Full Employment GDP

It is the level that corresponds to an economy with 0% unemployment.

What is Full Employment GDP?

Full employment GDP is a hypothetical real GDP level that an economy might reach if it reported full employment. That is, it is the level that corresponds to an economy with 0% unemployment.

It is also the highest level that can be sustained in the long run at the current technological level. It is Pareto efficient (allocatively efficient) by definition, meaning that the economy can't raise aggregate output without increasing inputs.

The level of inputs cannot be increased further since the economy is at full employment and all employees are employed.

Because conventional economics portrays the production process as a synthesis between capital owners and laborers, the output during zero unemployment is always Pareto optimal.

The Production Possibilities Frontier (PPF) is a graphical tool for analyzing production activities in an economy. Production technology, the overall quantity of capital assets in the economy, and the total number of employees all influence total output.

The locations on the PPF's interior correlate to unemployment in the economy, while the points on the curve's perimeter correspond to full employment.

Key Takeaways

- Full employment refers to an economic condition in which all available labor resources are employed to their maximum potential.

- Labor full employment is one aspect of an economy that is working at full productivity and producing at a position along the production possibilities frontier.

- The unemployment rate at which inflation does not continue to grow is known as the FE rate.

- Full employment GDP is the hypothetical GDP level that an economy would reach if it reported full employment, which corresponds to zero unemployment.

- By definition, the economy is Pareto efficient, meaning it cannot increase aggregate output without increasing inputs. Because the economy is at FE and all employees are employed, the input level cannot be increased anymore.

- Because conventional economics frames the production process as a synthesis between capital owners and laborers, the output level is always Pareto efficient.

What Is Full Employment?

The original definition for this would be a situation where everybody who wants to work is working.

This would indicate that unemployment is zero because you should not be regarded as jobless if you are unwilling to work. To be considered unemployed, you must be actively looking for employment.

This does not imply that everyone of working age has a job. Some persons, such as mothers caring for children, may quit the workforce.

However, we seldom experience 0% unemployment, making zero unemployment difficult to describe. Generally, it is defined as having an unemployment rate of 3% or less.

The 'optimal' level of unemployment is another definition of full employment. An economy will never have zero unemployment since people are considered jobless when they are between jobs, which is known as frictional unemployment.

Non-permanent unemployment is not an issue. However, people should spend their time looking for a job that is appropriate for their skill level rather than taking the first job that comes along.

Generally, frictional unemployment will result in a 2% to 3% unemployment rate. As a result, some economists may argue that less than 3% unemployment suggests "full employment" (FE) - or something very close to it.

According to some economists, FE is the unemployment rate at which inflation does not continue to rise.

Advocacy for avoiding accelerating inflation is based on a theory centered on the Non-Accelerating Inflation Rate of Unemployment (NAIRU), and those who embrace it commonly refer to NAIRU.

NAIRU has been referred to as the "natural" unemployment rate. Such perspectives stress long-term sustainability, pointing out that a government cannot keep unemployment rates below the NAIRU indefinitely: inflation will continue to rise as long as unemployment is below the NAIRU.

The long-run aggregate supply (LRAS) curve and the idea of FE correspond to the concepts of potential output or potential real GDP.

The greatest sustainable level of aggregate real GDP, or "potential," is thought to correlate to a vertical LRAS curve in neoclassical macroeconomics: any rise in real GDP demand can only lead to higher prices in the long term, while any gain in output is only transitory.

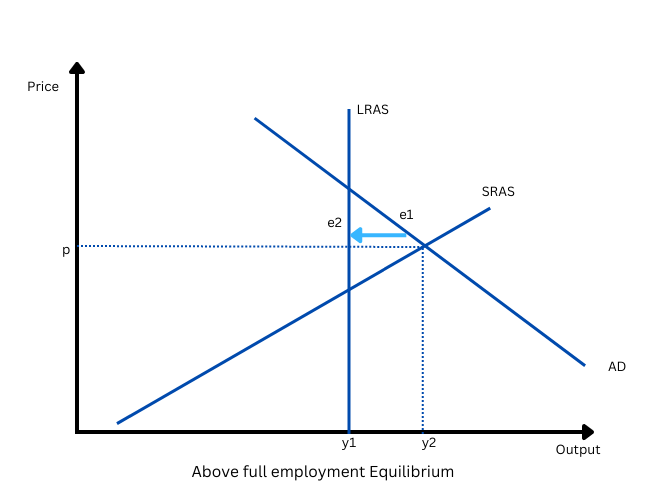

Above Full Employment Equilibrium

Above full-employment equilibrium occurs when an economy produces items or products at higher economic rates than typical. It's a macroeconomic word when an economy's real GDP is greater than normal, implying it's above its long-run potential.

The GDP of an economy frequently indicates the projected pace of production of products or commodities in that country.

However, there is an above-full-employment equilibrium where production rates exceed the optimal rate measured by GDP. Above full-employment equilibrium also means an economy's real GDP is higher than in prior years.

It's possible that when real GDP exceeds long-term potential, it's due to inflation in the economy. This is only possible when we use the country's nominal GDP.

When an economy works over its FE equilibrium, it produces more products and services than its potential or long-run average levels, as measured by GDP.

