Fixed-Rate Loans

A loan in which the interest rate is fixed throughout its life or for a portion

What are Fixed-Rate Loans?

A fixed-rate loan is a loan in which the interest rate is fixed throughout its life or for a portion. Most borrowers choose a fixed rate for long-term loans since they can accurately forecast future costs and monthly payments.

A borrower would want such a loan when taking out a 15-year mortgage to buy a property. For example, a fixed rate would reduce the risk of interest rates shifting over the period, raising mortgage payments.

What Is a Loan?

A loan is a credit instrument in which a sum of money is provided to another party for future repayment of the value or principal amount.

In many circumstances, the lender will add interest and finance charges to the principal amount owed by the borrower and the principal sum owed. For example, loans might be for a set sum or an open-ended line of credit up to a certain maximum.

Secured, unsecured, commercial, and personal loans are among the several types of loans available.

How Does Fixed Rate Loans Work?

Such a loan's interest rate remains constant during the loan period, regardless of interest rate or inflation fluctuations. Therefore, it indicates that the loan expenses and monthly payments will stay consistent for the entire duration.

The duration of the loan and the current interest rate environment will determine whether or not choosing such a loan is the best option.

The number of monthly installments made by the borrower grows as the interest rate rises.

Fixed interest rates are impervious to economic changes, but variable interest rates vary as the economy moves.

This loan is preferable over a variable-rate loan if current interest rates are low but are predicted to rise considerably. This is because a fixed-interest rate loan locks in the interest rate at the time of application and protects the borrower against future fluctuations.

On the other hand, if interest rates are predicted to fall, taking out a variable-rate loan is preferable to take advantage of lower borrowing expenses.

In such cases, a loan with a fixed interest rate would be more expensive, and the borrower will have to deal with higher interest rates than future accurate interest rates.

Types Of Fixed Rate Loans

The following are the most common types:

Automobile loans

A car loan can be a fixed-interest rate loan that requires borrowers to make monthly payments at a set rate for a set time. Borrowers can use the car they purchased as security when applying for an auto loan.

The borrower and the lender also agree on a payment schedule, including a down payment, recurring principal, and interest payments.

Assume a borrower takes out a $30,000 loan to buy a truck with a 10% interest rate, no money down, and a two-year repayment period. For this duration, the borrower will be expected to make monthly installments of $1375 [30000/24*1.1].

- If the borrower puts down $1,000, he will be responsible for $1,329 in monthly payments for the duration.

- If the borrower puts down $10,000, he will be responsible for $916.66 in monthly payments for the time.

- If the borrower puts down $20,000, he will be responsible for $458.33 in monthly payments for the time.

Mortgage

A mortgage is the most common type used by borrowers to purchase real estate. The lender agrees to offer cash upfront to set monthly payments under a mortgage arrangement.

The borrower utilizes the loan to buy a house and then uses the house as security until the debt is fully paid off.

A 30-year mortgage, for example, is a common type of fixed-rate loan that consists of fixed monthly payments spread out over 30 years. Charges paid towards the loan's principal and interest are periodic payments.

Fixed-Rate Loans vs. Variable-Rate Loans

Depending on the current interest rates, both fixed-rate and variable-rate loans have advantages and disadvantages. In addition, depending on the length and projected interest environment, borrowers can choose between a fixed-rate and a variable-rate loan.

Borrowers can choose various interest rate alternatives when taking out a home loan. For example, borrowers can opt for a fixed-rate mortgage, a variable-rate mortgage, or fixed and variable-rate mortgages.

The adjustable-rate mortgage is an example of a loan that combines fixed and variable rates. In addition, the borrower receives an introductory interest rate for a particular loan term period.

It is then adjusted regularly to reflect changes in the economy and the Federal Reserve lending rate.

In a declining interest-rate environment, an adjustable-rate mortgage is typically favorable since the rate adjusts to the changes in interest rates.

