Profit Model

A company's plan to make its business goals profitable and achievable

What Is A Profit Model?

A profit model is a company's plan to make its business goals profitable and achievable. This model shows how the company plans to produce or supply, how it will capture sales, and all the expenses required to bid in the marketplace.

The core concept of this model is a value proposition. So what is the value proposition?

As part of a company's market strategy, a value proposition is an introduction from 3 aspects, the company's position, operations, and project value, about a company's brand.

Generally, a value proposition summarizes reasons for customers to buy a product or service. A good value proposition is convincing. The statement can add value to the product or service and let customers believe it is better than similar products.

After understanding the core of profit modeling, we now focus on its general types. For example, a company makes various profit models based on the activity type, display, and charging method.

What does a Profit Model Include?

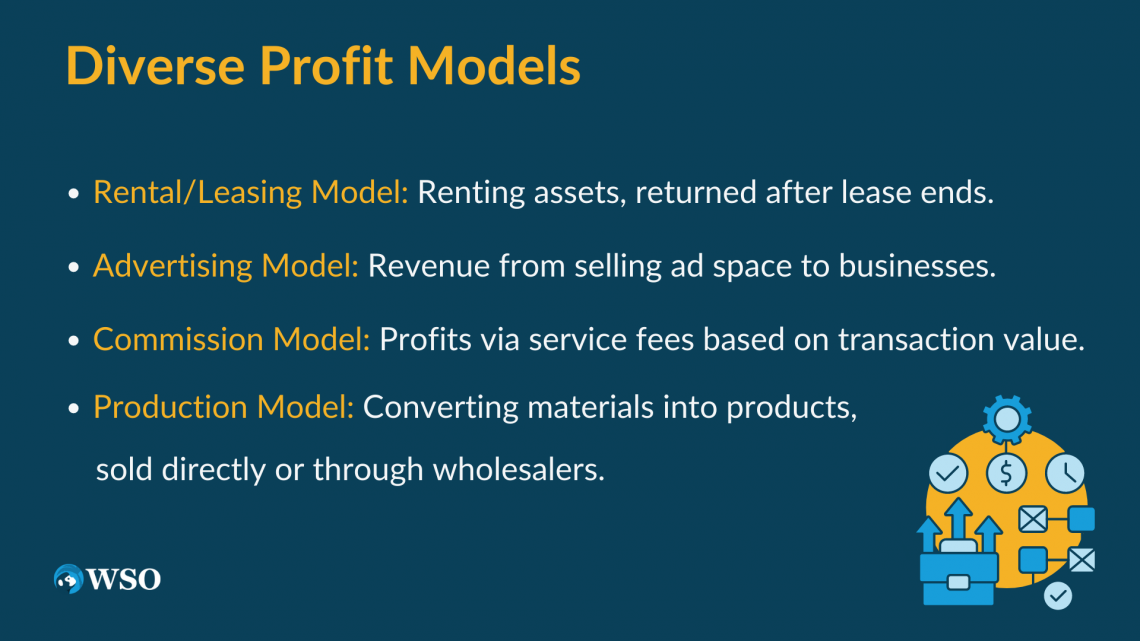

The different profit models include:

1. Production model

The production model describes the process by which a company buys raw materials to produce valuable products, then sells products to customers through various methods.

For example, a phone manufacturer sells its newest product to customers directly, or wholesalers resell products to customers.

2. Rental/leasing model

The rental/leasing model is about renting and leasing things, including houses, vehicles, furniture, etc. After the lease or rental contract ends, the property returns to the landlord.

3. Advertising model

The advertising model is mainly used by companies that rely on advertisements to generate revenue and provide information to the public.

This model involves selling advertising space businesses can use to promote their services or products.

4. Commission model

The commission model generates profit by charging service fees from other companies. The intermediary usually charges a commission depending on the value of the transaction.

After knowing these basic profit models, we can develop strategies for future profits by focusing on sales, overhead cost, cost of goods sold, expenses, etc.

To better understand this model, it is essential to distinguish the difference between the profit model and other models like the revenue and business models.

