Economic Equilibrium

Economic Equilibrium refers to a state in which economic forces are balanced.

What Is Economic Equilibrium?

The term "economic equilibrium" refers to a state in which economic forces are balanced. Without external effects, economic variables stay constant from their equilibrium levels. "Market equilibrium" is another term for economic equilibrium.

The combination of economic variables (typically price and quantity) toward which normal economic processes, such as the changes in supply and demand, push the economy to economic equilibrium.

Interest rates and aggregate consumer expenditure may be in economic equilibrium.

The point of equilibrium is a theoretical resting state in which all economic transactions that "should" occur have occurred, given the beginning condition of all critical economic variables.

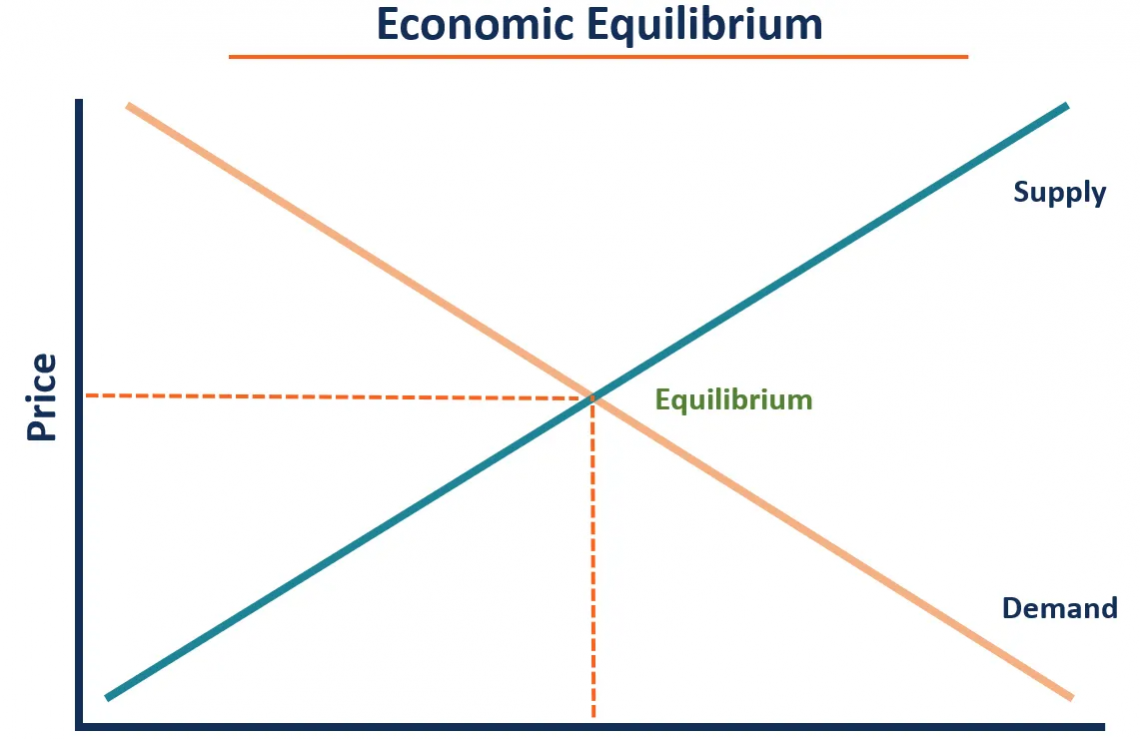

In microeconomics, the price at which supply equals demand for a product, where the hypothetical supply and demand curves connect, is economic equilibrium.

In this context, it is also known as partial equilibrium, as opposed to general peace, which refers to a condition in which all final goods, services, and factor markets are simultaneously balanced.

In macroeconomics, equilibrium is a condition where aggregate supply and demand balance.

Understanding Economic Equilibrium

Economists use the term equilibrium to describe economic processes comparable to physical phenomena such as velocity, friction, heat, or fluid pressure. There is no further change in a system when physical forces are balanced.

Consider the case of a balloon. You pump air into a balloon to inflate it, raising the air pressure inside it. The air pressure within the balloon is higher than outside air pressure; the stresses are not balanced.

Consequently, the balloon expands, decreasing the internal pressure until it reaches the same level as the outside air pressure.

When the balloon has expanded to the point where the air pressure inside and outside are equal, it will cease developing and attain equilibrium.

Market pricing, supply, and demand are all discussed in economics. If the price in a particular market is too low, the quantity demanded by buyers will be more than the amount sellers offer (Law of Demand).

The selling price is low, allowing purchasers to purchase more for the same amount. In another way, vendors make less money for the same number of items sold.

