Statement of Comprehensive Income

Refers to all changes in equity over a period, excluding those resulting from investments by owners and distributions to owners in a company's financial reporting

What Is The Statement of Comprehensive Income?

Comprehensive income (or total earnings) is defined as "all changes in equity over a period, excluding those resulting from investments by owners and distributions to owners" in a company's financial reporting.

For financial analysis from the shareholders' perspective, an economic measure of comprehensive income is required because that use disregards the consequences of shifting ownership interest (All changes in equity except those resulting from investment by or distribution to owners.)

The income statement does not include information regarding a company's equity, but a word of comprehensive income does. Total income can also be thought of as "other income."

An organization's accountant will determine this by taking the net income from the income statement and, as necessary, adding or subtracting this "other income."

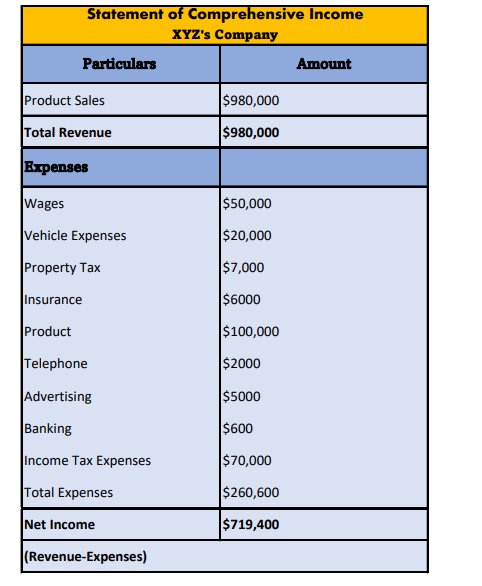

Here is an example of a complete income statement

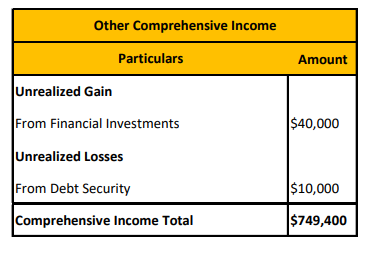

Other Comprehensive Income:

Because XYZ's business investments remain "unrealized" or still in play, they are not recorded as gains or losses on the company's income statement.

The above illustration demonstrates how creating a thorough income statement can give management a more accurate picture of the company's genuine income.

- It encompasses all equity changes except owner investments and distributions, providing a comprehensive view of a company's genuine income.

- Useful for assessing financial health and investment strategies, it goes beyond net income, revealing a company's performance and risks.

- Offers detailed revenue data, aids investor analysis, and enables tracking of company performance over time.

- Limited ability to predict future success, the potential for misleading information, especially when reliant solely on the income statement.

- Involves choosing a reporting period, creating a trial balance report, calculating earnings and costs, determining gross margin and operating expenses, considering income taxes, and arriving at net income, which helps in assessing financial performance over a specific period.

Why is Comprehensive Income important?

Comprehensive income is significant since the figures represent a company's earnings during a given time frame. Businesses with substantial financial investments will find this information to be helpful.

Realizing some assets may be able to keep the business afloat during times of lower profit if the firm is struggling but the investments are performing well.

According to multiple comprehensive income statements, the corporation may want to reconsider its investment strategy if investments continue to perform poorly.

One of the most significant aspects of the statement of comprehensive income is the income statement. It comprises all sources of income and spending, taxes, and interest payments.

However, net income merely accounts for earned income and outlays. As a result, organizations occasionally experience gains or losses due to changes in the value of their assets, which are not represented in net income.

Examples of unmentioned gains or losses include the following:

- Income from pensions and other retirement-related programs

- Adjusted payments made in foreign currencies

- Gains and losses resulting from valuation modifications\

- Profits or losses on unrealized debt securities

- Unrealized gains or losses on securities that are currently available for sale

It is important to note that small and medium-sized businesses rarely experience these problems. However, larger companies are more likely to have OCI items when facing financial difficulties.

While other comprehensive income, which includes any unrecognized balance sheet gains and losses that are not reflected in the income statement, is computed by adding net income, which is calculated by subtracting recognized revenues from recognized expenses, to the account of comprehensive income.

Advantages of Statement of Comprehensive Income

The advantages of the Statement of Comprehensive Income include the following:

1. Comprehensive revenue data

An income statement's primary objective is to display how a company produces revenue and the related costs. To emphasize these features, the income statement goes into great detail.

It covers additional expenses that are unrelated to operational operations, such as taxes, in addition to the cost of sales, which is linked to those activities.

Like the balance sheet, the income statement lists numerous revenue sources unrelated to a business's core activities. This covers items like interest accumulated on corporate investments.

