FP&A Role

Plays a crucial role in supporting an organization's financial strategy and is a subset of business planning and analysis.

What Is Financial Planning And Analysis (FP&A)?

Financial planning and analysis (FP&A) plays a crucial role in supporting an organization's financial strategy. It is a subset of business planning and analysis.

It was routinely done to support a company's financial stability and its chosen commercial initiatives.

It involves forecasting, budgeting, and analysis, and FP&A analysts are typically charged with giving senior management data on the same for them to make decisions that are business-focused about:

- Operations: It provides a roadmap for getting your business to the strategic planning goals.

- Finances: It provides the CFO with a projection of the company's profit and loss (income statement).

- Strategy: It's the determination of your goals and vision for your business.

FP&A in a contemporary company involves more than just reporting and forecasting. It lets a company analyze financial and operational data to maximize its future performance.

Corporations use these data-driven insights to inform strategic decisions to connect the various departments and divisions. As a result, FP&A contributes significantly to formulating operational and strategic decisions.

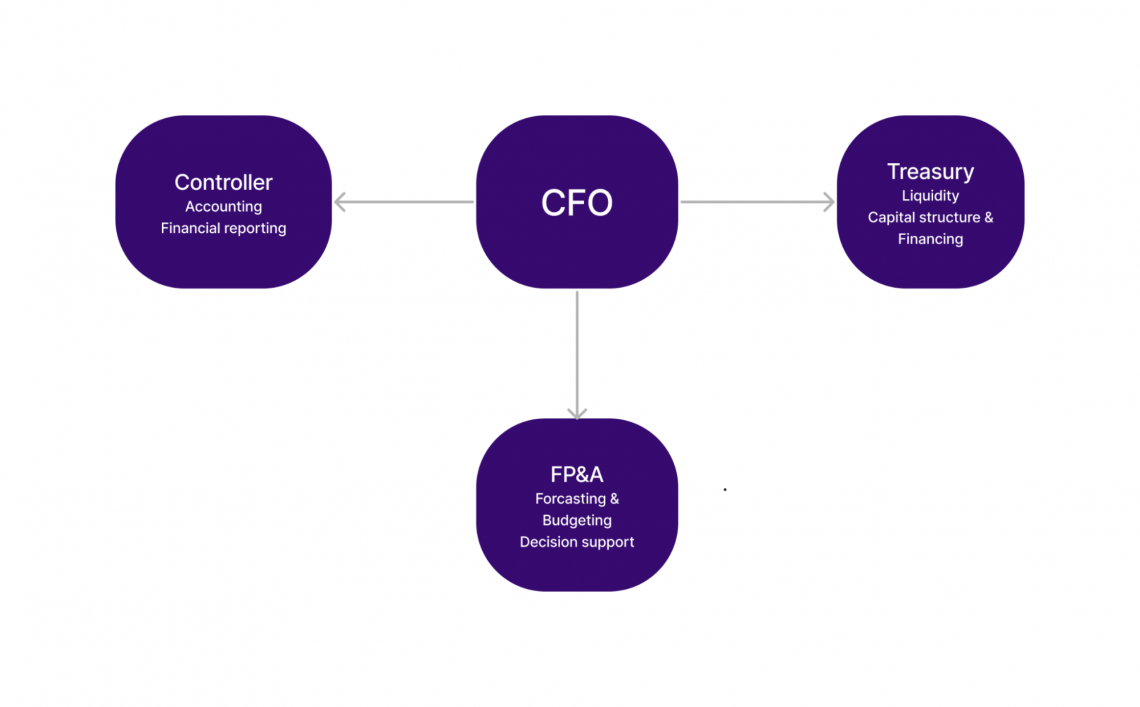

But who are the Controller and the Treasury Department? Let's take a look below:

- Controller: The Controller's duties are accounting and financial reporting. The Controller is responsible for producing the three primary financial statements and ensuring they adhere to GAAP and other legal criteria. Then, report it to the CFO.

- Treasury: The Treasury Department is in charge of managing the company's liquidity as well as its debt (amortizations) and equity. Managing the company's liquidity and financial investments, maximizing its capital structure, and monitoring its debt and equity are essential jobs.

Key takeaways

- Financial Planning and Analysis (FP&A) plays an important role by performing forecasting, budgeting, and analysis to support decision-making in a business.

- FP&A teams, led by the CFO, consist of analysts, managers, and directors with roles ranging from data analysis to strategic planning.

- The team focuses on forecasting, profit analysis, budgeting, and aiding decision-making by providing valuable financial insights.

