Form 11-K

A form that publicly traded companies must file yearly.

What Is SEC Form 11-K?

SEC Form 11-K is a form that publicly traded companies must file yearly. The form includes information about employee stock purchases and any savings plans or similar plans that own interests in any securities registered under the Securities Act of 1933, such as employee stock ownership plans (ESOPs).

11-K is a unique report that must be filed alongside Form 10-K each year. The issuer of the securities can file the form.

It is unique because of its focus on employee purchase plans of stocks issued by publicly traded companies that have filed their securities under the Securities Act of 1933.

The form records all insider or employee activity involving the buying and selling of a company's stock.

11-K is used to report employee transactions and transactions involving employee stock purchase savings or retirement plans.

This form must be filed annually, even if the issuer of the securities offered to employees according to the plan also files annual reports under Section 13(a) or 15(d) of the Exchange Act.

An 11-K is not required to be filed in case of stock option plans, restricted stock plans, or other incentive compensation plans.

Through Form 11-K, an issuer's employees are provided with financial information to assess the performance of the stock plan or the investment vehicle.

Key Takeaways

- SEC Form 11-K is an annual filing requirement for publicly traded companies, focusing on employee stock purchase plans, savings plans, or similar plans involving securities registered under the Securities Act of 1933.

- Form 11-K must be filed annually within 90 days after the end of the plan's fiscal year, except for plans subject to ERISA, which have a 180-day deadline.

- The purpose of Form 11-K is to provide accurate and timely financial information about a company's employee stock plans.

- Companies filing Form 11-K must adhere to the ERISA Format, requiring a full audit by an independent public accounting firm.

- While Form 11-K is similar to Form 10-K, it serves a unique purpose by specifically addressing employee stock plans.

Understanding SEC Form 11-K

It is used for annual reports filed under Section 15(d) of the Securities Exchange Act,1934, for an employee stock purchase plan, savings plan, or other similar plans.

