Freight Expense

Refers to the fees charged by a courier for transporting cargo

What Is Freight Expense?

Freight expenses refer to the fees a carrier charges for transporting cargo from a source site to a destination point.

The party responsible for bearing these expenses can vary depending on the terms of the shipment. The freight expense paid is determined by the form of transportation utilized to deliver the goods.

Airplanes, trains, ships, and lorries are examples of common types of transportation. Furthermore, freight firms charge variable freight rates based on the shipment's mass.

Some notable companies include:

The logistics supply chain is a complex operation with several possible services throughout. The cost of these services is frequently determined by the type of goods being shipped and the nations to and from which they are being shipped.

The Freight Expense account and Cost of Sales-Freight account are related in accounting. The Freight Expense account records the cost of shipping goods, while the Cost of Sales-Freight account allocates these shipping costs to the cost of goods sold.

The allocation depends on whether you are sending goods to customers or receiving goods from suppliers.

Assume you own a company that exports and imports a specific sort of good. When you deliver items to clients and pay for delivery expenses, you debit the Freight Expense account, leaving the Cost of Sales-Freight account unaltered.

When you buy products from a source and pay for a delivery, you boost the Cost of Sales-Freight account while leaving the Freight Expense account alone.

Key Takeaways

- Freight expenses cover transportation costs based on transportation mode and shipment terms. Leading players include DHL, Maersk, UPS, Expeditors International, and C.H. Robinson.

- Fees like Dock Security, Terminal Handling Charges, Immigration Clearance, VGM, and Sealing Charges are typical in freight expenses.

- Freight expenses are affected by demand, regulations, fuel prices, and events like piracy or geopolitical factors.

- "Freight Out" covers customer shipments and is an operational expense, while "Freight In" for supplier receipts is part of the Cost of Goods Sold (COGS).

- In accounting, freight expenses are categorized into "Freight Out" for customer shipments and "Freight In" for supplier receipts. These costs impact the income statement differently, with "Freight Out" as an operational expense and "Freight In" as part of the Cost of Goods Sold (COGS).

Common Freight-Related Fees And Charges

A few regular service fees are encountered practically every day – which can be seen when looking at freight expenses.

These include:

1. Dock Security

Think of port security as a parking charge for cargo! If cargo is stored at the dock, it will be in a secure location. Many vehicles will enter and exit to load and unload other cargo.

2. Terminal Handling Charges (THC)

Several duties must be completed at the dock before a shipment can be loaded onto a ship.

For example, the goods will be checked in at the pier a few days before the conveyance departs, just like we do for an airplane. When that day arrives, it must be carried to the transport, and cranes must load the container on board. The THC will cover the cost of these several duties.

3. Immigration Clearance

Whatever is being shipped needs to be declared. If there is something odd or if more checks are necessary, the items may be subjected to inspections. Different nations have varying customs processes, as well as different rates and prohibited items.

4. Verified Gross Mass Filing (VGM)

When a vessel arrives at the dock, the carrier checks the actual weight of the cargo and compares it to the weight declared.

Some countries, such as China, have requirements that require every vessel to be measured before boarding a ship. Therefore, if the weight that was filled does not match the weight at the port, there may be additional expenses and delays.

5. Sealing Charges

Once the goods have been placed into the vessel, they must be sealed to keep it safe and prevent damage – this is what sealing charges cover. There are, however, many types of seals, and each nation has some that it accepts and some that it does not.

That implies that when the container is sealed, it must be ensured that the seal is accepted in both the origin and destination nations to prevent delays or fines on the cargo.

Factors That Affect Freight Expenses

Organizations that keep inventory consider freight to be one of the most significant costs of conducting business. This is because companies can better comprehend and control accessorial costs and other surcharges if they understand average contractual freight rates.

Competitive shipping prices for the firm and its clients indicate a stronger overall connection.

Transporting items from the manufacturer's warehouses to the firm's warehouse or from the firm's warehouse to the retailer or consumer location may entail costs. The shipping expense might be billed either before or after the goods are delivered.

Some of the elements that influence freight expenses are as follows:

1. High Demand for Freight

The need for freight services also influences freight expenses. During peak times for shipping space, there will be a huge amount of items to ship, and shipping companies may charge a premium due to the limited availability of space.

When there is a low demand for freight services, shipping companies may reduce their charges to attract fewer customers looking to move cargo.

Peak season occurs yearly; August to October has historically been the prime shipping season, with "back-to-school" and "Christmas" shopping driving consumer demand.

2. Federal Regulations

The governments of various nations may adopt a strategy that directly impacts the shipping industry.

For example, during certain times of the year, government officials may restrict the maximum driving hours for truck drivers. This indicates that the shipment will take longer to reach its destination.

