Share Capital

It provides the advantage of raising funds without incurring additional debt.

If you're thinking about starting an enterprise or investing in an existing one, it is vital to have a clear understanding of share capital and its implications.

Share capital is the backbone of an agency's monetary structure, representing the funds raised by issuing stocks to shareholders. But what exactly are stocks, and how do they relate to Paid-in capital? In simple terms, shares represent ownership in a company.

When a company authorizes shares, it breaks up its proprietorship into smaller pieces, also vented to investors. The investors who purchase these shares become shareholders and hold a stake in the company's successes and failures.

Share Capital provides the advantage of raising funds without incurring additional debt. Companies can raise money from many investors by issuing shares without paying interest or principal on a loan.

This makes Paid-in capital a more adaptable and cost-effective way for companies to capitalize on their operations and excrescence.

Utilizing share capital allows companies to avoid additional debt and focus on investing in growth opportunities.

When you buy shares in a company, you have the prospect of earning returns in two ways:

- Firstly, through dividends, which are a portion of the company's gains paid out to shareholders.

- Secondly, through capital earnings/gains, achieved by selling your shares at a higher price than you initially paid.

However, investing in shares also comes with risks. Share prices can be unpredictable, and there is no guarantee of earning a return on your investment.

NOTE

To mitigate these risks, exploring and investing in companies with a strong financial track record and growth eventuality is essential. Conduct thorough research and analysis before making investment decisions.

Another important aspect of Paid-up capital is that it can be exercised to boost finances for specific projects or initiatives.

For instance, a company might issue shares to finance a new product launch or to expand its operations into new requests.

Key Takeaways

- Share capital serves as the financial foundation of a company, raised through issuing shares to shareholders.

- It allows capital raising without increasing debt, providing flexibility and cost-effectiveness.

- Shareholders become owners and share the company's successes and risks. As a result, they can earn returns through dividends and capital gains.

- Share prices can be unpredictable, and there is no guarantee of earning a return on investment. Therefore, it's important to consider the risks associated with investing in shares.

- Paid-up capital supports initiatives like new product launches or expansion without additional debt. It helps companies focus on growth opportunities.

- The two types of share capital are Equity shares (ownership with voting rights) and Preference shares (preferential rights, fixed dividends).

- The capital-raising process involves hiring an underwriter/investment banker, IPO registration, regulatory verification, application submission, IPO pricing, and share allotment.

Comprehension of Share Capital

Share capital plays a critical role in shaping a company's economic structure, which refers to the funds a company raises by issuing shares to investors.

As a non-human entity, a company is required to record its capital in the liabilities side of its balance sheet since it is obliged to pay back the capital to its stakeholders.

However, the Paid-in capital is also shown in the shareholder's equity section of the balance sheet.

This displays the reality that shareholders have a claim on the enterprise's belongings and income, and their ownership stake inside the company is represented through the stocks they hold.

Here are some key points of share capital:

- Shareholders and Ownership

Each share represents a fractional ownership in the company. Investors who purchase shares become shareholders, holding a stake in the company's assets and income. - Recording Share Capital

Companies record their Paid-in capital in the liabilities section of their balance sheet, as they are obligated to repay the capital to stakeholders, and in the shareholder's equity section, reflecting shareholders' ownership stakes. - Advantages of Paid-up capital

Paid-up capital offers companies the significant advantage of raising funds without accumulating debt. By issuing shares, companies avoid the interest or principal associated with debt and can raise capital from multiple investors. - Working with Investment Institutions

Companies often collaborate with investment banks or underwriters to sell shares to investors. These institutions assist in determining appropriate share prices and market the shares to potential buyers. - Rights of Shareholders

Shareholders control the property and profits of the organization and have the right to vote on important business choices along with the election of the board of directors. - Risks and Returns

Investing in shares carries risks, as share prices can be unpredictable, and returns are not provided. However, a well-researched investment in a company with strong growth potential can yield long-term returns.

NOTE

Investors, shareholders, and companies must understand the nuances and distinctions of different Paid-in capital types.

Types of Share Capital

The two primary categories of share capital are equity and preference capital, each with its characteristics and implications for shareholders.

So, let's embark on this journey to unravel the intricacies of capital and its diverse forms.

The two main types of contributed capital are:

1. Equity Share Capital

Equity capital represents ownership in a company. Shareholders who maintain equity shares have voting rights and participate in decision-making processes. They also have the potential to receive a share of the company's profits in the form of dividends.

