Allocational Efficiency

A condition of the economy in which production is aligned with customer desires or when supply meets all of the consumer demand

What is Allocational Efficiency?

Allocational efficiency (AE), also known as allocative efficiency, is a condition of the economy in which production is aligned with customer desires. Simply put, it occurs when supply meets all of the consumer demand.

In economics, the price and quantity specified by the intersection of supply and demand describe the point of allocational efficiency for a commodity or service. However, it only holds if markets are both informationally and transactionally efficient.

Understanding Allocational Efficiency

In a nutshell, we can say that:

- Both the producers and the consumers benefit. AE is when the demand has been fully fulfilled, production has been optimized till Marginal Costs (MC) equal Marginal Revenue (MR), and no more profits can be earned.

- An efficient economy produces an ideal mix of goods.

- In a perfect market, a business is efficient when its price equals its marginal costs (P = MC).

The demand curve corresponds to the marginal utility curve, which measures the additional unit's (private) benefit. In contrast, the supply curve corresponds to the marginal cost curve, which measures the additional unit's (private) cost. - There are no externalities in a perfect market; therefore, the demand curve reflects the additional unit's social gain, whereas the supply curve measures the additional unit's social cost.

- The market equilibrium occurs when demand equals supply, and the marginal social benefit equals the marginal social cost. The net social benefit is maximized at this time, indicating that this is the allocative efficient production level.

For example, imagine a shoe manufacturer producing 1000 units of shoes knowing that there is an exact demand of 1000 units for those shoes.

This is an example of allocative efficiency. There is no waste on the producers' part. The same goes for the consumers, as they are not left unsatisfied as all consumers who desired the good at the equilibrium point got the shoes.

As long as these main assumptions are true, we can properly assess if allocational efficiency is occurring. To allow for such to happen, there are a few conditions that must be met:

The premise that underpins a free market comparative equilibrium is that scarce resources are allocated efficiently. We assume that:

- There are a large number of buyers and sellers in the market,

- Both buyers and sellers have perfect information,

- There are no barriers to entry any firm can enter and compete in the market, any firm can exit at any time,

- Firms are profit maximizers, and consumers are utility maximizers.

If any of these fail, it will be a source of market failure since the market equilibrium will shift away from the point of allocational efficiency.

Producers and Consumers

From ancient times, the analysis of efficiency in the context of resource allocation has been a key issue of economic theory, and it is still an important part of current microeconomic theory.

The fulfillment of human needs through the supply of commodities and services is considered the goal of economic activity.

Production and exchange provide these, but the scarcity of resources and technology restrict them. Allocational efficiency focuses on being feasible in satisfying demand while facing constraints from resources and technology.

The market must fulfill two conditions to be allocatively efficient. The first is from the standpoint of the producer. The producer must keep supplying the market until it becomes unprofitable to do so. This, however, must be consistent with the second factor.

The supply must be provided at a cost that maximizes marginal utility. In a nutshell, this occurs when producers continue to create until their marginal costs match the highest utility and price a customer is prepared to pay.

Let us have a look at the two sides - the producer's side and the consumer's side.

Producer's Side

First comes the producer's side of the equation. The theory states that when goods and services in the market are allocated efficiently, the producer will stop producing as there is no profit.

In other words, the producer will continue to create more and more until his marginal cost equals his price.

The company will keep manufacturing until the supply and demand curves cross. This is where marginal cost equals marginal utility (MC = MU) in an efficient market. This is also known as the equilibrium point.

There will be extra demand if the producer produces less, implying that it is not efficient from the consumer's perspective.

Consumer's Side

A market is efficient from the consumer's perspective when the price represents the highest they are prepared to pay. It occurs when customer happiness is maximized relative to cost.

If there is an increase in the price, the level of satisfaction attained by the consumer will fall since the Marginal Cost will be greater than the Marginal Utility (MC > MU).

So from the consumer's side, the equilibrium between the supply and demand sides would be the ideal position as there will be an equal marginal utility and marginal cost (MC = MU).

The customer will be willing to pay up to the equilibrium prices as it gives them the desired level of satisfaction.

Allocative Efficiency for Economic Growth

Allocative Efficiency refers to an economy's optimal allocation of products and services to customers and an investor's best distribution of financial capital to enterprises or projects. All products, services, and capital are assigned and put to their optimal use under this system.

To recapitalize, the market must satisfy two requirements:

- The first of which is from the standpoint of the producer. The producer must keep supplying the market until it becomes unprofitable.

- This, however, must be consistent with the second factor. This has to be done at a cost that maximizes marginal utility.

This occurs when producers continue to create until their marginal costs are aligned with the maximal utility and price a customer is prepared to pay.

Economic growth is achievable when parties can decide how to use their resources based on accurate and easily available facts in the market.

