Marginal Propensity to Import (MPM)

It measures the fraction of additional disposable income spent on purchasing imported goods

What Is Marginal Propensity To Import (MPM)?

The marginal propensity to import (MPM) measures the fraction of additional disposable income spent on purchasing imported goods.

In other words, what fraction of an extra $1 in income is spent on buying foreign goods? How does that change in income influence the desire to purchase various goods from other countries abroad?

In breaking it down, the word ‘marginal’ in economic contexts refers to an additional unit or amount of something, while ‘propensity’ refers to the likelihood of spending. It is referred to by the acronyms MPM and MPI, but more commonly, the former.

Therefore, the marginal propensity to import examines an individual’s tendency to spend part of their additional income on imports.

A rise in disposable income stimulates a greater desire to spend and increased demand for goods and services in general, including products from abroad, and vice versa when disposable income decreases.

An increase in income is an injection into the economy. But, at the same time, imports are leakages because the money used to purchase the imported goods leaves and flows from the domestic economy to the exporting one.

Imports are considered endogenous and help provide employment and national income abroad but do not affect domestic income, so they may be subtracted from aggregate demand.

Key Takeaways

- Marginal Propensity to Import (MPM) measures the portion of added disposable income spent on purchasing imports.

- MPM is derived from the change in imports divided by the change in income, producing a value between 0 and 1.

- Marginal Propensity to Import is part of the larger picture involving marginal propensities like saving, taxing, and withdrawing.

- MPM is crucial in Keynesian theory, impacting the expenditure multiplier, imports, and foreign trade position.

- Open economies with higher MPMs have a larger trade sector, while developed countries with lower MPMs tend to be exporters.

Calculating the Marginal Propensity to Import and Examples

The MPM is calculated as the derivative or slope of the import function concerning disposable income.

The calculation thus generates a number equal to the change in imports divided by the change in income. This creates a ratio with a numeric value between 0 and 1.

Some examples are:

- If 30% of an increase in income is dedicated to purchasing imported goods, the MPM would be 0.30. This would reflect the idea that each dollar of additional extra income generates or instigates $0.30 of imports.

- If the number of imports increases by 500, while income increases by 1500, the MPM would be 500/1500 = 0.30.

- If there is an increase in income of 10 euros, and the proportion of spending on imports increases by 3 euros, then the MPM is equal to 3/10 = 0.30.

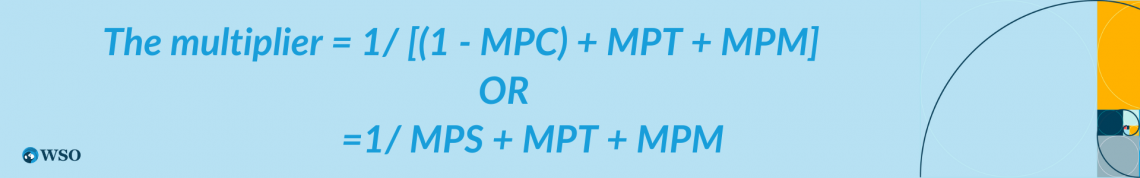

Another important aspect of studying the MPM is understanding its relation to other marginal propensities and the Keynesian multiplier.

Two important relationships are outlined as follows:

MPS + MPT + MPM = MPW

MPW + MPC = 1

Where:

- MPS = marginal propensity to save

- MPT = marginal propensity to tax

- MPW = marginal propensity to withdraw

- MPC = marginal propensity to consume

For the multiplier:

Suppose a country has a positive MPC and thus consumes a lot. In that case, it most likely has a positive MPM because a significant proportion of goods for a given country come from other countries.

When

- MPM equals 1: The entire additional income is spent on imports;

- MPM equals 0: None is spent.

MPM and Keynesian Macroeconomics

The marginal propensity to import is also relevant to Keynesian Macroeconomics theory. The marginal propensity to import reflects induced imports, prompted or instigated by domestic income levels.

