International Fisher Effect (IFE)

The theory bridges the gap between the relationship between interest rates and exchange rates

What Is the International Fisher Effect?

The International Fishers effect is a theory that bridges the gap between the relationship between interest rates and exchange rates. The idea primarily talks about the approximate equivalence of interest rate disparity and exchange rate disparity between two countries.

On that note, it is believed that the difference between the value of the currencies of the two countries will be approximately equal to the difference between their nominal interest rates.

The international fishers effect (IFE) is also known as the fishers-open effect and is a dominant indicator used in finance.

The only underlying assumption for the model given by Fishers is that the country's actual interest rates are not affected by any other financial factors like the country's monetary policy.

If that is the case, it is relevant to observe that any economy with more interest rates will also tend to have higher inflation than other economies with lower interest rates.

This phenomenon describes that if interest rates are high, inflation tends to be high. Still, the value of our currency in comparison to the economy with low interest rates would decrease.

The effect works vice versa for the opposite situation. Crisply, countries with high interest rates are likely to experience a high level of currency depreciation. The exchange rates are associated with terms like depreciation and appreciation.

When the value of the home currency falls in terms of other currencies, it is depreciation; conversely, when the value of the home currency rises in different currencies, it is known as currency appreciation.

For example, if today 1$ (USD) = ₹ 80 (INR), and now the value has changed to 1$ (USD) = ₹ 85 (INR), here the Indian currency (₹) is depreciated for USD. The IFE uses current and future nominal interest rates to predict the spot and future exchange rates.

Key Takeaways

- The international fishers effect is a theory that bridges the gap between the relationship between interest rates and exchange rates.

- The theory was contributed by an important economist of the 1900s, Irving Fisher.

- This phenomenon thus describes that if interest rates are high, inflation tends to be high. Still, the value of our currency in comparison to the economy with low interest rates would decrease.

- The international fishers effect is very efficient in knowing the future movement of currencies, depicting the representation of market behavior, and justifying capital investments.

How the International Fisher Effect was Conceptualized

The theory was contributed by Irving Fisher, one of the greatest economists of the 1900s. He was one of the earliest Neoclassical American economists though his later work reflected the post-Keynesian school.

Irving Fisher created the model of the international fishers effect in the early 1930s, and since then, it has been used extensively in the financial world. The economist did create more supporting theories for major money matters in economics.

This theory is just a more general analysis of fishers' effect on an international level. In other parts of the article, we will discuss the contrast between the Fishers effect and the International Fishers effect.

The only underlying assumption for effect is that inflation does not affect actual interest rates in an economy.

This means that even if inflation is high, there will be no significant change in accurate rates since actual interest rates are calculated by nullifying the effect of inflation on nominal interest rates.

The logic was taken from the mathematical representation of interest rates:

r = i - π

Where

- r = real interest rates

- i = nominal interest rates

- π = inflation rate

How to Calculate the Fisher Effect

Let us take two countries with nominal interest rates i1 and i2 and spot exchange rates at S.

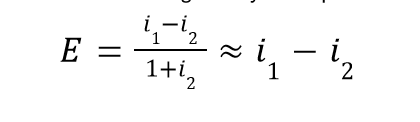

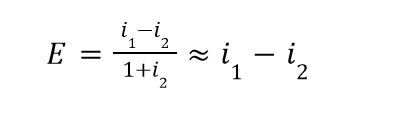

The equation gives the model of the IFE:

Where

- E = percentage change in spot exchange rates, that is ΔS/S

- i1= nominal interest rates in economy 1

- i2= nominal interest rates in economy 2

The equation does not make sense if taken just as it is, so to understand the actual usage; we have to predict the future spot rate and then make a decision regarding the trade or investment.

For example, suppose we compare two economies, one in India and one in USA the nominal interest rates in India are observed to be 6%. In contrast, nominal interest in the USA is recorded to be 5% hypothetically.

Let us assume that the spot exchange rate is given for USD/INR = 1.30. Let us name this current spot exchange rate E1.

Now, to find the future spot rate, we need to multiply the current spot exchange rate by the ratio of foreign interest rates to the domestic interest rate.

