Oil & Gas Primer

Oil and Gas industry, also known as the energy sector, is responsible for producing energy, fuels, and chemicals that are very important to the functioning of world economics

What is the Oil & Gas Industry?

Being one of the world's largest and most important sectors, the Oil and Gas industry, also known as the energy sector, is responsible for producing energy, fuels, and chemicals that are very important to the functioning of world economics.

It is a multinational powerhouse that generates billions of dollars globally each year, involving hundreds of thousands of workers.

Countries that house the major corporations of this industry play a vital role in contributing a significant amount towards their GDP. Not only in GDP, but they are also the major industry in the energy market and play an influential role in the global economy as the world’s primary fuel source.

This industry is very complex, and several aspects need to be better understood by the public in general. Here, we will discuss and provide an overview of this industry and understand its key significance and aspects.

In this Oil & Gas Primer, we will try to cover all the topics involved.

Key Takeaways

- Oil and gas industry is crucial for the global economy and GDP of countries.

- The industry involves exploration, production, transportation, refining, and marketing.

- Segments include upstream, midstream, and downstream activities.

- Prices are influenced by supply, demand, geopolitics, and economic factors.

- Valuation methods include NAV, production metrics, field netback, and accounting ratios.

How does the Oil and Gas Primer industry work?

The first area to cover in the Oil & Gas Primer is how the industry operates. The Oil & Gas industry includes three processes, each regulated by different laws by the local nation or any other international body.

Being aware of these processes involved will aid in understanding the industry. These are:

1. Exploration and Production (E&P)

The first method involved in the Oil and Gas Industry. This step encompasses the process and methods involved in finding potential oil and gas drilling sites for extraction. Different E&P companies use different techniques and equipment for this process.

Once the companies discover the deposits from their potential sites, the oil and gas are extracted by drilling the exploration wells and transported to the processing and refining facilities.

2. Transportation and Refining

Oil and gas in its refined stage and crude oil are transported in two ways:

- Tankers: These are through interregional water routes.

- Pipelines: Through which most of the oil and gas moves.

Once the oil and gas have been extracted, they are separated and transported to refineries.

3. Marketing

Involves the wholesale and retail distribution of petroleum products to businesses, industries, government, or directly to consumers. They are distributed first where the profit margins are higher than the others. This is the final stage involved.

Investors who want to invest in this industry can purchase stock market shares directly. This process is very crucial for all the personnel involved in this industry.

Components of the Oil and Gas Industry

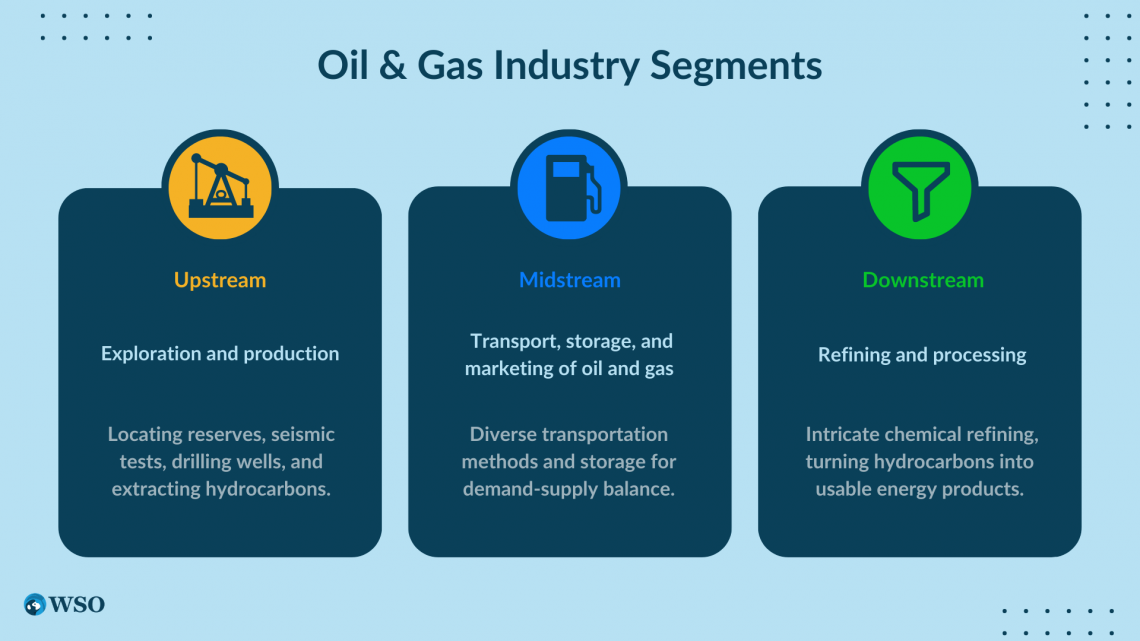

The Oil and Gas Industry is often divided into three main segments: Upstream, Midstream, and Downstream.