Profit Model vs. Revenue Model

First of all, we need to have a fundamental recognition of the revenue model. Revenue is money earned from normal business operations, which often refers to a company's total earnings.

A revenue model depicts a strategy for generating sales without considering costs and liabilities.

It is a framework for generating financial revenue and defines revenue streams to pursue, what value to provide, how to price that value, and who pays for it. It is also a vital component of a company's business model.

The model is primarily used to determine what products or services will be created to generate revenue and how the products or services will be sold.

Without a clear and well-defined revenue model, in other words, without a clear revenue generation plan, new businesses are more likely to face costs that cannot be offset.

By having a transparent revenue model, companies can focus on their target audience, fund product or service development programs, create marketing plans, open lines of credit and raise capital.

While profitability models focus on generating profit, revenue models focus more on business sales and growth if they put aside the goal of earning profits to grow their business. At this time, revenue stream and expansion opportunities may be more critical.

Profit Model vs. Business Model

A business model describes the fundamentals of how an organization creates, delivers, and captures value.

It can be described through nine building blocks. Customer Segments, Value Proposition, Channels, Customer Relationships, Revenue Streams, Key Resources, Key Activities, Key Partnerships, and Cost Structure.

The business model identifies the products or services the business wants to sell, the target market, and anticipated costs. This model focuses on growth instead of profitability.

The revenue and profit models are part of the business model, meaning that the business model is broader in scope than the other two models.

While the profit model includes one aspect of the business model, the business model will also take into account other factors such as competition, market conditions, and product development.

How to Construct a Profit Model

After a detailed understanding of what a profit model is and how it differs from other models, how do we build it? Furthermore, what elements should a good model have? In the following section, we will answer these two questions in detail.

The construction of the model follows the same pattern as that of a business model. But the components differ. When drafting this model, the primary consideration is making multiple predictions based on potential changes in your revenue and costs.

This means that we need to know the source of revenue, pricing structure, market saturation or capacity constraints impact on profit, and fixed and variable costs of the business.

The best way to do this is to look at quarterly financial results. This will give us an accurate picture of how your profits are evolving.

No matter what type of model we choose, several vital components include making more accurate forecasts. These include the essential financial indicators related to profit, including:

Profit margin accounts for the costs of producing and selling goods. It conveys the relative profitability of business activity. A company’s profit is calculated at three levels on its income statement – gross profit, operating profit, and net profit.

Usually, we say that the greater the profit margin, the better; however, in some situations, a higher gross margin and a small net margin may indicate further investigation is needed. Targeting higher profit margins will result in a higher return on equity.

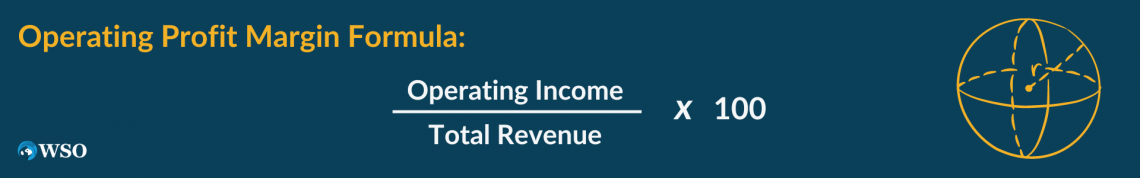

There are several ways to calculate profit margin:

a. Gross profit

Gross profit is a company's profit after subtracting all costs associated with the production and sale of its products or services. For example, gross profit can be calculated by deducting the cost of goods sold (COGS) from total sales.

Gross profit measures how effectively an organization uses labor and supplies to produce goods or provide customer services. It is essential when examining a company's profitability and financial performance.