The final unit's marginal cost equals the marginal value that customers obtain from the commodity or service at the ideal level.

The essential idea is to allocate an appropriate resource based on customer demands and wants. In economic terms, it refers to the utility gained through the consumption of an item or a service at a certain price level. As a result, both producers and consumers gain.

Benefits

Many manufacturing businesses can benefit from this. The following are some of the most significant advantages of measuring and achieving the point of allocative efficiency:

- Improved estimates for ideal production levels enable a business to best manage and distribute the resources available in its manufacturing plant.

- Creating a production run using this calculation allows the reallocation of physical and staffing resources to other projects after meeting the target production levels.

- Pricing based on such a model saves both consumers and businesses money.

Consumers profit from a lower price than they would for a smaller supply, while the corporation benefits from selling items at a price greater than their marginal cost for the full manufacturing run.

Other Efficiency Requirements

To be efficient, a market must fulfill the requirements of being both informationally and transactionally or operationally efficient.

- When a market is informationally efficient, all required and relevant market information is easily available to all market participants. There is no informational advantage for one party over another.

- Transaction costs are acceptable and fair when a market is transactionally efficient. This assures that all parties have equal access to all transactions and that none are excessively costly.

- Companies may develop an effective assessment that directs them to an optimal production level when the market is efficient. This offers investors the best risk-reward situation since corporations can reduce the risk of producing more units than they can sell and losing money.

Productive Efficiency (PE) vs. Allocative Efficiency (AE)

- When a company concentrates on manufacturing a product at the lowest feasible cost, this is referred to as productive efficiency (PE).

Allocative efficiency (AE) tries to optimize the distribution of products and allocation of resources.

When a company's output is on the production possibility frontier (PPF), it experiences productive efficiency. - We say that a firm is AE when its price is equal to its marginal cost, i.e., P = MC; while on the other hand, for PE, it is where the marginal cost is equal to the minimum average total cost, i.e., MC = min ATC.

- PE enables businesses to make the most of their available resources to achieve optimal financial results. Businesses may create product offerings at a cheaper cost while retaining the same level of quality by minimizing waste.

Calculating the Point of Allocational Efficiency

The steps include:

1. Calculate the cost of manufacturing

It is critical to have a solid grasp of the costs connected with producing a product or service, as well as how those costs change as the number with the number of units produced, to develop an accurate supply curve and discover the point of equilibrium.

Some expenditures for a manufacturing facility, such as site leasing, stay consistent throughout a wide range of output levels. Other costs, such as material costs, scale in direct proportion to the number of units added or deleted from the production order.

The more correctly you forecast your production costs, the better you'll be able to chart your marginal cost and determine the equilibrium point.

2. Examine data on-demand

The demand for your product or service in the market is the second important factor to consider. As you manufacture more units, you become more reliant on less interested customers to ensure you sell all of your production.

This implies you may have to offer a lower price per unit. The more exactly you estimate demand, the more precisely you can determine the point of equilibrium to avoid high costs from excess production.

3. Make a graph of the curves

After you've identified the marginal utility and marginal cost curves, plot them on the same graph. This allows you to compare the two curves on the same scale and location.

This graph can also show how market conditions change when you change your production levels, demonstrating how overproduction forces you to sell at a rate that is no longer profitable for later units.

4. Locate the intersection

Locate the intersection of the marginal revenue and marginal cost curves on your graph to find the equilibrium.

If your curve calculations are right, this is the exact supply quantity and price for your product or service that permits you to sell every unit.

Allocational Efficiency Graphically Explained

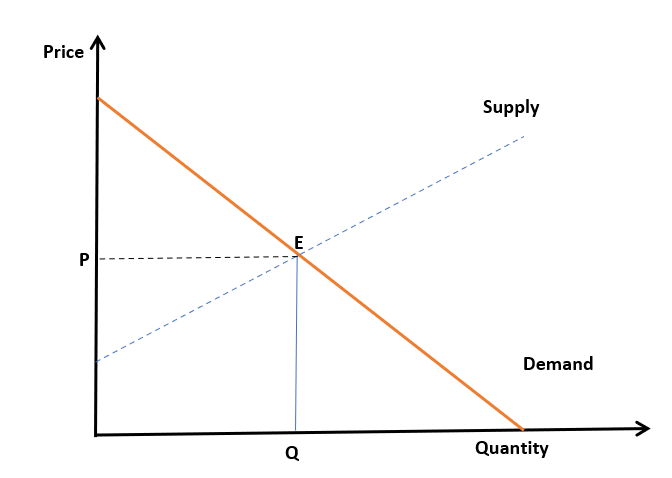

The graph consists of the demand & supply curves for a certain good, as can be seen below:

On the above graph:

- P is the equilibrium price

- Q is the equilibrium quantity

- E is the equilibrium point, where demand equals supply and allocational efficiency.