Shipping businesses hike freight charges to clients to offset anticipated losses. Other government rules that may have an impact on freight expenses include a prohibition on night driving, pollution tax legislation, limiting the amount of goods that trucks may transport, and so on.

3. Fuel Prices

Fuel costs are included in the freight valued methodology by some shipping firms. The cost of land and sea transportation is affected by the fuel price at the shipping time, which can impact the overall cost passed on to the customer.

If fuel prices are low, land and sea transportation will be less expensive to use, and the savings will be passed on to the customer as cost savings. However, if fuel costs rise, so will the expense of road and sea transportation, which will be passed on to the customer.

4. Rising Events

Rising events such as violence, piracy, and a corrupt government might result in higher freight charges as shipping companies attempt to mitigate increased risks and associated costs. Costs may also rise when shippers choose longer shipment routes that provide greater security.

For example, marine commerce traveling through pirate-prone sea routes such as Somalia must charge a higher price to reflect the greater risk, increased premiums, and prolonged sea routes.

Shipping firms may charge a higher cost when transporting goods through areas susceptible to terrorism and criminal groups to employ security or move cargo to safer forms of transit in such locations.

Types Of Freight Expenses

Freight charges from freight services are incurred when items are carried between suppliers and consumers and must be expensed using the appropriate method in accordance with U.S. Generally Accepted Accounting Principles (GAAP).

On the revenue statement, freight out and freight in are classified differently. Each form of the fee is described here, along with how the expenditures are handled.

Here's a brief rundown of the contrast between Freight out and Freight in as an expenditure in accounting:

1. Freight Out

The cost of moving products away from the shipper to a customer or client is referred to as a freight-out expenditure. This freight charge is classified as an operational expenditure and is recorded on the income statement in the operating expense account section.

Freight out charges may be indistinguishable if a single-stage profit and loss statement is used. On the other hand, a multi-step revenue statement makes it far easier to follow Freight out.

These are major expenditures for manufacturers, producers, and wholesalers since they routinely transport items to other firms and charge them for Freight out.

2. Freight In

The transportation cost involved with receiving products from a supplier or manufacturer shipper is referred to as a freight expenditure.

If the products are kept in inventory, the charge is classified as Cost Of Goods Sold (COGS) and, therefore, is recorded under sales on the multi-step profit and loss statement. COGS is reported and may be studied on the single-step statement, although its placement on the financial statement is described differently.

Freight in is a frequent expense for businesses, showrooms, and factories since they acquire supplies from other locations and add this expense to the price of receiving items.

Learn more about common freight charges.

How To Record Freight Expenses In Accounting

There are three things to think about when recognizing the Freight out charges on the income statement:

1. Charge freight when it is incurred

When an organization incurs the expenses of sending items, they should record the Freight out charges.

However, since some freight out charges may not be known until they are charged, they may be unable to do so immediately. To account for the difficulty, many businesses report their Freight out charges when they receive the invoice, regardless of when the cost was incurred.

2. Include Freight out in the cost of items sold

Freight or shipment expenses are considered a cost of goods sold because they are directly related to the quantity of items sold. Therefore, companies calculate freight charges into the cost of products sold and display them in the income statement to reflect this.

This demonstrates that freight transportation costs are not an operating expense but rather a variable cost based on the number of items sold. This enables businesses to plan for it more efficiently because the cost fluctuates with sales rather than being a fixed expense.

3. Billing the consumer

If a business sends the Freight out cost to the client, they can record it in the income statement as an accounts receivable alongside the freight expenditure. In this manner, when the buyer pays, the cost is offset.

Depending on what the organization charges the client and what they pay for the invoice, the organization may have a negative freight out expenditure. However, if the business operations rely heavily on Freight or shipment, they can include the invoicing to the client as revenue rather than a bill.

Example Of Freight Out Expenses

As an example of Freight out costs, consider the following:

