Equilibrium

The term represents a point at which there is no tendency for change. Equilibrium occurs when opposing forces or factors are in balance, resulting in a state of rest or stability.

What is Equilibrium?

Equilibrium represents a point at which there is no tendency for change. Equilibrium occurs when opposing forces or factors are in balance, resulting in a state of rest or stability.

Equilibrium is used to analyze and explain the behavior of systems, markets, and economies. However, in numerous fields like economics, physics, and biology, it refers to a state of balance or stability.

In economics, equilibrium performs a fundamental position in understanding the interactions between supply and demand, costs, and the allocation of resources.

It offers a framework to know the interactions among buyers and sellers, the quantity of products or services exchanged, and the price at which transactions arise.

Through understanding equilibrium, economists can gain insights into market efficiency, resource allocation, and the potential effects of external factors on market outcomes.

It isn't a static state but rather a dynamic process. It is subject to various impacts and may be affected by modifications in supply and demand, shifts in purchaser preferences, technological advancements, government policies, and different factors.

As such, it represents a point of stability that can be disrupted and adjusted as conditions change. The idea of equilibrium offers a basis for studying market conduct, predicting results, and formulating policies.

It helps economists and policymakers apprehend the forces at play in markets, become aware of inefficiencies or imbalances, and discover the potential consequences of interventions or external shocks.

By studying the concept of equilibrium, we can benefit from insights into the functioning of complicated systems and the factors that shape their stability or instability.

Key Takeaways

- Equilibrium represents a state of balance and stability where opposing forces or factors are in balance. It is a point at which there is no tendency for change, and the system or market is in a state of rest.

- Equilibrium in markets is achieved through the interaction of supply and demand. It is the point where the quantity of a good or service demanded by buyers equals the quantity supplied by sellers. At equilibrium, there is no excess demand or excess supply.

- It is a dynamic process that can be easily influenced by various factors. Changes in consumer preferences, production costs, technology, government policies, and other factors can shift supply and demand, leading to new equilibrium points.

- It helps economists and policymakers analyze market dynamics, predict outcomes, and formulate policies to promote stability and efficiency. Equilibrium serves as a fundamental concept in economic analysis and decision-making.

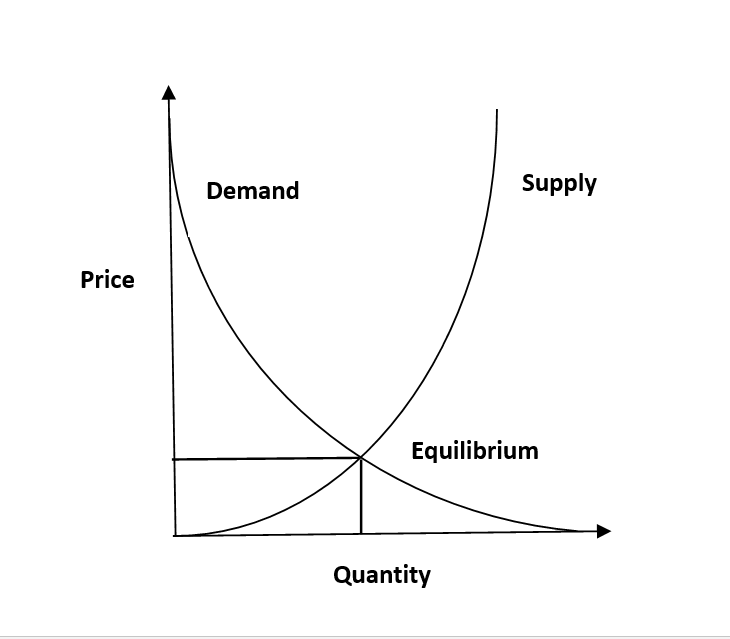

Understanding the Supply and Demand of Equilibrium

This concept refers to the state in which the quantity of a good or service that clients are willing and in a position to buy (demand) is equal to the amount that sellers are inclined and capable of providing (supply).

