VantageScore

VantageScore is a credit scoring system that was introduced in 2006 as an alternative to the dominant FICO score.

VantageScore is a credit scoring system introduced in 2006 as an alternative to the dominant FICO score.

The model was created to give customers greater transparency, ownership, and influence over their credit rating and a more reliable, consistent means to assess creditworthiness.

VantageScore uses a scoring range of 300 to 850, just like the FICO score. However, this model is different from FICO in several key ways. First, it prioritizes recent credit history above historical credit history, one of the largest variances.

This indicates that your score is likely better than your FICO score if you have a recent history of timely bill payments and maintaining a low credit balance.

Another important difference between the two is the way they treat credit inquiries. For example, VantageScore considers several requests for the same kind of credit made quickly instead of just one.

This implies that your score will not be punished as severely as your FICO score would be if you apply to numerous lenders quickly when looking for a mortgage or vehicle loan.

It also places more importance on credit utilization than FICO does. The percentage of your credit limits to your credit balances is your credit usage. If you have a high credit usage rate, it can be a warning sign to lenders that you rely on credit excessively.

If you have a high credit usage rate, your score will be lower than your FICO score since other metrics weigh this factor more seriously than FICO does.

This model has the benefit of being updated more regularly than FICO. It updates its models every few years, while FICO updates them less frequently.

The VantageScore framework is more likely to capture changes in the credit environment, such as adjustments to lending policies or consumer behavior.

It also gives customers better access and control over their credit ratings. It offers a free credit score to consumers through its website, which can be updated as frequently as every month.

It gives users a credit simulator tool to visualize how certain decisions—like paying off an outstanding credit card bill or establishing a new account—would impact their credit ratings.

It uses a scoring range of 300 to 850, just like FICO. In addition, it emphasizes recent credit history, treats credit inquiries differently, and places more importance on credit utilization.

It is updated more frequently than FICO, giving consumers more transparency and control over their credit scores.

- VantageScore calculates credit scores based on payment history, credit utilization, length of credit history, credit mix, and recent credit behavior.

- It differs from FICO's use of yearly credit data and alternative data sources.

- The scoring range for VantageScore is 300 to 850, with VantageScore 4.0 introducing a revised scoring range of 300 to 600 for the lowest score band and 601 to 850 for the Highest score band.

- Consumers can access their VantageScore for free through credit monitoring services, financial institutions, and AnnualCreditReport.com.

- VantageScore does not penalize consumers for rate shopping by treating multiple inquiries for the same type of credit within a short period as a single inquiry.

- Consumers can improve their VantageScore by making on-time payments, keeping credit utilization low, maintaining a long credit history, and limiting credit inquiries.

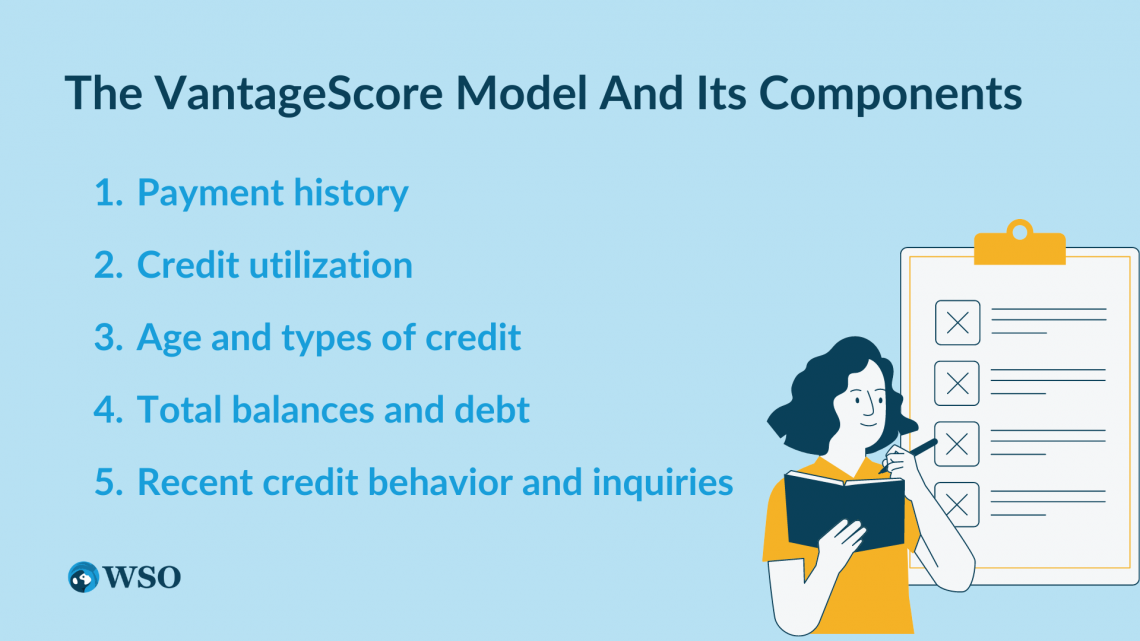

The VantageScore Model and Its Components

It was launched in 2006 as an alternative to the FICO score, offering a more precise and dependable approach to checking creditworthiness. This model has several components used to calculate a consumer's credit score.