Equity shares are considered the riskiest form of investment but also offer the potential for higher returns. In the event of liquidation, these shareholders are paid out last from the company's assets.

2. Preference Share Capital

Preference capital refers to shares that carry certain preferential rights over equity shares. Preference shareholders receive a fixed dividend amount, usually at a predetermined rate, before dividends are paid to equity shareholders.

In the event of liquidation, preference shareholders have a higher claim on the company's assets than equity shareholders. However, they generally do not have voting rights or the same level of ownership control as equity shareholders.

NOTE

It is important for businesses to cautiously not forget the forms of capital and the rights attached to them, as it can impact ownership structure, vote-casting power, and the distribution of earnings and dividends among shareholders.

Additionally, there can be further variations and classifications within these two main types of contributed capital.

By understanding these types, stakeholders can make informed decisions and navigate the complex landscape of corporate ownership and financing.

For example, equity stocks can be labeled into distinctive instructions, including regular stocks and founder's shares, each with its own set of rights and privileges.

Similarly, preference shares can have different features, such as cumulative preference shares (where unpaid dividends accumulate and must be paid before equity dividends) or redeemable preference shares (which the company can buy back after a specific period).

Process To Raise Share Capital

Raising capital can be a critical element in expanding your business. Whether starting a new undertaking or expanding a subsisting one, securing finances can help you bring your vision to life.

Although, the technique of raising capital can be convoluted and daunting, specifically for people new to the finance sector.

Raising capital is pivotal for any business looking to grow and develop. It requires a clear understanding of the available accessories and a strategic approach to presenting your business to implicit investors or lenders.

The process can be complex and challenging, involving various steps and considerations. From identifying your funding needs to developing a strong pitch, and negotiating terms with investors, raising capital requires careful planning and execution.

NOTE

Different types of businesses may require different approaches to raising capital.

For instance, startups and early-level companies may also need seed investment from colleagues and their own families or angel buyers.

Whereas more settled businesses can get entry to institutional investors or traditional financial institution loans. Further, raising capital isn't always just about securing funds but also constructing relationships with buyers.

It involves effectively communicating your business model, financial projections, and long-term growth strategy and addressing any concerns or risks associated with investing in your company.

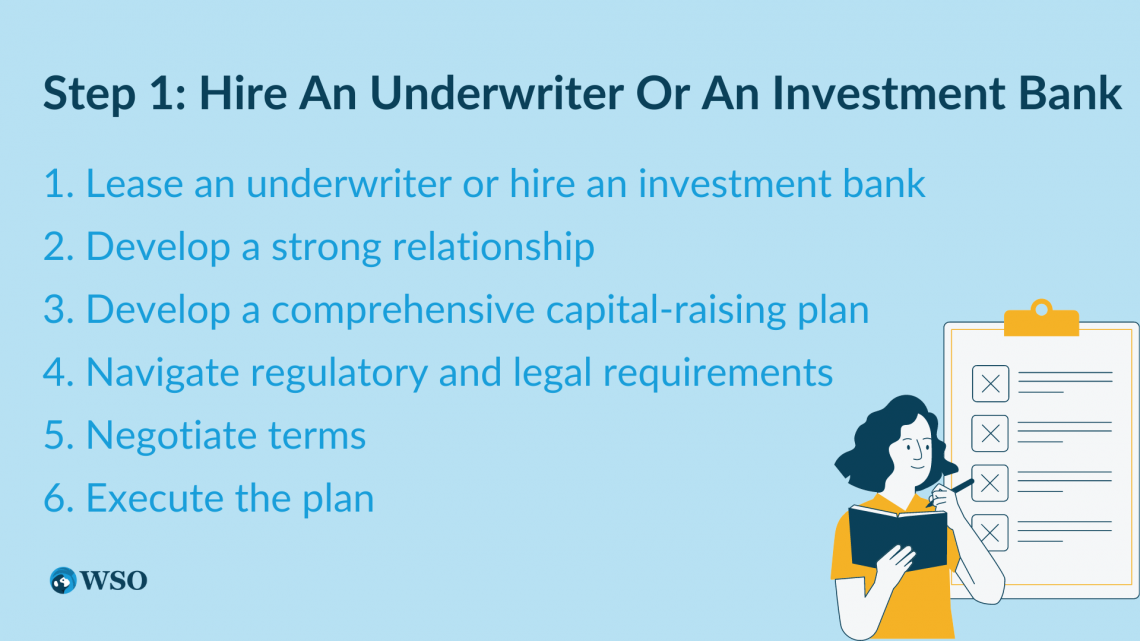

Step 1: Hire an underwriter or an investment bank.