The MPM is also referred to as the slope of the imports line (or function), which is upward or positively sloped, demonstrating how increases in income yield increase in imports. It is also the negative value of the slope of the exports line, which is downward or negatively sloped.

The MPM impacts the multiplier process and the magnitude of the expenditure multiplier and tax multiplier. In addition, the marginal propensity to import also influences the multiplier process and, thus, the magnitude of income expended and tax multipliers.

Unlike saving or investing money, spending works within fiscal policy to stimulate aggregate demand.

An initial amount of government spending goes towards consuming goods and services, and the expenditures become part of someone’s income. This income is partially saved, while another proportion is spent purchasing and consuming various goods and services.

Within the consumption of goods and services, some are purchased domestically from local producers and sellers, while others are imported from abroad.

When income changes and the marginal propensity to import changes, there is an impact on the number of imports purchased, and the ripple effect of how some is saved and some is spent occurs over and over. So, the cycle continues within the multiplier effect.

Thus, the MPM is significant in the study of Keynesian macroeconomic theory as it highlights how imports adjust and are influenced by changes in incomes or quantity of output.

The value of the marginal propensity to import typically reduces the multiplier effect because the demand for goods and services produced domestically falls when that for imports rises.

In other words, the multiplier effect gets smaller as the MPM increases. As incomes increase, most of that extra income is not spent in the domestic economy. Instead, it is injected into the foreign economy from which the consumer purchases imports, using their additional income.

When exports increase, this can also increase the incomes of those involved in the export industries. This creates demand for various types of goods. However, it also depends on the marginal propensities to save and import.

Note

As the marginal propensities to save and import are smaller, the value of the multiplier will be higher, and vice versa.

MPM and Trade

Countries that rely on various imported goods and consume more imports, especially when their population’s income increases, play a large role in global trade. The foreign trade multiplier highlights how changes in income influence a country’s exports and foreign trade position.

The calculation of the MPM is influenced by whether the economy is more open or closed in trade within the global economy. Open economies tend to have large trade sectors as a part of their GDP. So, imports and marginal propensities play a larger role in that sphere.

Some countries, especially developing countries, import various goods and rely on the foreign sector. Others, particularly in the developed world, are quite wealthy and productive on their own. So, they spend less on imports and are major exporters and partners in trade.

These exporting countries usually have enough natural resources for certain comparative advantages. Thus, they have lower MPMs.

If a country that imports many goods experiences a financial crisis at a certain point, its effect on exporting countries depends on its marginal propensity and the composition of its imports. This also has a significant impact on the exchange of commodities worldwide.

As mentioned before, decreasing income harms imports. This negative effect is larger when the marginal propensity to import is greater than the average propensity to import for a particular country.

The gap created leads to a greater income elasticity of demand for imports, which results in a more than proportionate decrease in imports as income decreases.

The Marginal Propensity to Import (MPM) FAQs

One advantage of the marginal propensity to import is that it is relatively easy to measure. Collecting the data needed, such as the number of imports, is typically easily accessible, and the calculation is fairly straightforward.

The MPM also helps policymakers predict changes in imports that come from planned or expected changes in the export patterns of a particular country. This forecasts and studies trade patterns, overall economic activity, and growth.

However, it can be quite unstable since the relative prices of goods (domestic and foreign) constantly change, and exchange rates also fluctuate. This affects the purchasing power of individuals buying goods from abroad and, thus, influences the size of the country’s MPM.

An increase in the MPM leads to an increase in the value of the multiplier’s denominator. This leads to a decrease in the value of the overall fraction, which means a decrease in the size of the multiplier.

When incomes increase, goods and services domestically and from abroad increase, so individuals import and consume more overall.

The UK has a good agricultural sector, but it also depends on various imports, especially fruits, vegetables, and sugar. The UK also does not have a comparative advantage in producing some manufactured goods. So, their reliance on imports rises, leading to a high MPM.

or Want to Sign up with your social account?