Multi-Step Income Statement

Company's profits and losses throughout a given reporting period.

What is a Multi-Step Income Statement?

The multi-step income statement shows a company's profits and losses throughout a given reporting period. It provides an in-depth examination of a company's financial performance.

Its structure distinguishes between operational revenue and operating costs and non-operating income and expenses. Multi-step income statements are one of the two ways firms may declare their earnings.

A corporation's sales, costs, and total profit or loss are all reported on a multi-step income statement for a specific reporting period.

It is a more sophisticated version of the single-step income statement that calculates a company's net income using numerous equations.

Along with a balance sheet and a cash flow statement, an income statement, often known as a profit and loss statement, is one of three primary financial statements that all firms should compile as part of their financial accounting.

The publicly traded company most commonly utilizes multi-step income statements. The primary distinction of this kind of presentation is categorizing costs into direct (non-operational costs) or indirect (operational costs).

The direct costs can be directly attributed to the cost objects—a product, service, or project.

In comparison, indirect costs are generalized costs that are expended for the company.

Understanding a Multi-Step Income Statement

The multi-step income statement provides insight into how a company's critical business operations create income and affects expenses, as contrasted to the performance of its non-essential activities, by distinguishing between operational and non-operating accounting.

The method of a multi-step income statement that calculates net income differs from how an income statement calculates net income. A single-step income statement uses only one computation to arrive at net income.

Multi-step income statements, on the other hand, multi-step income statements compute net income using many equations. They compute gross profit and operating income, which are not reflected on a single-step income statement.

A single-step income statement, on the other hand, a single-step income statement provides a detailed financial activity record.

For this way of determining net income, it needs to employ three formulas.

Using the method to determine gross profit on the income statement:

Net Sales - Cost of Goods Sold = Gross Profit.

The formula for calculating operating income is

Gross Profit - Operating Expense = Operating Income.

The formula for calculating net income is

Operating Income + Non-Operating Items = Net Income

Components of a Multi-Step Income Statement

A multi-step income statement has the following main components:

Gross Profit – Operating Head

The first element of a multi-step income statement is gross profit, which is calculated by subtracting the cost of items sold from total sales. It demonstrates

- How efficient are the primary operations?

- How efficient is a corporation at producing or selling its goods?

Creditors evaluate gross profit to assess a company's capacity to satisfy looming debt commitments and repay outstanding credit.

Investors use gross profit to evaluate the profitability of core business operations and the company's overall health.

Other than the cash intake from the selling of goods and the cash outflow from the purchase of goods, no other expenses are considered when calculating gross profit.

Net sales – Cost of Goods Sold = Gross Profit

Selling and Administrative Expenses – Operating Head

The running expenditures of selling and administration are recorded in the second component of a multi-step income statement.

The expenditures paid while selling items to customers are known as selling expenses, including marketing expenses, sales, people's salaries, and freight charges.

Administrative expenses are not directly tied to the sale of goods, such office staff salaries, rent fees, etc.

Adding both marketing and administrative expenditures to the total operating expenses yields the total operating expenses. Following that, the operating income is determined as follows:

Gross Profit – Operating Expenses = Operating Income

Non-Operating Head

The non-operating head is the third part. It contains all business earnings and costs unrelated to the company's primary and core activities.

A litigation claim paid by the corporation as compensation to an aggrieved party following a court dispute is an example of a non-operating expenditure.

An insurance payout paid to the company's account as settlement proceeds for damage or loss of a company's asset can also be considered non-operating income.

The loss, interest, or gain must be from an unusual item not part of the company's routine operation for an expense or income to be recognized as non-operating.

After adding up the items under the non-operating category, the net income for the given time is calculated as follows:

Operating Income + Non-Operating Items = Net Income

How to Prepare a Multi-Step Income Statement?

A multi-step income statement is more difficult to prepare than a single-step income statement. The steps for creating a multiple-step revenue statement for the firm are as follows.