An inflationary gap is viewed as a warning phase by economists because it results in a scenario where too much money is chasing too few goods. This causes inflationary pressures in the economy, which cannot be sustained over time.

Higher prices will eventually pull demand back to normal run-rate levels, bringing the economy and employment markets back into balance. However, an economy operating above FE is a concern since it may result in inflation.

For example, assume that:

- A country's usual rate of GDP growth is 3.5 percent per year.

- GDP has expanded at a rate of 7% each year during the previous three years.

- A country is currently in a state of over-full employment.

Where,

- SRAS stands for short-run aggregate supply.

- LRAS stands for long-run aggregate demand.

- AD stands for aggregate demand.

An economy operating above FE is a reason for concern since it may result in inflation.

Higher prices will eventually pull demand back to normal run-rate levels, bringing the economy and employment markets back into balance.

y2 - y1 = inflationary gap.

Market equilibrium is e2 in the long term.

Below Full Employment Equilibrium

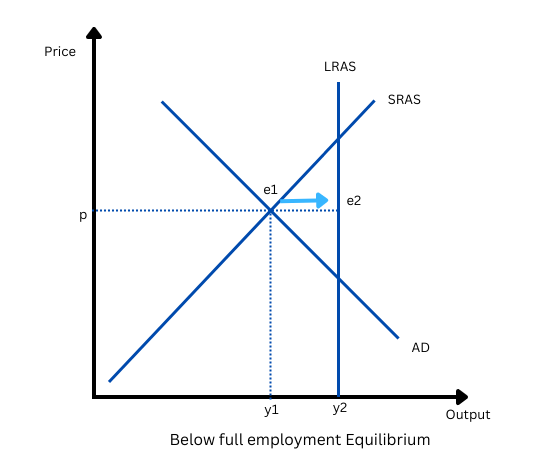

The opposite of the above FE equilibrium is below full employment equilibrium. It refers to a situation where an economy's short-term real GDP is lower than its long-term potential real GDP.

The disparity between the two GDP levels is referred to as a recessionary gap. FE occurs in an economy that is in long-run equilibrium.

The contractionary gap is another name for the recessionary gap. This is because an economy does not have to run at full capacity all the time. The recessionary gap is the discrepancy between the prospective and actual equilibrium.

In the long run, this recessionary gap lowers prices. A broad slowdown in economic activity, often known as a business cycle contraction, is referred to as a recession.

For a variety of causes, the economy can fall below equilibrium. A negative economic shock, for example, might temporarily disrupt the economy, or a real resource constraint caused by monetary policy-induced structural imbalances in the economy could result in a spate of firm failures.

Even a good economic shock, such as fast technical improvement, can result in unemployment as firms adjust to the new technology and close down outmoded activities, a process known as creative destruction.

Underemployment is a situation in which aggregate demand and supply are equal but not equal to FE, which is found along the LRAS.

This is a condition of equilibrium in which the amount of demand is lower than the output level at FE. As a result, not all of the economy's resources are completely utilized in developing output; certain resources are underutilized.

In this circumstance, a more expansive fiscal policy will be required to boost spending while lowering taxes, helping to move aggregate demand to the right.

y2 - y1 = recessionary gap

Market equilibrium is e2 in the long term.

Types of Unemployment

The unemployment rate is the most often used metric for assessing labor market conditions. Policymakers can concentrate on addressing the root causes of these unemployment categories, but doing so may compromise other policy objectives.

The unemployment rate can also inform how the economy behaves, making it a crucial consideration when considering a monetary policy.

The following are the several sorts of unemployment:

1. Seasonal/ Cyclical Unemployment

People are unemployed during specific seasons of the year when demand for labor is lower than usual, known as seasonal unemployment. Seasonal unemployment is defined as a period during which the quantity of available job possibilities diminishes.

Cyclical unemployment is the portion of overall unemployment that arises directly from economic ups and downs. Typically, unemployment rises during recessions and falls during economic booms.

Another type of seasonal unemployment is chronic unemployment, which refers to chronic joblessness in the economy. Put another way, and this unemployment is produced by persistent long-term unemployment in the economy.

2. Frictional Unemployment

The effect of voluntary employment transfers within an economy is frictional unemployment. Even in a rising, stable economy, frictional unemployment persists.

Frictional unemployment occurs when employees quit their jobs in search of new ones and workers enter the workforce for the first time.

The other type is when a worker is employed on a day-to-day basis for a contractual job and must depart when the contract expires, this is known as casual unemployment.

3. Structural Unemployment

Long-term unemployment caused by economic developments is known as structural unemployment. This sort of unemployment occurs when there is a mismatch between what employers want and what available employees can provide.

The loss of jobs induced by technical development is known as technological unemployment. It is one of the most common types of structural unemployment.

There are a few other types of unemployment, such as:

- Disguised: Unemployment that does not affect aggregate economic activity is disguised unemployment. This happens when low productivity and too many people occupy too few positions. It can refer to any segment of the population that is not fully employed.

- Technological: The loss of jobs induced by technical development is known as technological unemployment. It is one of the most common types of structural unemployment.

or Want to Sign up with your social account?