- The market is cleared because the price received by the producer matches the price the consumer is willing to pay

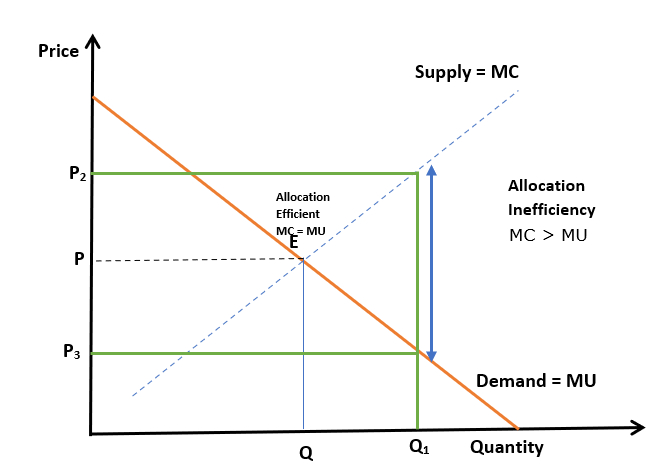

Cases of Inefficiency

The above graph shows that if there is an increased output (Q1), the marginal cost has also increased to P2. At point Q1, the customer's MU is decreased, and they are willing to pay the P3 price.

In other words, the consumer's marginal utility is lower than the marginal cost, leading to over-consumption. But, at the same time, the producer is overproducing the particular good.

Allocational efficiency would occur at price P where MC = MU, but here MC > MU.

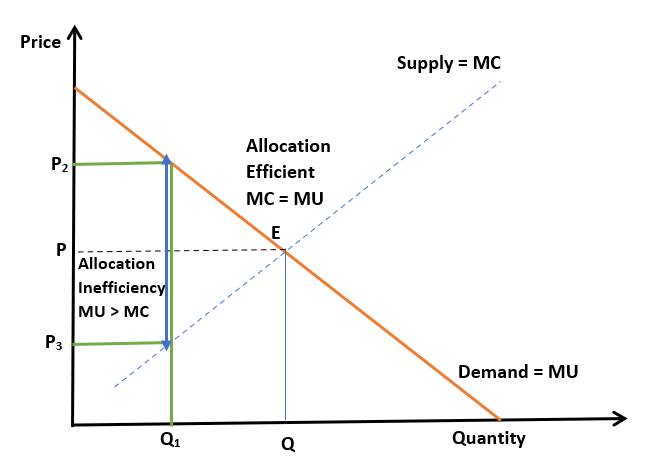

The above graph shows that the output has decreased to point Q1, and the marginal cost for producing the commodity is P3. However, consumers are ready to pay the P2 price. Here, MU > MC, which leads to under-consumption.

If the overall supply increases and the price starts falling, society will benefit from that good, and the equilibrium will occur at price P, resulting in allocational efficiency.

Summary

The term "allocative efficiency" refers to a situation in which supply fully meets demand, and there is no surplus or shortage of the desired product.

There are several assumptions behind this model:

- Many buyers/sellers

- Perfect information

- No barriers to entry

- Firms' profit maximization

- Consumers' utility maximization

Many manufacturing businesses can benefit from improved estimates for ideal production levels, freeing up both physical and staffing resources, saving both their consumers and themselves money,

Likewise, capital market resources should be dispersed across capital markets in an allocationally efficient manner.

In the perfect competition model, price equals marginal cost at the point of equilibrium. The social surplus is maximized at this stage, with no deadweight loss.

The marginal social benefit matches the marginal social costs at market equilibrium, where demand meets supply. Therefore, the net social benefit is maximized at this level, indicating that this is the allocative efficient point.

Market failure occurs when a market fails to distribute resources efficiently. Imperfect knowledge, differentiated goods, concentrated market power, or externalities can all lead to market failure.

Allocational Efficiency FAQs

AE is crucial because it minimizes waste.

Resource waste is minimized when a company's or economy's supply of a product meets its demand.

When production occurs at a level where the consumer's marginal benefit doesn't equal the producer's marginal costs, inefficiency in resource allocation occurs, and the resources could be allocated in a better way.

In practice, it’s hard to know precisely where allocational efficiency occurs.

It’s the intersection of the marginal benefit and marginal supply curves for a certain good.

A circumstance where the amount supplied to the market is precisely the same as the amount demanded.

This arises from the supplier's knowledge of how many units are demanded at the equilibrium price.

As a result, the producer can minimize waste and capacity use, while the buyer can always obtain the products they desire.

Because they do not produce at the quantity where price equals marginal revenue, monopolists are not allocatively efficient.

Because the monopolist dominates its market, it can demand a higher price for each unit and produce less. The less competitive a market is, the more price-setting power a firm has.

or Want to Sign up with your social account?