Smoot-Hawley Tariff Act

Implemented with the aim of adopting protectionist policies for the U.S. economy

What is the Smoot-Hawley Tariff Act?

The Smoot-Hawley Tariff Act was implemented with the aim of adopting protectionist policies for the U.S. economy. It was known as the Tariff Act of 1930 which imposed tariffs on the imports of the U.S. to support the U.S. farmers and businesses and increase the National Income by promoting self-reliance in producing, growing, and manufacturing different goods in the U.S. economy.

We all must have read in our history books about the Great Depression; This act was maybe (or maybe not) one of the reasons for this huge and infamously memorable economic downturn. It was sponsored by Senator Reed Smoot and Representative Willis C. Hawley and signed by President Herbert C. Hoover on June 17th, 1930.

The great depression began in 1929-1939. The act was implemented after the stock market crash of 1929 and many other economic impacts of different international trade policies influencing global trade.

During this time, the U.S. was trying to make an effort for import substitution and export promotion to support domestic workers and achieve higher levels of foreign exchange.

The Smoot-Hawley Tariff Act had already raised high tariff rates because the American farmers were facing competition from the European farmers who had started to recover from the effects of World War I.

Key Takeaways

- The Smoot-Hawley Tariff Act was implemented in 1930 with the aim of adopting protectionist trade policies for the U.S. economy.

- It imposed historically high tariffs on over 20,000 imported goods to America in an effort to protect domestic producers.

- The act led to retaliation by America's leading trading partners, causing a major decline in international trade and worsening the Great Depression.

- Over 1,000 economists opposed the act, arguing it would be counterproductive, but it was still passed into law and signed by President Hoover.

- The tariffs were eventually reduced in 1934 after the passage of the Reciprocal Trade Agreements Act under President Franklin Roosevelt.

Understanding the Smoot-Hawley Tariff Act?

The act was passed after various legislations and other economic impacts; Here, we have provided a list for you to understand why, how, and under what circumstances Congress passed the Smoot-Hawley Act.

1. Ford-McCumber Act, 1922

Ford-Mccumber Tariff Act 1922 was a law that aimed at increasing tariffs by imposing higher import duties on foreign goods and services to the U.S.

This act tried to protect the American workforce and the hard-hit American Agricultural sector after WW1.

This law increased tariffs to 40%, meaning any foreign company trying to sell their product in the U.S. must pay the government 40% value of the product. This product was sold to customers adding 40% to the cost, i.e., shifting the burden of tariffs to consumers, making the goods expensive and less attractive.

“The Fordney-Mccumber Tariff Act did not yield any results in mitigating the plight of the American farmer. Overproduction saw farm prices decline significantly during the second half of the decade. This led to the Hoover-led government to pass the Smoot-Hawley Tariff Act of 1930.”

2. Increased U.S. Productivity

The U.S. witnessed great levels of productivity gains in the early 1920s. Electricity distribution to different sectors led to the mass production of capital goods, increasing consumption production.

The wage level also shot up at this point, although the production went on to overproduction and underconsumption of such goods.

As the basic principle of economics says, “With the increase in supply, and a demand lower than that will result in falling prices”.

3. Onset of Increasing Tariffs

With the conclusion of the League of Nations’ World Economic Conference in Geneva, 1927, which held that the world economy and global trade could flourish by producing goods and services, importantly, the eradication of Tariffs.

France was one such delegate that opposed this with the increase in its tariff rates. The U.S. government passed the Smoot-Hawley Tariff Act, raising import duties as a protectionist policy.

4. Import-Substitution and Export Promotion

To promote the U.S. economy's production, it was left to these two measures to make national income, employment, and foreign exchange.

Import substitution is an economic measure used to increase production and manufacturing in the home country by imposing tariffs and trade barriers on foreign imports. This leads to self-sufficiency and modernization.

Export promotion is a measure that helps achieve higher levels of foreign exchange by exporting goods to foreign countries.

The American economy relied on these two in the early 1920s, but things didn't turn out that way.

Challengers to the Smoot-Hawley Tariff Act

President Hoover 1928, in his election campaign, emphasized increasing the tariffs on agricultural products to control the overproduction problem. However, that did not pan out well enough because every sector also wanted the same.

So these demands were then addressed, and there was an increase in agricultural goods and a decrease in the tariffs on industrial goods; The U.S. imports fell, and exports grew.

“But in the short run, it was good for the U.S. economy and bad for the world economy, and in the long run, it was bad for the U.S. and the world.”

More than 1,000 economists opposed this act and had signed petitions urging the President to veto the act.

J. P. Morgan’s CEO Thomas Lamont said he "almost went down on [his] knees to beg Herbert Hoover to veto the asinine Hawley–Smoot tariff".