1. Payment history

The payment history component of this model looks at a consumer's payment history on their credit accounts, including credit cards, loans, and mortgages.

Payment history is one of the most important factors in determining a consumer's credit score, and late or missed payments can significantly negatively impact a consumer's score.

When calculating a consumer's score, the model considers the frequency, recency, and severity of late payments.

2. Credit utilization

Credit usage is the term used when a consumer uses more credit than they have available to them. The model's credit usage component examines a consumer's credit limit and how much they utilize.

A high credit usage rate may warn lenders that a consumer depends excessively on credit. Compared to the FICO model, the model weighs this factor more heavily; therefore, if a customer has a high credit use rate, their score will be lower.

3. Age and types of credit

The model's age and types of credit component look at the age of a consumer's credit accounts and the different types of credit they have.

The model considers the kind and number of credit accounts a customer has had over time.

This model component determines a consumer's credit experience and how well they have managed credit accounts over time.

4. Total balances and debt

The total balances and debt component of the model looks at the total amount of debt a consumer has and the types of debt they have.

This model component determines a consumer's credit capacity and how much debt they can reasonably handle based on their income and other financial obligations.

The debt-to-income ratio is taken into account by the model, along with the overall amount of debt an individual owes.

5. Recent credit behavior and inquiries

The model's recent credit behavior and inquiries component looks at recent credit behavior. This includes new credit accounts, credit inquiries, and credit limit increases.

The model considers how frequently a consumer has applied for credit and whether they have been approved or denied.

The model also looks at how many new credit accounts a consumer has opened recently and how many credit inquiries have been made on their credit report. This model component determines how much credit risk a consumer poses to lenders based on their recent credit behavior.

The model is a credit scoring system that uses several components to determine a consumer's creditworthiness. These components include payment history, credit utilization, age and types of credit, total balances and debt, and recent credit behavior and inquiries.

Each component is used to calculate a consumer's credit score, which ranges from 300 to 850.

By understanding the different components of the model, consumers can take steps to improve their creditworthiness and manage their credit more effectively.

Difference Between FICO and VantageScore

Two separate credit scoring algorithms are employed to assess a consumer's creditworthiness. While both models use similar data, they have key differences in methodology, scoring range, and industry adoption.

| Point Of Differentiation | FICO | VantageScore |

|---|---|---|

| Methodology | The FICO model, developed by Fair Isaac Corporation in the 1980s, is the most used credit scoring model in the US. Payment history, credit usage, length of credit history, categories of credit, and current credit behavior are the five factors used by the FICO model to determine a consumer's credit score. | The model uses six components to calculate a consumer's credit score: payment history, credit utilization, age and types of credit, total balances and debt, recent credit behavior and inquiries, and available credit. |

| Scoring range | A higher score on the FICO model indicates more creditworthiness, with a scoring range from 300 to 850. | The model also has a scoring range of 300 to 850, but it uses different score ranges for different credit score bands. |

| Industry adoption | While both models are widely used, the FICO model is still more widely adopted in the lending industry. More than 90 % of reputable lenders, according to FICO, base their lending choices on FICO ratings. | However, more than 2,500 lenders and financial institutions now employ this approach, which has grown in popularity in recent years. |

| Differences in methodology | The FICO model puts more weight on payment history and credit utilization. | The model places more emphasis on the age and types of credit a consumer has. |

| How do the models handle credit inquiries? | FICO treats multiple credit inquiries for the same type of credit as a single inquiry if they are made within a short period of time, typically 14 to 45 days. This is known as "rate shopping" and is designed to allow consumers to compare different lenders without negatively affecting their credit scores. | This model also considers rate shopping but does not require the inquiries to be made within a specific time frame. |

Consumers should know their credit scores from both models and any other credit scoring models that potential lenders may employ.

By understanding the different components and scoring methodologies used by each model, consumers can take steps to improve their creditworthiness and make more informed decisions about credit.

In conclusion, while both are widely used credit scoring models, they have key differences in methodology, scoring range, and industry adoption.

Consumers may make better credit judgments and take action to increase their creditworthiness by being aware of these distinctions.

