De Minimis Tax Rule

A rule stating that the income from a discount bond at a certain minimum level discount rate should be taxed as a capital gain rather than ordinary income

What is the De Minimis Tax Rule?

One of the main advantages of municipal securities is that, in most cases, the coupon income is not subject to federal income tax. However, it's crucial to remember that the increase in the value of assets acquired at a discount on the secondary market may be subject to taxation.

"De minimis" in Latin means "about little things." The De Minimis tax rule is typically for municipal bonds acquired for minimal discount. These bonds can be subjected to capital gains or ordinary income tax.

The Internal Revenue Service (IRS) lays down certain rules regarding the de minimis tax rule that are allowed and permissible in the United States. The rules are related to its tax calculation, whether the tax is considered capital gains or ordinary tax.

Small market discounts must be treated and recorded according to the de minimis tax rule. The de minimis amount, loosely translated as "about little things," decides whether the market discount on a bond is taxed as capital gain or regular income.

According to the rule, a discount is deemed too minor and tax-exempt if it is less than 0.25 percent each year from the time it is acquired and maturity.

Key Takeaways

- Municipal securities offer tax advantages, but discounts on secondary market assets may be taxed.

- De Minimis tax rule applies to bonds acquired at minimal discounts for tax classification.

- Capital gains tax for asset profits, ordinary income tax for various income sources.

- De Minimis threshold calculated based on bond face value and years to maturity.

- Rising interest rates impact municipal bonds' tax treatment and liquidity.

Difference Between Capital Gain Tax and Ordinary Income Tax

Capital gains tax (CGT) is a charge levied on profits from the sale of non-inventory assets like bonds and real estate. In the US, assets purchased and sold within a year are subject to short-term capital gains tax levied at a higher rate than long-term capital gains.

On the other hand, ordinary income tax is levied on various income sources, such as:

- Wages

- Commissions

- Salaries

Dividends, partnerships, royalties, and even gambling winnings are all liable to ordinary income tax in addition to the basic sources of income.

Imagine income tax as a federally imposed levy on any money you have earned through your job and personal effort.

This is a helpful approach to thinking about capital gains vs. income tax. Instead, capital gains taxes are levied on earnings made as a profit from the purchase of an asset, such as a vacation house or shares, and the subsequent sale of the same for a higher price.

Capital gains taxes are further divided into two categories based on long-term and short-term capital gains. After owning an asset for at least a year, you must sell it to realize long-term capital gains, which are taxed at a lower rate. Instead, short-term capital gains are subject to the higher regular ordinary income tax rate.

Given the possible tax benefits that may accrue over time, it seems to reason that investors would be motivated to purchase and keep long-term assets.

However, paying short-term capital gains taxes is also frequent if you:

- Trade stocks

- Remodel

- Flip houses

- Work on other quick-turn ventures

How Does the De Minimis Tax Rule Work?

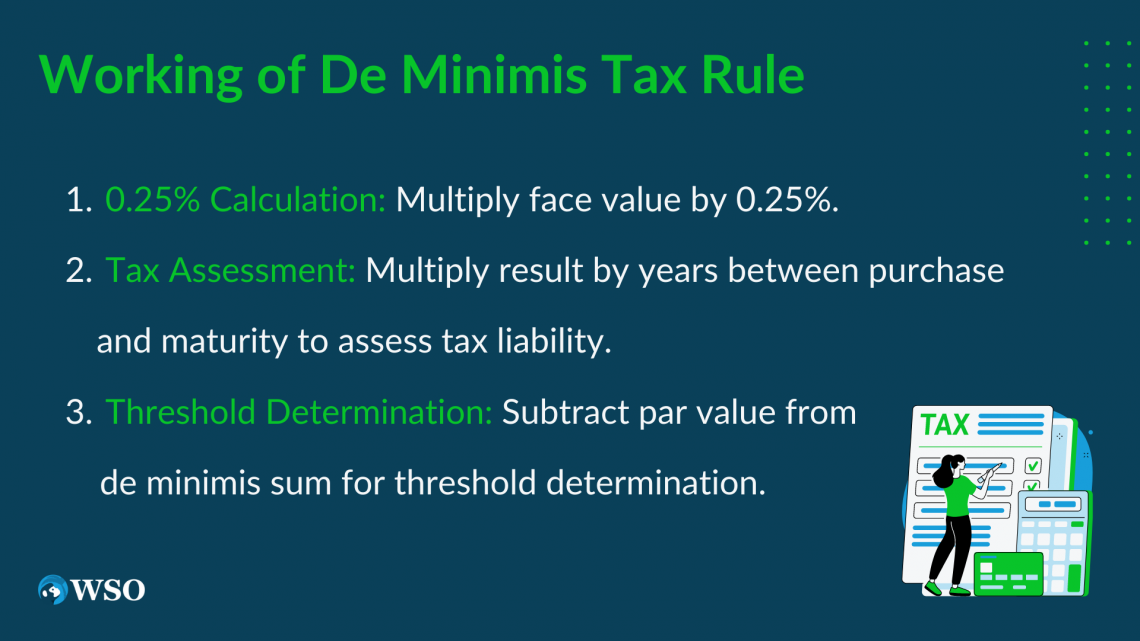

Using the de minimis tax rule:

