Is Facebook Use Declining in North America?

Before anyone gets their panties in a bunch, this post is meant mainly to ask the question: is Facebook still actually gaining new users? And if so, how many of those are really in North America? I've been trying to make sense of their user growth lately to hopefully find an area where the actual data given explains the empirical data I see around me... that no one who doesn't have a Facebook is just now making the move to get one, and if anything it's more long-time users leaving. More from my blog: huntingforcommoncents.wordpress.com

Facebook recently announced its Q4 earnings and gave some insight into how the company is faring in the often talked-about mobile world, the Facebook Gifts space, and other tidbits that gave us a look into the growth trajectory of the company in the next year or two. Facebook reported revenues slightly above expectations (1.58B vs 1.52B estimate) and earnings of $0.03 (or $0.17 on an adjusted basis, excluding stock-based compensation), but what people really care about is how well mobile is doing.

Reason being, mobile is the highest growing segment of Facebook users, yet only 14% of revenues had come from mobile ads last quarter. Fortunately for Facebook, this quarter they announced that mobile’s contribution to revenues increased to 23%, rightly in line with what many in the market expected. However, why is the important number the % contribution rather than the absolute number (or even the % growth) of mobile ad revenues?

Looking at it that way, mobile ad revenues just about doubled, or grew somewhere in the neighborhood of $160M to $320M, rough estimate. Anyway, it looks like Facebook has at least started to find a way to grow their mobile revenue… even though half their daily and monthly active users (DAUs and MAUs, for short) are on mobile. Put plainly, they need to eventually see that mobile revenue number in line with their user mix.

But the purpose of this writing is not to postulate on what Facebook is going to be able to do with mobile revenue in the future. What I’m interested in here is looking at how Facebook is actually representing their user base, what it means, and how that may affect the company once other people actually figure it out. So let’s do that.

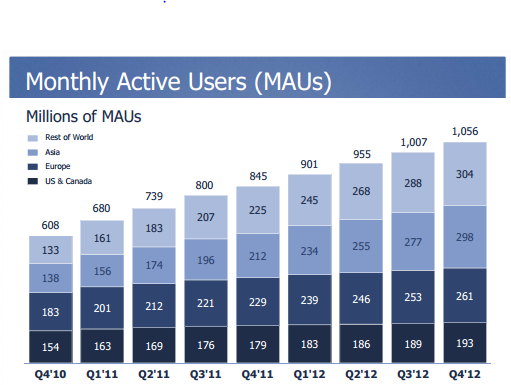

From their Q4 presentation, here’s a graph of the monthly active user (MAU) growth over time, meaning how many people log in to Facebook at least once a month.

Most of the growth here is obviously coming from the East, and if we look at the dark blue at the bottom (US & Canada), we see the growth has more or less slowed to a halt by Q3’12 and a slight uptick in Q4’12 but still pretty flat. While there’s still growth in the rest of the world, Facebook has very little growth in the areas where people are most likely to actually respond to their ads. But growth nonetheless. Or is that growth possibly not even real?

Facebook has some cute fine print at the end of its presentation that doesn’t command much attention, but should be considered by the inquisitive investor. Let us indulge.

This first slide is telling us that Facebook recognizes that many user profiles are for non-real and non-unique people, examples being Pets, fake celebrities, or simply made up people… Lennay Kakua, anyone? Facebook estimates this number of users to be about 5% of the population, and thus it’s possible MAUs are inflated by about 5%. If you believe it’s only 5% I have some oceanfront property in Kansas to sell you, but let’s humor them and say it is.

Now before I go any further, we need to take a look at a bit of Facebook’s history regarding fraud accounts. Facebook reported total MAUs for fake users to be estimated at about 5-6% on total MAUs of 845 million as of December 2011, repeating this estimate in May 2012 when it filed its s-1. By the time they disclosed again in June 2012, they estimated 8.7% to be fake on an increased total of 955 million MAUs. On an absolute basis, that means the fake accounts number had went from 42.25M to 83.1M, or a 64% to almost 100% increase. Keep in mind that if Facebook actually cut out their estimate of fake users from their reported MAU figures, the growth in fake users would be astronomically higher – in the 170% to 290% range. What’s clear from the past, no matter how you look at it, is that Facebook had previously under-reported the fake user estimates… or fake users are growing dramatically quicker than real ones.