Henry Ford also spent an evening at the White House trying to convince Hoover to veto the bill, calling it "an economic stupidity".

Although all this couldn’t be blamed upon President Hoover alone, the act was passed.

In the wake of passing such a law in the United States, many countries, as a counterattack, also raised their import duties on goods and services.

“This led to trade wars between the U.S. and the rest of the world, where nobody wins, but the people suffer”.

Reaction to the World Economy

The protectionist policy of the U.S. aimed at shielding domestic industries from foreign competition by increasing tariffs.

These protectionist policies aimed at making the US economy more self-reliant and aimed towards a self-sufficient economy. But the consequences did not pan out as anticipated.

Therefore, an increase in the cost of goods was witnessed, making American goods relatively cheaper, and the demand for such goods kicked in.

When American farmers began to struggle financially in the late 1920s in the aftermath of World War 1, the American Congress helped them by introducing tariffs on imported agricultural goods by passing the Tariff Bill in the 1930s.

Raising tariffs on foreign agricultural goods helped farmers; As the bill moved ahead, other legislators tried to help their people who worked in different capital goods industries.

The bill called for 890 different items for tariffs. This raised tariffs by 20% on average.

But, the bill was passed, and retaliation kicked in, making American goods expensive and less competitive.

The countries which protested and retaliated against the Smoot-Hawley Tariff Act were:

- In North America: Canada, Cuba, and Mexico

- In Europe: Spain, Italy, Germany, and Britain

- In Asia: Japan, China

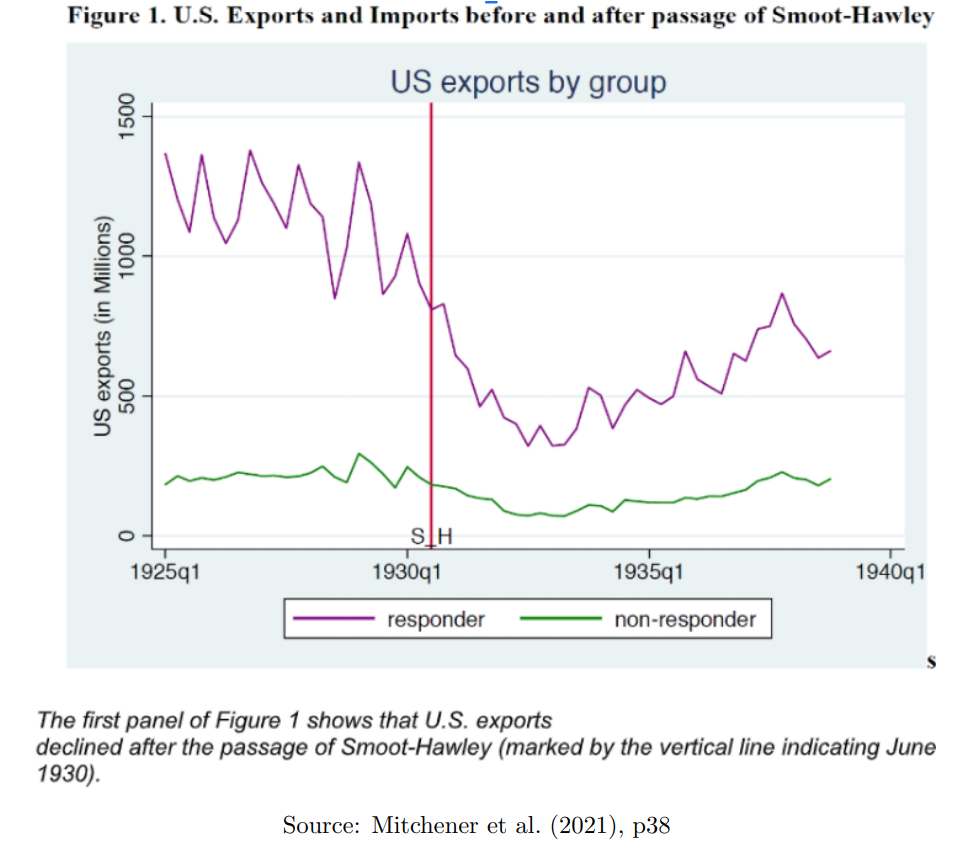

American exports fell by around 26.5% on average to the retaliators.

Analysis of the economic figures

The dutiable imports shot up to massive levels of around 60% in 1932 by the U.S. in the aftermath of the Smoot-Hawley Tariff Act, 1930, and these levels were at 40% in 1929.

The Act in 1933 had given a peak to the duty-free tariff rate of 19.8%, which can be substantiated by the contrasting nature of 1929 tariff rates which were only 13%.