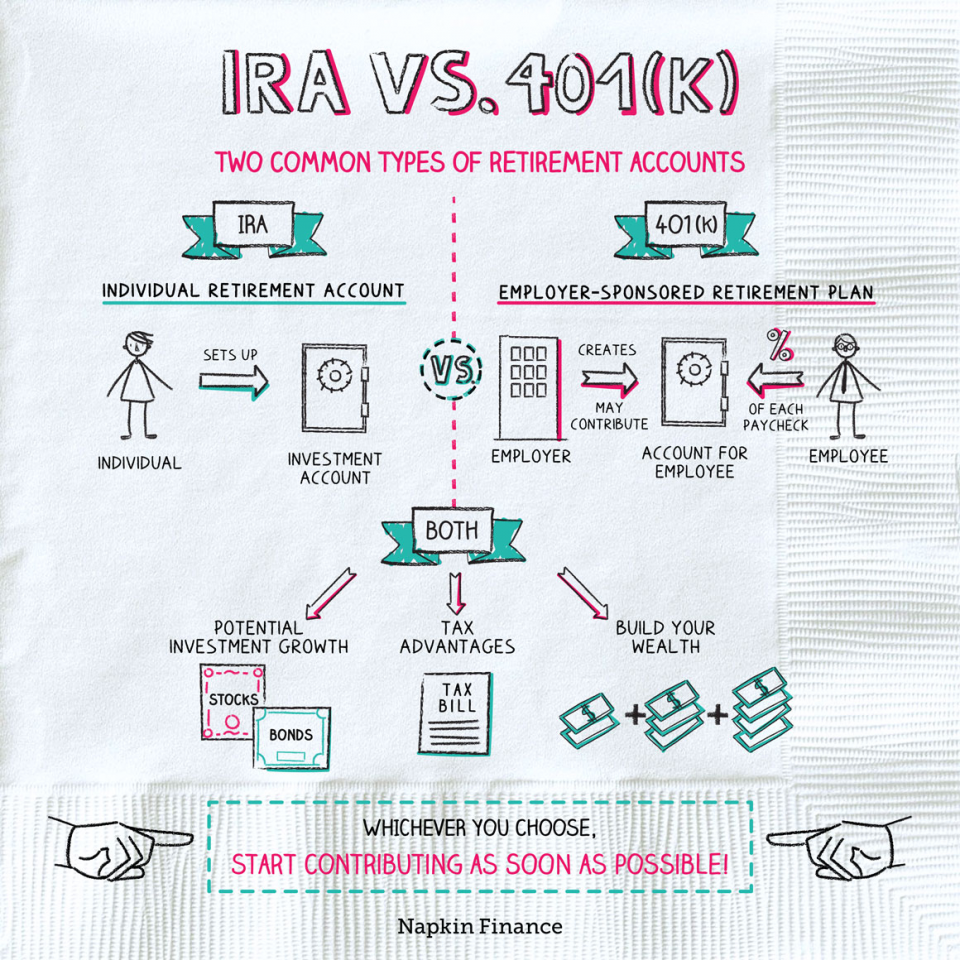

Alternatively, in the interests that constitute securities registered under the Securities Exchange Act 1934, such as the issuer's 401(k) employee savings plan with a component of the company stock fund.

It is not required to be filed for stock option plans, restricted stock plans, or other incentive compensation plans. It is required to be filed even though the issuer of the securities also files its annual reports under Section 13(a) or 15(d) of the Securities Exchange Act.

Rule 15d-21 under the Securities Exchange Act provides that an 11-K may be disclosed as a part of the issuer's annual report for the plan in some instances.

It must be filed within 90 days after the end of the fiscal year of the plan.

Except is present for plans subject to the Employee Retirement Income Security Act of 1974 (ERISA), which has a deadline of 180 days for filing after the plan's fiscal year-end.

It is also called the Annual Report of Employee Stock Purchase, Savings, and Similar Plans.

Form 11-K and Employers

An 11-K is a special form because it focuses on employees' purchase plans of stocks issued by publicly traded companies that would've filed their securities under the Securities Act of 1933.

When employers offer defined-contribution plans to their employees, such as an employer's 401(k) employee savings plan with a company stock fund component, they act as the plan's sponsor.

Employers give their employees the option to contribute their own funds to the plan, knowing that their money will be utilized to acquire securities. Companies must register all shares available through their defined-contribution plans on Form S-8 and file a Form 11-K annually.

The requirements for this annual reporting of an 11-K are detailed in the Securities and Exchange Act,1934.

The company publishes an annual report with Form 11-K and submits it to the Securities and Exchange Commission (SEC) alongside Form 10-K at the end of its fiscal financial year.

A Form 10-K summarizes a company's performance for the year. (It is more detailed than the report sent to shareholders annually.) An 11-K is not required to be filed for stock option plans, restricted stock plans, or other long-term incentive plans.

Publicly Traded Companies' role

Form 11-K is one of the many Securities and Exchanges Commission (SEC) required forms that must be filed yearly by publicly traded companies in the United States.

As a result of the Securities Exchange Act of 1934, publicly traded companies in the United States are required to disclose relevant information about their business and corporate structure to the Securities and Exchange Commission.

The information required in the SEC filings is made available to ensure:

- Investors, including the company's employees, have access to accurate and timely data regarding the company's financials, business models, and information that can be used to determine how financially and structurally sound a company is.

- The 11-K requires companies to provide audited financial statements for the past two fiscal years, audited income statements, and changes in plan equity for each of the latest three fiscal years of the plan.

- The information in the 11-K also helps potential investors predict a company's future performance and decide if they will invest in that company.

Following is the information included in the filing:

- Margin requirements

- Disclosure agreements

- Audit requirements

- Registrations

- All proxy solicitations

The Form 11-K form is similar to Form 10-K but is not the same.

Form 11-K requirements

While filing, certain requirements are deemed essential and must be considered carefully before filing the form with the Securities and Exchange Commission (SEC). These requirements are:

1. Reporting Deadline

The deadline for reporting it Must be filed within 90 days after the end of the fiscal year of the plan. This period is for plans not subject to ERISA or those that elect to file under Regulation S-X.

