Neutrality of Money

Refers to the concept that changes in the money supply have no effect on real economic variables

What Is the Neutrality of Money?

The neutrality of money is the concept that changes in the money supply do not affect real economic variables such as real interest rates, employment, real consumption, or GDP (gross domestic product).

The term 'neutrality of money' was coined by the economist Friedrich A. Hayek in 1931. Changes in the money supply only affect nominal variables within an economy, such as prices, wages, and exchange rates.

The theory suggests that changes in the money supply do not impact an economy's real variables. It posits that adjustments in the prices of goods and services and wages offset any change in the money supply.

According to the theory, when the neutrality of money aligns with zero population growth, the economy reaches a steady-state equilibrium. If a central bank increases the money supply by 10%, prices are expected to increase similarly.

Key Takeaways

- The neutrality of money theory suggests that changes in the money supply do not affect real economic variables like output and employment in the long run, focusing instead on nominal variables such as prices and wages.

- Coined by Friedrich A. Hayek, the theory argues that money is a neutral factor with no real effect on economic equilibrium, assuming flexible prices and wages where changes in money supply only impact nominal variables.

- The neutrality of money is foundational to classical economics but faces criticism from economists like Keynes and Mises, who argue that money is not inherently neutral, impacting both production and consumption over time.

- A stronger version of the theory, suggesting changes in money supply have no impact on any economic variable in the long run, assumes perfect price and wage flexibility.

- Critics argue that the theory overlooks business fluctuations and Cantillon effects, where early recipients benefit more from increased money supply, impacting relative prices and consumption patterns, challenging the idea of money neutrality in practice.

Understanding the Neutrality of Money

It is a theory based on the idea that money is a "neutral" factor that has no real effect on the economic equilibrium.

According to the theory, printing additional money does not fundamentally alter the economy, even if it stimulates demand and leads to increased prices of goods and services.

The theory suggests all the goods' markets are cleared continuously. As a result, the relative prices adjust flexibly and always towards equilibrium. Changes in money supply do not appear to change the underlying economic conditions.

As a result, the aggregate supply should remain constant. Not all economists agree with this; however, those who do argue that the theory applies primarily in the long term.

The assumption of long-run money neutrality is foundational to many macroeconomic theories. Furthermore, mathematical economists utilize this classical dichotomy to forecast the impacts of economic policies.

For example, if a macroeconomist studies the monetary policy of a central bank, such as the Federal Reserve.

When the Federal Reserve engages in open market operations (OMO), the economist does not assume that changes in the money supply will change employment levels, future capital equipment, or real wealth in long-run equilibrium.

Those factors will remain constant, giving the economist a more stable set of predictive parameters.

Note

Originating from classical economics, this theory has faced criticism for its perceived lack of alignment with contemporary economic needs, rendering it less relevant in the modern economy. The idea is probably helpful in the long term, not the short term.

Neutrality of Money History

Today, 'Neutrality of Money' and 'Veil of Money' are shorthand expressions for the quantity theory proposition, which states that money supply changes primarily affect an economy's price level rather than relative prices or the rate of interest.

Money neutrality began to develop within the Cambridge economics tradition between 1750 and 1870. The initial version of money neutrality proposed that changes in the money supply would not impact employment or output, even in the short term.

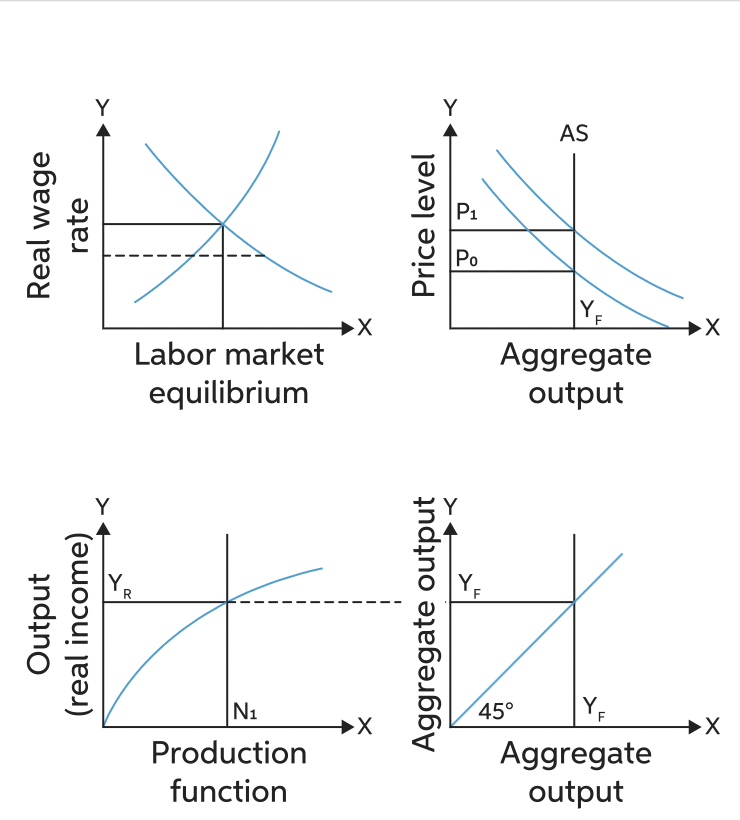

As the aggregate supply curve is presumed to be vertical, a change in the price level does not alter the aggregate output. Followers of the theory believed shifts in the money supply affect all goods and services proportionately and nearly simultaneously.