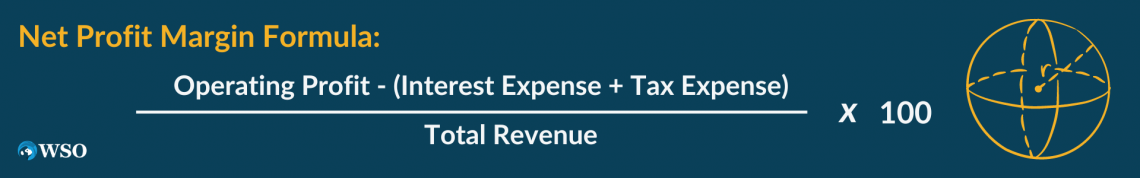

b. Net profit

Net income is the amount a company earns after deducting all operating expenses, interest, and taxes over a given period. To arrive at this value, it is necessary to know a company's gross profit. If the value of net income is negative, it is called a net loss.

Net income is another important metric for determining a company's financial health. It indicates whether a company can make more profit than it spends.

Net income can be used to decide when and how to work on expanding the business and when to reduce expenses.

c. Operating profit

Operating profit accurately indicates a company's health because it removes all extraneous factors from the calculation.

All costs necessary for the company's operation are included, so operating profit takes into account depreciation associated with assets- the accounting tools generated by the company's operations.

Operating income is called operating income and earnings before interest and taxes (EBIT). However, this is incorrect because the latter includes nonoperating income, which is not part of operating income. If a company had no nonoperating income, its operating profit would be equal to EBIT.

2. Asset turnover

The asset turnover ratio represents the value of a company’s sales or revenues relative to the value of its assets. It can be used as an indicator of the efficiency with which a company uses its assets to generate revenue.

This ratio is calculated as:

This formula shows exactly how many dollars in revenue are generated. The higher the asset turnover ratio, the more efficient a company is at generating from its assets.

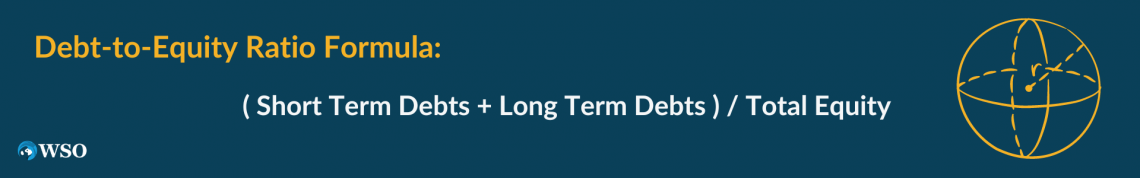

3. Leverage

Leverage results in using borrowed capital as a source of financing for investment to expand a company's asset base and generate a return on risk capital.

Leverage is an investment strategy that uses borrowed capital, specifically various financial instruments or money, to increase the potential return on investment.

It can be calculated using the following equation:

To know how profitable you are, you need to see the amount of debt you use to run your business compared to your net worth (assets minus liabilities).

4. Return on equity

Return on equity (ROE) is an index that provides investors with an idea of how effectively a company manages the money given to it by shareholders.

In other words, return on equity measures a company's profitability relative to its equity. The higher the return on equity, the more efficient the company's management is at generating revenue and growth from equity financing.

We can calculate using:

This formula is beneficial when comparing companies in the same industry, as it tends to show precisely which companies are more financially efficient and allows for evaluating almost any company with primarily tangible rather than intangible assets.