1. Decide on a reporting period

Someone must first choose a reporting period before anyone can begin preparing their income statement. Income statements are often generated weekly, quarterly, or yearly.

Financial statements are required by law to be prepared regularly and yearly for publicly listed businesses.

Making monthly financial statements allows someone to track how the earnings vary over time. This is useful information when making financial decisions regarding their firm, such as investing in new equipment.

2. Make a header for the document

Readers will get vital information from the heading of the multi-step revenue statement. It contains someone's company's name, identifies the document as an income statement, and specifies the reporting period that the document covers.

3. Add Revenues from Operations

The top portion of the multi-step income statement is someone's overall operational operations. To begin, add the operating revenues and the sales proceeds from selling the goods or services.

4. Include Operating Expenses in the calculations

Then, in the operational activities column, add the entire operating expenditures. This would include the costs of selling, advertising, wages, and administrative costs like office supplies and rent.

5. Determine the gross profit.

Subtract the cost of items sold from the net sales to arrive at the gross profit. Then, under the cost of goods sold, add the final sum as a line item and call it Gross Profit.

6. Calculate operating income

After that, someone will need to figure out the operating income. Subtract the operational expenditures from the gross profit to arrive at this figure.

Add the final calculation as a line item labeled Net Operating Income or Income from Operations at the bottom of the operating activities section.

7. Include Non-Operating Revenues and Expenses in the calculations

Create a segment for the non-operating operations in the bottom area of the income statement, below the operational activities. Include all non-operating revenues and costs, such as interest and the sale or purchase of investments.

8. Determine the net income

Calculating net income is the final stage in constructing a multi-step income statement. To do so, add the operating income and non-operating components together.

As Net Income, add the sum at the bottom of the income statement. That means reporting a profit if the figure is positive. Also, record a loss if the total is a negative figure.

Single-Step vs. Multi-Step Income Statements

A single-step income statement accounts for a business's net income straightforwardly. Still, a multi-step income statement accounts for net income in three steps, separating operational from non-operational revenues and costs.

Single-step or multi-step income statements are available to small enterprises with a simple operational structure, such as sole proprietorships and partnerships.

Income statements with only one phase are simpler to compile and need fewer computations. In addition, for many small firms, a single-step income statement gives all of the information someone will need to examine the company's financial health.

A multi-step income statement, on the other hand, a multi-step income statement is the ideal option if the small business is searching for a bank loan or fresh investment since it provides potential creditors and investors with more financial data about the company and may help them assess its long-term viability.

The multi-step revenue statement differs in several significant ways:

1. Ease of preparation

- The single-step income statement is the simplest to produce since it focuses on net income.

- On the other hand, the multi-step income statement needs three stages to complete and provides more information on business operations, making it particularly useful to investors and financial institutions.

2. The ability to figure out the gross profit

- The capacity to determine gross profit is one of the most significant distinctions between a single-step and a multi-step income statement.

- This statistic is critical for business owners who want more specific information on their company's profitability and financial health.

- Because gross profit considers sales income and the cost of products sold, business owners may understand how lucrative their core business is.

3. Understanding of how to calculate operating income

It's another metric available from the multi-step income statement. Rather than relying just on net income, operating income gives business managers more granular information about firm success.

Advantages of a Multi-Step Income Statement

Business owners put their resources into their companies to make a good profit. The company's accountant generates an income statement for each period indicating earnings or losses made during that time.

Maybe Business owners review the statements to track their decisions' progress. The income statement is available in two formats: multi-step income statement and single-step income statement.

Advantages of Single-Step Income Statements are:

- Single-step income statements take less time and effort to compile than multi-step income statements since they need fewer computations and don't break out operational vs. non-operating line items.

- Simple to Understand: The revenue statement in a single step is a time-saving document. It focuses on the bottom line and net income, so it's simple to evaluate the financial performance of the company.

Advantages of Multi-Step Income Statements include:

- Multi-step income statements provide a more detailed analysis of a company's revenue and costs, classified by operational and non-operating revenue, for greater insight into the company's financial health.