It represents the point of balance in a market with no inherent tendency for prices or quantities to change. At equilibrium, the marketplace has no surplus demand or surplus supply.

The equilibrium price, also called the marketplace-clearing charge, is the price at which the quantity demanded equals the amount supplied. It's far to the point where consumers are willing to pay for the best service, and sellers are willing to sell it.

The equilibrium quantity is the quantity of the goods or services exchanged at the equilibrium price. It represents the quantity demanded and supplied when the market is in balance.

Various factors influence the determination of supply and demand. Some factors can shift the supply and demand curves, leading to changes in equilibrium price and quantity, such as:

- Changes in consumer preferences

- Incomes

- Population

- Production costs

- Government policies

- Technological advancements

A shortage or a surplus occurs when the market is not in equilibrium.

A shortage happens when the quantity demanded exceeds the quantity supplied at a given price, leading to upward pressure on prices.

A surplus occurs when the quantity supplied exceeds the quantity demanded, resulting in downward price pressure. These imbalances create market forces that drive prices and quantities toward the equilibrium.

This is a fundamental idea in economics because it presents insights into the functioning of markets, price determination, and efficient allocation of assets.

By analyzing supply and demand interactions, economists and policymakers can understand marketplace dynamics, expect market outcomes, and make informed decisions to promote stability and performance.

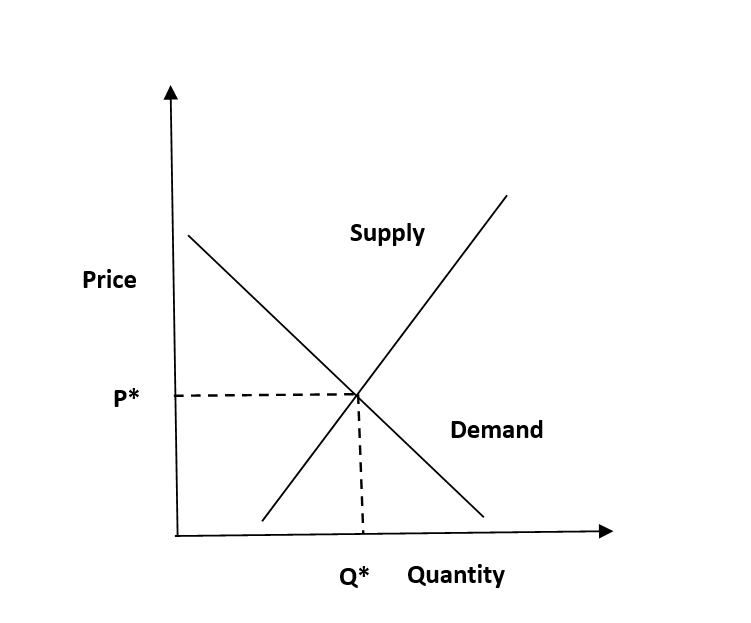

Equilibrium Point

Refers to the price and quantity at which the quantity demanded and the quantity supplied in a market are equal, resulting in a balance or equilibrium.

The equilibrium price, additionally known as the marketplace-clearing price, is the rate at which the quantity demanded by customers equals the quantity provided by means of sellers.

It is the point where the intentions of buyers and sellers align, and there is no inherent tendency for prices to change. On the equilibrium price, the market is in a state of balance, and there is neither a scarcity nor a surplus of the good or service.

The equilibrium quantity is the amount of the good or service exchanged in the market when the market is in equilibrium. It represents the quantity demanded and supplied at the equilibrium price.

The equilibrium quantity reflects the level at which buyers and sellers agree on the quantity to be transacted in the market. The interaction of supply and demand influences equilibrium price and quantity determination.

Changes in factors can shift the supply and demand curves, resulting in changes in the equilibrium price and quantity, such as:

- Consumer preferences

- Incomes

- Population

- Production costs

- Technology

- Government policies

When the market is not in equilibrium, either a shortage or a surplus exists.