Let’s pretend for a moment that these numbers, put face to face with the possibility of fake users outpacing real user growth, are legitimate. So our US and Canada demographic saw quarter-over-quarter MAUs increase from 189 to 193, representing a 2.1% increase. Net of Facebook’s “fake user” estimate, this would be a 2.9% decrease in real-people MAU growth in the US & Canada. In Europe, a 1.9% decrease. In Asia, only a 2.5% increase, and only 0.5% in the rest of the world. In aggregate, this would suggest a slight 0.2% decrease in MAUs coming from real users, for a company that the Street expects to grow revenues in excess of 30% a year… forever. For reference, the actual numbers for real MAU growth were about 8.6% last quarter, and 4.6% today.

The MAU decline, net of fake users, could actually be much harsher if Facebook was just playing fast and loose with its estimates. In the prior quarter, the estimate of 8.7% fake MAUs was reported higher than previous on higher growth. In the quarter just reported, the number dropped to what appears to be 7.2%. Facebook made this downward adjustment in fake and wrongly-classified, but actually increased duplicate accounts slightly. This would suggest total fake MAUs went from 87.6M to 76M, or about 14.5% less. This could be thanks to some sort of amazing effort by Facebook to “clean up the streets,” so to speak, or it could simply be a more lax estimate by Facebook, who would like to believe most users (particularly coming from the East, where most growth is anyway) are not only real people, but are mostly using their classification system correctly. Perhaps I’m too cynical but why wouldn’t a company who sets up ridiculous press conferences to announce its new stalker technology not be inclined to brag about eliminating almost 12 million fake accounts? Just saying – on an 8.7% estimate our new MAU number for fakes would be about 92M.

Given it touts over a billion MAUs in total currently, it’s not unreasonable to suspect a good portion of Facebook’s MAU growth is no longer coming from real ad-viewing people… and likely something closer to 10% of MAUs are currently fake users. Companies, brands, pets, duplicate profiles, etc. are all very common no matter where you are, and given the increasing commercialization of social media and Facebook’s history of upward revisions, that number is likely increasing faster than unique user growth. At some point this needs to translate to the realization that Facebook is done growing organically and could slowly be in decline.

Now let’s look at one other issue surrounding user geography and access methods which could be even more troubling.

The gist of this disclosure is that Facebook’s servers have limitations on identifying exactly where their website was accessed from geographically speaking, and also in identifying the authenticity of its mobile (and even desktop) user base. First, Facebook discloses that mobile devices with the Facebook app installed will frequently ping the FB servers to check for updates, even if the user doesn’t use Facebook or even have a profile anymore! Without getting too in-depth, additional research leads one to suspect that the mobile DAUs Facebook reports are also inflated significantly. Not only does that push the Street to be more upbeat about FB popularity and the future of mobile, it could result in justification for charging more to mobile advertisers.

In the bottom portion of the disclosure, Facebook mentions that “We estimate that the number of MAUs as of March 31, 2012 for the United States & Canada region was overstated as a result of the error by approximately 3% and these overstatements were offset by understatements in other regions.” Tacking on an additional 3% in MAU inflation, that would bring the number of MAUs in the US & Canada even lower, further increasing the growth of fake MAUs on a % basis if we take Facebook’s word for it and assume less-developed countries have more fake accounts (I question this, but it works to support me here). While this means there is some understatement in the numbers of other regions, those are regions where revenue per user is going to be lowest (and even lower after adjusting for these under/overstatements), so the net outcome is that Facebook use is dying in the developed world, and at a likely mid single-digit decline in real users in North America, it’s only the tip of the iceberg, and will result in lower ad revenues as time goes on. Even in the most conservative circumstances, Facebook growth is clearly overstated. Another piece worthy of note in the disclosure is that Instagram users who log in using their Facebook information (something that Instagram encourages), every picture they post will leak through to the FB servers, registering them as a DAU or MAU depending on their frequency. With all this extra counting, it’s clear that these numbers have to be much higher than the actual. And I don’t know about you, but I don’t have too many friends who are telling me they just got a Facebook – if anything, I’m seeing quite the opposite.

So that’s all from me for now. Chew on that a bit and feel free to leave a comment or two with your thoughts on the matter. Do these numbers make sense? Is Facebook still all the rage, or is it dying? And how would this end up affecting ad revenues as more and more shift goes to mobile?

This makes a lot of sense to me - if you are going to make a facebook account, you probably already have. I hate Facebook, have never used, don't trust it with my data, and have never clicked an ad...but I would be counted as an active user. Why? I use FB as an email/chat client because my girlfriend checks her facebook daily, but not her email.

Affluent markets are nearing saturation, and rest of world growth should be discounted - what advertiser cares if somebody in Somalia is signing up for a facebook account? With slowing growth, Facebook needs to monetize - fast. And I just don't see a legal way to do it.

