Typical Hierarchy of Investment Banks

This hierarchical structure is largely uniform across major global investment banks but can have minor variations depending on the bank's size, geography, and specific focus.

What Is the Typical Hierarchy of Investment Banks?

The typical hierarchy within investment banks can be categorized into several levels, which broadly outline a professional's career progression from the most junior to the most senior roles.

Investment banks have a structured hierarchy that defines roles, responsibilities, and career progression. This hierarchical structure is largely uniform across major global investment banks but can have minor variations depending on the bank's size, geography, and specific focus.

Additionally, there are support roles and divisions like Risk Management, Compliance, Human Resources, and Information Technology, among others. These divisions have their hierarchies, which may not align perfectly with the front-office hierarchy but are crucial for the bank's operations.

Key Takeaways

- Investment banks follow a structured hierarchy that defines roles, responsibilities, and career progression from junior to senior levels. This hierarchy is generally consistent across major global investment banks but may vary depending on size, location, and focus.

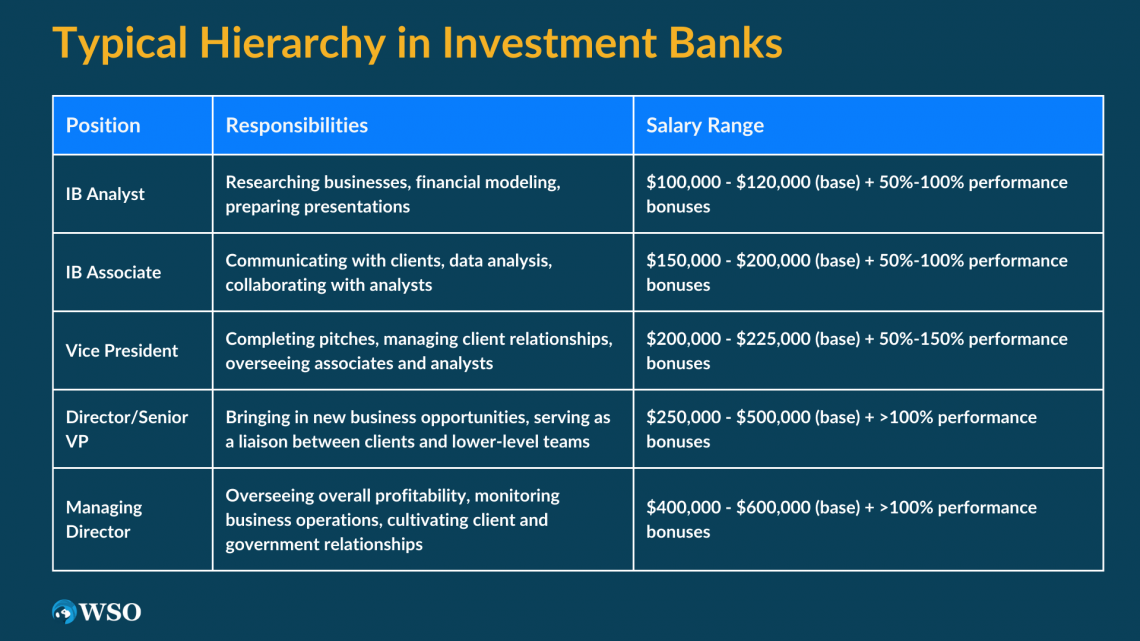

- Analysts typically start their careers by conducting research, creating financial models, and preparing presentations. Associates handle client interactions and data collection. Vice Presidents manage client relationships and deal execution. Senior Vice Presidents/Directors focus on bringing in new business opportunities. Managing Directors oversee the entire organization's profitability.

- Advancing through the hierarchy often requires gaining experience in each lower-level position, making it common for individuals to start as analysts. Investment banking positions are highly competitive and demanding, but they offer substantial financial rewards and opportunities for career growth.