- Report Multi-step income statements to report gross profit, as opposed to single-step income statements.

- Gross profit is essential because it demonstrates how well a company generates income by utilizing labor and resources.

- Report Operating Income: A corporation's operating income is reported on multi-step income statements, providing insight into how effectively a company produces a profit from its major business operations.

Disadvantages of a Multi-Step Income Statement

Disadvantages of Multiple-Step Statements are:

- Due to the complexity needed in managing and collecting much data, multiple-step income statements can be labor-intensive for accounting teams to prepare.

- For example, according to this system, each form of revenue and cost must be meticulously classified, and each transaction must be meticulously recorded.

- Any blunder might lead to investors making incorrect assumptions about the company, resulting in a detrimental impact on the business.

Disadvantages of Single-Step Statements include:

- On the other hand, single-step income statements may be too sparse in information for certain investors.

- The lack of gross margin and operating margin data can make determining the source of most costs difficult and predict whether a firm will remain profitable.

- Investors may be less reluctant to invest in a firm without this information, causing organizations to miss out on opportunities to raise operating money.

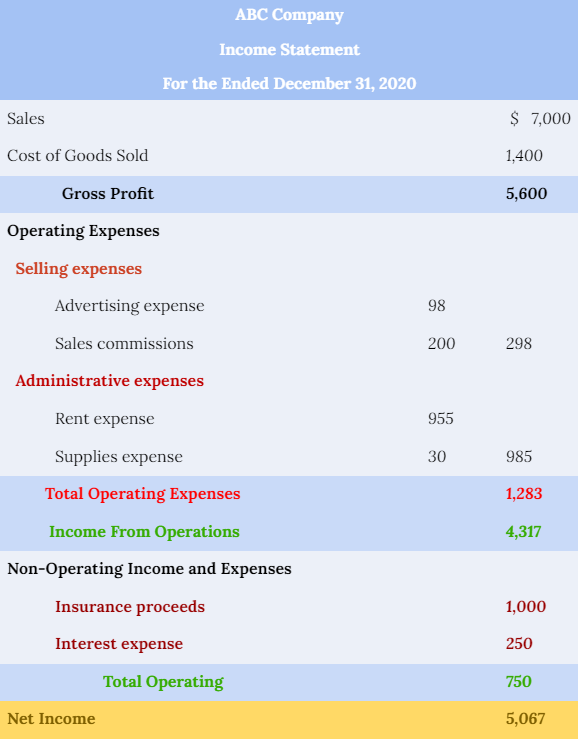

Example of a Multi-Step Income Statement

Let's look at an example of a multi-step income statement.

This multi-step income statement template computes net income in three steps, as shown below:

Step 1: Determine the gross profit (total sales less cost of items sold).

Step 2: Subtract gross profit from operating expenditures to arrive at income from operations.

Step 3: Calculate Net Income (Operating income less Non-operating and Other Income).

The gross margin portion includes the cost of products sold from operational expenditures. This is critical because it allows investors, creditors, and management to assess the sales and purchase the financial statement's efficiency.

The operating income of the firm is indicated in the operating part. After all operational expenditures have been paid, this is the amount of money the firm generated by selling its products.

This is an important metric since it depicts the company's health. A successful bottom line indicates that a company's operations are solid, although not all organizations with a profitable bottom line have good operations.

Take, for example, our retailer. It may have lost money on operations, but it was able to turn a profit thanks to a large insurance payment. Is this a viable business?

Most likely not. That is why this part is crucial.

Lastly, anyone can see the non-operating and other sections being subtracted to compute the net income.

The multi-step revenue statement provides significantly more data than the single-step income statement, but it may also be more deceptive if not correctly written.

To artificially boost their margins, management could move spending out of the cost of products sold and into operations. It's usually a good idea to look at comparative financial accounts over time to see trends and detect misplaced spending.

Researched and authored by Fatemah Kamali | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?