Thus, they would give more minor commodities on the market due to the unaltered cost of goods. Supply and demand won't be balanced much as the air pressures within and around the balloon.

As a result, a market condition of oversupply or undersupply is a state of market disequilibrium in which surplus or shortage occurs.

Also, something will have to give: buyers will have to offer more outstanding prices to persuade sellers to sell their items while there is an undersupply.

As they do, the market price will grow until the amount requested matches the quantity provided, similar to how a balloon expands until the pressures are equal.

It may eventually reach a point where the quantity demanded matches the amount supplied, known as market equilibrium.

Example of the Efficiency of the Market-Based Economy

Consider a tiny town with a single farm that supplies all the food for the residents: which method will be used to deliver the food?

Food will be delivered to one person or organization in a centralized economy (command economy), who will decide where the food will be distributed.

However, the procedure may take a long time and effort, and the food may not be distributed efficiently.

What if someone has a peanut allergy, and the central planner still gives them peanuts? It is tough to keep track of everyone's tastes and allergies in town.

The establishment of a market is another method of distributing food. People can trade goods for food to satisfy their needs: it is known as a barter economy. High-demand foods will be more expensive, and farmers will learn which foods to plant more of. It highlights the market economy's success by avoiding using money.

Allocative efficiency

Allocational efficiency (also known as allocative efficiency) is a feature of an efficient market in which money is allocated in the most advantageous way for all parties involved.

The best distribution of products and services to consumers in an economy and the optimal allocation of financial capital to enterprises or projects among investors is referred to as allocational efficiency.

All assets, services, and capital are assigned and dispersed to their optimal use under allocational efficiency.

Allocational efficiency occurs when public and private sector organizations spend their resources on initiatives that are both lucrative and beneficial to the people, resulting in economic growth.

Accordingly, this is made feasible when parties can judge how to deploy their resources based on reliable and readily available facts represented in the market.

Companies can make correct judgments about which initiatives will be most lucrative when all the data influencing a market is available.

Manufacturers can focus on providing items most wanted by the general public when all of the data impacting a market is available.

Allocative efficiency is the junction of supply and demand curves in economics. All items are sold at this equilibrium point because the price provided for a specific supply meets the demand for that supply.

Aggregate Equilibrium

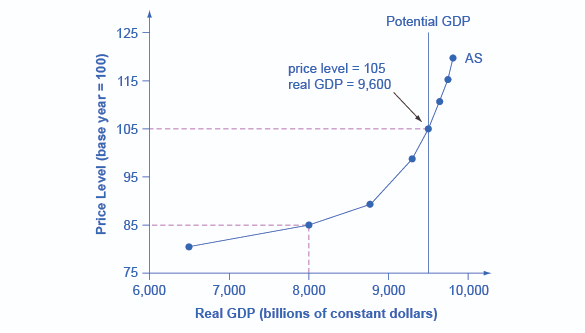

In the long term, the aggregate equilibrium refers to the LRAS or the level of potential GDP. As a result, the AD-AS model and illusion will be examined in order to determine the point of aggregate equilibrium.

The sample graph above shows that the AS curve slopes from almost flat on the far left to nearly vertical on the far right.

The economy's output is much below its potential GDP, which is the amount that an economy might produce if it fully utilizes its current levels of labor, equipment, capital, and technology.

At these low output levels, unemployment is rampant, and many industries are only functioning part-time or have closed entirely.

Because there are so many people and factories ready to go, a tiny increase in the pricing of the outputs that businesses sell, along with no change in input prices, can substantially increase the quantity of AS (real GDP).

However, as the quantity generated increases, specific organizations and businesses will approach their capacity limits.

For example, nearly all expert personnel in a particular industry may have roles or factories in specific geographic regions or industries functioning at total capacity.

In the intermediate section of the AS curve, a higher price level for outputs drives more output from suppliers due to the more profit they can make.

However, as the AS curve's steep upward slope indicates, the rise in quantity in response to a given price increase will be less significant.

At the far right, the AS curve approaches verticality. Higher output prices would not be able to stimulate different output at this time since the economy's labor and machinery inputs are already fully utilized.

The AS curve's vertical axis shows that potential GDP is reached at a total production level of 9,500.

When an economy's machinery and manufacturing operate at maximum capacity, the natural unemployment rate is low. As a result, full-employment GDP is also known as potential GDP.

Disequilibrium

The state of equilibrium is a theoretical concept. Dynamic forces do not always allow an economy to reach and sustain this balanced position.

When the economy is not in equilibrium, it is known as disequilibrium. Realistically, we are always in a state of disequilibrium that is trending towards a theoretical equilibrium.