1. Multiply the face value by 0.25 percent.

2. Multiply the result by the number of complete years between the discounted bond's purchase date and maturity date to determine whether a municipal bond is liable to capital gains tax or ordinary income tax.

3. Subtract the bond's par value from the computed de minimis sum, which leads us to the minimis threshold.

The acquired bond is liable to ordinary income tax if this sum is greater than the discount bond's purchase price. In addition, capital gains tax is imposed if the acquisition price exceeds the de minimis limit.

Suppose the market discount is smaller than the de minimis amount. In that case, the discount on the bond is frequently recorded as a capital gain instead of ordinary income upon sale or redemption.

A fundamental rule of bond pricing is that bond prices decline as interest rates rise and vice versa. The de minimis tax rule often applies when interest rates are increasing. As a result, bonds cost less during these times and are offered at discounts or significant discounts to par.

For example, assume a company has issued a bond for 13 years and has a face value of $4,675. The bond matures in 8 years.

Following the steps above, the de minimis threshold becomes:

4,675 x 0.25% = 4,675 x 0.0025 = $11.6875

11.6875 x 8 = $93.5

4,675 - 93.5 = $4,581.5

The bond may only be acquired for this amount for the IRS to record the discount as a capital gain.

Based on the rule, if the bond is purchased at a price higher than $4,581.5, it will be considered a capital gains tax. However, if the bond is purchased at a price lower than $4,581.5, it will be considered an ordinary income tax.

We can look at these results from another perspective where if the bond's selling price was at $4,400, then

$4,675 - $4,400 = $275 > $93.5 ⇒ profit on sale ⇒ ordinary income.

Impact of Market Discounts in A Rising Rate Environment

Investing in municipal bonds does not necessitate careful consideration of the de minimis tax rule during periods of downturn and low-interest rates. Due to the low-interest rates, the vast majority of municipal securities do not now trade at prices below the de minimis criterion.

Falling bond prices, however, would imply that more municipal securities would fall below the de minimis threshold in a situation with rising rates.

Persistently low-interest rates have also made it easier for municipalities to issue more bonds with lower-coupon bond structures at lower costs than their higher-coupon equivalents.

Bonds issued at par or close to par may now be more susceptible to the adverse tax and liquidity consequences connected with the de minimis rule if rising interest rates push down bond prices:

- Tax effects: Securities trading near or below the border will probably trade at an even lower price (and greater yield) to make up for the increased tax rate that any buyer would experience if they bought bonds below the de minimis barrier.

- Impact of liquidity: The de minimis rule's potential levies may also cause demand distortions in the market because of a smaller customer base. Even when yields make up for the greater tax treatment, the conventional tax-sensitive municipal buyer may avoid securities with tax ramifications.

As bonds get closer to the de minimis threshold, these processes might lead to the formation of a price cliff. Bond prices could degrade faster than they otherwise would if they were higher and closer to this threshold due to the effects of increased taxes and less liquidity.

De Minimis Fringe Benefits

Additionally, employers' fringe benefits are subject to the de minimis tax law. The offered de minimis advantages are so minor that it would be impossible to account for them; hence they are not subject to taxation.

The principal advantages include the following:

- Bringing snacks and coffee into the office to boost morale.

- The company provides holiday presents to its staff.

- Tickets for specific occasions or unique work events.

- Group-term life insurance with a face value of little more than $2,000 is payable upon passing a worker's spouse or dependent.

- Outstanding employees are granted a one-time dinner allowance.

- Transport costs for workers who opt to put in overtime.

- Cocktail hours or other activities are planned to increase staff motivation.

- Occasionally using office supplies for personal duties, such as mailing a letter to a friend, paying a parking ticket, writing, or making a sticky note about an errand to run on the way home from work.

Below is a short YouTube video explaining the benefits of the De Minimis tax rule:

Benefits that are considered de minimis cannot be given a monetary value. In other words, offering money as a gift without taxing it is impossible. On the other hand, de minimis benefits are exempt from taxes because of the common occurrence and little monetary worth of the aforementioned goods.

Researched and Authored by Ely Karam | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?