In the case of a shortage, the quantity demanded exceeds the quantity supplied, putting upward pressure on prices. Suppliers are incentivized to increase production as prices rise, reducing the shortage and moving the market toward equilibrium.

Conversely, in the case of a surplus, the quantity furnished exceeds the amount demanded, exerting downward pressure on prices. As prices fall, buyers are encouraged to grow their purchases, lowering the excess and transferring the market toward equilibrium.

The concept of equilibrium price and quantity is central to understanding market dynamics, price determination, and resource allocation.

By studying the interaction of supply and demand and identifying the equilibrium point, economists and policymakers can benefit from insights into market efficiency, predict market consequences, and make informed decisions to promote stability and optimize useful resource allocation.

Factors Affecting Equilibrium

Numerous factors can affect the equilibrium in a market and motive shifts in the supply and demand curves, affecting the equilibrium price and quantity. Some key factors that can impact equilibrium include:

- Changes in Consumer Preferences: Shifts in consumer preferences and tastes can alter the demand for a product or service. Changes in income can shift the demand curve and influence the equilibrium in a market.

- Price of Associated Goods: The prices of replacement and complementary items can affect the demand for a selected product. Substitutes are goods that may be used as options, while complements can usually be consumed collectively.

- For instance, if the price of coffee increases, it can result in a growth in the demand for tea as purchasers switch to a less expensive alternative.

- Changes in the Prices of Related Goods: This can cause shifts in the demand curve and affect the equilibrium. For instance, if consumers expand their preference for healthier food options, the demand for fast food may decrease, leading to a shift in the demand curve and a new equilibrium.

- Changes in Income: Changes in consumers' income levels can affect their purchasing power and demand for certain goods and services. An increase in earnings can lead to a higher demand for luxurious goods, while a lower income may also reduce demand for such items.

- Production Costs: Variations in manufacturing costs, including raw material prices, labor fees, or energy costs, can affect the supply of goods and offerings. Higher production costs can reduce supply, leading to a leftward shift in the supply curve and a new equilibrium with higher prices and lower quantities.

- Technological Advancements: This can impact production processes, efficiency, and costs. Improved technology can lead to increased manufacturing capability, decreased prices, and higher supply. Conversely, old technology or disruptions in technological advancements may limit production capacity and shift the supply curve.

- Government Policies and Rules: Government guidelines and policies, encompassing taxes, subsidies, trade regulations, or price controls, can affect market supply and demand. For example, increasing taxes on a specific good can raise production costs, reducing supply and potentially shifting the supply curve.

- Changes in Population: Population size and demographic changes can affect demand for various goods and offerings. A population boom may also cause higher demand for housing, healthcare, and consumer items. Population changes can shift the demand curve and influence the equilibrium in relevant markets.

Note

It's crucial to note that these factors are interconnected, and changes in one factor may have ripple consequences on different factors and the overall equilibrium.

The impact of every factor will rely on the particular characteristics of the marketplace and the products or offerings being analyzed.

Disequilibrium

This is a state wherein the quantity demanded and supplied in a market aren't identical. It represents a situation wherein there's an imbalance between consumers and sellers, resulting in both extra demand and extra supply.

When there's excess demand, also known as a shortage, the quantity demanded exceeds the quantity supplied at a given price. This will occur due to elements that include an increase in customer demand, a lower production capacity, or supply disruptions.

- In a shortage, buyers cannot purchase as many goods or services as they desire, leading to unfulfilled demand and upward pressure on prices.

- Alternatively, when there may be excess supply, also referred to as a surplus, the quantity provided exceeds the quantity demanded at a given price.

A surplus may arise because of:

- Overproduction

- Lower customer demand

- An increase in production capacity

In a surplus, sellers are left with unsold goods or services, prompting them to lower prices to stimulate demand and reduce the excess supply.