1. Upstream

The upstream segment of this industry often called exploration & production, is traditionally what comes to mind when we think about the oil and gas industry.

Here companies search prospective areas for potential oil and gas reserves and often perform seismic tests to determine the size and composition of the resource.

Initially, wells are often drilled to “explore” the basin we found, and if the results are satisfactory, a company will engage in the production phase to extract the hydrocarbons.

2. Midstream

Often coupled with the downstream segment, the midstream segment involves the transportation, storage, and marketing of oil and gas products. The transportation can vary depending on the commodity and distances the product has to cover.

The transportation system we discussed varies from small connected pipelines to massive cargo ships making trans-oceanic crossings.

Note

The midstream segment also includes the storage of oil and gas, which balances the fluctuations between the demand and the supply of energy products.

3. Downstream

The downstream segment is a segment that involves the refining and processing of hydrocarbons into energy products. Here, refining is required since “raw” hydrocarbons extracted from the ground are rarely useful in their natural form.

The process of refining is a very complex chemical process that helps separate hundreds of hydrocarbon molecules into their useful forms and is carried out in petrochemical plants. Hydrocarbon breakdown into chemical compounds is used to create a myriad of products.

From this, we can learn that all these three segments play an important role in the overall supply chain or the industry’s value chain.

How are Oil and Gas prices set?

Several key factors influence the prices of Oil and Gas.

Some of them include the following:

1. Supply and Demand

The supply and demand of oil and gas depend on their production and the companies or the nation involved in it. Therefore, these companies influence the prices of this industry.

Sometimes, these companies get affected by any economic condition or geo-political situation which indirectly impacts oil and gas prices.

2. Geopolitical Factors

Natural and human-made disasters can impact oil prices if they are dramatic enough. For example, natural disasters may include floods and earthquakes, which indirectly impact the prices of the products. In contrast, man-made disasters such as Russia - Ukraine War have ripple effects on the supply chain.

3. Economic Factors

The oil price heavily depends on the economy because we rely on it. Because we depend on energy products for transportation, chemicals, and manufacturing, the relationship between us and the economy we are under is a two-way street.

This implies that changes in our behavior can affect the pace of economic growth. Economic growth can push the oil demand, while a slowdown in the economy lowers the demand and prices.

For example, it contrasted with the plunge in the spring of 2020 in response to the COVID-19 pandemic. As a result, the price of this industry increased so much that it was described as an inflationary threat.