However, there may be certain situations where disequilibrium becomes more pronounced.

For example, protectionist laws by a country enact tariffs and quotas, but the international markets are in prolonged disequilibrium since the demand for certain products is capped.

The macroeconomic theory calls this "general disequilibrium'' when some or all aggregated markets, such as the money market, the goods market, and the labor market, fail to clear due to price rigidities; macroeconomic theory calls this "general disequilibrium."

Economists Edmond Malinvaud, Robert Barro, and Herschel Grossman studied how economic policy might affect an economy whose prices would not react swiftly to changes in supply and demand in the 1960s and 1970s.

The most common example happens when an external reason produces high unemployment in an economy, causing consumers to consume less and businesses to provide less employment, resulting in rationing of both products and labor hours.

Studies of general disequilibrium have been referred to as the "height of the neoclassical synthesis" and a forerunner to the new Keynesian economics that emerged after the synthesis's demise.

Moreover, studying the general disequilibrium revealed that the economy responded differently depending on whether markets were out of balance: the labor or products markets.

According to Keynesian theory, when goods and labor markets are oversupplied, the economy returns to the equilibrium economy; those actions are represented by the demand and supply curves.

The below diagram represents a normal equilibrium where the price and quantity levels are at the equilibrium point, and the market is efficient. The demand and supply curves are in the proper position.

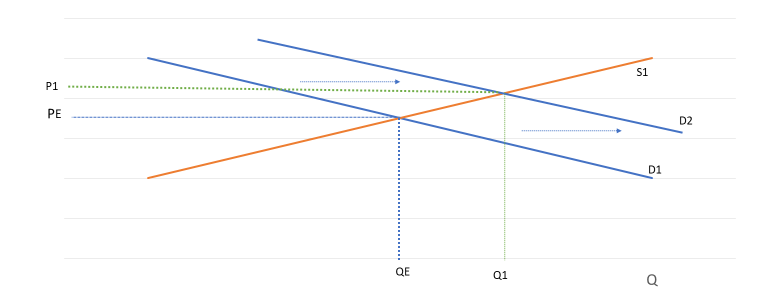

Demand curve shifts

Regarding the disequilibrium, the demand curve moves to the left from D1 to D2 due to certain factors. After that, the equilibrium point will move to P1 and Q1 instead of PE and QE, where the market reaches disequilibrium.

The price goes up, and quantity increases. Although curves D2 and S1 represent the new market equilibrium, the PE and QE is the long-run equilibrium point.

Thus, the curve will move left to the D1 from D2, and the price and quantity will return to PE and QE - the market back to equilibrium.

If it shifts to the right, the price and quantity will decrease but eventually return to equilibrium.

Supply curve shifts

A shift in the supply curve caused by a change in supply creates a market disequilibrium addressed by altering pricing and demand.

The supply curve moves to the right as the change in supply increases, whereas the supply curve shifts to the left as supply changes decrease. Essentially, there is a rise or fall in the quantity supplied and the supply price.

When demand remains constant, a positive change in supply moves the supply curve to the right, resulting in an intersection that delivers lower prices and more quantity.

On the other hand, a drop in supply would move the curve to the left; then, it will raise prices while decreasing quantity.

The disequilibrium of supply curve shifts is similar to the demand curve condition: the supply curve SE moves to the left (right) to be S1, the price goes up (down) and, the quantity decreases (increases), the new market price will be P1 and amount of selling will be Q1 where the market is disequilibrium.

After all, in the long run, the supply curve will shift back to the SE and the market back to equilibrium, where PE and QE return.

Economic Equilibrium in the Real World

Because supply and demand circumstances are frequently dynamic and variable, equilibrium is a fundamentally theoretical construct that may never materialize in an economy. All key economic variables are continually changing.

The economy strives for balance but never quite achieves it. However, the monkey, with enough practice, can come very close.

Entrepreneurs compete throughout the economy, relying on their judgment to make educated predictions about the optimal combinations of items, prices, and volumes to acquire and sell.

Entrepreneurs are rewarded for driving the economy toward equilibrium through the profit mechanism in a market economy because those who estimate better are rewarded.

Information regarding critical economic circumstances of supply and demand becomes more available to entrepreneurs over time due to:

- Business and financial media

- Price circulars and advertising

- Consumer and market researchers

- Advancements in information technology

This combination of market incentives that select better economic guesses and the increasing availability of better economic information to educate those guesses accelerates the economy toward the "correct" equilibrium prices and quantities for all the different goods and services produced, bought, and sold.

Researched and authored by JunFeng Zhan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?