One of the first steps is to lease an underwriter or hire an investment bank. These professionals possess the expertise and experience to assist companies in navigating the complex world of capital raising, offering a range of services to facilitate the process.

When beginning the capital-raising process, consider the following steps:

1. Lease an underwriter or hire an investment bank

- Find professionals experienced in capital raising to assist you.

- Look for a reputable company with a successful track record and industry expertise.

2. Develop a strong relationship

- Choose a partner you feel confident working with.

- Establish trust and collaboration for a successful capital-raising journey.

3. Develop a comprehensive capital-raising plan

- Work with your underwriter or investment bank to develop a strategy.

- Identify potential investors and target market segments.

4. Navigate regulatory and legal requirements

- Understand the regulations and laws related to capital raising.

- Ensure compliance throughout the process to avoid any legal complications.

5. Negotiate terms

- Determine the terms of the capital raising, such as share prices and investor rights.

- Seek favorable terms while considering the interests of all stakeholders.

6. Execute the plan

- Implement the capital-raising strategy with your underwriter or investment bank.

- Engage with potential investors, present your business, and seek investment.

Selecting the right underwriter or investment bank is crucial for a successful capital-raising process. Choose a partner with a proven track record, industry knowledge, and the ability to guide you through the complexities of capital raising.

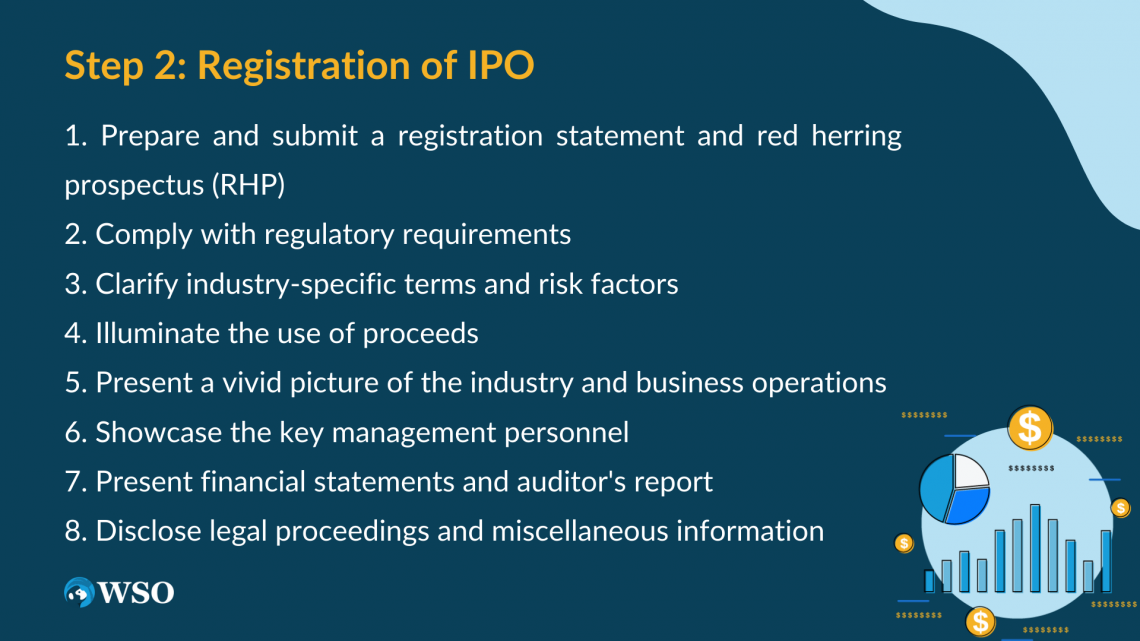

Step 2: Registration of IPO

When a company embarks on the journey of going public and conducting an Initial Public Offering (IPO) to raise capital, several crucial steps come into play:

1. Prepare and submit a registration statement and red herring prospectus (RHP)

The RHP is a comprehensive document that gives potential investors a window into the company's offerings. It includes definitions, risk factors, use of proceeds, industry and business descriptions, management information, financial statements, legal disclosures, and other pertinent details.