2. Investors' approach to analysis

Investors use the income statement as a financial statement when determining whether or not to invest in a company.

The financial statements illustrate the earnings per share, or net earnings, and how they are distributed among the outstanding shares. So, naturally, company investment is more profitable with higher earnings per share.

3. It is a way to monitor the company's performance.

In the end, the income statement gives a view of the total bottom line. A profitable company is typically doing something correctly. If not, they might be doing it improperly.

You can start tracking the organization's entire performance when you examine income statements over time.

Some of the drawbacks of this document will be mitigated by comparing multiple statements because you can identify trends and take out one-time expenses that might impact the data.

Disadvantages of Statement of Comprehensive Income

Some of the disadvantages are as follows:

1. Future prediction is challenging

The statement of comprehensive income's biggest drawback is its inability to predict a company's future success.

The income statement will show operational trends from year to year, but it will indicate whether or when significant other comprehensive income components will be included.

2. Information Falsification

An income statement is a standard tool for assessing a company's financial health, although it has some significant shortcomings. For example, both current sales revenue and accounts receivable that have not yet been paid to the company are included in the income statement.

It also emphasizes expenses the company still needs to pay, including current and cumulative expenses. The future viability of a corporation, however, could be significantly impacted if its assets or liabilities contain a sizable unrealized gain or loss.

Therefore, depending just on an income statement could be misleading.

Steps to prepare Income Statement

The income statement displays a company's sales, costs, and net profit or loss. The balance sheet and statement of cash flows are the other two reports that make up a complete set of financial statements, making this one of the three components.

How to create an income statement is demonstrated in the stages that follow:

1. Choose a reporting period

Selecting the reporting period for your report is the first step in constructing an income statement. The most popular business options are annual, quarterly, or monthly revenue statements.

For publicly traded firms, quarterly and annual financial statements are required, but similar reporting obligations do not apply to small businesses.

You can use monthly income statements to help you see trends in your earnings and spending over time. You can use this information to help you decide on business moves that will increase your company's productivity and profitability.

2. Create a trial balance report

To create an income statement for a business, users must print a typical trial balance report.

Trial balance reports are administrative records showing each account's final balances in the general ledger for a specific reporting period.

Since a corporation gathers information about account balances by creating balance sheets, doing so is crucial to producing an income statement. As a result, users will receive all the end-of-period data required to generate an income statement.

3. Calculate Your Earnings

The next step is determining how much profit the business generated throughout the reporting period. The income includes all the money paid for the services during the reporting period, even if you have yet to receive all the payments.

Add up every line item in your trial balance's revenue section, then input the total.

4. Determine the sales cost

The cost of sales includes money you spend on direct labor, materials, and overhead when supplying your products or services.

Include the entire cost of sales directly below the revenue line item on the income statement in your trial balance report by adding up all the cost of sales line items.

5. Calculate the gross margin

Include the entire cost of the goods sold as a deduction from the total income on your income statement. This computation will yield the gross margin or revenue from selling company products and services.

6. Include operating costs

Include all operational costs in your trial balance report. Check each expense item to be sure you have the correct values. Then, put the entire sum down as an item for overhead costs on the income statement. It is located just below the gross margin line.

7. Determine Your Earnings

Deduct the total overhead costs from the gross margin. This will reveal your financial situation before taxes. The bottom of the income statement should contain the total.

8. Remember to include it in your income taxes

Your pre-tax income should be multiplied by the relevant state tax rate to calculate your income tax. Then, from the income statement's pre-tax income figure, deduct this.

9. Figure out your net income

To get your company's net income, subtract income tax from pre-tax revenue. Then, put the sum in the last line item of your revenue statement. This will provide you with a comprehensive picture of your business's progress and enable you to determine how profitable it has been.

10. Finish the income statement

To finish your income statement, add a header to the report stating it is an income statement. Indicate the reporting period for the income statement and the details of your organization. You have created an exact income statement using all the data you acquired.

This will provide you and your company with a better understanding of the definition of an income statement in the future.

Accumulated Other Comprehensive Income

Unrealized profits and losses netted below retained earnings and shown in the equity column of the balance sheet are included in accumulated other comprehensive Income (OCI).

Gains and losses on certain investment categories, pension schemes, and hedging trades can all be included as other comprehensive income. However, because the profits and losses have not yet been realized, it is excluded from net income.

The OCI account can be used as a gauge by investors looking at a company's balance sheet for potential risks or windfalls to net income.

Components of Other Comprehensive Income

Pension-related unrealized profits and losses are frequently included in cumulative other comprehensive Income (OCI). In addition, to support a pension plan, companies are subject to several duties.

