NOMINAL Function

Calculation of the nominal annual interest rate

What is the NOMINAL Function in Excel?

The NOMINAL Function calculates the nominal annual interest rate. The function requires two arguments: the effective interest rate and the compounding periods. Both arguments are necessary for the calculation.

The NOMINAL function in Excel falls under the category of financial functions. Its primary purpose is to calculate and return the nominal annual interest rate, provided you have the effective interest rate and the number of compounding periods per year.

In the realm of financial analysis, it's common to assess multiple financial instruments or bonds, each with its unique terms and conditions. To make meaningful comparisons, especially when one bond presents its interest rate as a real rate and another as a nominal rate, the Excel NOMINAL function proves to be a valuable tool.

Key Takeaways

-

The NOMINAL function in Excel is a financial function that calculates and returns the nominal annual interest rate when provided with the effective interest rate and the number of compounding periods.

-

NOMINAL is a valuable tool for financial analysis, particularly when comparing different financial instruments or bonds, some of which may present interest rates as nominal rates and others as real rates.

-

Nominal interest rate is the stated rate on a loan or bond and is independent of the compounding period, making it less suitable for comparing loans with different compounding periods. Effective interest rate, on the other hand, considers the compounding period and is a better indicator of total expenditure or income from a loan.

-

The NOMINAL function is helpful for finance professionals to calculate total interest obligations, determine bond returns, and compare various debt securities.

What is the Nominal Interest Rate?

Before knowing how to calculate the Nominal interest rate using the Nominal function, you must know what Nominal interest is. Nominal interest is the rate of interest stated on loan. It is the interest rate that you pay over your borrowings.

The Nominal interest rate depends on two things, the Effective interest rate and the compounding period. Before you get confused and blank out, we have a table distinguishing both interest rates for you.

| Nominal Interest Rate | Effective Interest Rate |

|---|---|

|

|

|

|

|

|

|

The formula to calculate the Nominal Interest rate is R= N[(1 + E)1/N - 1] Where;

|

The formula to calculate the Effective Interest rate is E= (1 + R/N)N - 1 Where;

|

The effective interest rate is dependent on the compounding period of a loan. It increases with more frequent compounding in a year. This also widens the gap between the effective and nominal interest rates.

How to use the NOMINAL Function in Excel?

The function will calculate the interest rate when compounded more than once a year. The function is useful for finance professionals to calculate total interest obligation, know the bond return, or compare different debt securities.

The nominal function is simple and needs only two arguments. The arguments and what they mean are given below.

- Effect rate: This is the Effective Annual Interest rate.

- Npery: This is the number of compounding periods in a year.

The steps below will guide you on how to use the function.

Steps to use the function:

Step 1:

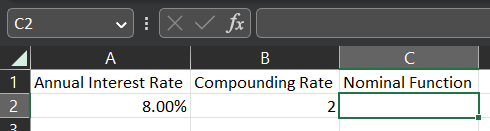

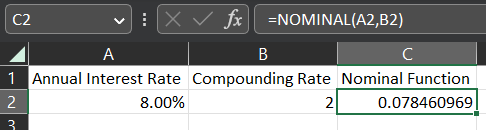

Here, we will use a simple example where we have an annual effective interest rate and the compounding periods in a year.

Step 2

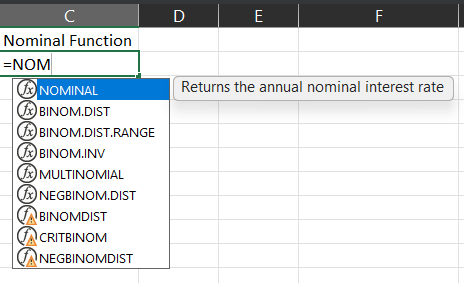

In cell C2, we will type in the sign = and then type Nominal, and the function will appear. Alternatively, you can press TAB instead of typing the whole word to select the suggestion.

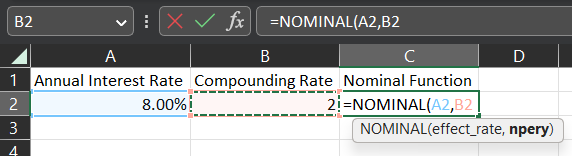

Step 3

We will select cell A2 as our effect rate, add a coma (,), and cell B2 as our npery or the compounding period. Press TAB or ENTER to execute the function.

Step 4

The function will execute, and you will see the answer.