2. Comply with regulatory requirements

Ensuring that the registration statement and RHP align with the regulations set by the securities regulatory board is of utmost importance. This ensures transparency and accountability throughout the IPO process.

3. Clarify industry-specific terms and risk factors

By providing clear definitions of industry terms, the company enables potential investors to understand the business landscape better.

Disclosing risk factors is crucial, allowing investors to make informed decisions while assessing potential challenges and rewards.

4. Illuminate the use of proceeds

Clearly outlining how the funds raised from investors will be utilized gives them a glimpse into the company's plans for growth and expansion. In addition, this transparency empowers investors to evaluate the potential value of their investment.

5. Present a vivid picture of the industry and business operations

Offering insights into the company's operations within its industry segment helps potential investors grasp its market position.

NOTE

Describing products, services, target market, competitive advantages, growth strategies, and industry forecasts showcases the company's potential for success.

6. Showcase the key management personnel

Highlighting the management team's backgrounds, qualifications, and experience provides reassurance to investors. In addition, investors recognize competent leadership's crucial role in driving the company's performance and future prospects.

7. Present financial statements and auditor's report

Sharing comprehensive financial information and the auditor's report offers a snapshot of the company's fiscal performance. This enables investors to assess the company's financial health and make well-informed investment decisions.

8. Disclose legal proceedings and miscellaneous information

Transparently addressing legal proceedings or litigation involving the company helps investors evaluate potential risks. Including relevant miscellaneous information provides a comprehensive view of the company's business landscape.

NOTE

The RHP contains various key components, such as definitions, risk factors, use of proceeds, industry and business descriptions, management information, financial statements, legal disclosures, and miscellaneous information.

By diligently preparing and submitting the registration statement and RHP, the company demonstrates its commitment to transparency and provides potential investors with the information they need to make informed decisions.

This instills confidence in the company's offering and paves the way for a successful IPO. In addition, by providing comprehensive and transparent information to potential investors, the RHP facilitates informed decision-making and promotes confidence in the company's offering.

Step 3: Verification by Regulatory

Every stock market has a different regulator based on the country. The market regulator verifies the disclosures made by the company.

The regulatory agency is in charge of supervising the IPO process and ensuring compliance with rules. It thoroughly investigates the company's factual disclosure, checking the correctness of mandated disclosures, financial statements, and other relevant information.

The goal is to safeguard investment interests while still preserving market integrity. On the approval of the application, the company can announce the IPO date, which is a big step.

This announcement indicates the company's intention to make its securities available for public subscription. Prospective buyers are excited about this opportunity because they want to capitalize on the employer's increased capability.

It is critical to recognize that this regulatory body's duty goes beyond the IPO clearance procedure. It regularly monitors market activity as a regulating entity, enforces compliance with legislation, and provides an equal and transparent environment for investors.

NOTE

The Regulatory Bodies are empowered by legislative frameworks. These bodies diligently monitor market activities and enforce compliance with rules and regulations.

Through ongoing monitoring, regulatory bodies foster investor trust and promote the healthy development of the capital market.

Regulatory bodies, Such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, keep a critical function in upholding the integrity and efficiency of financial markets.

They hold a pivotal position in safeguarding investor pastimes, promoting market transparency, and maintaining a degree of playing subject for all members.

They conduct thorough inspections, investigations, and audits to ensure adherence to prescribed standards. In addition, they create a strong deterrent against fraudulent practices and misconduct by imposing penalties and sanctions for non-compliance.

Step 4: Making of Application to Stock Exchange

After completing important milestones, including the appointment of an underwriter, an initial public offering (IPO) listing, and full certification in a regulatory body, the company has settled important milestones in its journey of raising capital.

These initial steps have set the stage for the next crucial phase: making an application to the stock exchange. In this process, the company will submit a comprehensive set of documents, fulfill specific requirements, and convey its value proposition to the exchange.

The application will undergo meticulous scrutiny to uphold market integrity, protect investor interests, and ensure compliance with exchange regulations.

This marks a pivotal moment as the company takes a significant stride towards making its securities available for public subscription.

This step involves the formal submission of documents and fulfilling requirements set forth by the exchange in making an Application to the Stock Exchange:

1. Completion of groundwork

Hiring an underwriter, registering for an IPO, and undergoing verification by the regulatory body.

2. Application process

- Formal submission of documents and fulfilling requirements set by the stock exchange.

- Prepare a complete set of documents, including the prospectus, financial statements, and criminal disclosures.