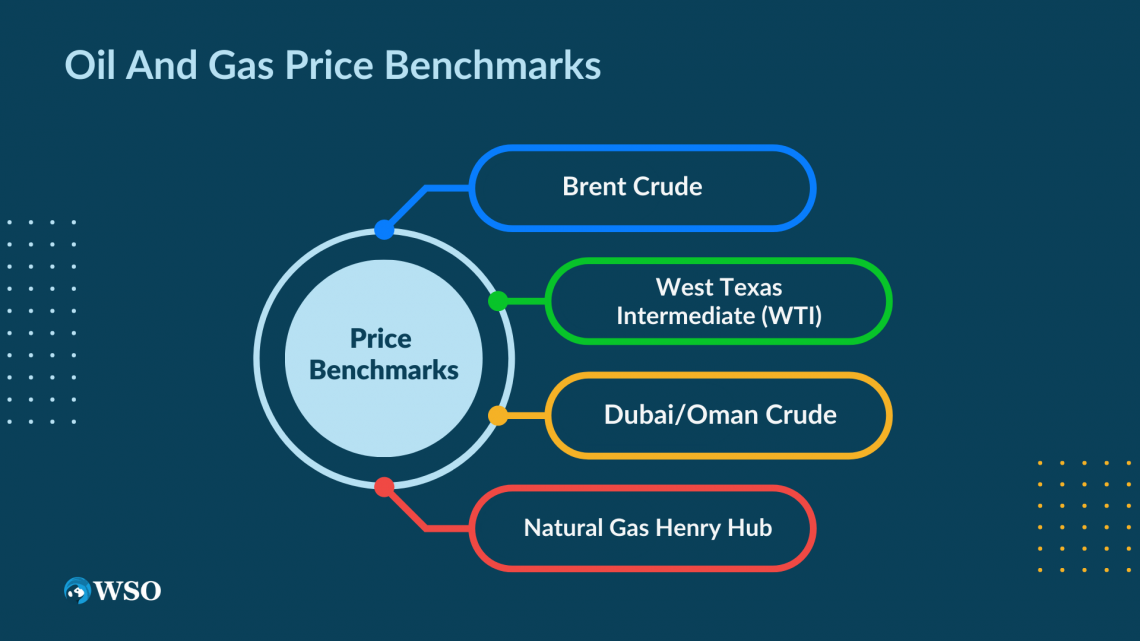

Oil and Gas Price Benchmarks

Oil and gas prices are typically measured using benchmarks. These price benchmarks are used because many different varieties and grades of crude oil are available to the market.

These benchmarks provide information about relative volatility (high API gravity is more valuable), sweetness or sourness (low sulfur is more valuable), and transportation costs. This is the price that controls the world’s oil and gas market.

Some of the most widely used price benchmarks of oil and gas include

1. Brent Crude

The Brent Crude benchmark is the most commonly used internationally for the price of crude oil. This benchmark is based in London and is traded on the Intercontinental Exchange (ICE). It is from the offshore drilling of the North Sea for light and sweet crude oil.

2. West Texas Intermediate (WTI)

The West Texas Intermediate(WTI) is a benchmark used for light and sweet crude oil in the United States drilled on the locked wells of Oklahoma.

3. Dubai/Oman Crude

The Dubai/Oman Crude benchmark is used for heavier sour crude oil with higher sulfur contents extracted from the Persian Gulf to the Asian Market.

4. Natural Gas Henry Hub

The Natural Gas Henry Hub is a benchmark for North American natural gas and global liquified natural gas (LNG) IN Louisiana. It is traded on NYMEX. It has four domestic and nine international pipelines, which heavily influence the prices of natural gas futures.

Methods used to value the Oil and Gas Producers

Oil and Gas producers are typically valued based on combinations of financial metrics and market factors. Several techniques are involved when evaluating the valuation of Upstream, Midstream, and Downstream oilfield services.

Here we will discuss some of the trading multiples and valuation methods involved:

1. Net Asset Value(NAV)

Net Asset Value, also known as discounted cash flow method (DCF), is used for evaluating the oil and gas industry. NAV is calculated so that the other users of financials, such as investors, producers, and analysts, determine the relative value of the oil and gas company.

An oil and gas producer’s probable and proven oil and gas reserves are estimated and valued based on current market prices. These reserves are considered a key asset of the company. NAV is generally the current value after-tax cash flows.

2. Enterprise value per barrel of oil equivalent per day

This is a widely used valuation method, also known as price per flowing barrel, where the value of a company is identified by comparing its per-day production. All firms report production in barrels of oil per day, boe/d.

Investors and analysts widely use this to determine the potential for future growth and success of a company. If the multiple is low, the company trades at a discount; if high, then at a premium.

3. Field netback

Field netback is a valuation method used to analyze a company's profitability and efficiency. It is based on the product's selling, production, price, and transportation. Netback is often evaluated as per barrel.

This is calculated by subtracting the operating cost from the revenues. Though this equation may depend on the companies, and there may be several different Field Netback methods, it is not a standardized equation.

Note

Calculating this metric tells an analyst how efficient the company is at producing and selling its oil and gas products.

Some of the accounting ratios used for the valuation of the oil and gas industry are:

a. Price to Earning Ratio(P/E)

The Price to Earning or the P/E ratio is an accumulating multiple that compares a company's stock/share price to its earnings per share (EPS).

It indicates to investors whether the company's share price is expensive or cheap in the current market. It also shows how much they pay for each dollar of earnings the company generates.

b. Price to Book Ratio(P/B)

A commonly used valuation metric in the oil and gas industry. The P/B ratio represents the relationship between the total value of an organization’s outstanding shares and the book value of its equity.