Therefore,

E2 = (1 + 0.5)/ (1 + 0.6) * (E1)

Which is,

E2 = (1 + 0.5)/ (1 + 0.6) * (1.3) = 1.312

Where E2 is the future spot exchange rate.

Based on the equation and logical reasoning based on the IFE theory, the Indian currency is depreciating.

By the logic, since Fisher says that the country having more interest rates will have depreciation, is provable by our example, E1 was lower than E2, which states that at given high-interest rates in India, the future of Indian currency is depicting depreciations.

This implies that the USA's currency is better valued than the Indian currency. This also means that returns from investing in USD are lower due to lower interest rates than in India at the given point.

Still, the investors who put their money in USD during the current period will benefit in the future due to the increased value of USD compared to the rupee.

Decision making

In a general scenario, investors tend to move their capital from low-interest-bearing countries to high-interest-bearing countries to earn more return on capital by speculating on future spot exchange rate values.

But since this movement occurs, the exchange rates also change with the demand and supply forces. Thus, the first tire prediction is nullified, and profits opportunities are backlashed.

This movement in the exchange rate will average and offset the interest differential. This perfectly describes that nominal interest rates are unbiased predictors of future spot exchange rates. The IFE says that exchange rates will offset foreign investment returns.

Therefore an investor who consistently purchases foreign assets will earn a similar average return if he invests in purely domestic assets. This coordinates with purchasing power parity discussed further.

The graph shows an international fishers effect line passing through the origin depicting all points on the line having percentage change in spot exchange rates equal to the interest differential.

To the left of the IFE line, the point shows interest differential is high, and therefore returns from investing outside the home country are inefficient.

The points to the right of the IFE line show that the interest differential is less. Therefore, profit in terms of returns is higher in a foreign country.

Fisher Effect vs. International Fisher Effect

The fishers effect and international fishers effect are related theories by the same economist but cannot be used interchangeably.

The Fishers effect marks the relationship between nominal and real interest rates with the help of expected inflation rates in the economy.

At the same time, the international fishers effect marks the relationship of nominal interest rates to the spot exchange rates in the currencies of the two countries.

The fishers effect also pertains to a separate analysis of each country, whereas the international fishers effect pertains to a combined currency analysis of two or more countries.

Fisher Effect and International Fisher Effect, studies interest rates and exchange rates, with the former focusing on rates within an economy and the latter on their link across currencies. Understanding these is important for global financial navigation.

The Fishers effect claims that the combination of expected inflation and the real rate of return is reflected by the nominal rate of return values in any economy.

Thus, as the nominal interest rates are high in any economy, we can anticipate that this might be because of high inflation and constant real returns. So the relationship is direct when inflation rises and nominal interest rates also rise.

Now the implication of this result is seen in the international fishers effect, where we say as the country has a more nominal interest rate, it would depict high inflationary pressures. It will explicitly depreciate the currency of that particular economy.

This is true; therefore, Fishers' open effect is an extended version of fishers' effect. The equation for the two effects is as follows:

Fishers effect:

i = r + π

Where

- i = nominal interest rates

- r = real interest rates

- π = inflation rate

International fishers effect:

Where

- E = percentage change in spot exchange rates, that is ΔS/S

- i1= nominal interest rates in economy 1

- i2= nominal interest rates in economy 2

Example

Assume economy 1 and economy 2 have real interest rates the same at 4% and inflation (π) as π1=3% and π2=2%. In this case, the fishers effect will give nominal interest rates (i) for both economies separately.

For Economy 1:

i1 = r + π1

i1 = (1 + r) (1 + π1) - 1

i1 = (1 + 0.04) (1 + 0.03) - 1 = 7.1%

For Economy 2:

i1 = r + π2

i1 = (1 + r)(1 + π2) -1

i2 = (1 + 0.04) (1 + 0.02) - 1 = 6.08%

Now using the international fishers effect, we can find the percentage change in the spot exchange rate:

E = i1 - i2 / 1 + i2

E = (1.1 - 6.08)/ (1 + 6.08) = 98%

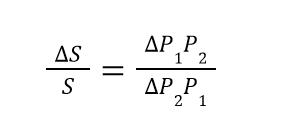

Purchasing power parity describes how the purchasing power in different countries varies for the same goods. The quick relationship of PPP to IFE is indirect concerning inflation.