Typical Hierarchy of Investment Banks

The roles and responsibilities might slightly differ based on the bank's size, specialization, and global presence. The typical hierarchy in investment banks provides a generalized overview of career progression and responsibilities in investment banks.

Even though there are more than a hundred types of different job positions within these banks, the majority of the personnel are organized in the following structure below.

IB Analyst

After graduating from top-tier business schools, almost all IB new hires start their careers as analysts.

These analysts are mainly tasked with researching businesses, developing Excel or similar software financial models, and preparing PowerPoint presentations. These tasks are essential in banks selling their ideas to clients.

The base salary for an analyst typically ranges from $100,000 to $120,000 with 50% -100% year-end performance bonuses. Most analysts follow their supervisors' daily instructions and are referred to by their superiors as "monkeys."

Excel, PowerPoint, research, and a few hours of sleep are the only occurrences in a typical 24 hours of the analyst.

IB Associate

After working as an analyst for two or three years (depending on skills growth), one will be promoted to the associate level with higher authority and responsibility. Alternatively, those who come to IB straight from prestigious MBA programs will skip the analyst route and be considered associates.

Most associates are tasked with communicating with clients, determining their needs, and offering services required to satisfy them. Associates collaborate with analysts to obtain data and models for creating proposals.

The base salary for an Associate typically ranges from $150,000 to $200,000 with 50% -100% year-end performance bonuses.

Most of an Associate's time is spent on end meetings and working on large financial figures. Therefore, analytical prowess is the most basic qualification for an associate role.

Despite the shift in emphasis, associates are still required to possess analysts' abilities. The communication between top management and the teams of analysts is mostly handled by the associates, a task that requires some leadership qualities.

Vice President

Typically, IB associates who work for three to four years and perform at the top level are advanced to the Vice President position.

The two main duties of a vice president are completing pitches and managing client relationships. In addition, they also keep track of the deals and update the deal statuses.

By default, the vice presidents are in charge of overseeing associates and analysts and making sure PowerPoint presentations and financial models are constructed free of errors.

Vice presidents earn significantly more relative to associates and analysts, mainly due to their participation in the execution of business transactions with clients.

The base salary for a vice president typically ranges from $200,000 to $225,000 with 50% -150% year-end performance bonuses.

Compared to associates and analysts, the total annual earnings gap among the vice presidents is significantly wider. These variations are mainly because every vice president is in charge of closing deals that differ in size. As a result, the greater the size of the deal is, the larger the VP commission will be.

Director/Senior Vice President

Senior vice presidents are occasionally called directors or principals, depending on the organization. They usually stay in the position for the entirety of their careers, mostly in the later stages of their lifespan.

The functions of senior vice presidents are far different than those of the junior VPs, associates, and analysts. This distinction is illustrated by the job description, as senior VPs are mostly responsible for bringing in new business opportunities.

Some of these banks have junior directors or senior vice presidents at different levels, ranging from a lower level, such as a superstar vice president, to a higher level VP acting as the assistant to the managing director. (We will discuss Managing Directors later).

To become a vice president at such a bank, you must have worked across all lower-level positions in the same industry, making it very uncommon to have a VP with no prior experience in IB. Therefore, if your dream is to become a vice president, you must ultimately start as a monkey if you haven't done so.

In addition to closely working with numerous clients, the SVP serves as a liaison between external clients and internal lower-level teams.

The base salary for a senior vice president typically ranges from $250,000 to $500,000, with more than 100% year-end performance bonuses.

Managing Director

Situated at the top of the investment bank is the managing director. They hold great influence and are in charge of the overall organization's profitability. The route requires tremendous relevant experience, unique skills, a raving leadership background, and even some luck to reach the MD level.

The managing director's responsibility is to monitor the entire business dealings and be wary of any political or economic developments that might impact the bank's operations and clients.

Most of the managing director's time is spent courting potential investors, meeting new clients, and cultivating connections with clients and government and large institutions.

The base salary for a managing director typically ranges from $400,000 to $600,000, with more than 100% year-end performance bonuses.

