Accounts Receivable Aging

Accounts Receivable Aging is a recurring report that organizes and shows the “age” of a company’s outstanding accounts receivable invoices.

What Is Accounts Receivable Aging?

The Accounts Receivable (A/R) Aging is a recurring report that organizes and shows the “age” of a company’s outstanding accounts receivable invoices. The report determines a customer's reliability with a company, a company’s bad debt expense, and its financial health.

Management uses aging to determine customer profiles regarding credit lending and payback periods. It is a common practice to use A/R aging to determine how much credit a company should lend its customers, just like how a bank checks its customer's credit score and history to determine loan eligibility.

This report usually shows current invoices:

- 1-30 days past due date

- 31-60 days past due date

- 61-90 days past due date

- Over 90 days past the due date

The information in this report is crucial for companies to interpret and make managerial decisions.

Companies using Accounts Receivable Aging are typically better off than those that do not. Customer payback can tell a lot about cash flow and financial health, along with benchmarks for the sales and communications departments to improve upon.

Key Takeaways

- Accounts Receivable Aging is the process of classifying accounts receivable via the length of time they have been outstanding; the information is used to track customer payments, identify potential problems, and manage cash flow.

- A/R aging is categorized within 30- increments, such as 0-30 days, 31-60, 61-90, and 91+. This helps businesses assess the time frame upon which customers are paying on time and which are not.

- A/R aging can be used to calculate the allowance for doubtful accounts and bad debts. The calculation can be used to estimate how much of accounts receivable is expected to be uncollectible.

- The information from the Accounts Receivable Aging is crucial for adjusting a company’s financial statements to avoid overstating its net income.

- A/R aging can also be used to review which customers are on the brink of defaulting on their payments.

How To Calculate Accounts Receivable Aging?

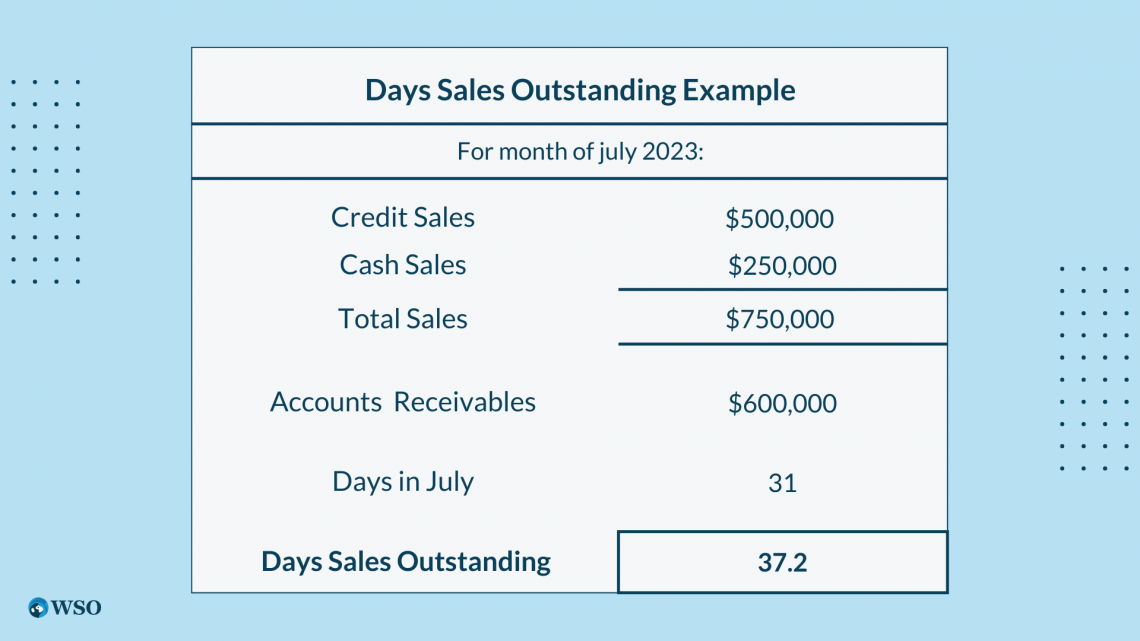

To calculate your A/R aging or of a customer’s account, you would multiply the average accounts receivable by the fiscal year (360 days) and divide that product by the total credit sales to determine an approximate payment date from the customer. This is also known as days sales outstanding.

The following is the formula to calculate days sales outstanding:

Days Sales Outstanding (DSO) = (Average Accounts Receivable / Net Credit Sales) * 365

For example, if you had a customer that had an average accounts receivable account of $10,000, you would multiply that by 360 days, which equals 3,600,000.