Let's step back and view Facebook as a normal company, just for the hell of it. Let's assume that, if they focused on profitability, they could get to $3 billion in earnings within the next couple years. This is baking in the elimination of share-based comp expenses, offset by higher payroll costs. And from there, let's assume they can grow 12% a year through margin expansion, incremental user growth, better ad targeting, etc. Throw a 12x multiple on that $3 billion. You are looking at a sub-$40 billion dollar valuation, without considering the volatility of their business; their users could migrate if a better product emerged.

Of course, the above is a back of the envelope calculation based on crude, uninformed estimates. And we all know that analysts will not be valuing FB using PE ratios anytime soon. That said, I just do not see this as a $70 billion business. Unlike Ebay and Google (and eventually Amazon), I don't think there is a clear path to monetization.

I think you're exactly right about the unclear path to monetization. As users migrate off desktop and onto mobile, not only does that make utilizing advertisements as a revenue stream more difficult but it also opens the door to a better/new mobile platform stealing market share.

If I were Google I would forget about trying to beat FB at the desktop social network game and instead focus on the mobile sector.

Does she not check her text messages regularly either?

I use it more as a chat client - it's easier to type on my PC than a phone. I'd text for anything under a couple sentences.

This makes more sense to me than the first one :)

I think this all comes down to the fundamental notion that Facebook's user base is not an effective audience for advertisers, and things like growing numbers of bullshit accounts can mask the fact that FB is getting less and less popular where it counts. Once things saturate more in Asia, I guarantee Facebook finds a way to show continued user growth simply because people in Asia probably make a shit ton of fake accounts for all sorts of different purposes.

Has anyone else ever heard of these "consultancies" that will literally get hired by a company to create accounts and increase their number of Likes or Followers or something on FB or Twitter? As an advertiser I'm sure they're aware of a bit of this but don't know how quickly it will translate into less people advertising on Facebook. But definitely have a problem with the MAU and DAU metrics as some sort of leading indicator of ad revenues.

I'd be interested to hear from a couple big customers for FB in terms of advertising. Wonder how they gauge their success and justify the expenses to their CMO, CFO, etc. to continue their social media advertising programs. Can't imagine someone like Clorox gets a ton of extra money in sales that they can directly attribute to having a bunch of Likes on Facebook or something.

Facebook has been declining in OECD nations simply because its no longer innovative. I mean I stopped using it when my parents made accounts. The idea of facebook was simply to stay connected with long lost friends, but they tried to make it more than that. I mean the idea of Timeline, where people can see what you do from the day you were born is a huge turn off for many. FB is no longer about staying in touch, but its about everyone's lives being seen by their friends/family, which many just don't want. I don't find it entertaining. I never do status updates and the only wall post I do is too wish someone a happy bday every now and then. I spend about 2 mins a week on FB.

In regards to the company monetizing itself. I think Zuckerberg even mentioned he doesn't care about money. He is just passionate and wants to create a connected world. Unfortunately what Zuck doesn't understand is that you can't fund your day to day operations on passion. I mean how do you expect to pay a $1 billion for instagram and not make a single penney on it.

I see what you did there. Bill Ackman be damned.

Haha glad someone got it. Should have capitalized the "P" though.

The guy is too bold.

I think Facebook is not only declining to get new North American users, but it is also alienating North Americans to the point where they are beginning to look for alternatives. Personally, I hate the fact that I can't get rid of my Facebook (I'm a UG, so FB makes it very easy to chase tail and throw parties, haha). If given the opportunity to join a new social media site only for college students that fulfilled that purpose, I would join in a heartbeat and leave Facebook. Also, having to deal with relatives adding you contributes to awkward family reunions ("JR, why were you doing a handstand on that metal barrel?")

Then of course you have LinkedIn, great for networking and promoting your professional self, also hurting FB.

Their profit model is unproven and unsustainable. It's only a matter of time before they start seeing a decline in users. Zuck may not care about the money, but a lot of shareholders do. The moment he sold equity, $$ became more important than his dream. Sad, but true.

Great Article though...

