Money Illusion

An economic theory that states people view their wealth in nominal rather than absolute terms

What Is Money Illusion?

Money illusion is an economic theory that states people view their wealth in nominal rather than absolute terms. The concept is sometimes referred to as price illusion. In other words, they think a dollar today is worth the same as a dollar in the future, without considering how inflation affects their purchasing power.

When inflation happens, the prices of goods and services go up, decreasing the purchasing power of money. So, in reality, a dollar tomorrow is worth less than a dollar today because money loses its value over time.

This is why it's crucial for people to think about their wealth in terms of what they can actually purchase with their money, rather than just how much money they have in their hands.

This concept is purely psychological because today's dollar looks the same as tomorrow's. However, the dollar's purchasing power is constantly changing because fiat currencies have no genuine value, and their actual value depends on the price level.

In other words, money illusion is individuals' inability to report inflation and deflation rates when making financial decisions correctly. These decisions can be completely wrong and could lead to financial struggles in the future when nothing goes to plan.

Money illusion is typically seen in households and individuals with a weak financial and economic background. That's why individuals with a solid financial foundation can have a long-term vision with suitable actions and plan to achieve their pursued dreams.

Key Takeaways

- Money illusion, also known as a money illusion, means that people view their wealth in nominal rather than absolute terms. Thus, ignoring inflation.

- Psychological in nature, it causes people to overestimate their wealth by ignoring the buying power of their money.

- "The Money Illusion" was originally a book authored by Irving Fisher in 1928.

- A weak financial background and sticky prices are two main reasons for money illusion.

- Employers tend to take advantage of what employees are unaware of, related to changes in wages and prices.

- Money illusion validates Friedman's version of the Phillips curve, which is an economic tool stating that unemployment and inflation have an inverse relationship.

- This illusion can directly impact financial planning, as people may neglect inflation rates when planning for the future.

- Understanding inflation and the whole aspect of the market with a few financial experts' advice can help prevent falling into the trap of Money illusion.

Understanding Money Illusion

Monetary illusion is more apparent in people with no financial education. Even though the nominal value is inaccurate, most people view money in its nominal terms instead of its actual value.

An increase of 5% in wages with a steady inflation rate of 1% would be promising as it represents a 4% growth in earnings. However, if inflation is 8%, yields will decline by 3%. An average person may see the two scenarios of a 5% raise as equal.

Let's take another scenario where wage rates dropped by 1%, and inflation decreased by 2%.

A person with no financial background may think his earnings are declining, given that he is earning less money.

However, the truth is, his earnings increased by 1% since the wage he is now earning can buy more goods and services than before the wage cut because the inflation rate also dropped by 2%.

In these two scenarios, a person with no financial background would prefer a raise of 5% in wages since he would think he earns more money, even though the inflation rate is 8%, which means a decline of 3% in earnings.

However, despite the wage cut, a well-educated person will choose the wage cut of 1% since their earnings would be higher given that the inflation rate dropped by 2%.

History of the Money Illusion Concept

"The Money Illusion" was originally a book written by the economist Irving Fisher in 1928. Fisher wrote this book to spread knowledge about an illusion people seem to believe, proving that finance and psychology are two equally correlated terms.

Fisher believed that we should look at the dollar as a fixed term which means that we tend to see the dollar the way it is over time, ignoring its actual value.

Since most of our financial plans can be affected by how we view money, Fisher decided to write a book to enlighten people about this psychological trick.

The book is about a shopkeeper in Germany after the First World War when the German mark (Germany's currency at the time) lost its value significantly due to hyperinflation. Hyperinflation is an accelerated type of inflation.

He details a story about a shopkeeper who sold shirts above the price she acquired them for and thought she was making a profit. However, according to Fisher and his theory, she was not making a profit and losing money from the shirts she sold.

This loss is because she could buy fewer goods or services with the money she earned from selling shirts due to inflation.

Fisher supposed people view their wealth according to how much they have rather than how much they can buy with that money.

Reasons for money illusion

It is purely psychological. People falsely believe that with the growth of the amount of money they have, they will become wealthy, ignoring inflation rates. Due to that false belief, people usually overestimate their wealth.

But why do people fall into the trap of this illusion?