The most popular adjustable-rate mortgage product is the 5/1 adjustable-rate mortgage. It starts with a five-year fixed interest rate and then switches to an annual adjustable interest rate.

Borrowers will have to pay more excellent interest rates after the original five-year term if interest rates rise after the initial five-year period. The interest rate adjustment is based on an index plus a margin.

Fixed-Rate Mortgages

A fixed-rate mortgage has a fixed interest rate that does not alter over time. Although the amount of principal and interest paid each month varies as the principal amount changes, the overall interest payment remains constant, making budgeting for homeowners simple.

The significant benefit of such a loan is that it protects the borrower against substantial and unexpected increases in monthly mortgage payments if interest rates climb.

Fixed-rate mortgages are simple to comprehend and differ little from one lender to another. However, these mortgages can make it more challenging to qualify for a loan when interest rates are high since the payments are less reasonable.

Although the interest rate is fixed, the total interest an individual will pay is determined by the length of his mortgage. These mortgages are available from traditional lenders for various durations, the most typical being 30, 20, and 15 years.

Because it has the lowest monthly payment, the 30-year mortgage is the most popular option. However, because the extra decade, or more, is spent mainly on paying interest, the affordable payment comes at a substantially greater overall cost.

The shorter-term mortgages have larger monthly payments since the principal is repaid in a shorter period.

It also has a lower interest rate, allowing for a more significant amount of principal to be returned with each payment. As a result, shorter-term mortgages are much less expensive in the long run.

Adjustable-Rate Mortgage Terminology

Because ARMs (adjustable-rate mortgages) are substantially more sophisticated than fixed-rate loans, grasping the benefits and drawbacks necessitates an essential awareness of terminology.

Before choosing an ARM, borrowers should understand the following concepts:

- Interest-Rate Adjustment Frequency: This is the time (monthly, yearly) between interest-rate changes.

- Adjustment Indexes: Adjustments to interest rates are linked to a benchmark.

The interest rate on a specific asset, such as certificates of deposit or Treasury bills, is also referred to as a specialized index like the Secured Overnight Financing Rate (SOFR), Cost of Funds Index, or London Interbank Offered Rate (LIBOR).

- Margin: an individual agrees to pay a rate more significant than the adjustment index when he signs the loan.

His adjustable rate, for example, might be the rate of a one-year T-bill + 5%. The margin refers to the additional 5%.

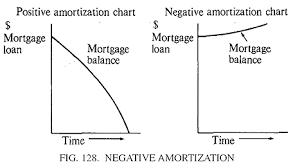

- Caps: A limit on how much the interest rate can rise each adjustment period is a cap. Some ARMs also have payment limitations on the overall amount due each month.

They, also known as negative amortization loans, have modest monthly payments but only cover a fraction of the interest owed.

Interest that is not paid is added to the principal. As a result, the individual's principal owing may be more than the amount you initially borrowed after years of payments.

- Ceiling: it is the maximum of the adjustable interest rate. It can go through the loan's life.

The main benefit of an ARM is that it is significantly less expensive than a fixed-rate mortgage during the first three, five, or seven years.

ARMs are particularly appealing since they generally allow borrowers to qualify for a larger loan due to their modest initial payments.

Borrowers can benefit from reduced interest rates (and lower charges) without refinancing their mortgage in a falling interest-rate environment.

An ARM can save a borrower hundreds of dollars per month for up to seven years, after which their payments are expected to climb.

Instead of the initial below-market rate, the new rate will be based on market rates. If the individual is lucky, depending on market rates at the rate reset, it may be cheaper.

The ARM, on the other hand, has several substantial drawbacks. First, the monthly payment on an ARM may fluctuate throughout the loan's term.

Furthermore, suppose an individual takes out a large loan. In that case, he may find himself in difficulties if interest rates rise: Some ARMs are designed so that interest rates can practically quadruple in a matter of years.