Disequilibrium situations create market forces that drive prices and quantities toward a new equilibrium.

- In the case of a shortage, rising prices incentivize suppliers to increase production and reduce the quantity demanded until they reach equilibrium..

- In the case of a surplus, falling prices encourage buyers to increase their purchases and reduce the quantity supplied until they achieve equilibrium.

Disequilibrium can occur temporarily as markets adjust to changing conditions or persist if ongoing imbalances exist.

It is a critical concept in economics as it highlights the dynamic nature of markets and the mechanisms via which they go back to equilibrium.

Understanding disequilibrium helps economists and policymakers identify market inefficiencies, assess the impact of external shocks, and formulate appropriate interventions to restore balance.

By studying the causes and consequences of disequilibrium, economists can take advantage of insights into market conduct, resource allocation, and the effects of supply and demand imbalances on prices and quantities.

Conclusion

Equilibrium is an essential economic concept that plays a vital role in understanding marketplace dynamics, resource allocation, and determining prices and quantities. It represents a state of stability wherein the forces of supply and demand are in harmony.

This concept allows economists and policymakers to analyze market interactions, predict outcomes, and formulate policies to promote efficiency and stability.

By studying equilibrium, we benefit from insights into how markets regulate modifications in supply and demand, how prices and quantities are determined, and the potential effects of outside elements on market outcomes.

It is not a static state but a dynamic process. It can change over time as market conditions and supply and demand factors evolve. It serves as a reference point towards which markets tend to adjust, eliminating excess supply or demand through price mechanisms.

Understanding equilibrium also demonstrates the importance of efficient allocation of resources. When markets are in equilibrium, resources are allocated to their most valued uses, maximizing overall welfare.

Deviations from equilibrium can lead to inefficient outcomes, indicating the importance of restoring balance.

While equilibrium is a powerful analytical tool, it is critical to understand that real-world markets may additionally face imperfections, externalities, and information asymmetries that may hinder the attainment of equilibrium.

In such cases, alternative frameworks and considerations may be necessary. In conclusion, equilibrium provides a foundation for analyzing market behavior, predicting outcomes, and formulating policies.

It aids economists and policymakers in understanding the functioning of markets, achieving efficient resource allocation, and promoting stability.

Equilibrium FAQs

The economic equilibrium concept refers to a state where the supply and demand for a particular good or service are balanced, resulting in no inherent tendency for change.

There are three main types of equilibrium:

- Stable equilibrium: In this case, any deviation from the equilibrium point leads to forces that bring the system back to the original equilibrium. It represents a state of stability and balance.

- Unstable equilibrium: In this case, any deviation from the equilibrium point leads to forces pushing the system further away. It represents a state of instability.

- Neutral equilibrium: This type of equilibrium occurs when any deviation from the equilibrium point neither leads to forces that restore the system to equilibrium nor pushes it further away. It represents a state of indifference or neutrality.

Several factors can disrupt equilibrium in an economy, including:

- Changes in demand: An increase or decrease in consumer demand can shift the demand curve, causing a new equilibrium to be established at a different price and quantity.

- Changes in supply: Alterations in production costs, technology, or input prices can shift the supply curve, leading to a new equilibrium with a different price and quantity.

- Government intervention: Government policies such as taxes, subsidies, or regulations can impact the supply and demand curves, causing a shift and altering the equilibrium position.

- External shocks: Events like natural disasters, wars, or economic crises can significantly impact supply and demand, leading to disturbances in the equilibrium.

Yes, an economy can reach a long-run equilibrium, often associated with general equilibrium.

In the long run, prices and quantities adjust to achieve equilibrium in all markets simultaneously, considering the interdependencies among different sectors of the economy.

This equilibrium accounts for factors that include production, consumption, savings, funding, and the distribution of sources.

Everything You Need To Break into Private Equity

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

or Want to Sign up with your social account?