Economists have come up with two reasons why individuals fall victim to price illusions:

1. Weak financial background

Economists believe that due to the lack of proper financial education, individuals ignore the effects of inflation on their purchasing power and, ultimately, on the concept of wealth.

Take action immediately with several finance courses that can help you avoid being a victim of price illusions and other financial traps.

2. Sticky prices

Some goods and services have sticky prices, meaning their prices remain the same even though their production cost has changed. This stickiness occurs in markets with low competition, imperfect information, or strict regulations.

Economists also believe that price illusion is one of the main reasons inflation benefits the economy since it helps increase wages.

3. Inflation paves the way for wage increases

Employers will offer minimal raises in nominal wages as long as inflation rates are low. But when inflation rates go up, consumers realize the rise in prices. Then, they would ask for a wage increase to compensate for such increases.

Money Illusion and the Phillips Curve

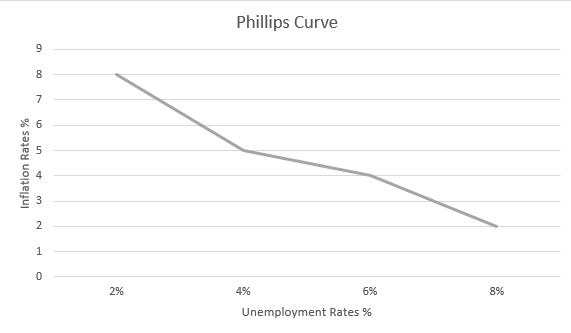

Money illusion is a critical concept in the Friedman version of the Phillips curve, an economic theory stating that inflation and unemployment have an inverse relationship.

The Phillips curve is a famous tool used to analyze macroeconomics. It declares that economic growth is followed by inflation, leading to more jobs and lower unemployment rates.

Price illusion supports this theory. It says that employees rarely ask for a wage increase even though inflation is eating into their wealth, making employers take advantage of lower labor costs.

Price illusion validates the Friedman Phillips curve theory because:

1) Employees are satisfied with their wages: since individuals falsely view their wealth in nominal terms, they rarely ask for a wage increase. That's because they tend to think they are earning enough salaries even when inflation is rising.

Thus, when inflation increases and employees aren't asking for a wage increase, employers tend to hire more individuals, ultimately reducing unemployment.

2) Different price responses to modified demand conditions: Friedman believes that an increase in the total demand affects market prices sooner than it affects labor market prices.

Thus, a decrease in unemployment is correlated with a reduction in actual wages. As soon as employees realize they are victims of price illusion and demand higher wages to meet the inflation rates, unemployment rates start returning to normal.

3) Information asymmetry: employers tend to take capital advantage of whatever employees are unaware of, related to variations in wages and prices.

Money illusion's financial impact

It is a tricky intellectual bias that may dramatically impact an individual's long-term plans. When a person tries to estimate the amount of money they need to retire comfortably, they tend to fall into the trap of this illusion.

Suppose a person estimates they need 2 million dollars for a comfortable retirement, but what does this amount of money equate to in 10, 20, or 30 years when the person retires?

The answer is pretty obvious; this person will need more than 2 million dollars to achieve the plan they are pursuing.

There are a few ways to avoid this illusion: To start making intelligent financial plans, you first need to understand inflation. With the understanding of inflation, you can acknowledge the buying power of the amount of money you have.

That's why you must look at the inflation rates and compare them to the income growth rates when making long-term plans.

Another thing you have to do is to understand the whole aspect of the market. As mentioned, price stickiness tricks people when they look at what they can afford.

Of course, you would still be able to afford the things you want at different prices than those advertised.

Finally, you should seek financial experts' advice that helps you fight inflation. When making long-term goals, always ask for an expert's opinion about what investment to make and what strategies to follow to protect yourself from inflation and price illusion.

Money Illusion FAQs

The term was first used by the American economist Irving Fisher when he wrote a book titled "Money Illusion" in 1928.

Price illusion occurs when people ignore the effects and consequences of inflation on the value of the money they hold and the overall prices of goods and services in the market

Economists believe that price illusion only occurs in the short run during the period when consumers haven't realized that prices have increased.

People can avoid this illusion by building a solid financial background and understanding the world's economy. After that, you can start planning your long-term goals with complete accuracy.

Researched and authored by Kassim Faour | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?