However, many classical economists disagreed with this idea, suggesting that short-term factors, such as price stickiness, could lead to deviations from neutrality.

The term 'neutrality of money' was coined in 1931 by Austrian economist Friedrich A. Hayek.

According to Austrian business cycle theory, Hayek initially defined the neutrality of money as a market interest rate at which malinvestments—poorly allocated business investments—would not occur and would not contribute to business cycles.

Later, neo-Keynesian and neoclassical economists adopted the phrase and applied it to their general equilibrium framework, giving it its current meaning.

The neutrality of money – classical economics

The neutrality of money theory is a fundamental concept in classical economics, initially proposed by Scottish economist David Hume (1711-1776).

Hume established the classical dichotomy, distinguishing between real and nominal economic variables. He argued that factors affecting nominal variables may not necessarily affect real variables, such as those about the real economy.

In the classical model, characterized by flexible prices and wages, changes in the money supply solely influence the price level and nominal variables, such as the nominal interest rate and money wages.

Conversely, real variables, including levels of labor employment and output, saving and investment, real wages, and the real interest rate, are unaffected by changes in the money supply.

Note

The classical dichotomy is the separation of real variables from changes in the money supply and nominal variables.

Nominal and real variables

Nominal economic variables include wages, exchange rates, and prices, while real variables encompass employment, real investment, and output (GDP).

While Hume conceived the concept of the neutrality of money, continental economists first employed the term 'The Neutrality of Money' at the beginning of the twentieth century.

Friedrich Hayek

Economist Friedrich Hayek (1899-1992), known for his defense of classical liberalism, introduced the term in 1931, sparking significant interest in economic literature, particularly in English.

Superneutrality of Money

The Superneutrality of Money posits an even stronger version than the neutrality of money, suggesting that changes in the money supply have no impact on the real economy. Additionally, it proposes that the money supply growth rate does not affect real variables.

Under superneutrality, nominal prices and wages maintain proportionality to the nominal money supply following one-off permanent changes in the money supply and permanent changes in the growth rate of the money supply.

The neutrality of money and superneutrality concepts are applied in analyzing long-term economic models.

Reasons for departure from super neutrality

Despite money neutrality, the level of the money supply at any given time not impacting real variables, money could still be non-superneutral if the money supply growth rate affects real variables.

An increase in the monetary growth rate, accompanied by a rise in the inflation rate, results in a decline in the real return on narrowly defined (zero-nominal-interest-bearing) money.

Consequently, individuals opt to reallocate their asset holdings away from money, leading to a decrease in real money demand and toward real assets such as goods inventories or productive assets.

The shift in money demand can affect the supply of loanable funds, and the combined changes in the inflation rate and nominal interest rate may leave real interest rates changed from previously. Real expenditure on physical capital and durable consumer goods can be affected.

Neutrality Of Money Vs. Superneutrality Of Money

To best understand the difference, take a look at the table below:

| Aspect | Neutrality Of Money | Superneutrality Of Money |

|---|---|---|

| Definition | States that changes in the money supply have no real effect on variables such as output and employment in the long run | Suggests that changes in the money supply have no real effect on any economic variable in the long run |

| Time Frame | Applies to the long run | Also applies to the long run |

| Variables Affected | Primarily affects real variables like output and employment | Extends the neutrality to all economic variables |

| Assumptions | Assumes sticky prices and wages, hence real effects in the short run | Assumes perfect flexibility in prices and wages |

| Central Role of Money | Recognizes the central role of money in the short run | Emphasizes the role of money as a medium of exchange, but its real effects diminish over time |

Criticism of Neutrality Of Money

The neutrality of money theory has faced criticism from prominent economists such as John Maynard Keynes, Ludwig von Mises, and Paul Davidson, who challenged its short- and long-run implications.

Critics argue that money is not inherently neutral. They contend that an increase in the money supply leads to a decrease in its value.

Numerous econometric studies indicate that changes in the money supply impact relative prices over extended periods. The central argument posits that as the money supply increases, the value of money diminishes.

Furthermore, increasing the money supply allows early recipients to acquire goods and services with minimal price adjustments.

Subsequently, as the newly injected money circulates, prices rise to offset the surplus of funds. This phenomenon, the Cantillon Effect, leads to higher prices for later recipients of the money.

Moreover, an increase in the money supply influences both production and consumption. This price rise affects consumer behavior, leading to changes in consumption patterns for individuals and families. Additionally, it increases costs for companies, rendering production more expensive.

Note

The injection of new money necessitates a shift in relative prices.

Conclusion

The theory of money neutrality posits that an increase in the money supply affects only nominal variables, such as prices, wages, and exchange rates, without impacting the overall economy.

However, critics argue that this theory overlooks business fluctuations in the modern economy.

Critics argue that this concept is impractical because money, by its nature, cannot achieve a neutral status. Moreover, an increase in the money supply can affect production and consumption.

Critics who oppose the theory suggest that the nature of money is such that it cannot be neutral.

When the money supply goes up, its value goes down, and when the money supply rises, it enables the initial receivers to purchase products and services with zero or minimal change in price. This means those receiving money lately will be bound to pay higher and unjust prices.

This is known as the Cantillon effect. An increase in the supply of money can also impact production and consumption.

When new money is introduced into an economy, it causes prices to change, which means that if the prices of goods and services are increased, it will impact individuals and families.

Furthermore, this increase in the money supply can lead to higher associated costs as goods and services become more expensive.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?