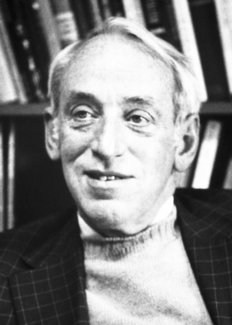

James Tobin

America's most distinguished Keynesian economist.

Who is James Tobin?

James Tobin, an American economist, born in Champaign, Illinois, to a suburban family, died in New Haven, Connecticut, on March 11, 2002. He contributed to the theoretical formulation of investment behavior and offered insight into the financial markets.

Following his graduation from Harvard University (B.A., 1939; Ph.D., 1947), he worked as an economist for the Office of Price Administration in Washington, D.C., from 1941 to 1942. He also held the position of second in command of a destroyer in World War II.

In 1950, he joined the faculty of Yale University, where he held the position of Sterling Professor of Economics from 1957 to 1982. Aside from teaching, he was also director of the Cowles Foundation for Research in Economics from 1955 to 1961, followed by another term from 1964 to 1965.

Many people consider him America's most distinguished Keynesian economist of all time. In 1981, he earned the Nobel Prize for "his study of financial markets and their impact on spending decisions, employment, production, and prices."

He subsequently distanced himself from the campaign that typically bears his name, arguing that campaigners were right to support a currency transactions tax but were doing so for the wrong reasons.

Early Life and Education

He was born on March 5, 1918, in Champaign, Illinois. His educational background includes a bachelor's and master's degree from Harvard University.

A few months after graduating in 1940, he began working at the Office of Price Administration and Civilian Supply in Washington, D.C. During World War II, he served in the United States Navy.

In 1947, he returned to Harvard to earn a Ph.D. in economics. In 1950, he joined the faculty at Yale University and remained there until he retired in 1988.

Public Service

He dedicated most of his career to applying economics to real-world problems, once stating, "Economics has always been a policy-oriented subject." If not applied to the urgent policy issues of the day, it becomes sterile, ineffective, and of no interest to anyone."

In 1961, he was appointed as one of the three economists to serve on President Kennedy's Council of Economic Advisers.

In addition to providing economic policy advice to the executive branch, the group drafted the 1962 Economic Report, which laid out economic growth and stabilization policies.

His involvement in the Kennedy Administration did not stop there; he also served as an academic consultant to the Federal Reserve Board of Governors and the United States Treasury Department during this period.

The Tobin Tax

The tax is based on short-term international capital flows. It was named after James Tobin, an economist who proposed a currency transaction tax in 1972.

The purpose of this tax is to maintain the stabilization of a country's currency. Also known as the Financial Transactions Tax (FTT) or Robin Hood tax, It is a tax on financial transactions.

This tax is imposed on spot currency trades to penalize short-term currency trading, stabilize the markets, and discourage financial speculations.

In response to the collapse of the Bretton Woods agreement in 1971, he came up with the so-called "Tax." As a result of the breaking of the U.S. dollar's link to the gold standard, volatility of the floating exchange rates replaced the old fixed exchange rates.

In an environment of varying rates, where money moved quickly, he proposed to reduce this volatility by imposing a small tax on each transaction in which one currency is exchanged for another.

In addition to discouraging short-term currency speculation, this tax would buffer the effect of such speculation on small developing economies that cannot compete with large financial institutions.

Upon his death in 2002, the "tax" was not formally implemented or used. As a result, the tax's original purpose- to halt currency speculation - has been eclipsed by ideas about using the tax to raise revenue for economic and social development on a global level.

Tobin Tax: Background

The global economy experienced a significant increase in stability in 1971 due to a rise in funds moving between various countries. The reason for this was the replacement of fixed exchange rates under the Bretton Woods system with flexible exchange rates.

Increasing short-term currency speculation increased the cost of exchanging currencies among countries because of the free currency market. It was therefore decided to introduce the tax to eliminate these issues.

Many European countries accepted the idea of deterring short-term currency speculation and stabilizing currency markets worldwide.

Need For Tobin Tax

It is extremely difficult to predict short-term capital flows (movement of international investable money) because they are speculative.

As a result of frequent inflows and outflows of short-term capital, many emerging market central banks, such as the Reserve Bank of India (RBI), face management challenges.

This tax aims to prevent the movement of volatile short-term capital flows or "hot money" that is very volatile and speculative.

Benefits Of Tobin Tax

Due to the tax, governments and central banks can provide the necessary adjustments to combat the destabilizing effects of capital inflows and outflows. Moreover, it slows down the process of entry and exit of capital.

The revenues generated from capital tax can be used for social development purposes, which is beneficial, particularly for developing countries.