Suppose you had credit sales of $60,000; you would divide that 3,600,000 by 60,000 and get an Accounts Receivable Aging of 60 days. You now know that your customer will most likely pay within 60 days.

In the A/R aging report, we can derive an important metric called Days Sales Outstanding (DSO); monitoring the DSO for the A/R reports is important.

First off, DSO is a key metric that can be derived from the A/R aging report. The average number of days required to collect payment from customers is represented by this formula. This particular formula was introduced earlier in the article.

One option is to calculate for the entire year, while another is to calculate for each month, as illustrated in the example below.

DSO is a key indicator of how efficiently a business can manage its A/R and convert its credit sales into cash. The lower the DSO, the better. This means the business is collecting payments more quickly, which can improve cash flow.

Importance Of DSO

DSO is related to a business’s working capital, and having a delayed collection can stir issues up with cash in A/R, which will eventually lead to liquidity issues. DSO is a vital metric for measuring the financial health of a company.

Additionally, comparing DSO with the industry benchmarks can help provide insight into a company’s performance against competitors. Having a high DSO indicates weakness in A/R management and should be improved using some of the tips mentioned throughout the article.

A lower DSO can utilize higher cash flow and can be reinvested in other business departments for good use and growth. In other words, a business will be better off when it can receive payments on shorter notice as it can boost liquidity and customer satisfaction.

On the contrary, it can help identify potential problems within the business and act as a warning sign when the business's DSO value rises.

How Can I Improve My Accounts Receivable Aging?

One of the best ways to improve accounts receivable aging is dunning. Dunning is the method of communicating with clients who have extraordinary installments. This communication can take any shape: emails, in-app notices, or a great old-fashioned phone call.

The key thing to keep in mind is that nectar catches flies. Begin by keenly reminding a client of their installments due sometime recently, raising to more forceful communication and results.

When your customers can pay easily and provide early payment discounts, you are likely to get more cash flow as a result.

If you have tried everything mentioned to get your customer to pay, the last straw would be to hire a collection agency to collect your accounts receivable from the customer.

One thing to note is that you should be patient and persistent in collecting payments from customers in difficult circumstances. It is best to be proactive in collecting payments from all customers.

Common Mistakes To Avoid With Accounts Receivable Aging And How To Fix It

There are several common mistakes when managing A/R aging that could lead to potential financial loss. Here are some common mistakes and ways to fix them:

1. Waiting Too Long

Not taking immediate action when your customer hasn’t paid over 30 days past due can easily turn into 90-120 days past due, and your customer will probably not pay or partially pay. Studies have shown that the longer the receivable is past due, the less likely it is to be collected.

Instead of waiting too long, implementing the latest A/R Collections Software system can alert employees to follow up on overdue customers and use the dunning technique to receive the collection.

2. The Collection Of A/R Is Undermined

When thinking about the collection of A/R, most would assume that it is only the accounting department’s responsibility, when in fact, A/R collections reflect sales and customer experience, which is important for growth and customer loyalty.

To resolve the issue, involving your whole organization in working on accounts receivable can reinforce and improve receivable conditions and faster payback via the sales department and communications. Other departments can work on easier ways of payment and customer convenience.

3. Limited Payment Options

This should be obvious–writing a check and then mailing it or paying in cash is inefficient, nor is it convenient for customers. In today's digital world, there are many ways to receive payments that best suit a customer.

Something to consider would be offering various payment options and plans that can personalize and tailor a customer’s preference, giving customers a reason to come back as a result and pay on time

4. Manually Collecting Accounts Receivables

Collection A/R is a time-consuming and immense amount of work to process past-due invoices. And on top of that, a manual system to manage past-due accounts is very inefficient.

As mentioned before, implementing the latest A/R collections software will essentially revolutionize the outdated workspace. This software can provide advanced metrics and data regarding a company’s A/R aging, such as cash flow summary and A/R turnover ratio.

5. No Credit Policy

As mentioned before, do not implement a credit policy to incentivize customer payback, but make sure you establish policies and procedures for those who can pay back in time.

Establishing a credit policy and getting customers to fill out a credit application can help filter who should get extended credit, and implementing this system throughout one's business can improve A/R aging.

The Role Of Accounts Receivable Aging In Credit Management

Using the Accounts Receivable Aging Report can help manage credit risk as it tracks the age of invoices, which businesses can analyze to see the creditworthiness of their customers.

The information can then be used to make decisions such as extending credit to new customers and whether to set credit limits for existing customers. There are a lot of roles that A/R aging plays in credit management:

- A/R aging can monitor payment patterns in the report, and it allows companies to the payment trends and identify the root cause of it.