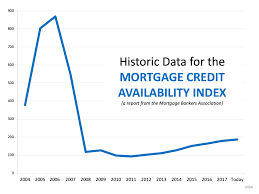

After the subprime mortgage meltdown of 2008, which ushered in an era of foreclosures and short sales, adjustable-rate mortgages fell out of favor with many financial advisors.

When ARMs were modified, borrowers were hit with sticker shock as their payments rose. Fortunately, new government laws and legislation have been enacted to improve the housing bubble's control, which turned into a worldwide financial catastrophe.

The Consumer Financial Protection Bureau (CFPB) has helped consumers avoid fraudulent mortgage tactics. As a result, lenders lend to borrowers with a good chance of repaying their debts.

Candidates for ARMs

The following are the eligible candidates for ARM:

The Short-Term Homeowner

An ARM might be a good option if an individual needs modest payments now and does not expect to stay in the house long enough for rates to climb.

As previously stated, an ARM's fixed interest rate duration varies, often ranging from one to seven years, so an ARM may not be appropriate for those who want to stay in their house for longer.

On the other hand, an ARM makes a lot of sense if the borrower knows he will move soon or does not want to stay in his current home for decades.

Because of the current interest rate situation, an individual can get a five-year ARM with a 3.5% interest rate. On the other hand, a 30-year fixed interest rate mortgage would have an interest rate of 4.25%.

He will save much money on interest if he relocates before the five-year ARM resets.

However, if he decides to stay in the property for a more extended period, significantly when interest rates rise when his loan adjusts, the mortgage will be more expensive than a fixed interest rate loan.

An ARM may be perfect for a person if they want to upgrade to a larger house once they have a family or think they will be relocating for employment.

The Bump-Up-In-Income Earner

A fixed-interest rate mortgage is better for folks with a steady income who do not expect it to rise dramatically in the future. On the other hand, if an individual intends to raise his revenue in the future, an ARM might save them a lot of money in interest over time.

Assume a graduate student is shopping for his first house after graduating. When his loan adjusts to a higher rate, there is a good possibility he will earn more in the future years and be able to handle the higher payments.

In this situation, an ARM will suffice. If he plans to receive money from a trust at a given age, he might acquire an ARM that resets the same year.

The Pay-It-Off Type

Mortgage borrowers who have, or will have, the means to pay off the loan before the new interest rate kicks in will find an adjustable-rate mortgage highly appealing.

While this does not apply to most Americans, there are several circumstances in which it may be achievable.

Consider a borrower who is purchasing and selling a home simultaneously. That individual may be compelled to buy a new house while the previous one is under contract, resulting in a one-year ARM.

When the borrower receives the sales profits, they can use the money to pay down the ARM.

Which Loan Is Right for You?

When deciding which mortgage to pick, you must weigh various personal concerns against the economic realities of an ever-changing market.

Individuals' finances go through ups and downs, interest rates increase and fall, and the economy's vitality waxes and wanes. Consider the following questions to place your loan choices in the perspective of these factors:

- What mortgage payment can you currently afford?

- If interest rates rise, would you still be able to afford an ARM?

- How long do you plan to stay at the house?

- What direction are interest rates going now, and do you think that trend will continue?

Then, if you consider getting an ARM, you should run the math to see the worst-case situation.

An ARM will save you money every month if you can still afford it if your mortgage resets to the maximum ceiling in the future.

If you utilize the money saved over a fixed-rate mortgage to make extra monthly principal payments, the total loan will be less when the rate resets, decreasing costs.

If interest rates are high and predicted to decline, an ARM will allow you to benefit from the decrease because you are not tied to a specific rate.

A fixed-interest rate mortgage may be the best option if interest rates rise and you want a consistent, predictable payment.

The Bottom Line

Choosing wisely can help you avoid costly blunders regardless of the loan. However, one thing is sure: do not choose an ARM because you believe the reduced monthly payment is the only option to get into your dream home.

You could obtain a comparable rate at the reset, but it is a significant risk. So instead, it is advisable to look for a property with a lower price tag.

Researched and authored by JunFeng Khan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?