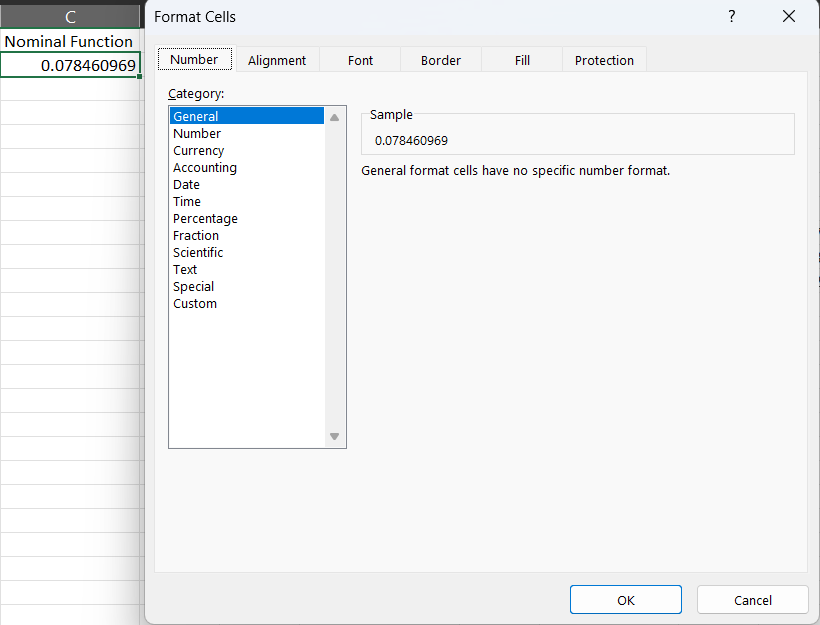

Percentage Conversion

You will see that the answer is displayed in decimal format instead of in percentages. This is due to the cell format, which is in General. You will have to manually change the format into a percentage to see the answer in the correct format.

There are two ways to change the format of the cell. The one shown below is the easier one. Below, you will see the steps to do this.

Steps to convert the format of the cell:

Step 1

Select the cell with the Nominal function; here, we will select cell C2. Press CTRL + 1 to open the Format Cells box.

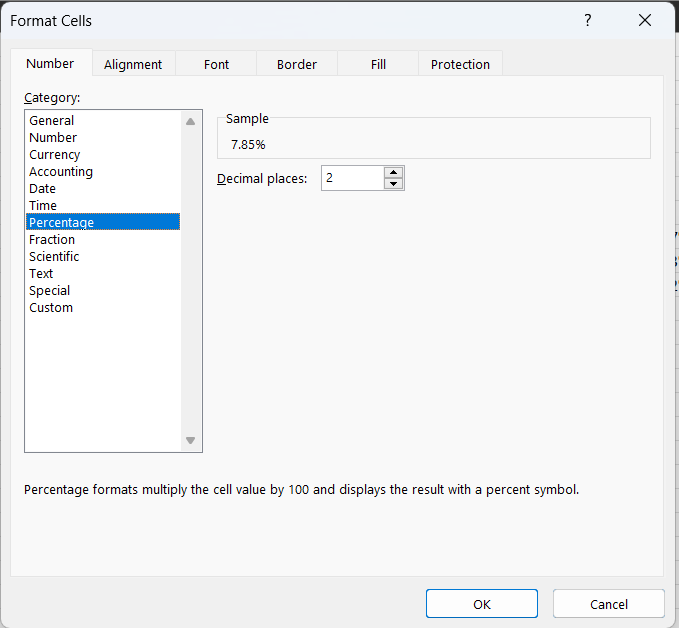

Step 2

In the Category section, select the Percentage category. Here, you can choose the number of decimal points you want to show. Click OK to execute.

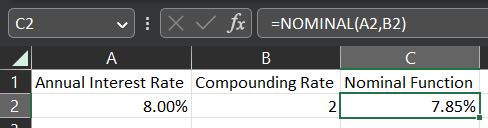

Step 3

There it is; the answer makes much more sense now since both the Effective Interest rate and the Nominal Interest rate are in percentage.

Situations Where We Can Use NOMINAL Function

We have just learned how to use the function in Excel, but where will we use it? To be more precise, what situations will require us to use this function?

Think no further, for we have below different situations where the function will be helpful for you. You can thank us later.

1. Financial Analysis

Financial Analysis is a way to assess and evaluate a company's finance or project's viability. Professionals use historical data and company records to forecast current and future financial performance. This may sound scary and tiring even for the most motivated professional. We got just the course for your jitters.

Financial Analysis is also done by investors so that they can assess a company's financial position before investing. External Auditors may analyze statements and accounts to check for fraud.

To compare different debt instruments, a finance professional will need the help of the nominal function. The function can help calculate the nominal interest it can afford at a set compounding period.

The function can also help calculate the nominal interest to be charged on debentures on a specific compounding period, say 2 per year, to earn a specific interest of 8% per annum.

2. Budgeting

We have all been there budgeting our monthly expenses or yearly vacations. Even companies and other organizations need to form a budget.

Budgeting is used to forecast future expenses and incomes. It helps companies to evaluate where they are and what needs to be done for the future. Not just companies; even governments, cooperative societies, and partnership firms also make a budget.