The exception of Plans subject to the Employee Retirement Income Security Act of 1974 (ERISA) for those who do not wish to file under Regulation S-X has a filing deadline of 180 days after the plan's fiscal year ends.

The filers can request a 15-calendar day filing extension under Section 12b-25. An agency can not sponsor or conduct, and a person is not mandated to respond to, a collection of information unless it displays a currently valid control number.

2. Financial Statements and Schedules

It is filed under Section 15d (See Article 6A of Regulation S-X) of the SEC Act of 1934.

3. ERISA Format

A full-scope audit is required; a limited-scope audit is not acceptable. If a limited-scope audit was performed in the prior year, an upgrade of the prior year audit to a full-scope audit is required. A modified cash basis of accounting is acceptable.

Form 11-K Objective and Regulatory Compliance

The primary objective of this form is to give stakeholders and any individuals considering an investment in a company all of the necessary financial and operating information about a company.

It enables the investors to obtain a good picture of the company and hopefully helps determine the best way to structure their investments.

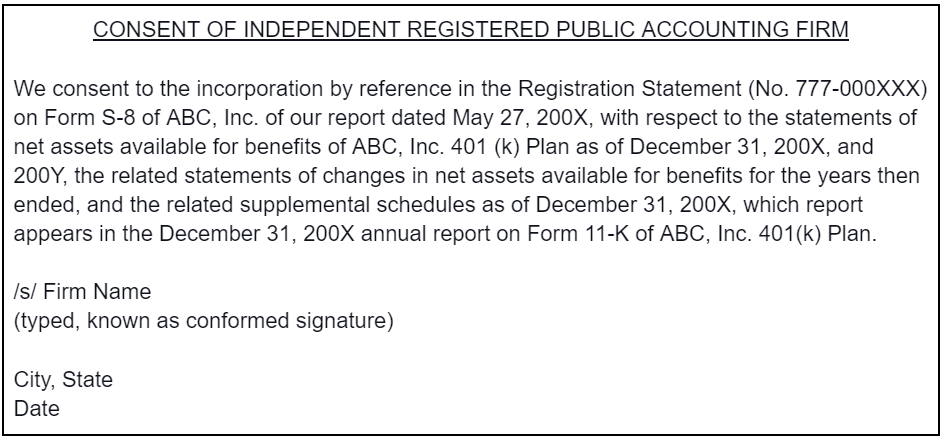

A company filing an 11-K must strictly adhere to the ERISA Format as laid down by the SEC. It requires a full audit by an independent public accounting firm and consent.

A sample of the consent provided by an independent accounting firm is given below:

Example

Walmart Inc. is an American multinational retail corporation headquartered in Bentonville, Arkansas. It operates a chain of hypermarkets, discount department stores, and grocery stores in the United States.

The company is also the largest private employer in the world. Walmart is a publicly traded family-owned business, as the Walton family controls the company. Walmart employs approximately 2.3 million associates worldwide and 1.6 million in the United States alone.

Walmart operates approximately 10,500 retail units and eCommerce websites in 24 countries. It is the world's largest company by revenue, with about US$570 billion in annual revenue. The company was listed on the New York Stock Exchange in 1972.

Walmart Inc. filed a Form 11-K with the Securities and Exchange Commission on June 30, 2022, for the year ending January 31, 2022.

This 11-K filing is available to the public via the SEC's EDGAR database or on Walmart's investor relations website. To view this 11-K filing, click on this link.

Form 11-K FAQs

Electronic submission of registration statements and other paperwork is required for all businesses, domestic and international. Then, investors can view registrations and other corporate.

A partnership, corporation, limited liability company, or tax-exempt charity having assets worth more than $5 million. A general partner of the company selling the shares or any general partner of a general partner.

All 11-K filings are available to the public via the SEC's EDGAR database or the company's Investors Relations website.

No, Form 11-K is a document made publicly available, free of cost.

Yes, filling out the SEC Form 11-K is mandatory.

The Securities and Exchange Commission (SEC) requires public corporations, certain company insiders, and broker-dealers to file periodical financial statements and other disclosures.

Researched and authored by Rohan Kumar Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?