- Cloud services, AI, and embedded tools are transforming FP&A, improving accuracy, collaboration, and efficiency in financial planning.

- FP&A offers a rewarding career for those who enjoy mathematics, data analysis, and financial modeling, with salaries varying based on experience.

FP&A Team Structure And Functions

Role of Financial Planning and Analysis (FP&A)

Companies require financial planning and analysis regardless of the state of the economy. Therefore, FP&A is critical for planning strategic goals during times of growth.

The analysis assists in determining what course controls and adjustments will keep the company on the path and in optimal fiscal health during leaner or more turbulent times.

As this position evolves, industry leaders will be able to address the modern demands they face through technological proficiency, effective communication, and the ability to tell the story behind the numbers.

The financial closing process combines budgeting, forecasting, reporting, and analytics to predict which investments, resource allocations, and other decisions will best achieve a company's goals.

The importance of financial planning and analysis has been recognized for a long time; recent advancements in cloud software have enabled finance and accounting teams to provide precise information and in-depth analysis to align business goals and plans across an organization.

Financial planning and analysis teams make recommendations that directly impact their companies' success because they are tasked with consolidating, forecasting, analyzing, and reporting on data to support decisions that drive the best business results.

Note

FP&A experts must incorporate best practices not only in their core tasks but also in revealing and communicating actionable insights to their companies' key decision-makers.

Core responsibilities of FP&A teams

In recent years, their role has changed. For example, FP&A analysts used to focus on recording and reporting financial results and using historical financial data to forecast future sales and earnings.

However, the flood of data available today and the technology that enables analysts to use it allowed them to shift from more activated tasks to value predictions and analytics that strongly affect the business's direction.

1. Forecasting and Planning

In financial planning and forecasting, analysts use data from the past to create estimates of future performance and trends, which helps to make decisions about managing the business and whether it is on track.

Forecasting financial outcomes involves projecting sales, cash flow, and other factors.

It is frequently applied to forecast future income, outlays, and investment costs. In addition, financial forecasting models are frequently compared to the actual budget to evaluate past performance. Here are four examples of financial forecasting models:

A) Anticipate planning

This forecasting model is the simplest one that is available. It uses past data to predict future events, guiding the forecasting of revenue for the next three years.

Predictive analytics helps speed up the planning process by providing enhanced planning tools integrated into a single solution and augmented with artificial intelligence and machine learning.

B) Driver-based planning

This model is a management strategy that identifies the major business drivers of an organization and develops several business plans that statistically predict how various variables might impact the factors most crucial to the firm's performance.

They aid in developing business savvy, teamwork, and comprehension of how those drives result in results and outcomes that can be put into practice.

C) Scenario planning and analysis

This is a planning method that businesses are increasingly using today. Analysts jump to conclusions about what might happen in the future during multi-scenario planning.

Analysts anticipate the consequences of various scenarios and formulate strategies tailored to each situation. Finally, these concepts and financial forecasts are used to develop the financial and operational plans required to meet the company's overall strategic goals.

Note

The strategic plan, developed by top management with input from FPA, includes high-level targets for both short and long-term revenue and net income.

D) Departmental collaboration

All different kinds of planning require cross-departmental collaboration. It ensures that plans consider all data, variables, and expertise, and it helps increase accuracy and engagement.

Collaboration gives plans more credibility and aids in the formation of consensus. This is where xP&A links and coordinates projects across departments so the company can eliminate silos and operate as a well-oiled machine.

2. Profit and Loss

This team is responsible for compiling financial statements, such as profit and loss statements and management reports, as well as statements of cash flow.

These statements require collecting data from different departments and then verifying and consolidating that information. The financial planning and analysis team uses specific indicators to calculate key financial figures, like debt-to-equity and current ratios.

3. Profit Merging

Profit margins are critical to financial analysts as they help identify which products or services generate the most money for the company.

The Financial planning and analysis team is responsible for assessing the cost and revenue generated by each department within the company and finding new investment opportunities.

4. Budgeting

Financial planning and analysis's more forward-thinking responsibilities include budgeting and forecasting the company's future financial performance. Budgeting entails analyzing financial reports to allocate funds effectively.

Forecasting necessitates the development of financial models that consider trends within the company, the broader industry, and the economy that may affect revenue and profit.

Planning and forecasting are no longer just annual or quarterly events; more businesses are shifting to continuous planning and rolling forecasts, regularly evaluating the most recent numbers for making adjustments.

5. Assistance in making decisions

Financial planning and analysis reports forecasts and variances and uses that data as a characteristic of this method to improve performance, minimize risk, or capture new possibilities from both within and outside the company.