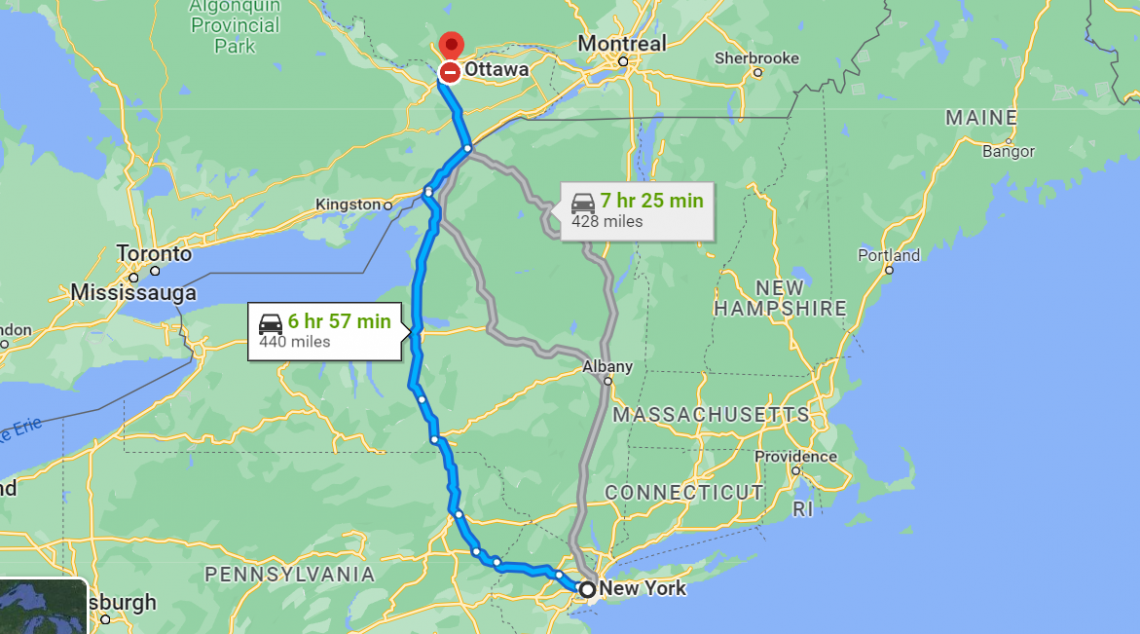

Joel Motors, a New York vehicle manufacturer, ships 200 automobiles to Ottawa, Canada, every quarter for $1,100 each car, resulting in a total freight expense of $220,000.

This cost is considered a part of the product cost on Joel Motors' income statement.

However, since the shipping fee is passed on to the Ottawa dealership as part of the transaction, Joel Motors can offset the expense by recording a corresponding revenue of $220,000 from the Ottawa dealership on its income statement.

| Particulars | Debit ($) | Credit ($) |

|---|---|---|

| Materials Cost | $1,000,000 | - |

| Freight Out | $220,000 | - |

| Revenue | - | $220,000 |

The above journal entry reflects how Joel Motors would record the costs associated with shipping its automobiles to Ottawa and how it would offset those costs with revenue received from the Ottawa dealership.

Free On Board (FOB) Freight Terms

Below is some freight-related terminology to better understand how to discuss freight expenses.

1. Free on Board (FOB) shipping point

The concept of "free on Board" refers to whether the customer or seller is responsible for products that are misplaced, destroyed, or damaged during transportation.

When a free-on-board shipping point is utilized, it signifies that the customer assumes this liability the minute the items are delivered to the freight company.

The term FOB shipping point refers to the fact that the sale takes place at the shipping point, and the customer pays for the cargo as a freight-in shipment. When the products arrive at the shipping location, they legally become the buyer's property.

2. Free on Board (FOB) destination

Free on Board destination indicates that the seller retains responsibility for the items until they are delivered to the customer. This also implies that the seller has legal ownership of the items and is accountable for them during the delivery procedure.

The seller pays for delivery, and the point of sale happens when the shipment arrives at the buyer's or destination's location. Ownership passes from the vendor to the customer when the products are delivered.

Freight Expense FAQs

The expense of shipping completed products to a distributor or retailer is referred to as freight-in. Freight-in is a selling charge that is deducted as it is incurred.

Freight expenditures are categorized as nominal accounts. All nominal accounts are those that are in the nature of a business's revenue and spending. These accounts are terminated at the end of the fiscal year with an income and expenditure summary to calculate the net loss or profit amount.

Nominal accounts begin the year with zero balances (or no balances) and conclude with no balance to carry forward.

When a company bills a client for shipping and freight, it must record these costs as revenue.

A manufacturer, for example, creates and distributes equipment to consumers. Revenue can be represented through shipping charges billed to consumers.

Divide the shipment's weight (in pounds) by the total cubic feet. The density is the end consequence (in pounds per cubic foot).

When dealing with several pallets, add the weight of each pallet before dividing by the total cubic feet of the cargo. Fractions must be rounded to the nearest full cubic foot.

Freight, sales tax, transportation, and installation charges should all be capitalized. Businesses should implement a capitalization policy with a monetary amount threshold.

In the realm of freight shipping, there are four primary modes of freight transportation accessible to shippers.

The basic modes of transportation are via land (road), train, ocean, and air. Although these are the primary modes of freight transportation, each has its own set of procedures that differ from one another.

Researched authored and by Shannon Fernandes | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?