- The report can reveal issues with credit policies in place if there is a discrepancy between the credit policy and customer payback. It can evaluate how well a credit policy performs.

- A/R aging allows credit managers to prioritize collections by focusing on customers who have older balances, as they pose the highest credit risk and require immediate mitigation of bad debts and delays.

How To Use Accounts Receivable Aging To Identify Potential Problems

Many companies often face many problems with their business; however, using accounts receivable aging can help identify several problems before they arise.

1. Identifying Customers Overdue On Payments

By tracking the age of your customer's invoices, businesses can identify customers who are overdue on their payments and make managerial decisions to mitigate and prevent these problems from worsening.

2. Identifying Customers Who Are Likely To Default On Payments

Additionally, by tracking the age of customer invoices and the payment history of customers, businesses can identify customers who are at risk of defaulting on their payments. Businesses can then take proper steps to mitigate the payment by receiving it early or reducing credit limits.

3. Identifying Trends In A/R Aging

Finally, tracking accounts receivable aging over time can help businesses identify trends among customer invoices and generalize data as a whole.

For example, if the average age of a business’s accounts receivable is increasing, this indicates that customers are taking longer to pay their bills. The interpretation could be that some customers are experiencing financial difficulties or may be a sign that the business is extending more credit to customers.

Bad Debts Expense & Allowance Of Doubtful Accounts

Another utility of A/R aging is that it can determine the allowance of doubtful accounts, which is a contra-asset account–meaning that it reduces the balance of the accounts receivable account to reflect the money expected to be uncollectible.

Another important term to know is the bad debts expense. Bad debt expense is an amount of money that is written off by the creditor when a borrower defaults on his/her payments.

This bad debt is uncollectible and is a contingency that all businesses must expect. Companies calculate their bad debt expense via either A/R aging or the percentage of sales method.

For example, let’s take a scenario: A business has $90,000 in accounts receivable, and it divides its receivables aging into three brackets:

- 1-30 days past due

- 31-60 days past due

- 61-90 days past due

Usually, a business gives a fixed default percentage on each date range. The longer the date, the higher the percentage.

So, in this case, let’s say the business fixes 5%, 10%, and 20% concerning the date ranges. To calculate the bad debts in each date range, multiply $30,000 by each of the respective percentages, so for 1-30 days past due, the bad debts in that range are $1500.

Once everything is calculated, the total bad debts expense and allowance of doubtful accounts for this business amounts to $10,500.

Why is Allowance of Doubtful Accounts and Bad Debts Expense Important? Accounting for the allowance of doubtful accounts and bad debt expenses can improve financial reporting on the balance sheet and reduce the risk of financial loss when businesses identify accounts that are likely to be uncollectible.

Benefits of Accounts Receivable Aging

The benefits of using A/R Aging include:

1. Improved Cash Flow

The process of identifying and collecting overdue payments improves a business’s cash flow as it can meet financial obligations and increase working capital.

2. Better Customer Satisfaction

The art of dunning and sending timely reminders can build better customer relations, especially if a business is making it easy for the customer to pay. Customer loyalty is key to building a successful business and leading to more sales as a result.

3. Identifying Potential Problems

As mentioned repeatedly, it’s extremely crucial to look for factors that could potentially lead to a business's downfall.

Using A/R aging can mitigate loss by identifying customers who are overdue on payments and making decisions based on that, such as reducing credit for those with bad credit payment histories and so forth.

4. Improved Financial Reporting

Lastly, accounts receivable aging can be used to estimate bad debts, expenses, and allowance of doubtful accounts so businesses can improve the accuracy of their financial statements. Doing this can mitigate the risk of financial loss.

All of the accounting topics that are covered in this article are in Wall Street Oasis’ Accounting Foundations course; you should take a look at it and experience the world of accounting and vital knowledge to sustain and grow a business using accounting concepts.

Accounts Receivable Aging FAQs

If you are creating an A/R aging report on Excel, make columns and list out your customers’ names, the money they owe you on each date interval, and then a total column of all your outstanding balances.

If you are on QuickBooks, click on the reports tab on the left side of your screen, then search Accounts Receivable Aging. The report is automatically prepared for you to view your outstanding balances and clients.

Checking your A/R aging report weekly or monthly is a good time to identify potential problems, as mentioned previously, and manage any cash-flow issues from any customers due soon. Checking regularly can help to maximize any collections and reduce any risk of loss.

This habit can be devastating in the long run as you may forget to bill customers or have any idea whether your customers have paid you. Customers will have no idea when to pay and may lose touch with your business afterward.

So make sure to check your accounting receivable aging regularly!

or Want to Sign up with your social account?