Note

Calculating total debt obligation and the income gained is crucial for a correct budget.

Say you want to pay an annual interest of 8% and set a compounding period of 2 per year. The nominal function can help calculate the nominal interest that a loan should charge.

3. Business Decision-Making

Decision-making is an often repeated but important part of the business. Businesses must ensure that they make correct and informed decisions. A wrong decision can jeopardize the company’s liquidity.

One area that needs serious decisions is funding and investing money. Knowing how much interest should be paid and how much should be earned is critical.

Note

As a business manager, you can use the help of the nominal function to calculate and compare different debt and investment options.

4. Personal Finance

This function is helpful for Finance professionals and everyday individuals who want to make informed financial decisions. One area of Personal finance is putting our money in a savings account that returns a good fixed income.

One way to compare different savings accounts is by setting a minimum annual interest we want to earn and checking the nominal interest at different compounding periods.

As you can see, the Nominal function can be used in many situations to derive the nominal interest rate from an effective interest rate. Below you will also find real-life examples that can further explain the uses of this feature.

NOMINAL Function Examples

Here, we will see how we can use the function to compare different bonds. This comparison is made mostly by Financial Analysts, Investment bankers, Fund managers, etc.

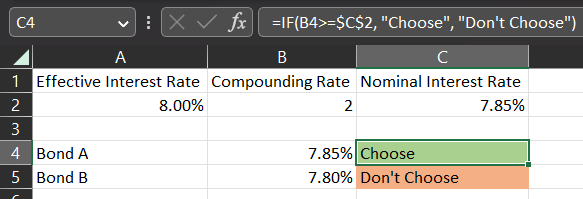

Example #1

In our example, we want to invest in a bond that returns a minimum Effective Yield of 8%. The interest earned will be re-invested to earn more.

The interest will be received semi-annually. We want to know the bond's Nominal Yield to achieve the Effective Yield of 8% compounded semi-annually.

We have two different bonds that we want to choose from. Bonds A and B have their respective nominal interest rate mentioned. Using the function, we calculate the interest needed to earn an effective interest of 8% annually.

We see that Bond A is the one that matches the answer from the function. Thus, we will choose Bond A and reject Bond B.

Example #2

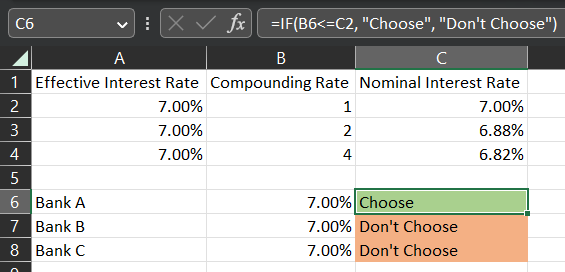

We will see how we can use the function to compare different loans. This comparison is made mostly by businesses, investors, and people looking to take out a loan.

Let’s assume we are a clothes manufacturing business and want to take a loan to build a new factory. We want to pay no more than 7% interest on our loan annually. We have different compounding periods which different banks charge on loans.

Bank A, B, and C are three banks with a nominal interest rate of 7%, but A compounds its loan annually, B compounds it semi-annually, and C compounds it quarterly.

We use the nominal function to calculate the nominal interest rate on different compounding periods, with the effective interest rate being the same. We can see that as the compounding period increases, the effective interest rate increases.

Bank A has the same effect and nominal annual rates as the compounding. Bank B has a higher effective rate as the compounding is semi-annually, and Bank C has an even higher effective rate as the compounding rate is quarterly.

Example #3

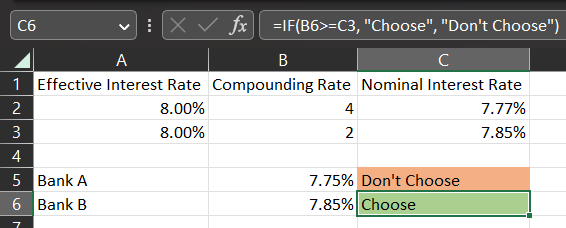

Here, we will see how we can use the function to compare savings accounts. This form of comparison is done mostly by Individuals or Wealth fund managers.

Suppose we want to earn an effective interest of 8% annually on our savings account. We want to know the nominal interest rate we would need at different compounding periods to maintain the 8% income.

Bank A’s savings account has an interest rate of 7.75% compounded quarterly. Bank B’s savings account has an interest rate of 7.85% compounded semi-annually.

We can use the function to find the rate needed to earn a fixed income of 8% per annum. This way, we can choose between the banks' rates at different compounding periods.

As we can see, the rate provided by Bank B, compounded semi-annually, will give us 8% effective interest. Whereas Bank A, even with quarterly compounding, falls short of 0.02%. Thus, we will choose to open a savings account in Bank B.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?