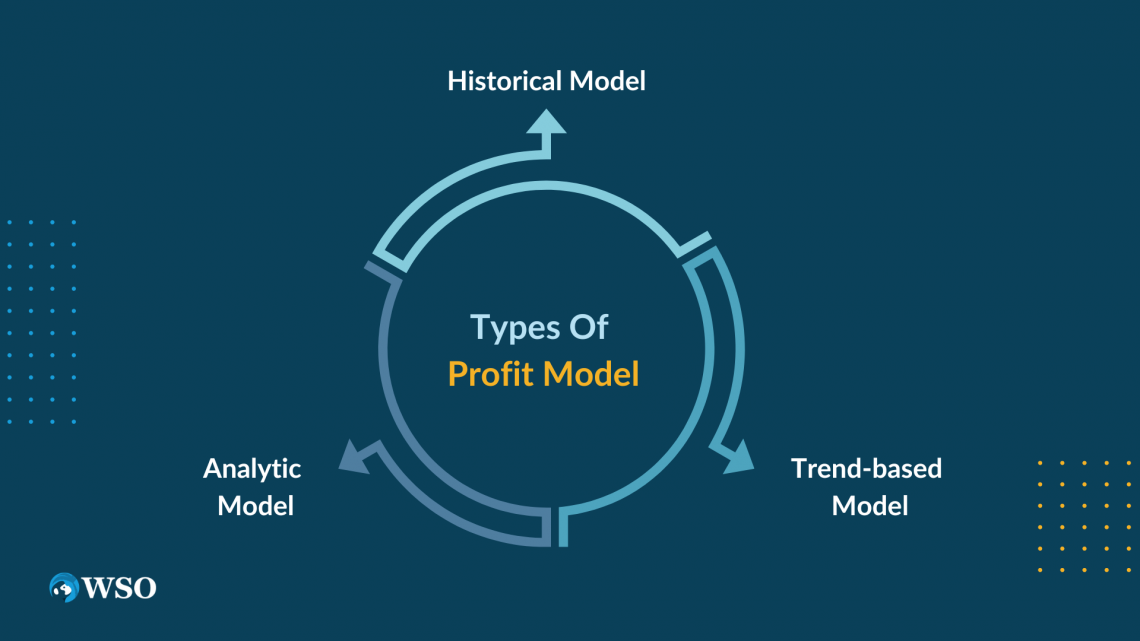

Types of Profit Model

There can be a considerable time lag between the launch of a product and its profitability, which must be considered in any accurate model. As a result, some profitability models are better suited to short-term forecasts, while others are better suited to long-term situations.

Most businesses will want to look into one of the following three methods for predicting profitability, which is helpful in forecasting.

1. Historical Model

The historical profitability model is more suitable for companies with a track record of steady growth and profits.

Historical modeling involves examining past annual growth rates to predict the company's future profitability. To obtain accurate results, it is necessary to consider possible future expenses that do not contribute to past data.

2. Analytic Model

In a fast-moving market, analytical models are better suited for forecasting because you cannot access specific trends and historical data.

3. Trends-based Model

Trend-based models best suit situations where trends can be observed and predicted.

Market trends, such as new demand or changing customer opinions, can affect your future profitability. Therefore, taking trends into account can lead to more accurate profit forecasts.

For example, if trends indicate that more competitors may take away some of your market shares, you will need to adjust your forecasts.

Profit Model in forecasting

First, let’s talk about financial forecasting. Financial forecasting is the process of estimating or predicting the future performance of a business. The most common type of economic forecast is the income statement.

However, all three financial statements can be forecasted in a complete economic model. In this part, we will discuss how the profit model can be used in forecasting.

A good profitability model can help you make financial forecasts and adapt to changing business conditions.

For example, if you want to hire team members or increase production costs, having a solid profitability model allows you to account for these variables and forecast your profits.

It may take 2 or 3 years for a company to become profitable. Therefore, modifying the model based on lessons learned from past profits may also be necessary.

To choose the most suitable model, you need to consider your current and future business, your financial data for the past few years, and your position in the market. Choosing a tailored solution will ensure that you can take the necessary steps to achieve greater profitability.

By considering costs and liabilities and examining different profitability models, you will better understand the steps you need to take to achieve your business goals.

Profit Model FAQs

- B2C - Business to consumer.

- B2B - Business to business.

- C2B - Consumer to business.

- C2C - Consumer to consumer.

It is essentially about how a firm earns money and is sometimes referred to as business model innovation. It finds a new way to convert the company’s product and other sources of value into cash.

An instrument is used to assess a company's profitability; return on equity is calculated by multiplying the net profit margin by the asset turnover ratio to obtain the return on assets and then multiplying by the leverage.

Generally, companies should aim for a profit margin between 10% and 20%, keeping the average for their industry. Most industries consider 0% average, while 20% is high or above average.

Researched and authored by Zezhao Fang | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?