It can be drawn from the below graph that these rates were still not the highest. There were a considerable number of consistently high levels of tariff rates before this last highest tariff rate.

The U.S. economy had witnessed huge long-lasting tariff levels in the past, which did not result in a large-scale global depression.

Hence, it is a valid argument that this law was not the sole factor for the great depression, but it also cannot be ruled out entirely.

To interpret the above graph, we need to know the meaning of total imports and dutiable imports.

- Total imports are the actual value of imports without including any duties, tariffs, and taxes.

- Dutiable imports are the value sold to the market. These imports include all duties, tariffs, and taxes.

This marvelous graph shows that in the 1920s, the total imports and suitable imports were close to each other, meaning that the tariffs were at a very low level.

Still, in the period of 1930-1934, the dutiable imports, i.e., the imports, including the tariff rates, shot up so high without even matching the actual value of imports. This led to large-scale implications, such as depression in the U.S. and the world economy for a period lasting 10 years.

Trade liberalization was at the onset of the pre-depression period. The tariff rates in 1913-1927 were around 24%, remaining constant for these 10 years. Further, these rates were reduced in 1928-1929 in the U.S. and most of the flourishing European economies.

To quote Paul Krugman - In a trade war, since exports and imports will decrease equally, for everyone, the negative effect of a decrease in exports will be offset by the expansionary effect of a decrease in imports. Therefore, a trade war does not cause a recession.

He also mentioned that the act did not cause the great depression. The trade decline was a consequence of the depression and not the cause.

Impact of the Smoot-Hawley Tariff Act

Countries like Canada, Mexico, and Spain started retaliating with huge tariffs on U.S. goods. American farmers were hit hard because exports to Canada were a major part of the American farmers.

For example, Before tariffs, the U.S. exported 12 Million eggs to Canada, but after the retaliatory policy of Canada, it reduced to only a handful of 170 thousand eggs (almost a 99% drop).

The U.S. exports of capital goods, such as steel, automobiles, etc., dropped by 80%.

Protectionist & retaliatory policies followed by other countries made international trade shrink and deepened the great depression. Also, it may(or may not) have resulted in WW2.

The Smoot-Hawley Tariff Act succeeded in the short run but disrupted the trade in the long run. The industrial sector was growing at a much higher rate in the short run in 1930-31, but a major chunk of the destruction of wealth began in 1932.

Many weak banks started to fail, but this cannot entirely be said to be a repercussion of the act.

The Smoot-Hawley Act had no direct impact on the U.S. economy and could have only operated through other channels like bank failures.

The Act encouraged the purchase of domestic products by increasing the cost of imported goods by 6% while raising revenue for the federal government and protecting farmers (Irwin, 1998).

The imports and exports both plummeted by 20% in the period of 1929-1933.

A decrease in net exports coupled with deflation is what caused bank runs. The mismanagement of bank failures was what led to a recession transitioning into a decade-long depression.

The U.S. was the instigator, and the potential retaliators were countries that responded to the Smoot-Hawley by implementing their measures in reprisal.

38% of America’s trading partners were direct retaliators to the Smoot-Hawley Act, a further 41% were threats, whereas the remaining 19% chose not to take any actions against the American government.

Foreign Policy Consequences of the Smoot-Hawley Tariff Act were high tariffs on the sugar imports of the U.S. from Cuba. This made Cuba economically weak because most of its national income depended on sugar exports to the U.S.

Also, a geopolitical aspect to this was that the U.S. was a keen and important friend to Cuba.

The high tariffs made exports for Cuba unprofitable. The Cuban government, which the U.S. set up, was overthrown by the revolutionary movement, with Fidel Castro as its leader.

Reciprocal Trade Agreement Act

The Smoot-Hawley Tariff Act was a law of significance. It attempted to change the economy's outlook by adapting to protectionist policies, as things didn’t play quite well enough to ensure what was expected.

In the Presidential campaign of Democrats in 1932, President Franklin D. Roosevelt assured the people of the United States that the tariffs would be lower if he won the elections.

When President Roosevelt won, he acted upon the same by passing the Reciprocal Trade Agreement of 1934.

The act was passed, recognizing that tariffs shouldn't just be considered a domestic economic tool to regulate trade and an important device for foreign relations policy and balancing international trade.

By this act, the tariffs were set to a lower level, and the President was also authorized to negotiate the tariffs with his foreign counterparts.

As the decades went by, the tariffs were made lower by liberalizing globalizing the U.S. and the world economy, and the succeeding Presidents used the authority to get into international agreements that generally reduced tariffs.

Between 1934 and 1945, the United States signed 32 reciprocal trade agreements with 27 countries.

This act was enacted for 3 years and extended 3 times till 1948. However, this was in effect until 1961.

Researched and Authored by Basil Khalidi | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?