Natural Rate of Interest

It is a crucial indicator since it is part of what central banks base important economic decisions on.

What is the Natural Rate of Interest?

The natural rate (also known as the neutral rate) is an interest rate that allows the economy to reach its maximum output, or full employment, in terms of GDP while maintaining a steady inflation rate. Unfortunately, this number is tough to determine and cannot be looked up directly.

It is a crucial indicator since it is part of what central banks base important economic decisions on. Therefore, short-term bank rates are implemented according to this number.

As a result, it also impacts whether monetary policy is being implemented through expansionary (increase in the supply of money and credit to supplement economic growth) or contractionary (reduction in government spending or the rate of monetary expansion by a central bank).

According to official or academic papers, the natural interest rate is often referred to as r* (r-star). Therefore, the global natural rate of interest is global r*. However, in recent years, many economists have believed this number is declining.

Unfortunately, it must be calculated because the natural interest rate cannot be observed. Nevertheless, financial market participants are interested in estimating it because it is useful when forecasting short-term interest rates many years into the future.

They do this to calculate the value of the yields of long-term government and private bonds.

Why is the Natural Rate of Interest Important?

Economists often concentrate on actual interest rates when considering the natural interest rate.

They contend that changes in those rates, more so than changes in nominal rates, impact decisions made by firms and individuals. These decisions relate to capital expenditures, the purchase of durable items like automobiles and refrigerators, new homes, and, as a result, economic development.

For economic policymakers, this is a crucial number with significant sway over decisions on monetary policy. After doing many complex estimates and models, the central bank will decide how they should alter the short-term bank rate.

During economic contraction, the central bank will set its rate lower than the neutral rate. Alternatively, the bank rate will be set above the natural rate during an economic expansion to fight inflation.

An increase or decrease in the bank rate may significantly impact inflation, unemployment, exchange rates, and the GDP growth of a country.

These factors are directly correlated with the overall economic development of a nation. This is because they can change how businesses, in both the private and public sectors, make decisions.

The difference between the natural interest rate and the market interest rate is critical. This can tell investors about the central bank's goals (expansionary or contractionary). It also helps the central bank alter the economy's performance.

As a result, the market can react differently to the bank's stance on the natural rate of interest, which can lead to market rallies (short-term price hikes) and sell-offs (short-term price drops).

This definition of the natural rate adopts a "long-run" viewpoint by referring to the level anticipated to exist, say, in the next five to ten years, after any current economic "booms" and "busts" underway have concluded.

The natural rate, for instance, does not refer to the actual fund rate anticipated over the coming year or two for the U.S. economy. Instead, it refers to the rate anticipated to prevail once the recovery is complete and the economy is expanding at its potential growth rate.

Natural Rate of Interest vs. Market Rate of Interest

Conclusions drawn from the difference between the natural interest rate and the market rate of interest can be the foundation for a central bank's decision to change the rate.

The current interest rate on cash deposits is the market interest rate. This rate is affected by several variables, including the interest rates set by the central bank, the inflow and outflow of capital, the quantity and length of deposits, and the duration of deposits.

This number is determined by the market supply and demand model for funds and depends on the central bank's rate.

The natural interest rate frequently diverges from the market interest rate in the short run, which can lead to different price movements.

When the market interest rate is below the natural rate, the supply of savings is less than the demand for loans. In turn, the demand for money increases and goes higher than the supply. As a result, prices continue to climb.

On the other hand, when the market interest rate is above the natural rate, people tend to save more than lend money, causing prices to move downwards.

How is the Natural Rate of Interest Determined?

There are many methods economists and policymakers use to estimate the natural rate of interest. Unfortunately, there are significant differences between the results produced by different models.

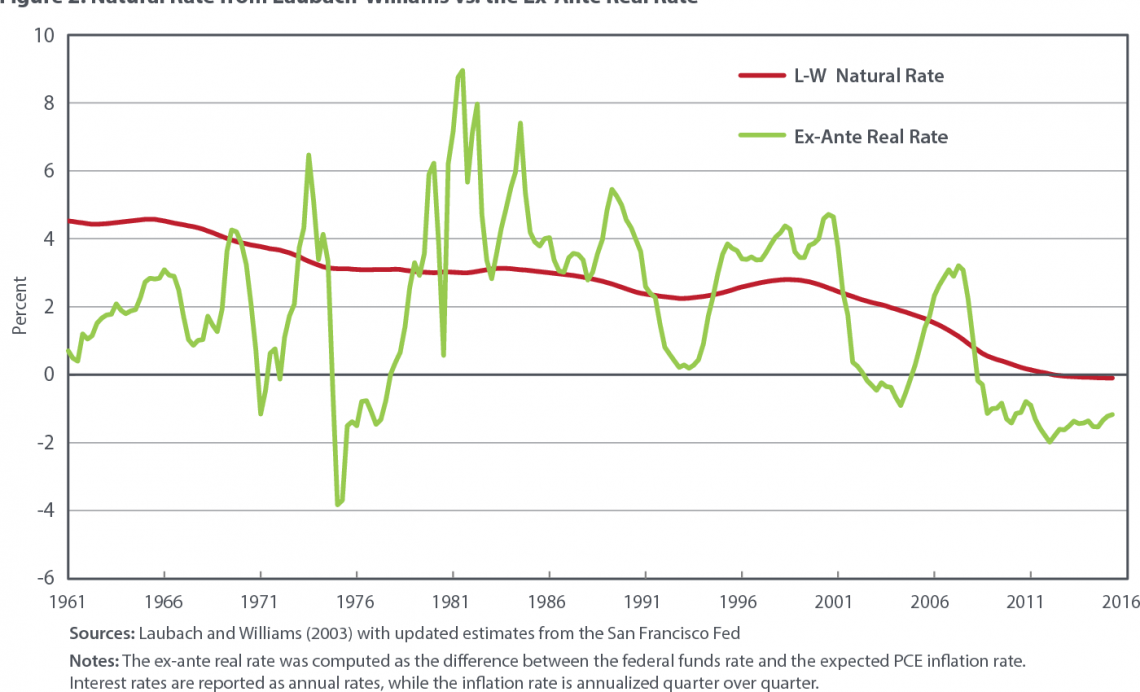

However, Federal Reserve economists Thomas Laubach and John Williams developed the most commonly used method.

This approach is based on the direct connection between interest rates and economic activity. From this, they use accurate data to calculate the natural rate.

They establish the relationship based on the Keynesian model's fundamentals, where genuine interest rate changes affect decisions about investments and consumption.

When prices are sticky, for instance, a rise in the federal funds rate would result in a rise in the natural rate, lowering investment and consumption.

A more contemporary, forward-looking methodology considers how fundamental rate changes impact households' intertemporal savings and portfolio allocation decisions. This theory can be used to infer a similar link.

or Want to Sign up with your social account?