Major Differences Between Investment and Commercial Banks

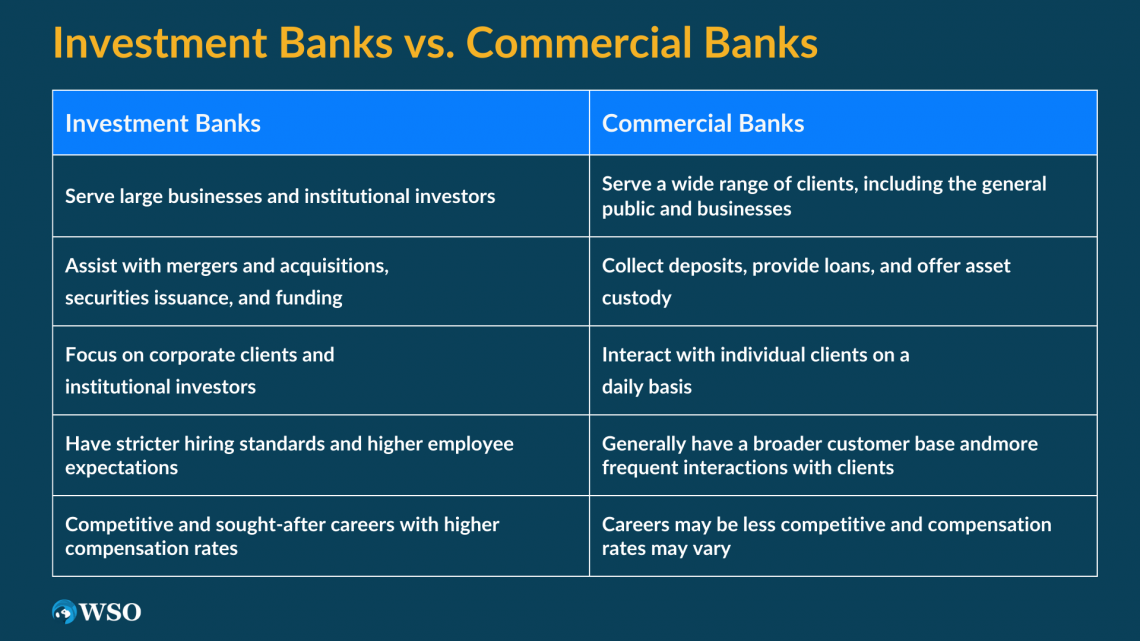

Despite being equally important financial institutions in the contemporary economy, commercial and IBs serve distinct purposes and are run by different skill sets.

Typically, when someone says "bank," they think of commercial banks, where our wealth is stored in savings or checking accounts.

Given that commercial banks are typically open to the public, they serve a wide range of clients, including the general public and businesses, and interact with each client to collect deposits, provide loans, and provide custody of their assets.

On the contrary, the clients of IBs are large businesses and institutional investors. IBs assist them with closing mergers and acquisitions deals, the issuance of securities, or even the funding of substantial business projects.

Compared to professions in commercial banking, those in investment banking are more sought-after, more competitive, and typically pay higher rates. As a result, IBs frequently have stricter hiring standards and higher employee expectations.

Typical Hierarchy of Investment Banks FAQs

Investment Banking or Corporate Finance (IBD), Sales and Trading (S&T), Equity Research (ER) or Research, and Asset Management are the four primary sections that make up the structure.

Depending on how a bank divides up its services, there are a variety of divisions.

The managing directors are at the top. They are in charge of the bank's profitability and have a great deal of influence.

Bulge bracket banks, middle-market banks, and boutique banks are the three groups into which companies working in the investment banking sector are typically divided.

In IBs, the front office, middle office, and back office are typically divided into these three categories. Depending on the responsibility of each category, the sections are separated.

They generate revenues from assisting clients in areas such as advisory, capital raising, M&A transactions, wealth management, and etcetera.

Edited by Abdul Aziz Rasheedy | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?