the help of the WSO community (700,000+ members and counting), we are building a massive, self-adapting crowdsourced list of family offices that won’t break the bank.

This list includes contacts from family offices along with contacts at wealth management companies, endowments, trusts, foundations, etc. Email and location are provided for each of the contacts. LinkedIn profile URLs & phone numbers are provided for most of the contacts.

You can gain access to this database of highly valuable list of family office investors in one of two ways.

1. Purchase the list - click here. We expect the price to jump quickly as the list continues to grow. In the latest update we added 2,421 new contacts to the High Quality list resulting in an increase of nearly 50% With the scale of the WSO community, we plan to have the cleanest and most accurate list on the market. Our next update will involve adding extra data to enrich the contacts we already have. Jump on board now for the best price!

2. Share your current list. If your contacts are approved and unique to our database, then you get

- 1st year = 100% free, if you submit over 1,000 verified unique contacts

- 1st year = 50% off, if you submit over 500 verified unique contacts

- 1st year = 10% off, if you submit over 100 verified unique contacts

Family Office Database Preview Below

Family Office Database Stats

List of Family Offices - Credit Rules (List Hygiene)

Once you have access, for each 10 existing contact emails you help correct (or update) you will be given a 10% credit (partial refund - up to 100%). This partial refund policy will be valid for 60 days from the date of purchase. After 60 days, you will not be able to receive a partial refund for correcting the contacts in this list.

Additionally, for each additional 10 verified unique contacts you contribute, you will be given a 1% credit (partial refund).

WSO Family Office Directory is Now LIVE

We look forward to using the power of crowdsourcing and WSO to build the most accurate, helpful and cost-effective family office database in the world. Stay tuned for updates!

For more information, click here

- Patrick

also very interested. usually difficult to get by or pretty expensive. would be great if anyone had one.

You will likely have to pay for one unless someone has something they are willing to post.

I remember searching for family offices a few years back during an internship I had and it was nearly point less. Most of the places don't want/need to be well known so their contact information is not plastered all over the internet. Good luck.

Regards

jeez.. shows what kinda background I come from. I've never heard of Family Offices until this post. I read up on some stuff now, seems like a great thing to have when you are rich.

Don't worry. I'm convinced that making the Family Office list is something the seniors make the juniors do when they think they have nothing else to do.

It is a lot easier to use institutional money to back deals. For family offices you have to first find them, then figure out who the gatekeepr is to the wealthy individuals, then round up a lot of those individuals to get a decent amount of money together. There are usually guys who make a career of just learning the family office system (at least in Europe). From a bankers perspective they will always be a last resort, unless there are some personal connections.

Thanks for your very thoughtful comment on this. How would you compare family offices to private banks/pwm in term of ease of access to capital?

Yeah, the place I briefly interned at was going to use the list to pitch a fund or something. It is basically a list of advisors that managed a lot of money. I would imagine it would be a good cold call list for people interested in PWM or something. Either way it was the biggest pain in my ass for 2 months.

List of U.S. Family Offices/Multi-Family Offices (Originally Posted: 04/27/2014)

Has anyone been able to find a list of U.S. based family offices? I know they're not as readily accessible but I was wondering if someone had one on deck. Would save me hours of research.

They're usually semi hidden for a reason ;)

Pretty much. I've got a buddy at a >$15B family office for an international family that flies waayyyy under the radar. There's 12 people on the investment team and the fee structure is 1 and 5, do the math..

We have $1+ bil AUM and according to the internet we don't exist. Good luck.

bump

I am interested in your family office list.

bump

Dolore suscipit quo debitis perspiciatis. Id sint ut repellat animi aperiam quam ipsam. Eligendi voluptas fugiat sit aut aspernatur est. Id consequatur at expedita debitis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...