Furthermore, the tax discourages short-term speculative investments.

Limitations Of Tobin Tax

The proposed tax can potentially decrease financial transactions, leading to a reduction in employment opportunities. As a result, the liquidity of assets may fall as well.

Due to this impacted liquidity, investors will be forced to pay a higher investment cost.

The banks have passed on the cost of the taxes to their customers, which means a decrease in return on various funds such as pension funds.

Examples Of Tobin Tax Across The World

A Tobin tax of 0.5% was imposed by Sweden on the buying and selling of shares. However, the tax couldn't bring about the desired results.

In 2013, Italy introduced a new high-frequency share trading tax, which included a 0.02% tax on trades occurring every 0.5 seconds or less.

The Belgian, German, Estonian, Greek, Spanish, French, Italian, Austrian, Portuguese, Slovenian, Slovakian, and Hungarian governments have now decided to impose a levy of 0.1% for the exchange of shares and bonds and a 0.01% tax on derivatives settlements.

In addition to Thailand, Brazil, Chile, and Malaysia, the tax has been tried in other countries with mixed results.

The Securities Transaction Tax (STT) is a variant of the Tobin tax practiced in India. Introduced in 2004, it has been levied on every transaction of securities listed on stock exchanges and mutual funds.

Tobin's "Q "Ratio

This "Q" ratio was formulated by Nicholas Kaldor, an economist, in 1966 and popularized by James Tobin in his heyday as a professor at Yale University. In Q ratio terms, the value of a company is defined as its total asset value divided by its market value, as shown below.

Tobin's q = (Equity Market Value + Liabilities Market Value)/(Equity Book Value + Liabilities Book Value)

The Tobin Project. An independent non-profit organization was established in 2005 as the result of the work of James Tobin. Their goal is to perform independent, non-partisan research that tackles the pressing problems of our age, focusing on institutional democracy, government and markets, economic inequality, and national security.

Baumol-Tobin Model

A cash management model, also known as the Baumol-Allais-Tobin (BAT) model, was proposed by William Baumol in 1952. The model assumes that stock inventory quantities will be utilized to maximize surplus funds.

Upon further reflection, he concluded that money could also be considered a type of stock, one that is indispensable when doing business. There is a clear analogy between cash optimization and materials regarding their balances.

It comes from the fact that cash surpluses are kept in enterprises as securities, often in the form of Treasury bills, where cash management is often compared with inventory management.

The Baumol model is based on the economic model of supply size called Economic Order Quantity (EOQ). The BAT model assumes the following:

- The cash demand can be forecasted and set for the entire period

- A steady and predictable flow of cash

- Investments in securities at a fixed interest rate

- Cash receipts that follow a rhythm

- Instant money transfers

Based on the above assumptions, one can conclude that cash is consumed steadily. Upon reaching the lowest level, 0, the equivalent of money is converted into cash to reach the highest level possible. Once this has been accomplished, the cycle begins again.

Baumol's goal is to illustrate the margin of safety. When the current fund's approach comes close to this point, Treasury bills or other securities are sold so that the funds can be supplemented.

The optimal cash level in the Baumol model is calculated as follows:

C= √((2*T*F)/R)

Where:

- C = Optimal cash balance

- T = Total cash demand (over a year)

- F = Cost of transferring cash

- R = Alternative cash maintenance cost.

According to this formula, if the cash level is optimal, the following equality must hold K.A. = K.T., or alternatives must equal transactions. The former is calculated as follows:

KA= (C*R)/2 and KT = (T*F)/C

Baumol calculates when transaction costs and alternative costs will be minimized in determining the appropriate level of cash.

Principal Implementation Areas

The Portfolio Selection Theory was theorized by James Tobin. In 1981, Tobin won the Nobel Prize in Economics for his research on financial markets and their effects on expenditure decisions, employment, production, and prices.

Based on a weighted risk-return relationship and a projected rate of return, he formulated his portfolio selection theory, which rules out the role of financial markets in influencing investment decisions.

It was stressed that these microeconomic decisions made within a household or business could affect macroeconomic aggregates, such as overall consumer spending, employment, and inflation.

The Tobin tax is a proposed tax on short-term currency transactions. The tax is intended to discourage speculative flows of hot money or money that regularly travels from one financial market to another in search of higher short-term interest rates.

It is not intended to affect long-term investments. Generally, the shorter the investment cycle (the period between buying and selling a currency), the higher the effective tax rate, thereby encouraging investors to extend the term structure of investments.

Even though several names know them, such taxes are typically named after James Tobin. He popularized levying a tax on currency transactions as early as the 1970s.

While multiple reasons were cited for introducing such a tax, the researcher focused on the economic justifications for taxing speculative flows of hot money. Others later concentrated on the positive global efforts that could be financed with tax revenue.