RANT: I also hate the amount of pointless shit posted on Facebook. I swear, if I see one more god damn picture by Occupy Wall Street talking about how "Greedy Investment Bankers caused the housing bubble in some scheme to get more land" or how "Student loans should be paid by the greedy banks that got bailouts" (I shit you not, I am paraphrasing real recently seen comments) I will snap. Facebook has become a bastardized version of what it once was, and the coup de gras was the IPO...the moment where Facebook transfered from the vision of an ambitious computer "geek" to a declining social media site which will soon follow MySpace (remember that thing?). END RANT

Social media companies compete for peoples' time, which has obvious limits (there's only so much of it). People have jobs, girlfriends; they need to have sex, they need to exercise, they need to meet with friends (in person). Facebook was definitely something the world needed, but its growth is limited by the fact that there are only 24 hours in a day. I find myself turning to traditional print forms like magazines and papers when I'm trying to relax. I can only take so much screen time everyday.

There's been a push towards the "post-modern" in food production, clothing, media, travel...just about everything, and as long as the quality is there, traditional business models can still be successful. Then I think about Zynga and how it fits into all of this. I mean, the fat dude commuting to work every morning obviously had a need to play video games, but how many hours is he actually going to spend doing that before he realizes he needs to hit the gym or do something healthy. The market segment's no doubt going to stick around, but the growth potential is pathetic. It's not like the whole world's going to spend more and more hours playing Angry Birds.

Tech has infinite potential in its application to national security, medicine, manufacturing, process improvement etc. But when it comes to competing for peoples' time, I don't see much changing. Lives are getting too cluttered..

i only use instagram now

Facebook reminds me of AARP in a way. AARP is, by far, the largest senior advocate organization in the U.S., and yet their active partisan political advocacy has turned off enough people that alternative organizations have been started. Most conservatives are still a member of AARP because of its benefits, but a million people have moved to other organizations in the last decade or so. In a similar way, Facebook has been widely reported on for its overt censorhip, particularly that of conservatives. Most of us still use Facebook because of its quality and benefits, but it's one thing that is probably slowing Facebook's growth in North America--it's actively turning off tens of millions of potential users, many who are starting to shut it off.

Like Michael Jordan said when he was asked why he's not more overtly political, "Republicans buy shoes, too." Facebook clearly missed this brilliant piece of insight. If you're a medium of free speech, censorship of ideological foes is the quickest way to have people shut down, so to speak.

They do this? I am surprised they haven't attracted the ire of a free speech advocacy group.

To me, having a Facebook account is a potentially massive liability. For instance, some employers are apparently requiring you to log in to you Facebook account during the interview process.

Even if you avoid those employers, there is always the chance that a change to the Facebook website could bring some damaging information to light. For instance, the introduction of Timeline brought up a lot of old (potentially unflattering) material for some people. Facebook isn't alone here - Google bungled the launch of Buzz in the same way. If it is publicly viewable for any meaningful length of time, it gets indexed and archived by a search engine.

It might sound paranoid, but I don't trust a company with my data when that company absolutely must monetize that data to maintain its share price. Google has a ton of data about me too, but they do not need to monetize it the same way FB does.

I probably care more about privacy than most, but I am sure other people have similar concerns. If people are concerned with what they put on Facebook, that equals less data, and more importantly less useful data, for Facebook.

http://news.cnet.com/8301-1023_3-57567745-93/study-facebook-fatigue-its…

I kinda think so, maybe in the people i know they get tired of the same thing. I've always wondered when will people get tired of facebook?

I agree with N.R.G's quote. I was going to put a personal story in which many of my friends in the mid 20's to 30's demographic no longer use FB or have dropped out entirely. I mentor juniors and seniors from college who want to get into our industry and they told me they use FB for limited purposes because of the ramifications it can have on getting a job. Most importantly, many high school students stay away from FB because they use twitter or tumblr. Those high school students are going to be the target market for FB in 5-10 years and if they are not using it now what's going to convince them to use in when they are in college or graduated and all FB has are advertisements and pictures of people's cats!

And FB going international, most developed countries have similar (arbitrage website industries) that basically copycat the idea (Russia and China already have knockoff sites).

So all we will be left with as someone mentioned earlier are fake webpages, advertisements in the newsfeeds and the only ones left on FB will be people like this (which isn't too bad considering she adores people in the financial industry and only dates bankers) : marinagirlsays on facebook

Ipsa maiores fugit et omnis sit impedit. Omnis ducimus at beatae quaerat veritatis optio deserunt. Adipisci a deleniti quos corrupti dolore magnam. Voluptatibus voluptatem consequatur voluptatum et. Deleniti sint laborum molestias consequatur iusto.

Culpa rerum sit corporis aliquid. Unde voluptatem excepturi harum vel. Vel omnis ipsam praesentium sit est reprehenderit nostrum. Et aliquid dolor voluptate distinctio voluptas nemo. Rerum unde possimus consequatur quo quidem minima.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...