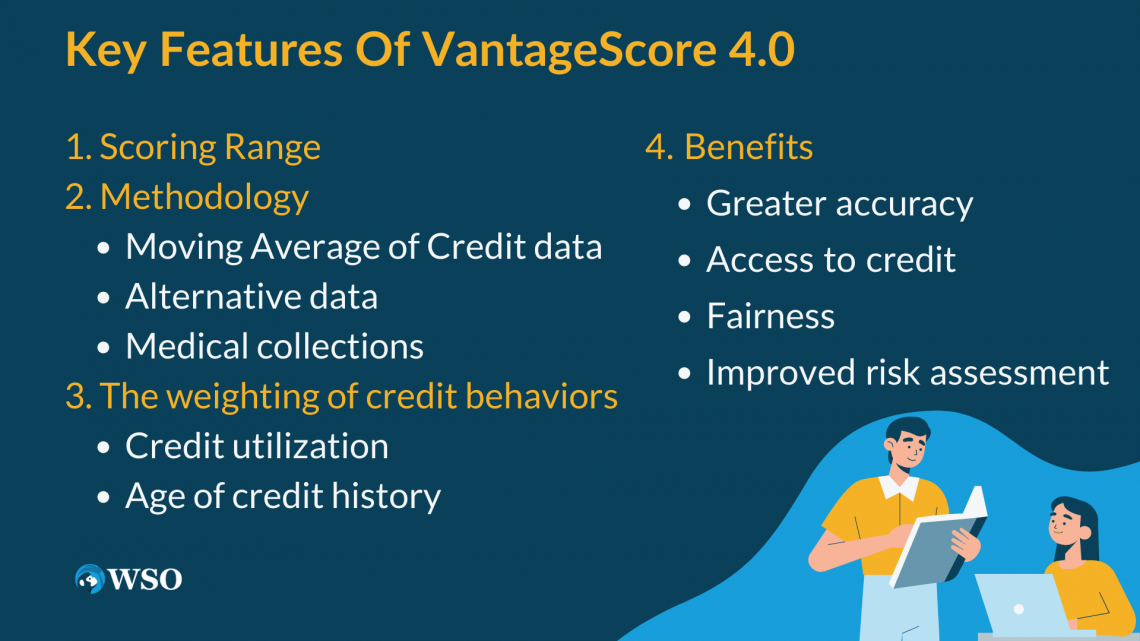

VantageScore 4.0

The most recent iteration of this credit rating methodology, introduced in 2017, is VantageScore 4.0. This revised version represents a significant update to the previous model, with changes to the scoring range, methodology, and how certain credit behaviors are weighted.

Here are some of the key features of this score mentioned below:

1. Scoring Range

The scoring range has been expanded from 300-850 to 300-600 for the lowest and 601-850 for the highest.

This is one of the significant modifications. This is intended to display a consumer's creditworthiness more clearly and truthfully, especially for individuals with lower credit ratings.

2. Methodology

This includes several changes to its methodology, including:

a. Moving Average of Credit data

It now includes the moving average of credit data, which allows lenders to see a consumer's credit behavior over time.

This implies that rather than only looking at a static picture of a consumer's credit report, lenders may see how their credit balances, payments, and utilization have evolved.

b. Alternative data

It also incorporates alternative data sources, such as rental payment history and utility bills, into its scoring model. This is designed to help consumers with thin credit files, such as those new to credit or who primarily use cash, build their credit history and access credit.

c. Medical collections

This metric treats medical collections differently, recognizing that medical debt is often unexpected and beyond the consumer's control.

3. The weighting of credit behaviors

It also makes changes to how certain credit behaviors are weighted, including:

a. Credit utilization

The new model emphasizes credit utilization, the amount of credit a consumer uses compared to their total credit limit.

High credit utilization can signify financial distress, and this model now places more weight on this factor in determining a consumer's credit score.

b. Age of credit history

It emphasizes the age of a consumer's credit history, particularly those with thin credit files. This recognizes that a longer credit history can indicate more stability and predictability in a consumer's credit behavior.

4. Benefits

The new features and changes offer several benefits for both consumers and lenders:

a. Greater accuracy

Expanding the scoring range and including moving averages of credit data provide a more accurate representation of a consumer's creditworthiness and behavior over time.

b. Access to credit

Including alternative data sources can help consumers with thin credit files build their credit history and access credit.

c. Fairness

The changes to how certain credit behaviors are weighted, particularly the treatment of medical collections, can help to ensure that the credit scoring model is fair and equitable for all consumers.

d. Improved risk assessment

The updated methodology and weighting of credit behaviors can help lenders to make more informed decisions about lending risk, reducing the likelihood of defaults and delinquencies.

The new score represents a significant update to the previous credit scoring model, with changes to the scoring range, methodology, and how certain credit behaviors are weighted.

VantageScore FAQ

The scoring range for VantageScore is 300 to 850, with higher scores indicating better creditworthiness. However, the newer version introduced an updated scoring range of 300 to 600 for the lowest score band and 601 to 850 for the highest score band.

While VantageScore and FICO are credit scoring models, they use different algorithms and scoring ranges.

VantageScore includes the moving average of credit data and alternative data sources in its calculations, while FICO does not. It also has a different scoring range and weighting of certain credit behaviors.

Many credit monitoring services and financial institutions offer free access to these credit scores. For example, through each of the three main credit agencies, consumers may check their score for free once a year by browsing AnnualCreditReport.com.

No, it does not penalize consumers for shopping around for credit. The scoring model allows for rate shopping by treating several requests for the same kind of credit made quickly as one.

Yes, there are several actions customers can take to raise their scores, such as paying bills on time, having a low credit use rate, building a long credit history, and reducing credit inquiries.

It's also crucial to routinely review your credit reports for any mistakes or inconsistencies that can hurt your score.

or Want to Sign up with your social account?