For instance, a business must budget for special payments to retirees in future years under a defined benefit plan. As a result, the company's pension plan liabilities grow if the assets invested in the program are insufficient.

When the investment portfolio experiences losses, the firm's pension plan liabilities grow. OCI allows for the reporting of unrealized losses and retirement plan expenditures.

After the gain or loss is recognized, amounts are moved from OCI to net income. In addition, the balance sheet includes a line item for other comprehensive income.

The following are some typical instances of objects seen in the OCI account:

A) Gains or losses on listed firms as "available for sale."

Smaller, more diversified businesses like banks, insurance providers, and other financial organizations have significant investment portfolios. Treasury bonds and bills, stock in other firms, term financing certificates, etc., might all be included in these investments.

These businesses include the income statement's realized profits or losses for sold investments. At the end of the financial quarter, the corporation will still hold significant investments.

The unrealized profits and losses on these "available for sale" securities are displayed on the balance sheet as other comprehensive income.

B) Gains or losses resulting from a derivative contract used as a hedging mechanism

Derivative contracts are used by businesses to reduce risk, among other things. For example, a company might sign a futures contract to protect itself against rising oil prices, which account for its production costs.

Oil prices will change on the market during the financial term as the derivative contract is started. This would imply that depending on which way the prices moved, the corporation would have unrealized gains or losses on its derivative contracts.

C) Gains or losses from the exchange of currencies.

Currency fluctuations will affect a company's profitability if it receives a portion of its sales from abroad. A higher native currency would negatively affect a company's total sales and profitability.

Foreign exchange adjustments will thus appear in other comprehensive income as unrealized profits or losses. These unrealized profits or losses will be reflected in the income statement and realized after the earnings have been transferred back to the nation of origin.

D) Gains and losses in pension plans.

A corporation builds a portfolio of assets to pay for its pension obligations. As a result, the company will experience a gain known as "funded surplus" as long as it earns the required return on its planned assets to cover any growth in pension obligations.

The converse will be accurate if the company's assets cannot cover the pension fund's liabilities. Therefore, the OCI will reflect this funded position (surplus or deficit).

Other Comprehensive Income

Other comprehensive Income (OCI) in company accounting refers to revenues, expenses, gains, and losses that have not yet been realized but are not included in net income on the income statement.

A portfolio of bonds that have yet to reach maturity and have not been repaid is a typical illustration of OCI.

The interim adjustments are therefore recorded in other comprehensive income since the gains or losses resulting from the fluctuating bond value cannot be fully identified until their sale.

Other comprehensive Income (OCI), which tracks unrealized and realized profits and losses from specific transactions, is accumulated in other total Income (AOCI).

Unrealized refers to paper gains and losses, typically excluded from a small business's net income computation.

Other comprehensive incomes and net income are included in the statement of total income, whereas accumulated other comprehensive income is included in the shareholders' equity section of the balance sheet.

In the equity section, "other comprehensive income" is classified as "accumulated other comprehensive income" (summed or "aggregated").

The balance of AOCI and the balance of Retained Earnings, which combines past and present earnings and past and present dividends, are shown in the Equity portion of the Balance Sheet.

While such things influence a company's balance sheet, following GAAP reporting requirements, their impact is not recorded on the income statement and does not influence net income.

The "paper" gain or loss would then manifest and impact the company's income statement and net income after it was realized.

Furthermore, because OCI has no impact on net income, it also has no impact on the retained earnings account on the balance sheet.

A "gain" would result in an increase (credit) to the AOCI account, whereas a "loss" would result in a decrease to the AOCI account (debit).

Conclusion

Given the asymmetric information and the numerous and diverse goals of the corporate entities, the challenge of conceptualizing and, in particular, measuring the firm performance under the influence of international accounting standards is far from obtaining a suitable response.

The long-term financial statements compare the two balance sheets' values over time. It considers the costs and revenues produced by the ongoing activities and the profit or loss incurred by retaining assets.

The comprehensive income preserves the balance sheet's usability and the profitability and loss report. The net income is the most appropriate measure of the present operational performance in the comprehensive income structure.

Making business decisions is a combination of art and science. A business owner must closely examine the income statements and other financial statements.

Planning a successful business requires balancing various factors and possibilities, drawing definite conclusions from solid data, and using experience and judgment.

The single-step income statement summarizes the company's sales, costs, and profits or losses for the year. It is an easy-to-read document. Therefore, it can only be used by smaller firms or larger organizations for internal management purposes.

The bigger organization can use these to assess a company's performance for the fiscal year and create a budget for the primary income and expense categories for the next fiscal year.

or Want to Sign up with your social account?