Now, for PPP:

S = P1/ P2

Where

- S = ratio of exchange rate for 1 and 2

- P1 = price in country 1

- P2 = price in country 2

By this, we can find a percentage change in the exchange rate as:

In contrast, we know that the percentage change in exchange rates by IFE is given as:

E = i1 - i2 (approx)

This implies that the change in inflation rates in PPP theory explains the change in interest rates in IFE theory. Therefore, both theories explain the change in spot exchange rates.

International Fisher Effect Limitations

There are a few important points made by Fisher's effect that can depict certain factors' movement. These are as follows:

1. Forecast for future currency movements

The IFE is efficient in knowing the future movement of currencies, depicting the representation of market behavior, and justifying capital investments in a given set of economies.

Inventors' decision is highly dependent on IFE as it is a long-term predictive tool to assess the future streams from current investment in foreign assets.

2. Lending and borrowing decisions

When we talk about borrowing, any individual would consider borrowing from a country where interest rates are low; in contrast, inflation is low.

For that purpose, they use IFE to know the future accounted payment of loans and assess the beneficial country. Similarly, the banking system lends loans at higher interest rates than inflation to book some profits.

The International Fisher Effect (IFE) has limitations in failing to account for certain nuanced factors that could impact exchange rates and inflation rates in the future. These limitations may include geopolitical events, market sentiment, and unexpected economic policy changes.

These banks use IFE to asses the future pressures of inflation on interest rates and decide in what composition domestic and foreign loans are to be given.

Despite being the best work, the IFE has some limitations when it comes to factors that it could not describe in further detail.

Fisher's Open Effect Limitations

This concept is related to Fisher's theory of interest rates and exchange rates. It describes the impact of interest rate differentials on capital flows and exchange rates in an open economy.

Fisher's open effect suggests that when a country's interest rate is higher than that of another country, investors may borrow money in the low-interest-rate country and invest it in the high-interest-rate country. Let's look at some of the limitations of Fisher's open effect mentioned below:

1. Long-term prediction only

The international fishers effect is dominantly efficient in assessing long-term markets and not useful for deciding short-term positions. The effect assesses the benefits for more than 1 year; therefore, monthly quarterly assessment is impossible.

2. Uncovered interest parity

The IFE is also known as uncovered interest parity because it is efficient in telling the effect and magnitude of change in exchange rates but does not provide insights on when these changes would occur.

Therefore, the decision-making depends on the time assumption of the investor solely.

3. Uncontrolled exchange rates

When IFE theory was conceptualized, the economic view was worldwide similar to controlling the exchange rates via authorities.

In today's world, where exchange rates are free-floating, the efficiency of Fisher's open effect is questionable.

The word banks and monetary authorities of all economies now work on the principle of inflation targeting rather than interest targeting. This implies that the inflation is targetted first, and the expected is set. Then interest rates are used as tools to touch the expected inflation rate.

5. Factors affecting exchange rates

In a competitive market now, the world has a lot of governance, restrictions, taxes, and other policies in each economy that affect the exchange rate. But the IFE does not consider any factor other than nominal interest rates to determine the exchange rate.

Conclusion

The International Fisher Effect provides a valuable framework for understanding the relationship between nominal interest rates and exchange rates in the global economy.

While the theory has been widely used in finance and has practical implications for investors and policymakers, it is not without its limitations. Its reliance on long-term predictions and assumptions about uncovered interest parity may not always hold true in volatile or unpredictable market conditions.

Despite these limitations, the International Fisher Effect remains a valuable tool for assessing long-term trends in currency markets and informing strategic decision-making in the realm of international finance and economics.

It reveals how interest rate disparities affect currency values, shaping global trade and investments. As markets evolve, grasping interest rate and exchange rate dynamics is vital in today's finance.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?