- Scrutinize the documents for accuracy, transparency, and compliance with regulatory standards.

3. Drafting the application

- Strike a balance between comprehensive information and reader engagement.

- Use a mix of concise and detailed sentences, incorporating industry-specific language where necessary.

- Articulate the company's objectives, financial performance, growth potential, and potential risks or challenges.

4. Submitting the application

- Send the completed application to the Stock Exchange for evaluation.

- The exchange meticulously assesses the application and conducts due diligence.

- The provided information is scrutinized to ensure compliance and accuracy.

5. Content of the Application

- Convey the company's vision, mission, and strategic objectives.

- Showcase the unique value proposition and competitive advantage.

- Highlight the expertise and track record of the management team.

- Instill confidence in potential investors.

The application's content plays a crucial role in conveying the company's strengths, potential, and credibility to attract investors.

NOTE

The process of making an application aims to uphold market integrity, protect investor interests, and ensure compliance with exchange regulations.

The application's content should convey the company's vision, mission, and strategic objectives while showcasing its unique value proposition and competitive advantage.

Additionally, it should highlight the management team's expertise and track record, instilling confidence in potential investors.

Step 5: Pricing of the IPO

The process of pricing an Initial Public Offering (IPO) is a crucial step in the journey of raising contributed capital for a company.

It requires careful consideration of various factors to balance attracting investor interest and maximizing the funds raised. Let's explore the key aspects involved in determining the IPO price:

1. Extensive Analysis and Evaluation

- Assessing Financial Performance: Analyzing the company's revenue, earnings, cash flows, assets, and liabilities helps gauge its financial health and potential value.

- Evaluating Growth Prospects: Understanding the company's growth potential, market opportunities, and industry trends is essential in determining its attractiveness to investors.

- Market Conditions and Investor Demand: Considering the prevailing market conditions and investor sentiment provides insights into the demand for the company's shares.

2. Articulating Pricing Considerations

- Clear and Concise Statements: Effectively communicating pricing considerations requires concise statements that convey the main points succinctly.

- In-depth Explanations: Providing more detailed explanations helps readers, including potential investors, understand the pricing process comprehensively.

3. Financial Metrics and Valuation

- Analysis of Financial Metrics: Thorough exam of financial signs, inclusive of a sales boom, profitability, and cash flow, facilitates examining the corporation's cost.

- Market Comparables and Industry Benchmarks: Comparing the company's metrics with similar businesses in the market and industry provides a relative valuation perspective.

4. Balancing Investor Appeal and Long-term Sustainability

- Reasonable Upside Potential: The IPO price should allow for a reasonable upside potential for investors, enticing their interest in the company's growth prospects.

- Mitigating Overvaluation Risk: Setting the IPO price at a level that avoids excessive overvaluation is crucial to maintain long-term sustainability and to mitigate potential challenges.

NOTE

Market conditions, investor sentiment, and economic climate significantly influence the pricing decision. Therefore, assessing market volatility, investor confidence, and overall market appetite for IPOs is essential for setting the right price.

The IPO pricing process involves collaboration with underwriters, financial advisors, and other relevant parties who provide expertise and market insights.

This consultation helps determine an optimal price range that aligns with the company's interests while meeting investor expectations.

Pricing an IPO is a complex task requiring thorough analysis, financial metrics evaluation, and market conditions consideration. In addition, it is important to strike a balance between attracting investors and ensuring the long-term sustainability and growth of the company.

Through effective communication and consultation with experts, companies can navigate the intricacies of pricing and maximize their chances of a successful IPO.

Step 6: Share Allotment

The final step in the contributed capital-raising process is the share allotment. Once the IPO pricing has been determined, the company proceeds with allocating shares to investors who participated in the offering.

This step involves carefully assigning shares based on investor demand, regulatory requirements, and the company's overall allocation strategy.

The share allotment process can be described with a mix of concise statements and more detailed explanations. This approach will provide readers with a comprehensive understanding of the intricacies involved in allocating shares.

The share allotment process begins by analyzing the demand generated during the IPO subscription period.

The company reviews the number of shares requested by individual investors, institutional investors, and other categories, along with their respective investment amounts.

A designated party, such as a registrar or a lead manager, typically oversees the allotment of shares.

They carefully review the subscription applications, verifying investor eligibility and compliance with regulatory guidelines. Factors such as the size of the offering, the availability of shares, and the overall demand influence the allocation decisions.