To that end, the FP&A team is typically tasked with producing a monthly "CFO" or "Senior Management" book that includes,

historical financial analysis, explanations for variations, an updated forecast with risks and opportunities compared to the current plan, and Key Performance Indicators (KPIs).

At its best, the report provides enough information to the CFO to clarify questions from various stakeholders. For instance, it may compare strategic measures that can be implemented to maximize performance or achieve specific goals.

What Tools Does FP&A Need?

Data collection is the most difficult challenge that FP&A teams face. Because many FP&A teams do not have access to source systems, they spend most of their time collecting and processing data.

They are still drowning in a flood of Excel spreadsheets, which are prone to errors, take a long time to analyze information, and limit collaboration.

Furthermore, many senior executives who should be drawing strategic points from financial planning and analysis insights do not trust the data or analysis enough to let it help guide their decision-making.

So automation, artificial intelligence, and the cloud are changing the game by improving the accuracy of plans, budgets, and forecasts and the power of financial analytics.

Planning, budgeting, forecasting, and performance management are some functions that have been the focus of financial planning and analysis.

The difficulties of the previous two years have demonstrated how crucial it is to make use of the opportunities presented by digital transformation as well as cross-functional planning and analysis for more effective collaboration outside of the conventional remit of Finance that includes:

1. Cloud

The FP&A market is moving more quickly away from established on-premises services and toward cloud alternatives.

Compared to the preceding generation of on-premises offerings, new solutions developed or extensively re-architected as cloud services are often simpler to use and maintain. As a result, the vast majority of new FP&A sales use the cloud as such:

2. AI and machine learning

Creation, implementation, and promotion of better methods for using AI/ML and other relevant data science approaches within Finance.

Advanced statistical tools can reveal business drivers and patterns used to create forecasts (FP&A). It discovers, promotes, and supports emerging trends and focuses on how these technologies enhance financial planning and analysis (FP&A).

Note

The Committee holds its regular meetings online to ensure a broad audience.

3. Embedded tools

It is an automated scheduling tool within a calendar and mobile display across phones, tablets, and virtual boardrooms.

By leveraging tools for consultation and feedback, built-in collaboration and planning orchestration can promote involvement, accuracy, and efficiency in the planning process and FP&A organization.

Through improved technologies and more effective procedures that enable better cross-departmental data management, the Office of Finance will enhance its collaboration with the rest of the company.

Automation is the crucial first step on the vital corporate journey to contemporary, sustainable FP&A procedures. As a result, organizations of all sizes and industries are adopting cloud technology at even more significant rates, enhancing collaboration, agility, and efficiency.

Note

Companies that adopt these trends will develop to support long-term business performance and financial health better.

Potential income and salary for FP&A professionals

The variation in earnings is largely influenced by experience. For example, a Senior FP&A Manager typically receives a considerably higher salary compared to an FP&A Analyst.

Let's take a look at the table below for the potential salary for the FP&A Professionals:

| Position | Average Salary |

|---|---|

| Global Overall Average | $76,767 |

| Lower End FP&A Manager | $30,071 |

| Mid-Level FP&A Manager | $64,800 |

| Senior FP&A Manager | $135,429 |

FP&A exit opportunities

Below, we'll discuss some exit opportunities for the FP&A:

-

Craft Clear Goals: Define specific roles you aspire to within your company, be it a senior FP&A position, Director of Finance, or CFO. A clear target helps you focus and monitor progress.

-

Actively Enhance Your Skills: Continuously improve by seeking training in finance, data analysis, or leadership. Attend workshops, conferences, or online courses to become more valuable to your organization.

-

Embrace Fresh Challenges: Volunteer for projects showcasing your abilities, demonstrating initiative, and broadening your understanding of different business departments.

-

Build Internal Networks: Cultivate relationships with colleagues across departments and levels. Networking enhances visibility, exposes you to opportunities, and helps construct a robust support system.

-

Solicit Feedback and Seek Mentorship: Regularly ask for feedback to identify areas for improvement. Consider finding a mentor for guidance and valuable insights into the company's culture and expectations.

-

Showcase Achievements: Keep a record of accomplishments and share them during performance reviews, reinforcing your value to the company and keeping your aspirations on their radar.

-

Proactively Pursue Promotions: Initiate conversations with your manager or HR about potential promotions or available positions, expressing your interest and showcasing your preparedness.

-

Stay Informed About Company Goals: Understand your organization's strategic direction and priorities, aligning your efforts with objectives to position yourself as a valuable asset to the team.

Researched and authored by Ranad Rashwan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?