Note

This ratio and other valuation methods are used to understand the company's overall value.

c. Price to Cash Flow Ratio(P/CF)

This ratio is calculated by dividing the company's market capital by its operating cash flow. It is also one of the most commonly used valuation metrics.

This ratio helps investors to understand the performance of a company's financial condition.

5. Finding, Development & Acquisition (FD&A) Costs

Finding, Development & Acquisition (FD&A) Costs are a crucial component in the valuation of oil and gas producers. FD&A costs are incurred when the company purchases, researches, and develops properties to establish oil and gas reserves.

FD&A costs include potential site exploration, drilling, production, and acquisition costs. This cost plays a significant role in determining the reserve life index (RLI).

Note

Reserve Life Index (RFI) is an index that measures the length of time a resource takes to get depleted. It is calculated as the gross proven plus probable reserves of the mine divided by the average sales volume of the past three years.

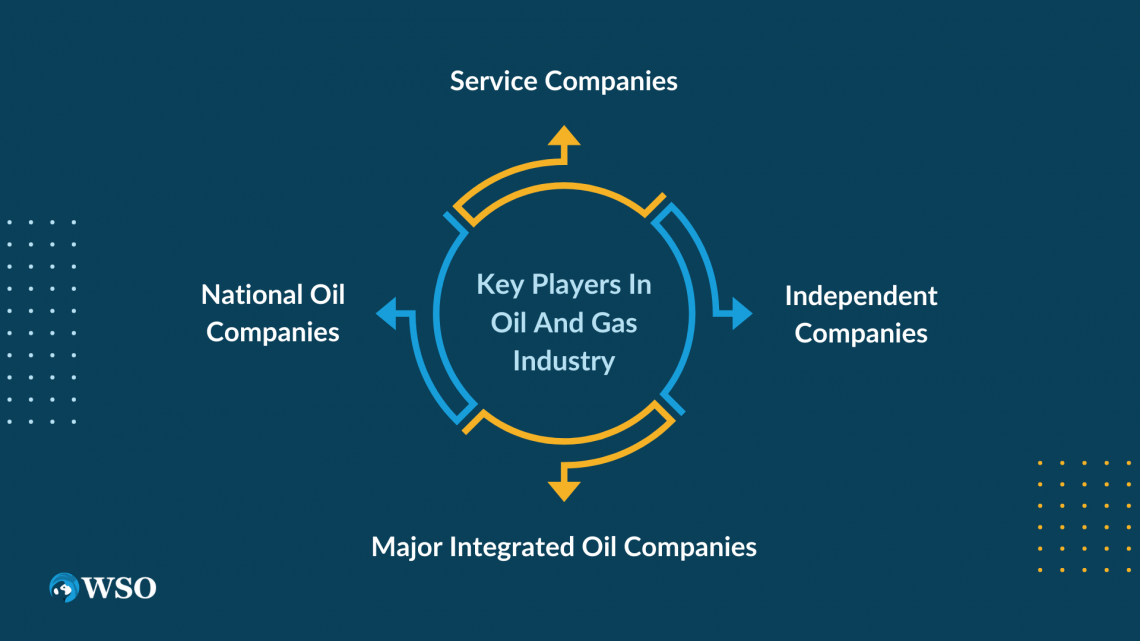

Key players in Oil and Gas Industry

Many independent key players dominate the oil and gas industry; major key players are often integrated, meaning their business consists of mixtures of activities from Upstream, Midstream, and Downstream, as explained above.

These players play an important part in global economics. Some of them are:

1. National Oil Companies

These are companies that the national government fully or majorly owns. These companies mostly look after production and distribution. For example, Gazprom, China National Petroleum Corporation(CNPC), and Saudi Aramco are some companies that fall into the category of NOCs.

2. Major Integrated Oil Companies

Major Integrated Oil Companies, also known as supermajors, are large Multinational Corporations(MNCs) involved in the entire value chain of this industry.

3. Independent Companies

Small companies engaged in a specific region or segment of this industry, such as exploration and production or drilling, etc., are called Independent Oil Companies.

These companies often partner with larger companies to develop their operations.

4. Service Companies

Oil Service Companies provide a range of services to the E&P companies, including drilling, production, and support services but do not typically produce them.

Large companies often contract these companies to provide specific services essential to the oil and gas industry.

We can conclude that many companies or different nations do not control the Oil and Gas industry. Therefore, it becomes very important for us to understand what roles the companies or the nations play to benefit from the enormous industry.

or Want to Sign up with your social account?