Throughout the share allotment process, the company aims to ensure fair distribution and prevent any instances of favoritism or bias.

In addition, regulatory bodies and stock exchanges closely monitor this step to maintain transparency, protect investor interests, and uphold market integrity.

NOTE

The allocation of shares is typically done under predefined rules and guidelines. These may include provisions for minimum and maximum allotments per investor, priority allocation for certain categories, and pro-rata distribution based on the subscription amounts.

Once the shares have been allocated, the company communicates the allotment details to the investors.

This information includes the number of shares allotted to each investor, the share price, and any additional relevant instructions or disclosures.

The content related to share allotment should reflect the meticulousness of the process, emphasizing the company's commitment to ensure a fair and transparent allocation.

It should provide a balanced mix of clear statements and comprehensive explanations to engage readers and provide them with a thorough understanding of the share allotment process.

The share allotment process is a critical step in the contributed capital-raising journey. Using a combination of concise and detailed explanations, the content can effectively convey the complexities of allocating shares to investors.

This step requires careful analysis of investor demand, compliance with regulatory guidelines, and the company's allocation strategy to ensure fair distribution and uphold market integrity.

Share Capital FAQ

Shares and contributed capital have distinct meanings in corporate finance. A share represents an individual unit of ownership, entitling the holder to assets, earnings, and voting rights.

Paid-in capital refers to the total value of stocks issued by an agency, representing the aggregate real worth of its stocks in arrears. It is vital in determining a company's net worth or equity.

It encompasses the initial capital shareholders invest and can be categorized into different types, such as equity and preference shares.

While shares represent ownership units shareholders hold, Paid-in capital signifies the cumulative value of all issued shares.

Recognizing this difference is crucial for investors, aiding them in assessing ownership structures, evaluating ownership rights, and understanding the financial claims associated with shares.

Paid-in capital may be received through various channels, depending on the precise situations and targets of the person or corporation seeking it. Here are some common ways to acquire Paid-in capital:

A. Initial Public Offering (IPO)

Companies can raise Paid-in capital by going public through an IPO. In this process, shares are offered to the public, allowing individuals and institutional investors to purchase them and become shareholders.

B. Private Placements

Companies can raise Paid-in capital via non-public placements by presenting stocks to a select organization of investors, together with undertaking capitalists, private equity corporations, or strategic companions.

This approach is typically used by companies that are not ready for an IPO or prefer to maintain a more controlled ownership structure.

C. Rights Issues

Existing shareholders can be offered the opportunity to purchase additional shares in a company through rights issues. This enables companies to raise additional capital while allowing existing shareholders to maintain or increase their ownership stakes.

D. Venture Capital and Angel Investors

Startups and early-stage companies often secure Paid-in capital from venture capital firms or angel investors. These investors provide funding in exchange for equity shares, supporting the company's growth and development.

Companies can accumulate Paid-in capital by retaining a portion of their earnings over time. By reinvesting profits into the business, companies increase their wealth and Paid-in capital.

Yes, a company can alter its Paid-in capital, subject to legal and regulatory requirements. Altering Paid-in capital typically involves changing the number of shares issued, their nominal value, or the rights attached to the shares.

Here are some common ways a company can alter its Paid-in capital:

A. Increase in Paid-in capital

A company may decide to increase its Paid-in capital by issuing additional shares.

This can be done through rights issues, private placements, or public offerings, allowing the company to raise additional funds and potentially dilute existing shareholders' ownership.

B. Reduction in Paid-in capital

In certain situations, a company may seek to reduce its Paid-in capital. This could be done to eliminate accumulated losses, adjust the capital structure, or return excess capital to shareholders.

Reductions in Paid-in capital require regulatory approvals and may involve shareholder resolutions and court approval.

C. Share Buybacks

Companies can repurchase their own shares from existing shareholders. Share buybacks can be used to return surplus capital, improve earnings per share, or support share price stability.

The bought-back shares may be canceled, held as treasury shares, or reissued at a later stage.

D. Conversion or Subdivision

Companies may convert existing shares into a different class of shares or subdivide their shares to increase liquidity and affordability. This allows for more flexibility in attracting investors and adapting to changing market conditions.

E. Consolidation or Reverse Stock Split

The opposite of subdivision, consolidation, or reverse stock split involves reducing the number of shares outstanding while increasing their nominal value. This can be done to improve the perceived value of the shares or meet listing requirements.

or Want to Sign up with your social account?