Foreign Exchange Markets

Even a very small currency transaction tax would bring in huge sums of money because the daily turnover on the foreign exchange markets is so out of proportion compared to all other forms of economic activity.

Advocates of implementing a tax for social reasons argue that it would provide a method of global redistribution, allowing poverty to be dealt with at the source. Although there are concerns about whether the tax can be enforced, its revenue would enable several development goals to be achieved.

Furthermore, a tax would protect the foreign exchange market from destabilizing. In the late 1990s, the Asian financial crisis demonstrated how whole economies could be affected by momentum trading, where a loss of confidence in a currency can cause a collapse.

However, neither was the reason for imposing a currency transactions tax. Instead, Tobin wanted policymakers to be able to make decisions without being disturbed by hot money destabilizing the currency.

Thus, the tax serves as a tool for reactivating the sphere of autonomous policy-making. The argument he offered was primarily directed toward developing countries.

To achieve that goal, he suggested that public policies be used to reduce speculation against their currencies to integrate developing countries more fully into the dynamics of international trade.

There was a time in the second half of the 20th century when the pressures of speculation against the currencies of developing countries proved particularly difficult to resist.

Trading relations with other countries were weakened significantly as the exchange rate risk elevated.

Financial Markets

Tobin is best known for his work in the field of financial markets. During his career, he developed numerous theories to explain how the financial markets impact people's decisions about consumption and investments.

He is best known for his work in the field of financial markets. During his career, he developed numerous theories to explain how the financial markets impact people's decisions about consumption and investments.

He postulated that monetary policy has the most impact on one-area capital investment and that interest rates are one factor in capital investment, but not the only one.

During the 60s and 70s, he introduced what is known as Tobin's Q, the ratio between the market value of an asset and its replacement cost.

The Q of an asset determines whether new investments in similar assets will be profitable. If Q is greater than one, one should consider investing further in matching assets and vice versa.

In 1972, he served as an adviser to George McGovern, the Democratic presidential nominee. Like other economists across a wide range of political spectrums, he pointed to the destructive effects of government policies, such as the impact of a high minimum wage on inner-city youths' job prospects.

He once said: "We should be especially wary of interventions that seem both inefficient and inequitable, for example, rent controls in New York, Moscow, or Mexico City, or price supports and irrigation subsidies meant only for affluent farmers, or low-interest loans designed for the wealthiest students."

Among his many publications are the American Business Creed (1961), the National Economic Policy of the United States (1966), the Essays in Economics, which are in three volumes (1971–82), and The New Economics One Decade Older (1974).

Key Achievements of James Tobin

The fundamental achievements of the American economist are as follows:

-

He asserted that one could not predict the effect of monetary policy on output and unemployment merely by analyzing the interest rate or the growth of the money supply.

-

His view was that monetary policy affects capital investment in plant and equipment and consumer durables. The interest rate is not the only factor determining capital investment, although it is an important factor.

-

Tobin's Q concept was introduced to predict whether capital investment would increase or decrease in the future. In finance, Q is the ratio between the market value of an asset and its replacement cost.

-

He explained that if an asset's Q is less than one, that is if the asset's value is less than its replacement cost, new investments in similar assets are not profitable. Alternatively, further investment should be made in similar assets if Q is greater than one.

-

He applied his insights to his ongoing debates with Milton Friedman and other monetarists. "Q," he argued, would be a good indicator of economic conditions because it predicts future capital investment.

-

Another of his contributions is the portfolio-selection theory. He proclaimed that investors should balance their portfolios by combining high-risk, high-return investments with safer ones. His insights helped shape finance theory.

-

His contribution to the 1962 Economic Report of the President made him quite proud. According to him, the report, which was mostly written by chairman Walter Heller, along with Tobin, Kermit Gordon, Robert Solow, and Arthur Okun, is the manifesto of [Keynesian] economics as it applies to the current economic conditions in the U.S. and around the world.

-

Reagan's economic report in 1982 was a counterpart to this report. Despite his partisanship, he was honest and thoughtful. He said, "It is interesting to compare the two; we have nothing to fear."

-

During the 1972 presidential campaign, he served as an adviser to George McGovern. He and most other economists in his generation believed that government regulation often harms the economy.

-

He forewarned, "We should be wary of inefficient and inequitable interventions, such as rent controls in New York or Moscow, price supports and irrigation subsidies benefiting wealthy farmers, or low-interest loans designed for the wealthiest students."

-

In 1970, he became the president of the American Economic Association and wrote an article about money and monetary policy that was published in the Encyclopaedia of Economics.

or Want to Sign up with your social account?